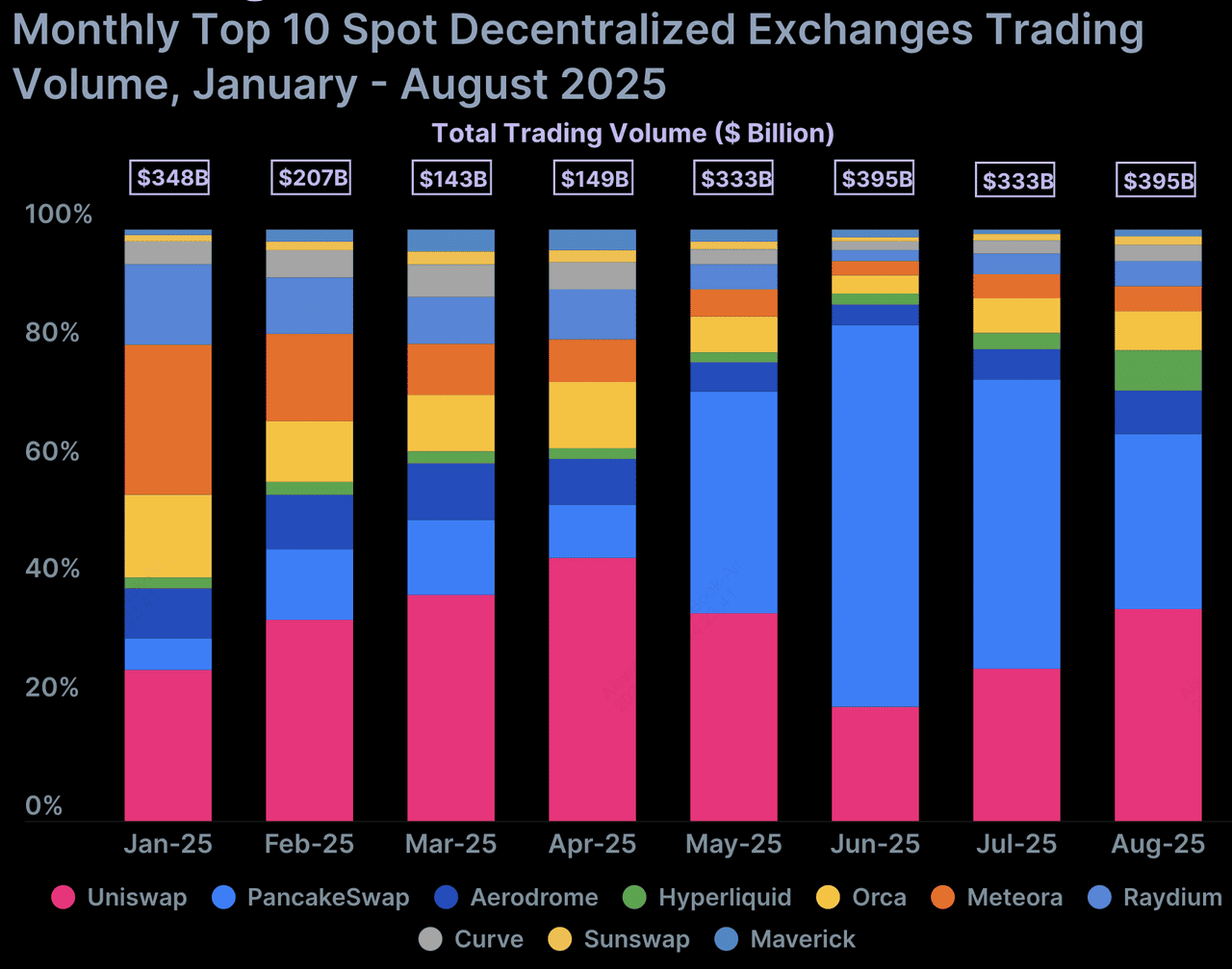

DeFi isn’t slowing down, it’s compounding. As per CoinGecko research, in August 2025,

Uniswap reclaimed the leading position with 35.9% market share and $111.8 billion monthly volume, a +28.3% MoM gain, followed by

PancakeSwap at 29.5% and monthly volume of $92.0 billion, and

Aerodrome at 7.4% with a monthly volume of $22.9 billion, while

Hyperliquid surged to 6.9%, the fastest riser in the top cohort. Weekly spot activity is also hot: analysts clocked $171.26 billion in on-chain DEX volume over the past week in September 2025, underscoring sustained trader migration to non-custodial rails.

Monthly trading volume of the most popular DEXs between January and August 2025 | Source: CoinGecko

DEXs (decentralized exchanges) now compete head-to-head with CEXs (centralized exchanges) on speed, UX, and number of assets listed, especially on Layer-2s (L2s) and high-throughput chains. Uniswap’s modular v4 pools, PancakeSwap’s multi-chain reach, Base’s Aerodrome flywheel, and the breakneck rise of perp venues like Hyperliquid and

Aster are resetting expectations for price discovery, capital efficiency, and governance.

In this guide, we profile 10 standout DEXs shaping 2025, what they do best, where they operate, and the trader types they serve.

What Is a Decentralized Exchange (DEX) and How Does It Work?

A decentralized exchange (DEX) is a crypto trading platform that allows you to swap digital assets directly from your wallet, no centralized custodian required. Instead of depositing funds into an exchange account, you stay in control of your private keys at all times. Trades are executed through smart contracts, which automate order matching, liquidity provision, and settlement on-chain.

Most DEXs use an automated market maker (AMM) model, where liquidity pools (funded by users) replace traditional order books. When you swap tokens, the AMM uses algorithms to determine prices based on supply and demand in the pool. Some next-gen DEXs, like Hyperliquid and Aster, go further by running decentralized order books and supporting perpetual contracts with near-CEX execution speed.

Liquidity providers (LPs) play a crucial role in DEXs. By depositing token pairs into pools, they earn a share of trading fees and sometimes additional incentives like governance tokens. This makes DEXs not just trading platforms, but also income-generating hubs for active participants.

