The

crypto bull run in 2025 has been turbulent, but a handful of projects and sectors have stood out over others. One such standout project is Definitive (EDGE), whose token price has skyrocketed nearly 800% in just 30 days, pushing its market cap past $920 million. This explosive growth comes as traders and institutions alike turn their attention to platforms that deliver real infrastructure rather than hype.

So what makes Definitive different? Built by former Coinbase Prime engineers, it combines the speed and precision of centralized exchanges with the openness of DeFi. From advanced order types and gas-less execution to deep liquidity routing across 100+ DEXs, Definitive is positioning itself as the go-to hub for professional on-chain trading. At the heart of this ecosystem is the $EDGE token, which unlocks lower fees, premium features, and

staking rewards for active users.

In this article, we’ll break down what Definitive is, why EDGE is surging, its key features, and how you can get started, whether you’re new to DeFi or looking for professional-grade trading tools.

What Is Definitive (EDGE)?

Definitive is a decentralized trading platform built to deliver the speed, precision, and reliability of centralized exchanges (CeFi) within the decentralized finance (DeFi) world. Unlike centralized platforms where you give up custody of your funds, Definitive is non-custodial; you stay in full control of your assets while benefiting from a streamlined, professional-grade trading experience.

The project was developed by former Coinbase Prime engineers, the same team that designed trading systems for billion-dollar institutional clients. Definitive runs natively on the Base blockchain, alongside support for Solana and major EVM networks, giving traders a unified way to access liquidity across chains. Its mission is simple: equip everyone, from retail traders to hedge funds, with the same powerful execution tools that traditional finance takes for granted.

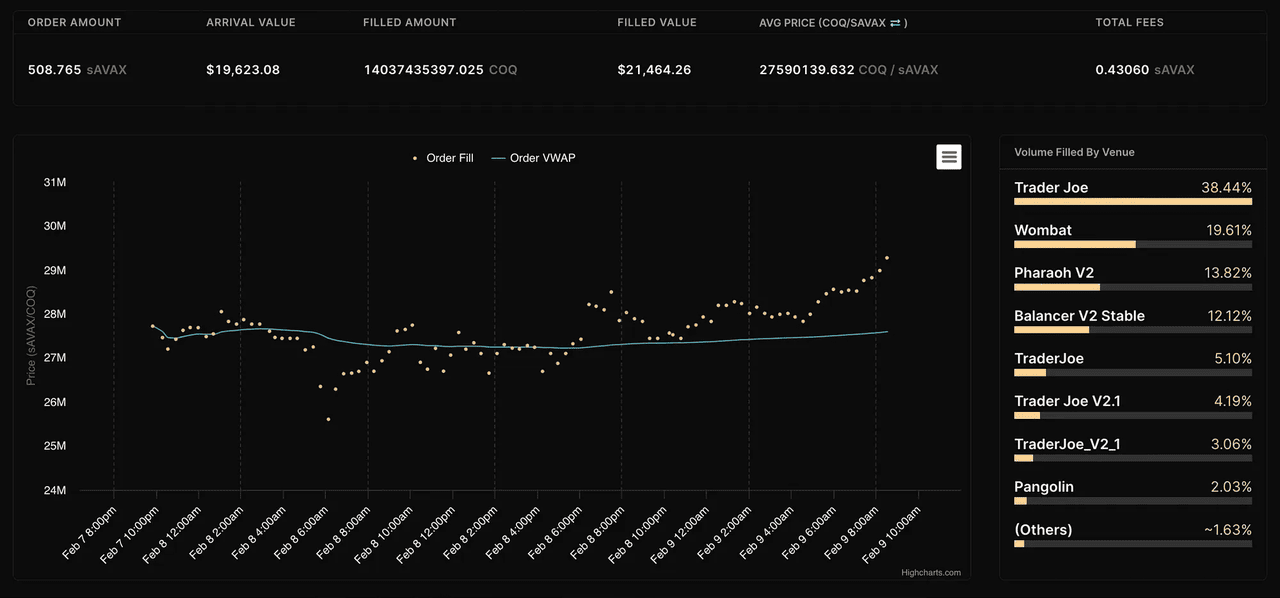

For example, imagine you want to buy $50,000 worth of a new altcoin that only exists on-chain. On a typical DEX, you’d risk high slippage or front-running by MEV bots. On Definitive, you can place a TWAP (Time-Weighted Average Price) order, which breaks your trade into hundreds of smaller fills. The platform’s smart router automatically finds the best liquidity pools, spreads the execution over time, and secures you a better average entry, all while you let the system handle the work.

