In just a few weeks,

Hemi (HEMI) transformed from a quiet new token into one of the most talked-about launches in crypto. Backed by $15 million in growth funding and riding the wave of a major Binance spot listing plus airdrop, HEMI has delivered gains of over 800% in the past one month and nearly 140% in the past week. But beyond hype, what’s actually powering the rally?

In this article, you’ll learn what Hemi is and how it works, its tokenomics and unlock schedules, the reasons behind HEMI’s sharp surge, the key risks and metrics to monitor, and practical strategies for trading it.

What Is Hemi Protocol, Bitcoin Layer-2 Network?

Hemi’s vision is to make

Bitcoin more than a store of value by turning it into a base layer for decentralized finance (DeFi). Unlike wrapped BTC solutions that rely on custodians, Hemi integrates native Bitcoin directly into an EVM-compatible environment, giving developers the ability to build lending,

staking,

restaking, and trading applications using real

BTC.

Hemi's TVL | Source: DefiLlama

As of September 2025, Hemi reports $1.2 billion in total value locked (TVL), 90+ deployed protocols, including Sushi,

LayerZero, and Redstone, and over 100,000 verified human users. Its DeFi-specific TVL is over $278 million, making it the second-largest

Bitcoin DeFi sidechain after CORE, with a TVL of $289 million.

An Overview of Hemi's Architecture

• hVM (Hemi Virtual Machine): A runtime that embeds a full Bitcoin node inside the EVM. This gives Solidity smart contracts direct access to Bitcoin headers, UTXOs, and block data, enabling use cases like trustless lending or collateralized stablecoins backed by BTC without third-party wrappers.

• Proof-of-Proof (PoP): Hemi’s hybrid consensus protocol that anchors network state to the Bitcoin blockchain. PoP miners publish cryptographic proofs of Hemi’s chain to Bitcoin, making reorganizations prohibitively expensive and delivering Bitcoin-level finality after ~9 BTC blocks, around 90 minutes.

• Tunnels & Cross-Chain Bridges: Hemi provides “tunnels” for secure asset transfer between Bitcoin, Ethereum, and Hemi itself. In September 2025, Hemi partnered with Owlto Finance to integrate a cross-rollup bridge, allowing BTC-native assets on Hemi to flow into other L2s like

Arbitrum,

Optimism, and Base. This expands liquidity channels and makes Hemi part of the wider multi-chain DeFi economy.