DEX vs. CEX: Key Differences to Know

While centralized exchanges (CEXs) like BingX act as custodians holding your funds and managing order books off-chain, DEXs let you trade directly from your wallet with full custody, greater transparency, and fewer barriers to entry, but often at the cost of steeper learning curves and higher self-responsibility.

What Are the 10 Best DEXs for Crypto Traders in 2025?

Selecting the top DEXs requires balancing many factors: liquidity, security, innovation, user adoption, multichain support, governance, and product differentiation. The 10 listed below combine legacy strength with emerging momentum. Some are incumbents pushing new boundaries, while others are rising challengers redefining trading design.

Here are the 10 DEXs we’ll cover:

1. Uniswap (UNI)

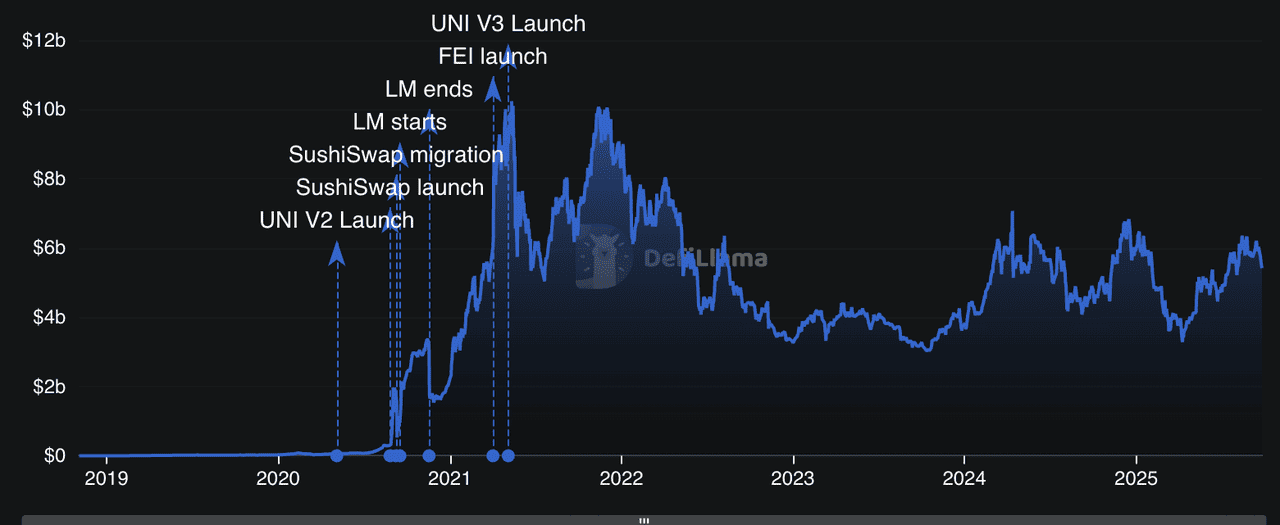

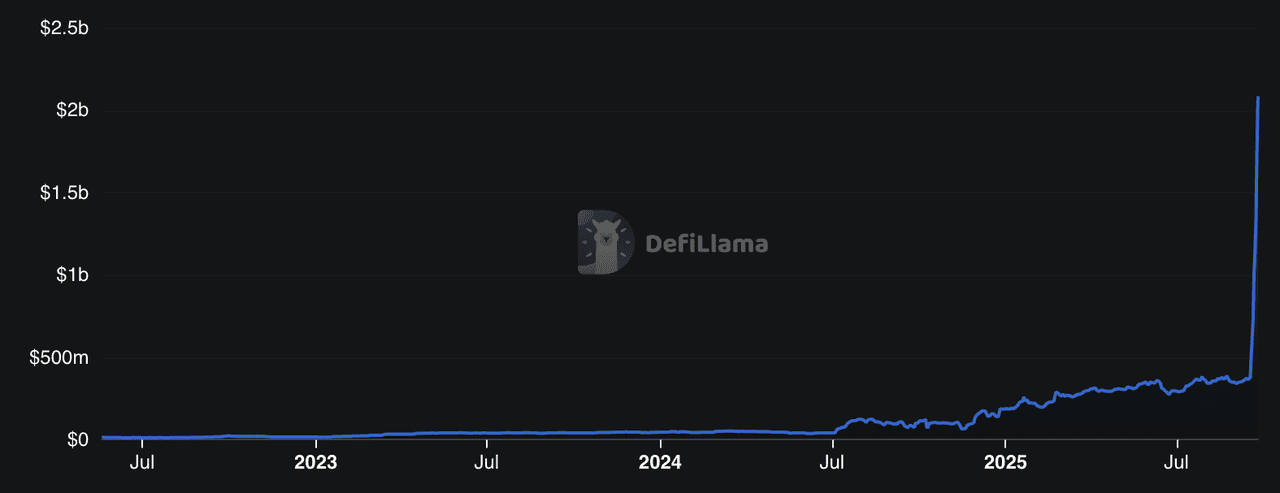

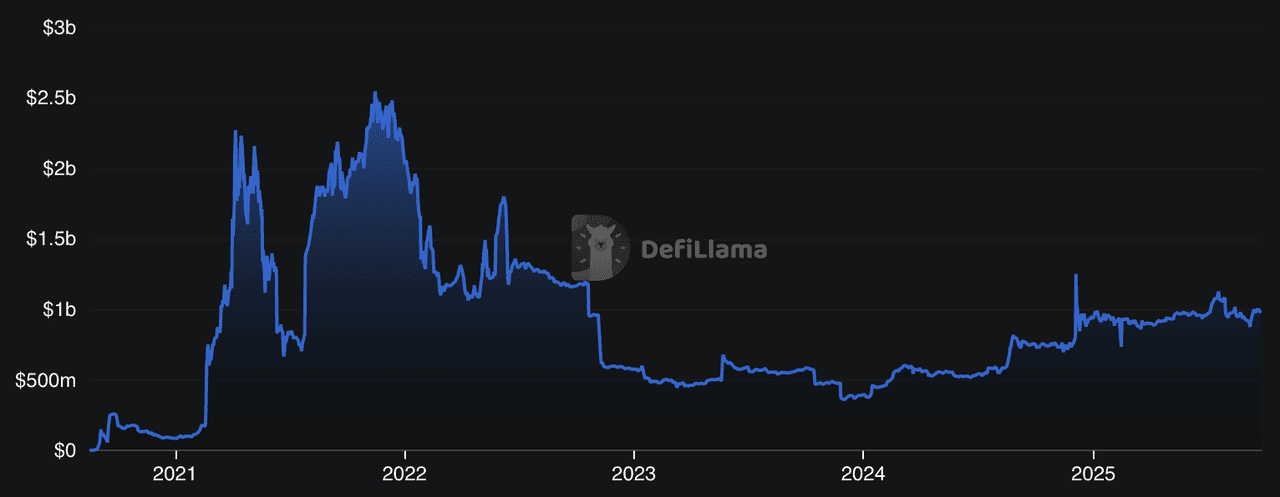

Uniswap TVL | Source: DefiLlama

Uniswap is the largest decentralized exchange (DEX) by market share, processing over $100B+ in monthly volume in 2025. Built on

Ethereum, it has expanded to 14+ chains, including

Arbitrum,

Polygon, Base, and

BNB Chain, giving users access to deep cross-chain liquidity. The newly launched Uniswap v4 adds modular “hooks” for custom pool logic and better gas efficiency.

The

UNI token is primarily used for governance, allowing holders to vote on protocol upgrades, treasury allocation, and community proposals, while also aligning incentives across the Uniswap ecosystem. Uniswap's trading fees range from 0.05%–1%, depending on pool configuration. Liquidity providers (LPs) earn these fees, while Uniswap itself doesn’t charge protocol revenue.