Key Features of Definitive DeFi Platform

How TWAP orders work on Definitive | Source: Definitive blog

1. Advanced Order Types for Precision: Traders aren’t limited to basic swaps. Definitive offers Market, Limit, Stop-Loss, Take-Profit, and TWAP (Time-Weighted Average Price) orders. These tools let you execute trades more strategically, whether you want to spread a large buy over time or lock in profits automatically.

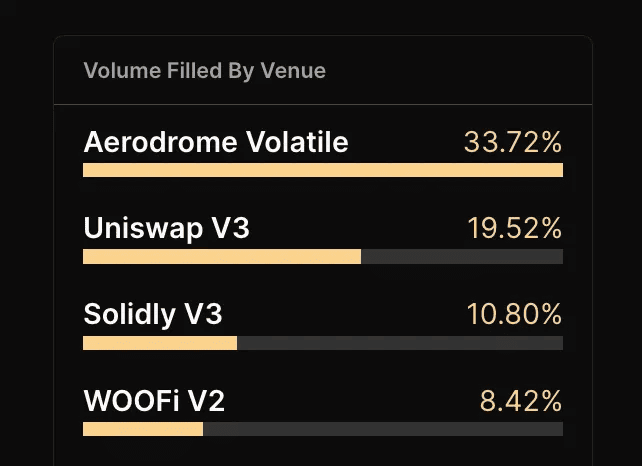

2. Access to Deep, Aggregated Liquidity: Liquidity in DeFi is often fragmented across hundreds of decentralized exchanges (DEXs). Definitive solves this by pooling liquidity from 100+ DEXs and 15+ private market makers. This ensures you get the best available price without wasting time hunting across platforms.

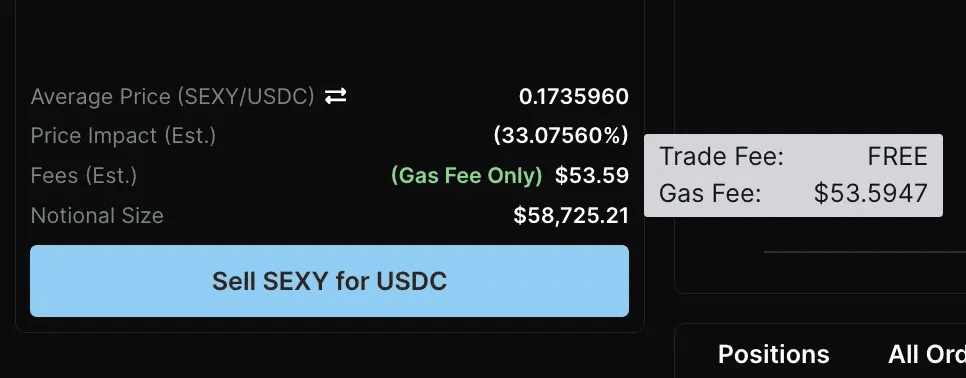

3. Gas-less and Friction-Free Trading: Paying gas fees and signing multiple approvals has always been a headache in DeFi. Definitive abstracts these steps away, covering gas costs upfront and deducting them from the final trade. Traders can execute multiple orders with a single signature session, creating a seamless “gas-less” experience while also shielding trades from MEV bots and front-running.

4. Institutional-Grade Infrastructure: Beyond individual traders, Definitive is built for funds, DAOs, and OTC desks. Features like role-based access controls, sub-accounts for teams, and automated post-trade reporting make compliance, auditing, and portfolio tracking effortless. This level of infrastructure, combined with support across Solana, Base, and seven major EVM chains, is rarely seen in DeFi today.