HEMI’s Price Explode Over 820% in September: Key Driving Factors

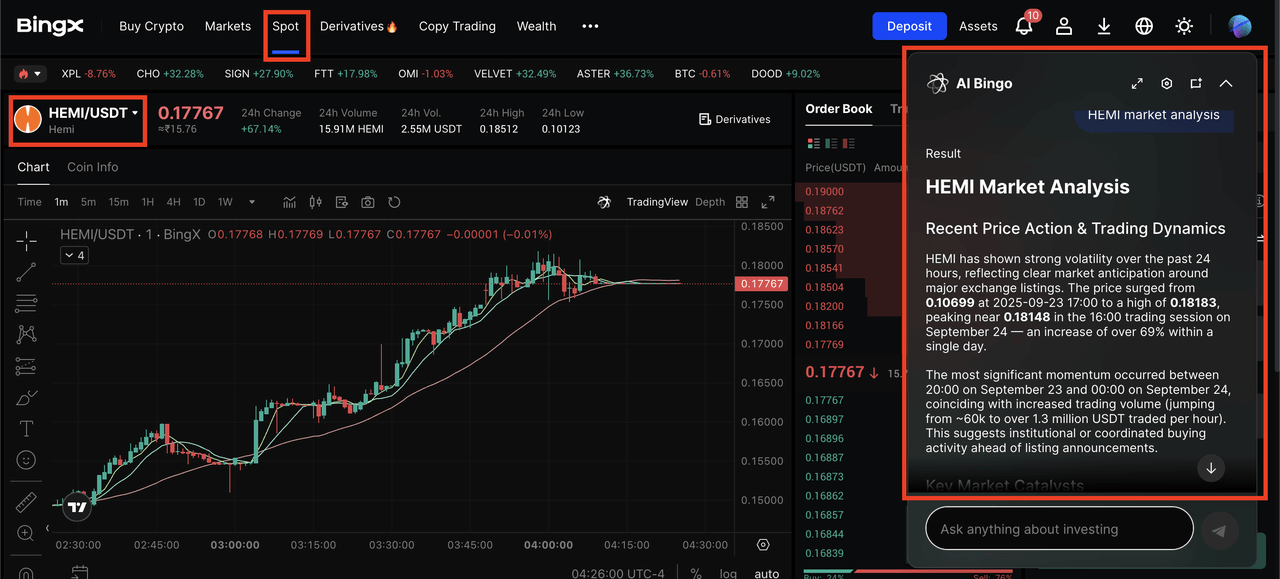

HEMI token price surged almost 140% in mid-September | Source: BingX

HEMI’s breakout was first triggered by its Binance listing and 100 milliion token airdrop to

BNB holders on September 23, 2025. The snapshot period between September 17 and 19 rewarded users who staked BNB in Simple Earn or On-Chain Yields, with tokens delivered to wallets just before spot trading opened. This “listing plus airdrop” combo acted as a powerful catalyst, boosting visibility and pulling in new traders eager to capitalize on fresh liquidity. Historically, such dual events often drive intense inflows during the first weeks of trading.

The momentum was reinforced by a dramatic surge in trading volume and price action. Daily volume jumped from around $20 million to nearly $893 million within ten days, with listing-day activity hitting $420 million, roughly 7× the day before. Prices spiked intraday to $0.17 before retracing to the $0.14 range, reflecting speculative fervor around the token’s debut. Analysts noted HEMI trading 100% above its 50-day moving average and 133% above its 100-day MA (moving average), signaling overbought but highly liquid conditions.

Finally, the broader Bitcoin DeFi (BTCFi) narrative amplified HEMI’s rally. By positioning itself as a programmability layer anchored to Bitcoin security, Hemi captured the market’s appetite for the “next frontier” in BTC yield and utility. Backing from YZI Labs (ex-Binance Labs) and institutional recognition added legitimacy, while media coverage framed HEMI as one of the top hype tokens of the week. Across sources, performance metrics ranged from 250% in a single week to nearly 500% across its first month, with some analysts citing 760%+ depending on the measurement window.

HEMI Token Utility and Tokenomics

The HEMI token is the backbone of the Hemi ecosystem, powering transactions, security, and governance. Its core utilities include:

• Gas and Fees: HEMI is used to pay transaction fees on the network and to execute smart contracts within the hVM.

• Security Incentives (PoP): Validators and participants are rewarded in HEMI for anchoring state proofs to Bitcoin’s blockchain, reinforcing consensus security.

• Staking & veHEMI: Holders can stake tokens to earn rewards, receive veHEMI for governance voting, and boost incentives across DeFi protocols.

• Ecosystem Adoption: HEMI serves as the medium of exchange for on-chain payments, DeFi apps, and liquidity incentives, aligning growth across its 90+ deployed protocols.