Uniswap's Key Features

• Automated Market Maker (AMM) with concentrated liquidity (v3)

• Uniswap v4 Hooks for custom strategies like dynamic fees and limit orders

• UniswapX aggregator for gasless swaps with MEV protection

• Permissionless listings for thousands of tokens

• Developer-friendly API powering third-party DeFi apps

Who Should Use Uniswap?

Traders and liquidity providers seeking maximum liquidity depth, advanced tools, and multichain coverage in a trusted DEX environment.

2. PancakeSwap (CAKE)

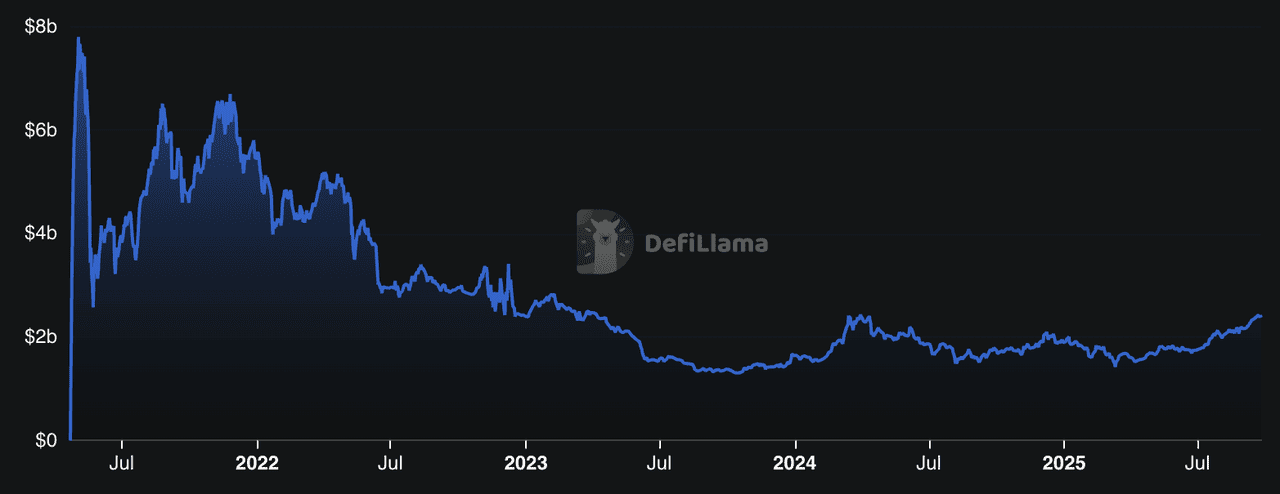

PancakeSwap TVL | Source: DefiLlama

Launched in 2020 on BNB Chain,

PancakeSwap DEX has grown into one of the largest DEXs, now spanning nine major blockchains including Ethereum, Arbitrum, Base,

Solana,

zkSync, and Polygon. With over $2.3 billion in TVL and millions of active wallets, it supports swaps,

yield farming,

staking,

NFTs, lotteries, and even

perpetual futures. Fees are 0.01%–1% depending on pool type, making it cheaper than most Ethereum-based DEXs. Its native token,

CAKE, powers governance, staking, yield farming, IFO participation, and deflationary burns.

Key Features of PancakeSwap

• Multi-chain token swaps with Smart Router V3

• Yield farming and Syrup Pools for staking rewards

• Perpetual contracts with up to 50x leverage

• Prediction markets, lotteries, NFT marketplace

• SpringBoard & IFOs for token launches

Who Should Use PancakeSwap?

DeFi users who want low-cost, multi-chain trading with gamified features and yield opportunities in one platform.