Definitive (EDGE) price surges nearly 770% in July-August 2025 | Source: Coinmarketcap

The price of EDGE has exploded in the past month, climbing nearly 770% from around $0.072 to an all-time high (ATH) $0.91 on August 17, 2025. This rally has pushed its market capitalization to nearly $930 million as of mid-August 2025, a ninefold increase in just 30 days. For context, many DeFi tokens have struggled to maintain momentum in the same period, making EDGE one of the standout performers in the sector. The surge reflects not only speculation but also measurable growth in liquidity and trading activity on the Definitive platform.

A key driver behind this rally is institutional adoption. Hedge funds and professional investors like Skycatcher Capital and Starkiller Capital have incorporated Definitive into their strategies, citing its ability to handle complex trades across fragmented liquidity markets. Starkiller’s CIO noted that Definitive made it possible to trade assets that were previously “inaccessible and impractical” through centralized exchanges or OTC desks. This endorsement highlights the platform’s real-world utility, showing that EDGE is backed by serious trading infrastructure.

At the same time, the broader DeFi market is shifting away from speculative tokens toward platforms that deliver tangible infrastructure value. Definitive fits squarely into this trend with its gas-free execution, cross-chain trading, and detailed reporting tools. Community discussions on Reddit echo this sentiment, with users praising its ease of use and professional-grade features. This combination of strong fundamentals, institutional trust, and grassroots excitement has fueled confidence that EDGE could be positioned for long-term growth, even as the wider crypto market remains volatile.

What Can You Do on Definitive?

Beyond a DeFi swap platform, Definitive is a full suite of tools that let you trade like a professional while keeping full control of your assets. Whether you’re a casual trader or managing larger capital, here’s what you can actually do on Definitive:

1. Trade Any Token on Any Chain

With Definitive, you aren’t restricted to one network or a handful of pairs. You can trade across

Ethereum,

Solana, Base,

Arbitrum,

Avalanche,

Polygon, and more, all from a single interface. For example, you could swap a small-cap token on Solana and then rotate profits into ETH on Arbitrum without juggling multiple wallets and bridges.

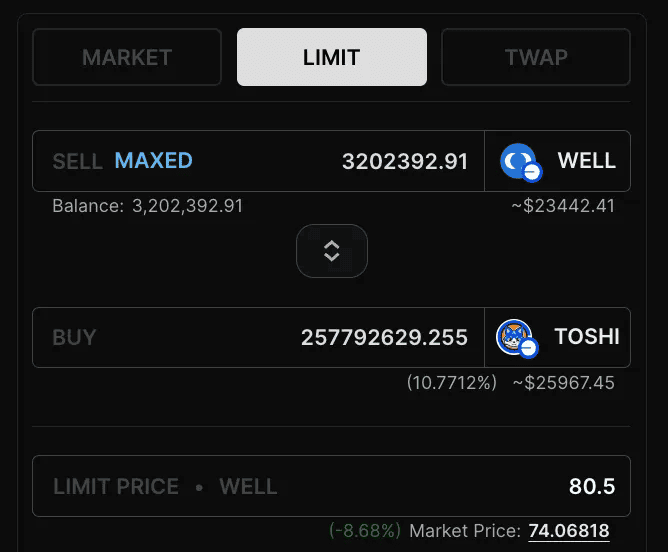

2. Use Advanced Order Types

Order types on Definitive | Source: Definitive blog

Most DeFi apps only give you basic swaps. Definitive lets you set up:

• Market Orders for instant execution at the best price.

• Limit Orders to buy or sell at your chosen price, automatically filled when conditions are met.

• TWAP (Time-Weighted Average Price) Orders to break up a large trade into smaller chunks over time, reducing price impact.

• Stop-Loss & Take-Profit Orders to protect against sudden market moves or lock in gains while you’re away.

This means you can automate strategies and avoid being glued to charts 24/7.