HEMI Token Distribution

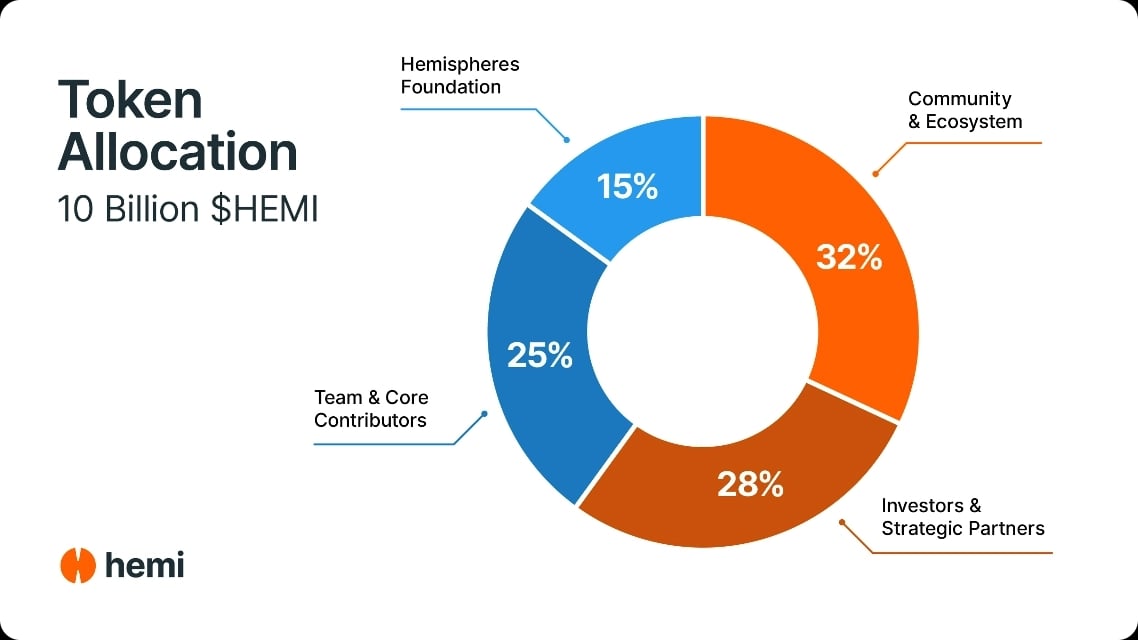

HEMI token allocation | Source: Hemi Network

The HEMI token has a total supply of 10 billion, with an initial circulating supply of about 977.5 million tokens (9.8%).

HEMI Token Allocation

• Community & ecosystem: 32%

• Investors & strategic partners: 28%

• Team: 25%

• Hemispheres Foundation: 15%

HEMI’s unlock schedule extends over 50 months, allowing tokens to be released gradually and reducing immediate sell pressure. At launch, 100 million HEMI were airdropped to BNB holders through Binance, with further allocations set aside for marketing and ecosystem growth to drive adoption and liquidity.

At launch, the limited float helped reduce immediate sell pressure and supported the rapid price rally. However, the extended unlock cycle means traders should monitor monthly token release schedules, as these can introduce fresh supply and volatility into the market.

How to Trade HEMI on BingX

If you want exposure to HEMI, BingX offers both spot trading for long-term holding and futures trading for short-term strategies, with

BingX AI tools available to help you analyze market trends, volatility, and support levels before making a move.

Buy or Sell HEMI/USDT on the Spot Market

HEMI/USDT trading pair on the spot market, powered by AI Bingo - BingX's AI assistant

Spot trading works best if you want to accumulate HEMI gradually and hold through ecosystem growth.

1. Log in or create an account on BingX and

complete KYC for full access.

2. Deposit

USDT into your Spot wallet via card, bank transfer, or crypto transfer.

4. Choose your order type:

• Limit order → set your preferred price and wait for execution.