3. Hyperliquid (HYPE)

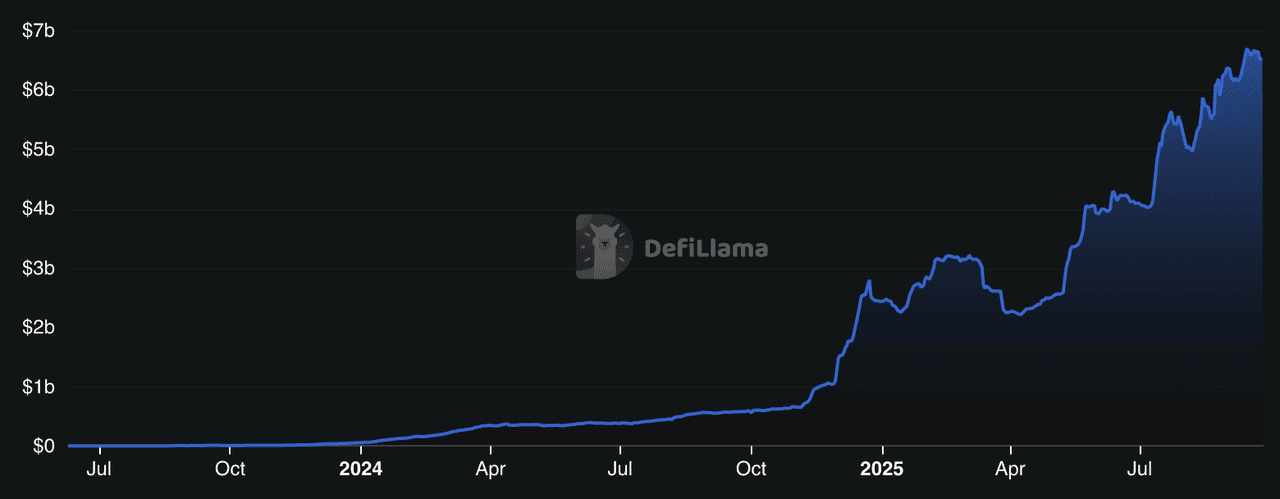

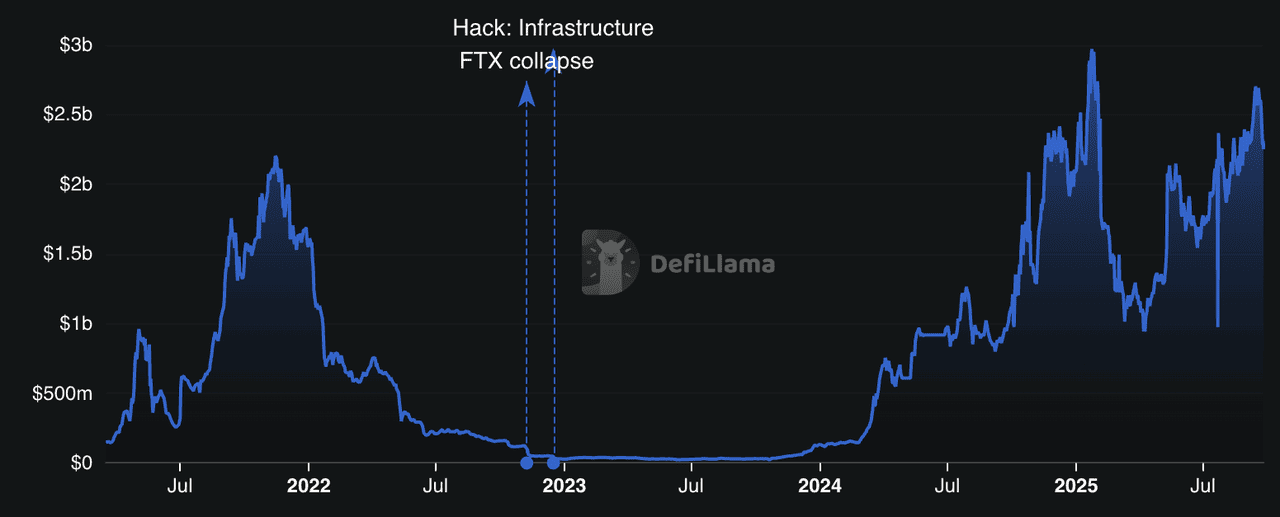

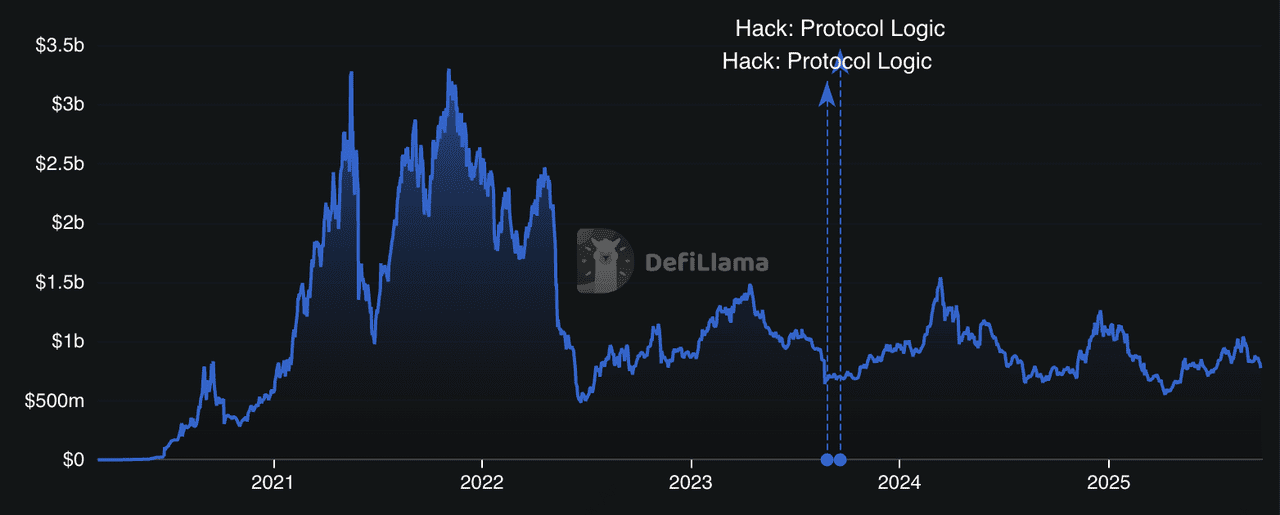

Hyperliquid TVL | Source: DefiLlama

Hyperliquid is a perpetuals-first DEX running on its own high-performance Layer-1 blockchain (Hyperliquid L1) with an EVM-compatible HyperEVM, delivering gas-free trading, a fully on-chain order book, and real-time execution across 130+ perp markets. It targets CEX-level speed (sub-second finality) with maker ~0.01% / taker ~0.035% trading fees and up to 50× leverage, plus one-click trading and transparent on-chain liquidations. HYPE is the native token used for governance, staking rewards, and ecosystem alignment, with a fee buyback (“Assistance Fund”) that programmatically purchases HYPE using exchange fees.

