Crypto trading presents unique challenges: overwhelming data streams, lightning-fast market moves, and emotional decision traps. While technical analysis and fundamental research remain essential, many traders now leverage

AI tools like ChatGPT to streamline their process.

ChatGPT isn't replacing trading expertise; it's amplifying it. By processing information faster and offering structured analysis frameworks, it helps traders focus on what matters.

In this guide, we’ll walk through five real-world use cases where traders are putting ChatGPT to work. You’ll also get actionable prompt examples you can start using today to improve your speed, clarity, and consistency in the crypto markets.

Use Case 1: News Summarization & Sentiment Detection

Crypto markets run 24/7, and headlines break faster than most traders can react. From ETF filings to exchange hacks, the sheer volume of information makes it hard to separate market-moving news from irrelevant noise. Missing a key update or misinterpreting its impact can mean entering trades too late or missing opportunities altogether.

How to Use ChatGPT for News Summaries and Sentiment Analysis

ChatGPT helps traders digest information faster. Simply paste a news excerpt, and it returns:

• A three-bullet summary of key facts

• A clear sentiment rating: bullish, bearish, or neutral

• A short forecast on the potential price impact

You can go further by asking ChatGPT to compare it with similar past events or suggest what token pairs might react.

Real-World Example

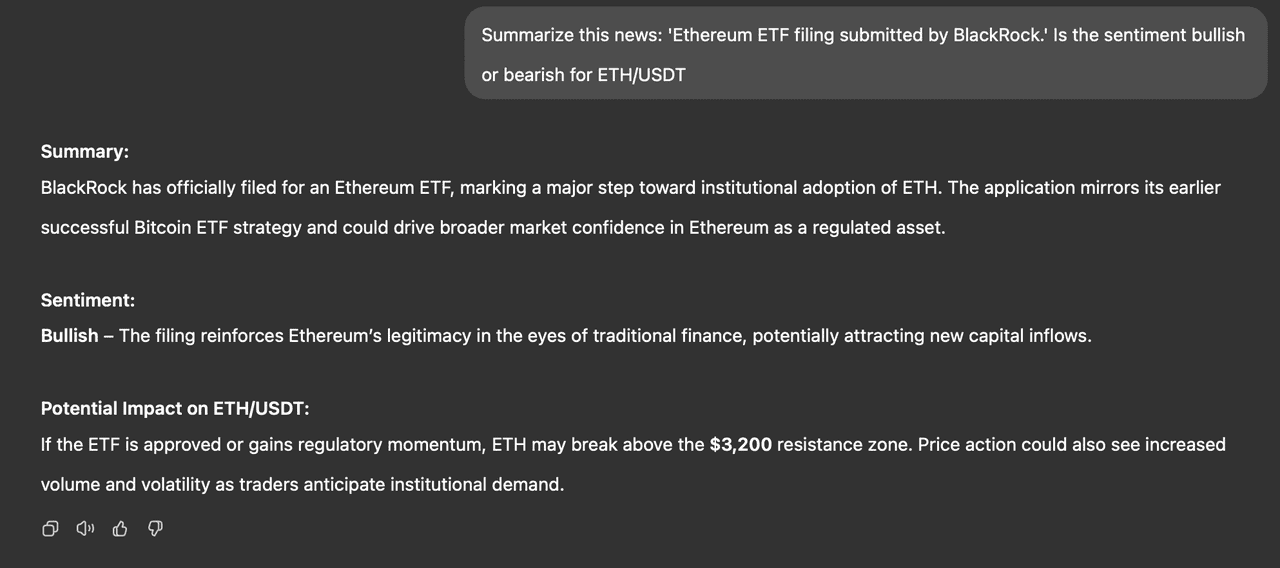

Prompt: "Summarize this news: '

Ethereum ETF filing submitted by BlackRock.' Is the sentiment bullish or bearish for

ETH/USDT?"

Output:

• Summary: BlackRock's ETF filing signals institutional validation of Ethereum

• Sentiment: Strongly bullish

• Potential impact: ETH likely to test resistance at $3,200 with increased volume

This allows traders to quickly assess news impact without getting lost in details or market noise.

Use Case 2: Building Trade Setups from News and Charts

It’s one thing to spot a bullish headline; it’s another to build a structured trade around it. Many traders hesitate to act because they lack a clear entry, stop-loss, or take-profit plan.

How to Use ChatGPT to Build Trade Setups

Combine

technical indicators, price levels, and news catalysts to generate structured trade setups with entries, exits, and rationale.