3. Enjoy Gas-less and Friction-Free Trading

Definitive's gas-less interface | Source: Definitive blog

Instead of paying gas fees on every transaction, Definitive abstracts them away. You sign once to start a session, and then you can place multiple trades without constant pop-ups or hidden costs. The system automatically calculates gas and deducts it from your trade outcome, making the process simple and predictable.

4. Get the Best Price With Smart Liquidity Routing

How Definitive's smart order routing works | Source: Definitive blog

Liquidity is scattered across hundreds of DEXs, but Definitive’s Smart Order Router checks more than 100 venues and private market makers in real time to give you the best possible execution. This protects you from slippage, MEV attacks, and poor fills that often plague on-chain trading.

5. Track Your Performance Like a Pro

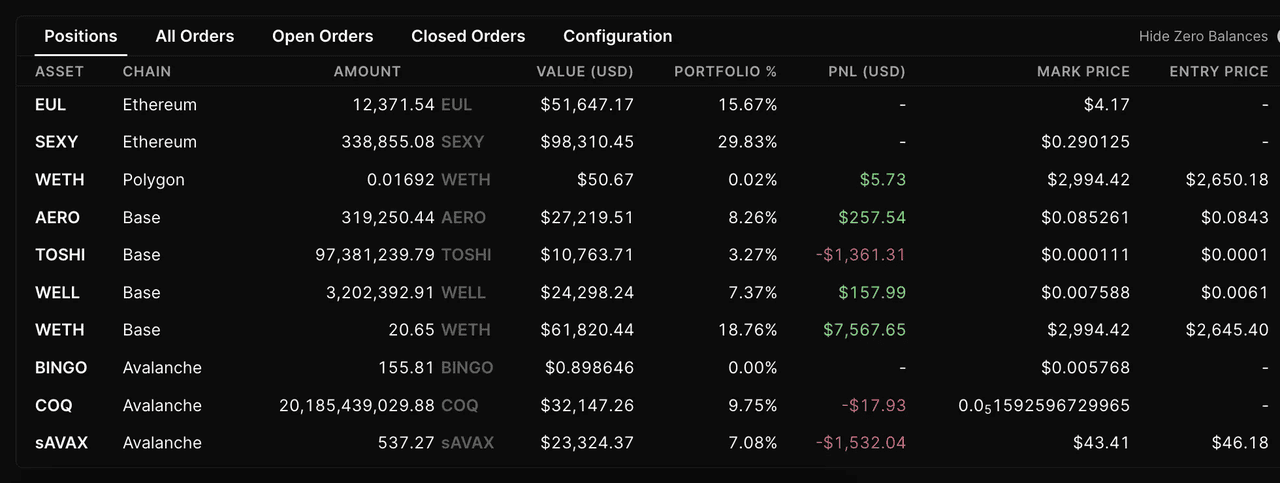

PnL and activity tracking | Source: Definitive

Every trade comes with detailed post-trade reports, including fill breakdowns, profit and loss (PnL), and activity history. You can download these reports as CSVs, share them with an accountant, or use them to fine-tune your strategy. For professionals, this level of reporting is essential for compliance and auditing.