Hyperliquid runs on its own Layer 1 with HyperEVM, enabling users to deploy EVM apps and connect via familiar wallets. It offers CEX-like speed, zero gas fees on trades, a fully on-chain order book, deep perpetual liquidity, and a fee-driven

HYPE buyback model. However, its derivatives-first focus means spot and tooling are still developing, the single-chain design carries concentration risk compared to multi-chain DEXs, high leverage can increase liquidation exposure, and newcomers may face challenges with evolving wallet and bridge support.

Hyperliquid's Key Features

• Custom L1 + HyperBFT consensus; unified state for Core (order books) and HyperEVM

• Fully on-chain order book (trades, funding, liquidations recorded on-chain)

• Zero gas to place/execute orders; maker/taker fee tiers

• Up to 50× leverage, cross/isolated margin, scale/TWAP/limit orders

• One-click trading (minimal approvals) and real-time funding

• HYPE buyback via Assistance Fund; staking/governance for token holders

• Growing vaults & builder ecosystem on HyperEVM

Who Should Use Hyperliquid?

Active derivatives traders who want CEX-grade speed, zero-gas on-chain perps, and a token model that recycles fees back into the ecosystem.

4. Aster (ASTER)

Aster TVL | Source: DefiLlama

Aster is a fast-growing perpetuals DEX that merged Astherus + APX Finance and now runs multichain across BNB Chain, Ethereum, Arbitrum, and Solana. It offers MEV-resistant, one-click trading, with Simple Mode up to 1001× leverage and a Pro Mode order book for power users. Fees are paid by traders, maker/taker vary by market, and collateral can include yield-bearing assets, e.g., asBNB, USDF, so positions earn while open. The

ASTER token is a BEP-20 token on BNB Chain, powers governance, can be used as trading collateral and to pay fees, and fuels incentives/airdrops and ecosystem growth, including buybacks and treasury per program design.

Aster DEX’s strengths include rapid volume growth, deep liquidity, hidden orders that reduce slippage, multichain access, productive collateral like asBNB and USDF, and even stock perpetuals. However, as a newer protocol it still faces security and longevity risks, its ultra-high leverage heightens liquidation risk, the wide feature set can overwhelm users, and incentive programs may shift over time.

Aster DEX's Key Features

• Two UIs: Simple Mode with up to 1001× leverage and Pro Mode, offering order book, multi-asset margin, grid/TWAP

• Hidden Orders concealed until execution to limit frontrunning & slippage

• Yield-integrated collateral, such as asBNB, USDF, for capital-efficient perps

• Stock perpetuals with 24/7 trading alongside crypto perps

• Multichain deployment across BNB Chain, Ethereum, Arbitrum, and Solana; ASTER as BEP-20

• Oracle blend, e.g.,

Pyth/

Chainlink/Binance Oracle, and MEV-aware routing

Who Should Trade on Aster?

Traders who want CEX-like tools on-chain, stealth execution, very high leverage, and yield-efficient collateral, and are comfortable with the risks of a newer, fast-moving perp DEX.

5. Aerodrome (AERO)

Aerodrome TVL | Source: DefiLlama

Aerodrome Finance is the

largest DEX on the Base blockchain, designed as the central liquidity hub for Base-native tokens and DeFi projects. Built as a “MetaDEX,” it offers low-fee swaps of 0.01%–0.3%, liquidity pools, and governance through its native AERO / veAERO system. Unlike many competitors, all trading fees and incentives are returned directly to users, aligning long-term growth with community participation. Its design makes it a core infrastructure piece for Base, with TVL surpassing $1B in 2025. The

AERO token is used for liquidity incentives, governance voting, and protocol rewards, while veAERO provides boosted emissions and voting rights for active participants.

Aerodrome’s strengths lie in its low-fee structure, strong integration with Base, and governance-aligned tokenomics that reward long-term users. Its growth has been rapid, backed by Coinbase Ventures and modeled after Velodrome, but its liquidity remains concentrated within the Base ecosystem, limiting reach compared to multi-chain DEXs. Risks include competition from other Base-native protocols and

Ethereum L2 DEXs, as well as the challenge of sustaining incentives long term.

Aerodrome's Key Features

• Native to Base blockchain, optimized for liquidity depth

• SlipStream gasless trading and cross-chain staking support

• veAERO governance with emissions voting and fee sharing

• No VC funding or token presales; launched as a public good

• Rewards 100% of fees and incentives back to users

Who Should Use Aerodrome Finance?

Aerodrome is best for Base ecosystem traders and liquidity providers seeking low fees, deep pools, and governance-driven rewards.

6. Raydium (RAY)

Raydium TVL | Source: DefiLlama

Raydium is a

leading DEX built on Solana, combining AMM pools with order book integration via OpenBook. This hybrid model offers fast execution, low transaction costs of fractions of a cent on Solana, and deep liquidity. Raydium supports both constant product (CPMM) and concentrated liquidity (CLMM) pools, giving traders flexible options and liquidity providers efficient capital use. Fees are highly competitive, with a small percentage of each swap of 0.25% distributed to liquidity providers and

RAY stakers. The RAY token powers governance, staking rewards, and access to exclusive features like the AcceleRaytor launchpad.

Raydium’s main strengths are speed, affordability, and flexibility, making it one of the most efficient DEXs for both casual swaps and professional strategies. Its integrations with farms, staking, and launchpads provide diverse earning opportunities, while Solana’s scalability ensures low costs. However, competition from newer Solana DEXs and aggregators could pressure liquidity, and past security incidents highlight ongoing risks. Cross-chain expansion remains limited compared to multi-chain platforms.

Raydium's Key Features

• Built on Solana with ultra-fast, low-cost execution

• Hybrid AMM + order book (OpenBook) model for deeper liquidity

• Supports CPMM and CLMM pools for flexible strategies

• Farms, staking, and AcceleRaytor launchpad integration

• Native $RAY token for governance, rewards, and fee sharing

Who Should Use Raydium DEX?

Raydium is ideal for Solana users and DeFi traders seeking fast swaps, yield opportunities, and access to new token launches.