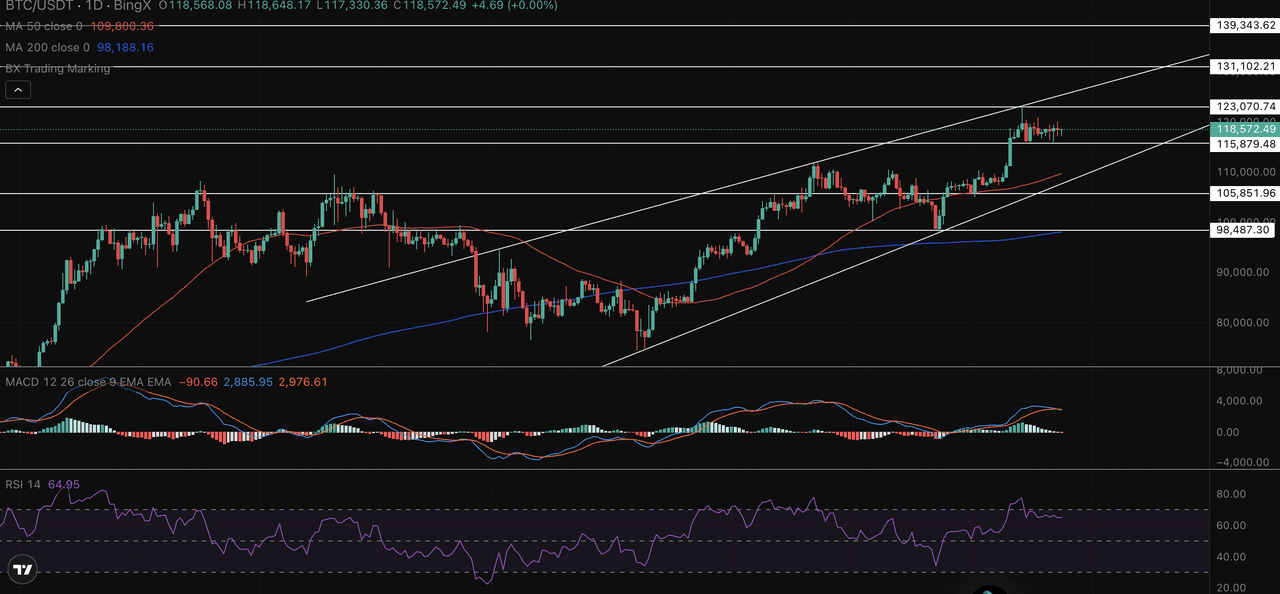

Real-World Example

Prompt: "BlackRock adds

BTC to treasury. RSI is 65. Price is near $118,500. Build a short-term

BTC/USDT trade idea."

Output:

• Entry zone: $118,400-$118,700

• Take profit: $123,000 (previous resistance)

• Rationale: Institutional accumulation + momentum without overbought conditions + key level retest

This framework helps traders move from information to execution with clear risk management parameters.

Use Case 3: Backtesting Historical Scenarios

Traders often react to news without considering how similar events have unfolded in the past. Backtesting provides much-needed context, helping you distinguish between hype and historically meaningful catalysts.

How to Use ChatGPT for Backtesting Historical Scenarios

Ask ChatGPT to summarize how the market responded to specific events in the past, such as ETF approvals, rate hikes, token unlocks, or exchange hacks. This lets you ground your current trade idea into historical behavior.