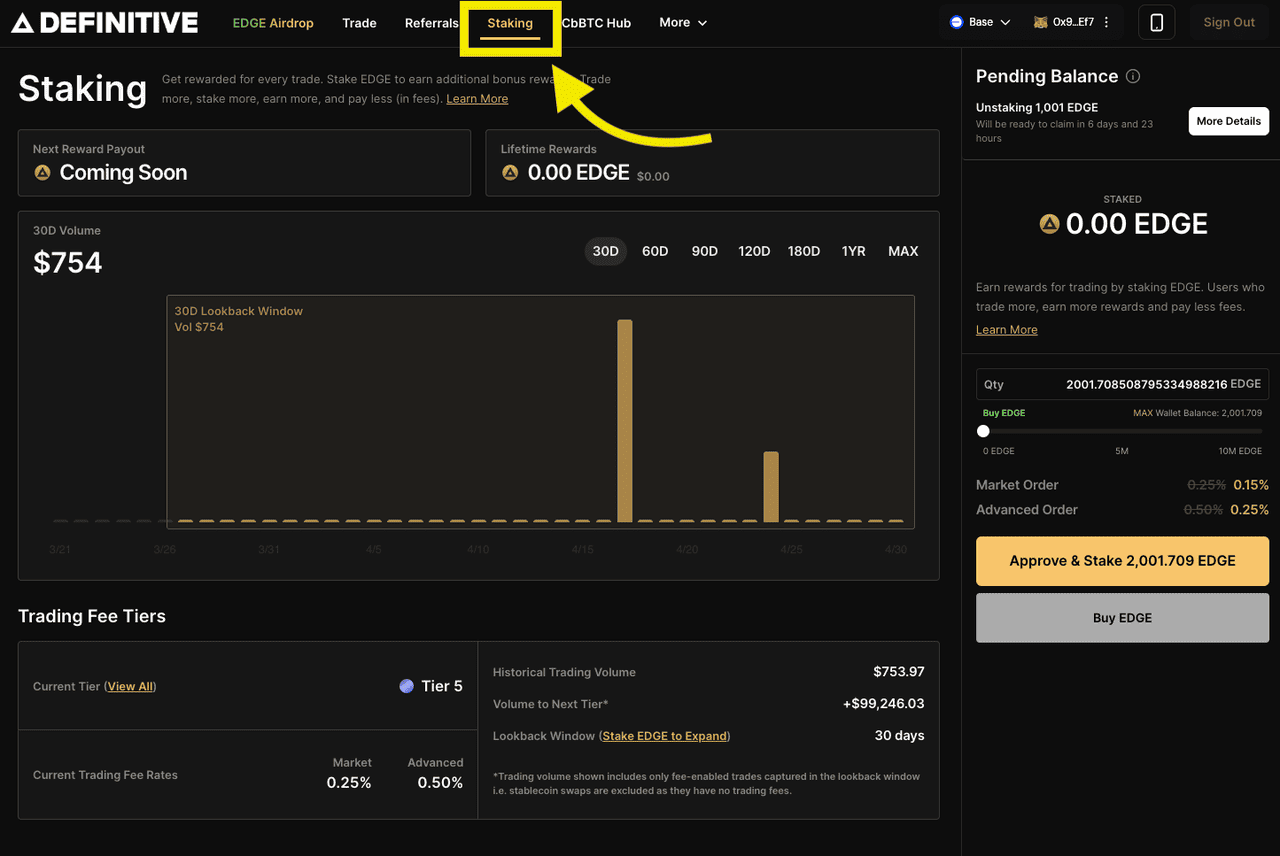

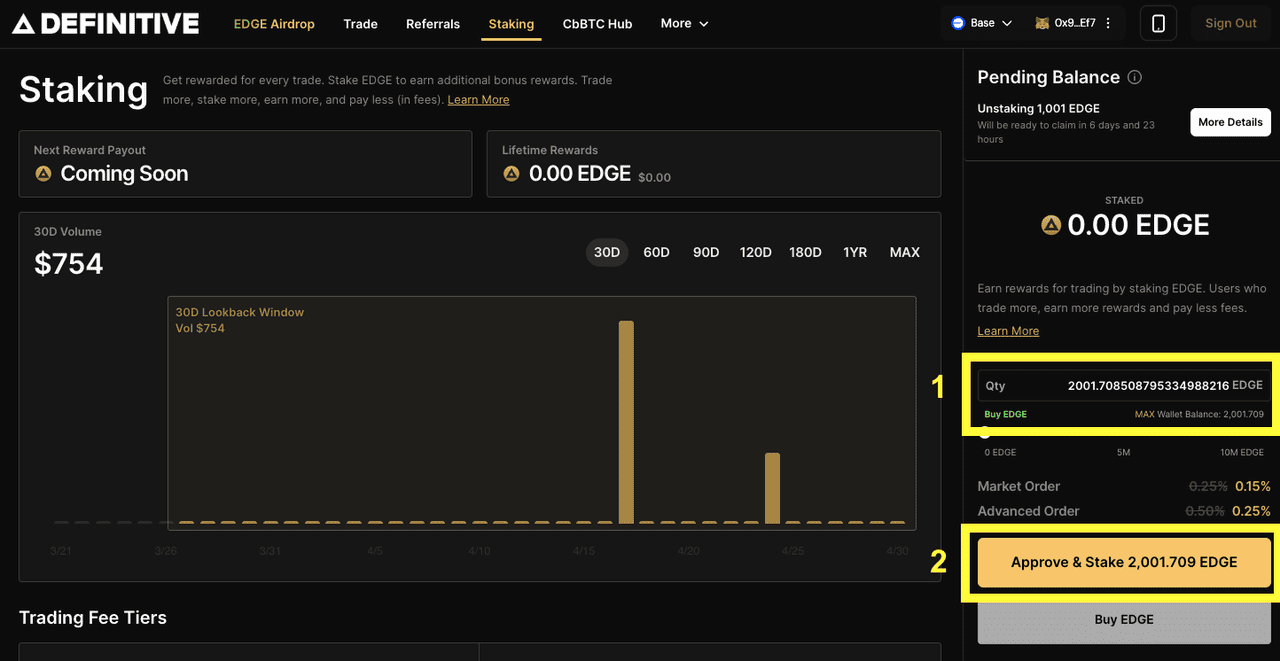

6. Stake EDGE for Lower Fees and Rewards

By staking the platform’s token, $EDGE, you can reduce your trading fees, unlock premium features, and potentially earn future rewards. Even staking as little as 2,000 $EDGE qualifies you for fee discounts, making every trade cheaper in the long run.

What Is the EDGE Token Utility?

The $EDGE token powers the Definitive ecosystem and gives traders tangible benefits beyond speculation. By holding and staking EDGE, users unlock practical advantages that make trading cheaper, faster, and more efficient.

First, staking $EDGE reduces trading fees across the platform. Even staking a minimum of 2,000 EDGE qualifies you for lower fee tiers, while larger stakes extend your discount period and unlock deeper savings. This makes a big difference for active traders, where fee reductions can translate into thousands of dollars saved over time. Stakers may also gain early access to new features and future reward distributions, aligning long-term holders with the platform’s growth.

Second, EDGE enhances the trading experience itself. Staked users can access advanced order types such as Limit, Stop, and TWAP orders across multiple chains with gas abstraction. This ensures trades execute at the best available price without manual approvals or surprise network costs. On top of that, institutional users can leverage exclusive features like role-based access controls, private order flow, and automated post-trade reporting, tools designed to support funds, OTC desks, and professional teams. In short, EDGE transforms Definitive from a trading app into a full-scale, institutional-grade trading infrastructure.

How to Stake EDGE on Definitive and Earn Rewards