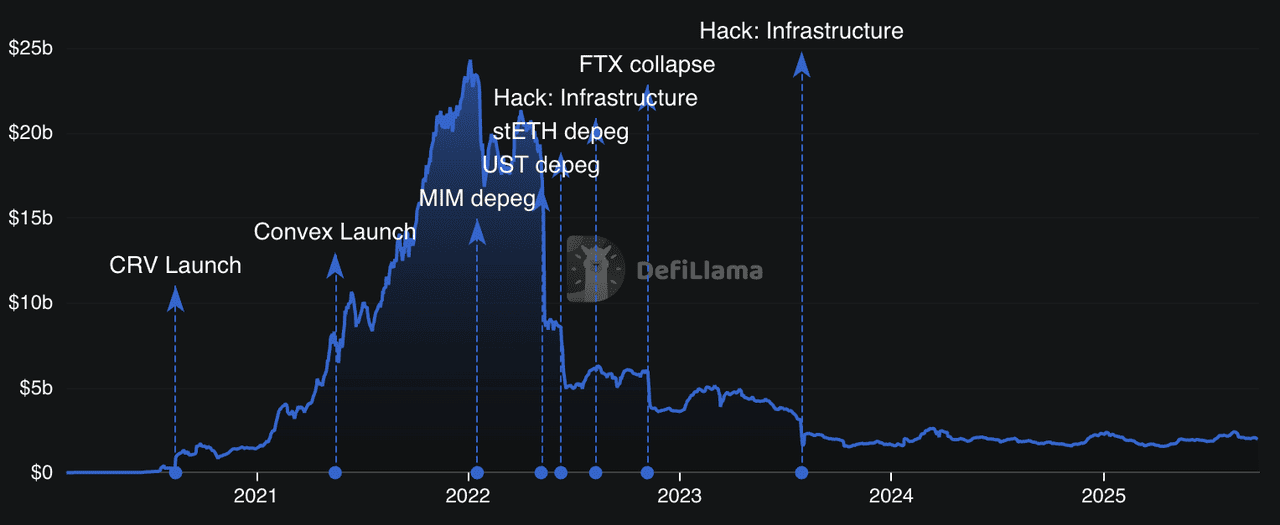

7. Curve (CRV)

Curve TVL | Source: DefiLlama

Curve is a DEX built for

stablecoin and like-asset swaps, offering some of the lowest slippage and fees in DeFi, typically 0.01%–0.04% per trade. Its StableSwap AMM algorithm makes it ideal for trading stablecoins,

liquid staking tokens (LSTs), and pegged assets. Curve has expanded across 12+ blockchains including Ethereum, Arbitrum,

Optimism, Polygon,

Avalanche, and

Sonic, while also introducing crvUSD, its own overcollateralized stablecoin. The native

CRV token powers governance, liquidity mining, and the vote-escrow (veCRV) model, which lets long-term stakers earn boosted rewards and direct incentives toward chosen pools.

Curve’s advantages are its deep liquidity, ultra-low fees, and efficiency for stable asset trading, making it a backbone for many DeFi yield strategies. It is also highly integrated into lending and farming protocols. However, it’s less effective for volatile tokens, faces growing competition from specialized stablecoin DEXs, and has experienced notable security incidents in the past.

Curve DEX's Key Features

• StableSwap algorithm for near 1:1 stablecoin swaps

• Expanded to 12+ chains with multi-asset liquidity pools

• crvUSD stablecoin for borrowing/lending integrations

• veCRV model for governance and boosted rewards

• Heavy DeFi protocol integrations for yield strategies

Who Should Trade on Curve?

Curve is best suited for DeFi users seeking efficient stablecoin swaps, liquidity providers earning yield, and DAO voters directing incentives.

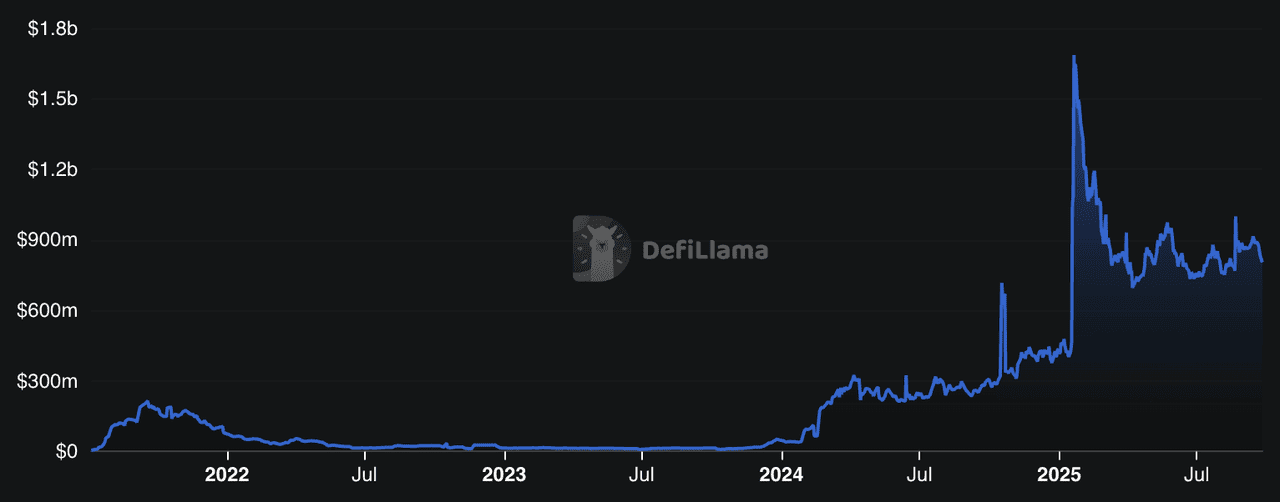

8. Meteora

Meteora TVL | Source: DefiLlama

Meteora is a Solana-native liquidity engine that has quickly risen to the top of DEX rankings by offering dynamic AMM pools, DLMM concentrated liquidity pools, and auto-rebalancing vaults. Built entirely on Solana’s fast, low-fee blockchain, it processes billions in monthly volume and supports integrations with Jupiter, Raydium, and other Solana dApps. Trading fees vary by pool type, with dynamic fees adjusting during volatility to reward liquidity providers (LPs). The protocol’s focus on memecoin markets and dual-yield pools has made it a hub for high-volume, high-risk assets. Meteora’s upcoming token (rumored through airdrop programs) will likely serve governance, liquidity incentives, and ecosystem growth, further anchoring its role in

Solana DeFi.