5. Confirm your trade and manage your holdings under the “Assets” tab.

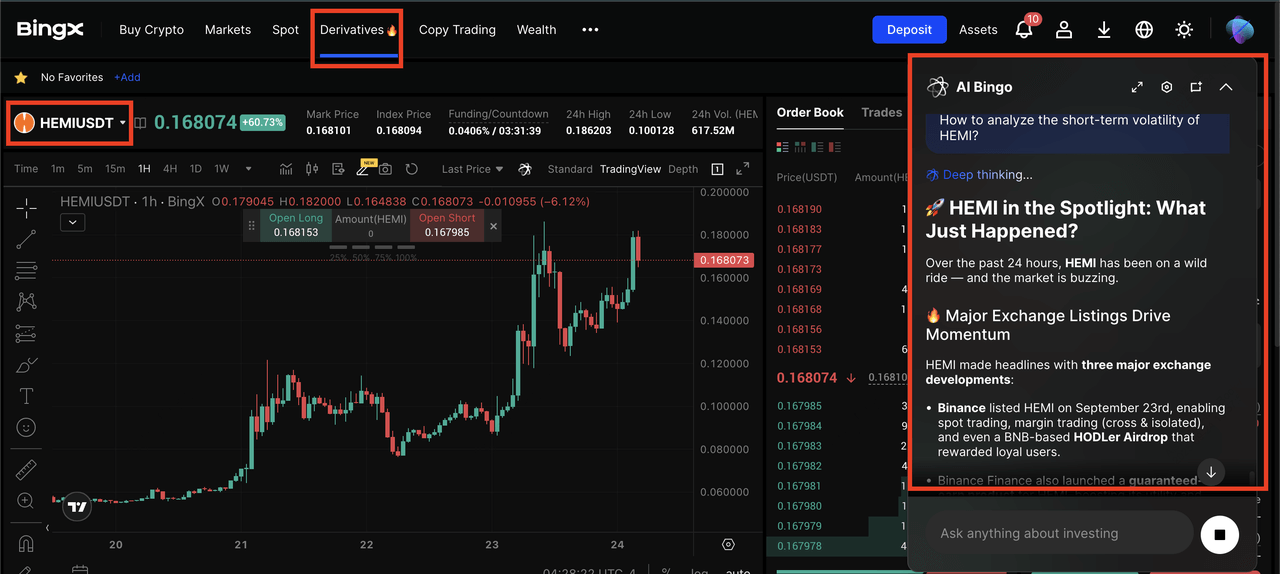

Long or Short HEMI/USDT Perpetual in the Futures Market

HEMI/USDT perpetual contract on the futures market powered by AI Bingo

For traders seeking leverage or short-term opportunities, BingX also offers HEMI/USDT Perpetual Futures.

2. Adjust leverage; beginners should start small, say 2–3× leverage.

3. Decide whether to go long (buy) if you expect HEMI to rise, or go short (sell) if you expect a pullback.

5. Monitor real-time insights with BingX AI tools, which highlight volatility spikes, funding rates, and support/resistance zones.

Futures are ideal if you want to profit from volatility in either direction, but they carry higher risk. Always size positions carefully and avoid over-leveraging.

Key Considerations When Investing in Hemi (HEMI)

Like many fast-rising tokens, HEMI offers strong upside potential but also comes with meaningful risks. Before investing, it’s important to balance the excitement with discipline.

1. Avoid FOMO-driven entries. HEMI’s rally has been sharp, but chasing parabolic moves often leads to losses. Safer entries come after pullbacks or confirmed breakouts with healthy trading volume. Monitoring order books and liquidity depth is especially important in the early days of listing, when spreads can be volatile.

2. Track token unlocks and vesting schedules. With most of HEMI’s 10 billion supply still locked, gradual releases over 50 months could introduce sell pressure. Watching monthly or quarterly unlock events, especially those tied to investors or the team, helps you anticipate potential dilution.

3. Monitor on-chain and DeFi adoption. Real usage will decide whether Hemi sustains momentum beyond hype. Keep an eye on TVL, number of active users, transaction counts, and integrations. Strong growth here signals lasting traction, while stagnation may warn of fading interest.

4. Manage position size and risk. Use stop-loss or trailing stop strategies, particularly in high-volatility periods. Start with smaller positions until the ecosystem matures, and consider pairing HEMI exposure with BTC or stablecoins to balance risk.

Risks to keep in mind: HEMI is still new and highly volatile. Price momentum can reverse quickly, unlock-driven dilution could weigh on markets, and the project’s technical complexity means execution risk remains. Narrative-driven hype may fade if usage lags, while competing Bitcoin programmability projects could erode its edge.

Conclusion: Future Outlook for Hemi and BTCFi

Hemi introduces a new model for Bitcoin-native DeFi, combining Bitcoin’s security with

Ethereum-style programmability through its hVM, PoP consensus, and cross-chain tunnels. Its early momentum, fueled by a Binance listing, large-scale airdrop, and rapid TVL growth, shows strong market interest in the broader BTCFi narrative, where Bitcoin evolves from a passive store of value into an active layer for decentralized applications.

Looking ahead, Hemi’s future will depend on whether developers continue to build on its network, whether liquidity deepens across its bridges, and whether TVL and user adoption sustain growth. At the same time, upcoming token unlocks and rising competition in the BTCFi sector may create headwinds.

For investors, HEMI represents a high-risk, high-reward opportunity at the intersection of Bitcoin and DeFi. Its potential is significant, but as with all new tokens, volatility, dilution, and execution risk remain. A cautious, disciplined approach, anchored in tracking fundamentals and protecting capital, is the best way to navigate Hemi’s path forward.

Related Reading