Staking $EDGE on Definitive is straightforward and only takes a few minutes. To get started, connect your Base-compatible wallet (such as

MetaMask or

Base App) to the platform and head to the Staking page. Enter the amount of EDGE you’d like to lock up. Staking at least 2,000 $EDGE immediately unlocks discounted trading fees and better execution tiers.

Staking EDGE on Definitive | Source: Definitive docs

Once you confirm the transaction in your wallet, your tokens are staked and the benefits apply instantly. If you decide to unstake, keep in mind there’s a 7-day cooldown period before you can withdraw your tokens. This system helps protect liquidity on the platform while still giving users the flexibility to exit when needed.

Staking EDGE on Definitive | Source: Definitive docs

By staking EDGE, you’re not only lowering your costs but also positioning yourself for future rewards and feature access as Definitive expands its ecosystem.

Conclusion

Definitive stands out in the DeFi space by combining institutional-grade infrastructure with practical tools for everyday users. It goes beyond being just another token by offering advanced order types, gas-free execution, and deep liquidity aggregation that make on-chain trading more efficient. The recent surge in EDGE price highlights growing interest from both institutional players and retail traders who see value in its utility-driven model.

That said, it’s important to remember that EDGE remains a highly volatile digital asset, and its performance depends on broader market conditions as well as continued adoption of the Definitive platform. As with any crypto investment, users should do their own research, manage exposure carefully, and only stake or trade what they can afford to lose.

Related Reading