Meteora’s strengths include capital-efficient DLMM pools, dual-yield vaults that auto-lend idle assets, and strong traction in Solana’s booming memecoin sector. Its challenges lie in being a newer protocol still building security trust, potential liquidity fragmentation across pool types, and exposure to risks from external lending protocols.

Key Features of Meteora

• Dynamic AMM pools with dual yield (swap fees + lending interest)

• DLMM concentrated liquidity pools with volatility-adjusted fees

• Alpha Vaults for fair memecoin launches with anti-bot protection

• M3M3 stake-to-earn program for memecoin holders

• Auto-rebalancing Dynamic Vaults across Solana lending platforms

Who Should Use Meteora DLMM?

Meteora is best suited for active Solana traders and liquidity providers chasing yield in volatile and memecoin-heavy markets.

9. SUN.io (SUN)

SUN.io's TVL | Source: DefiLlama

SUN.io is

TRON’s largest DeFi hub, combining DEX trading, stablecoin swaps, yield farming, and DAO governance under one platform. Native to the TRON blockchain, it offers stablecoin swaps with fees as low as 0.04%, plus concentrated liquidity pools through SunSwap V3. The

SUN token powers governance, liquidity incentives, and buyback-and-burn mechanics, while veSUN (vote-escrowed SUN) boosts rewards and grants voting rights in SUN DAO. With nearly $1 billion in TVL and strong ties to the

TRON ecosystem, SUN.io continues to expand its role in on-chain liquidity and governance.

Its advantages include low-cost stablecoin swaps, community-driven governance, deflationary tokenomics, and strong integration with TRON-native projects like SunPump and SunPerp. Challenges involve relatively modest liquidity compared to Ethereum-based giants, reliance on buyback commitments, and the need to expand beyond its TRON user base.

SUN.io's Key Features

• StableSwap for low-slippage stablecoin trades

• SunSwap V3 with concentrated liquidity pools

• veSUN model for boosted yields and voting power

• SunPump meme launchpad with fair-launch mechanics

• Ongoing buyback-and-burn programs reducing supply

Who Should Use SUN.io?

SUN.io is best for TRON ecosystem users seeking low-cost stablecoin swaps, yield opportunities, and active governance participation.

10. Balancer (BAL)

Balancer TVL | Source: DefiLlama

Balancer is a DeFi-native AMM and liquidity hub built primarily on Ethereum, with extended deployments on chains like Arbitrum, Polygon, Optimism, and Avalanche. Unlike most DEXs, it supports multi-asset pools (up to 8 tokens) with customizable weights, letting users design portfolios that also earn swap fees. Fees vary by pool, typically 0.01%–1%, and Balancer v3 introduces better MEV protection, streamlined pool creation, and boosted pool strategies. The BAL token powers governance, liquidity incentives, and protocol upgrades, with veBAL (vote-escrowed BAL) giving holders voting power and boosted rewards.

Balancer’s main advantages are its highly customizable pools, index-style liquidity support, integrations with protocols like Aura and CowSwap, and a flexible governance model. However, high Ethereum gas costs can discourage smaller traders, the pool design can be complex for beginners, and it faces stiff competition from simpler AMMs such as Uniswap v4.

Balancer's Key Features

• Multi-token pools with flexible weights (index-style)

• Smart order routing for best prices across pools

• Boosted pools for yield-bearing tokens

• veBAL system for governance and boosted liquidity rewards

• Cross-chain deployments on top Ethereum L2s

Who Should Use Balancer?

Balancer is ideal for advanced DeFi users, liquidity providers, and institutions looking to design custom portfolios or optimize liquidity strategies.

How to Choose the Right DEX for You: Key Factors to Consider

Here’s an essential checklist of factors to evaluate before choosing a DEX:

1. Check Liquidity Depth – Deep pools help minimize slippage on large trades. Prefer DEXs with high TVL in your trading pairs.

2. Review the Fee Structure – Trading costs directly impact net returns, especially for active traders. Compare base and dynamic fees against fixed-rate models.

3. Confirm Chain & Token Compatibility – Ensure the DEX supports the token and network you want to use. Stick to DEXs native to your blockchain when possible.

4. Evaluate Security & Audit History – Weak or unaudited protocols can expose funds to major risks. Choose platforms with strong audits and transparent security practices.

5. Assess Innovation & Advanced Features – Some DEXs provide tools that fit specific trading styles. Look for features like concentrated liquidity, hidden orders, or perpetual markets.

6. Examine Governance & Incentive Alignment – Governance models influence rewards and platform direction. Review tokenomics such as voting power, burns, and distribution policies.

Key Considerations and Risks of Trading on DEXs

Before trading on decentralized exchanges, it is important to understand the risks and limitations involved:

• Liquidity Risk – Smaller pools may not support large trades without high slippage.

• Smart Contract Risk – Bugs or exploits in protocols can lead to permanent fund losses.

• High Volatility – Many DEX-listed tokens are thinly traded and prone to sharp price swings.

• Impermanent Loss – Liquidity providers can lose value compared to simply holding tokens.

• Gas and Network Fees – On chains like Ethereum, fees can be unpredictable and costly.

• Fragmented Liquidity – Prices may vary across pools and chains, requiring aggregators for the best execution.

• Limited Customer Support – Unlike centralized exchanges, DEXs offer no direct recourse if issues arise.

For safer, more efficient trading, you can use BingX instead, a regulated platform offering deep liquidity, advanced risk controls, and features like

ChainSpot for seamless multi-chain token access.

How to Trade DEX Tokens on BingX

Trading decentralized exchange (DEX) tokens on BingX is straightforward, whether you want to build a long-term position in the spot market or capture short-term price movements using futures.

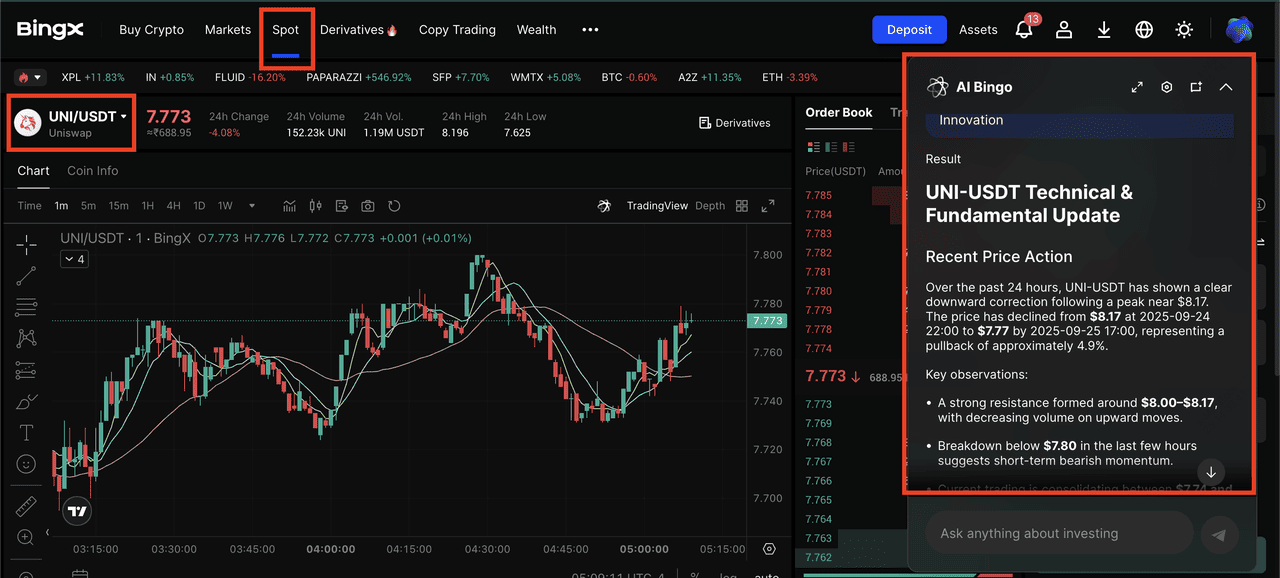

1. Spot Trading

UNI/USDT trading pair on the spot market powered by AI Bingo's insights

Spot trading is best suited for investors who want to buy and hold DEX tokens like UNI, RAY, or CRV.

1. Log in to your BingX account and go to the Spot Market.

3. Choose

Market Order for instant purchase or Limit Order at your desired price.

4. Confirm the trade; your tokens will appear in your BingX wallet.

5. Hold, transfer to an external wallet, or stake on

BingX Earn if supported.

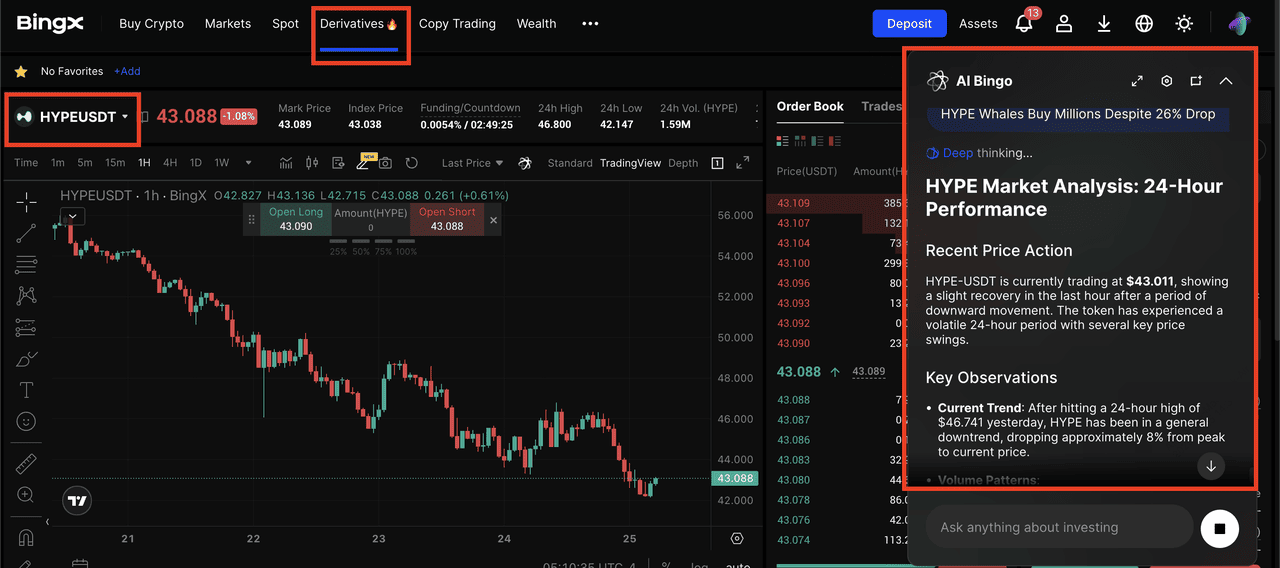

2. Futures Trading

HYPE/USDT perpetual contract on the futures market powered by AI Bingo

If you want to trade on volatility, BingX Futures allows you to go long (profit from rising prices) or short (profit from falling prices) with leverage.

3. Set your leverage level and margin type - cross or isolated.

4. Place a Long (Buy) order if you expect prices to rise, or a Short (Sell) order if you expect a drop.

Final Thoughts

The DEX landscape in 2025 is more diverse than ever. Established platforms like Uniswap, Curve, and Balancer continue to provide core liquidity infrastructure, while newer entrants such as Aster and Meteora are testing innovative models. Hyperliquid is narrowing the gap between centralized performance and decentralized transparency, PancakeSwap still offers broad accessibility, and Aerodrome is building a stronghold on Base.

As always, traders should balance opportunities with caution, including high volatility, smart contract risks, and evolving tokenomics. It’s important to manage exposure carefully and only trade what you can afford to lose.

Related Reading