Real-World Example

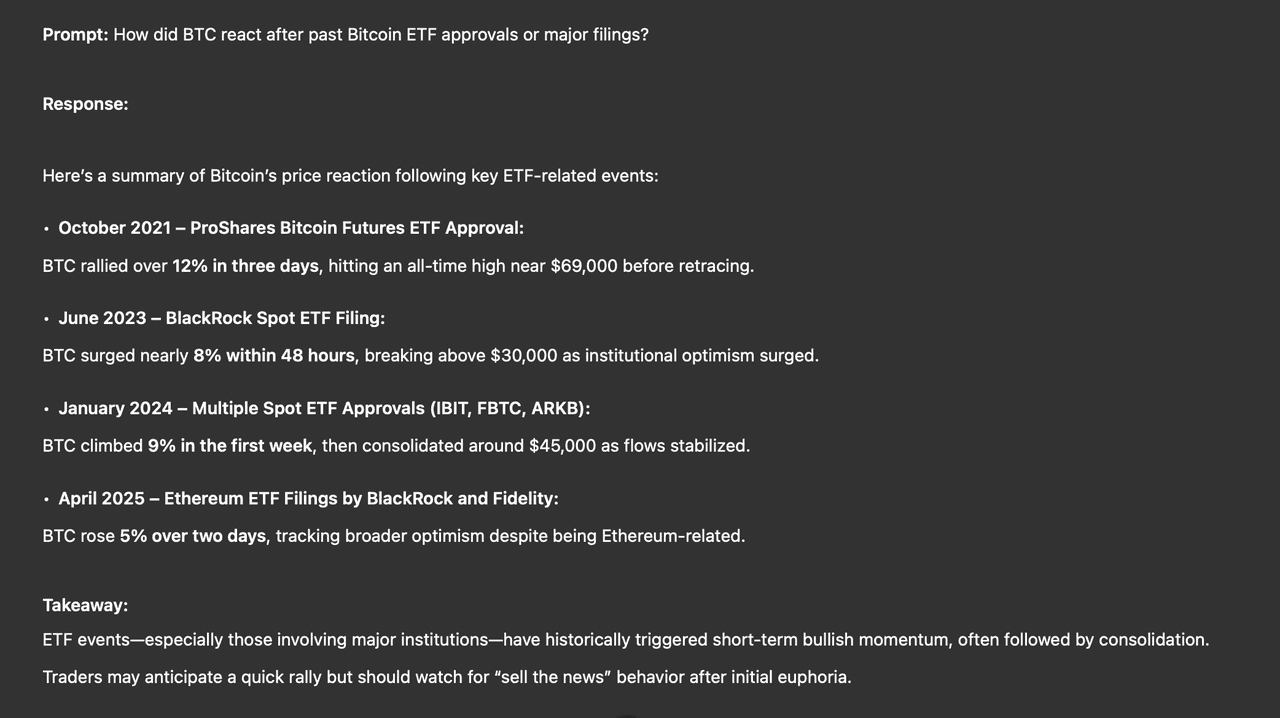

Prompt: "How did BTC react after past

Bitcoin ETF approvals or major filings?"

Output:

• 2021 ProShares ETF approval: Initial 12% rally followed by 8% pullback within 72 hours

• 2023 BlackRock spot ETF filing: 8% gain over 48 hours, sustaining above previous resistance

• Previous pattern: "Buy the rumor, sell the news" dynamic with initial spike followed by consolidation

• April 2025 – Ethereum ETF Filings by BlackRock and Fidelity: BTC rose 5% over two days, tracking broader optimism despite being Ethereum-related.

This historical perspective helps traders anticipate probable market reactions and avoid recency bias.

Use Case 4: Trade Journaling & Review

Most traders neglect journaling, especially during fast-paced sessions. But skipping post-trade analysis means losing valuable lessons. Without reflection, you’re likely to repeat mistakes or miss patterns in your wins and losses.

How to Create a Trading Journal with ChatGPT

ChatGPT can act as your personal trading journal. Just paste your trade details, entry, exit, stop-loss, and result, and it will summarize the trade, assess the reasoning, and offer constructive feedback. It removes the emotional weight and saves time.

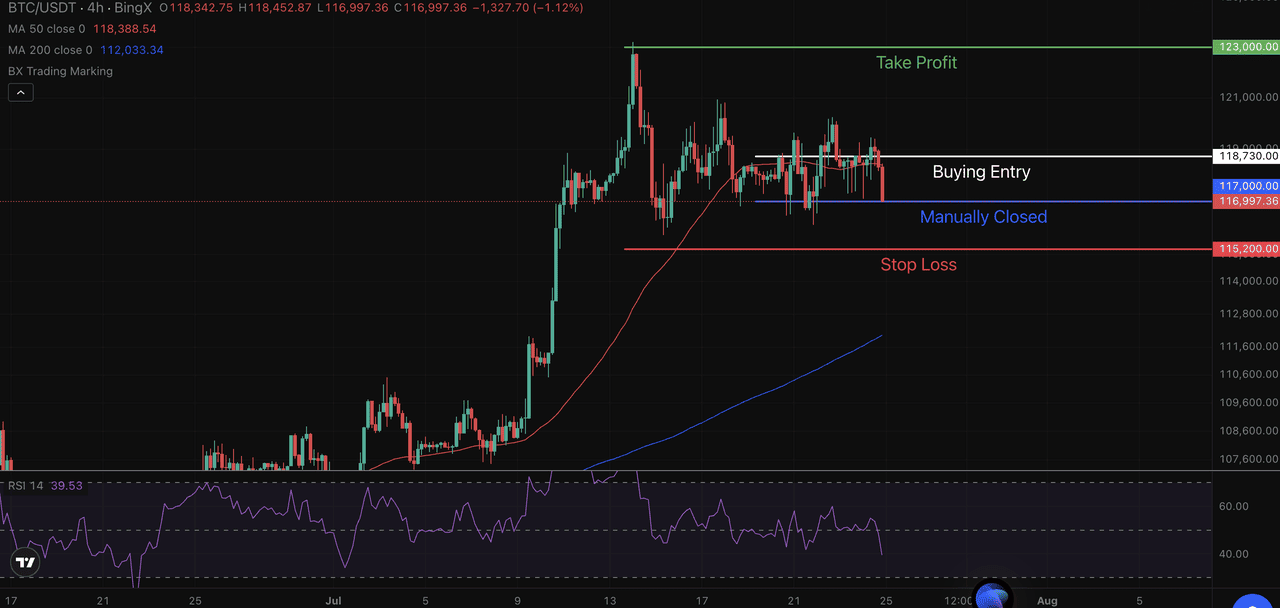

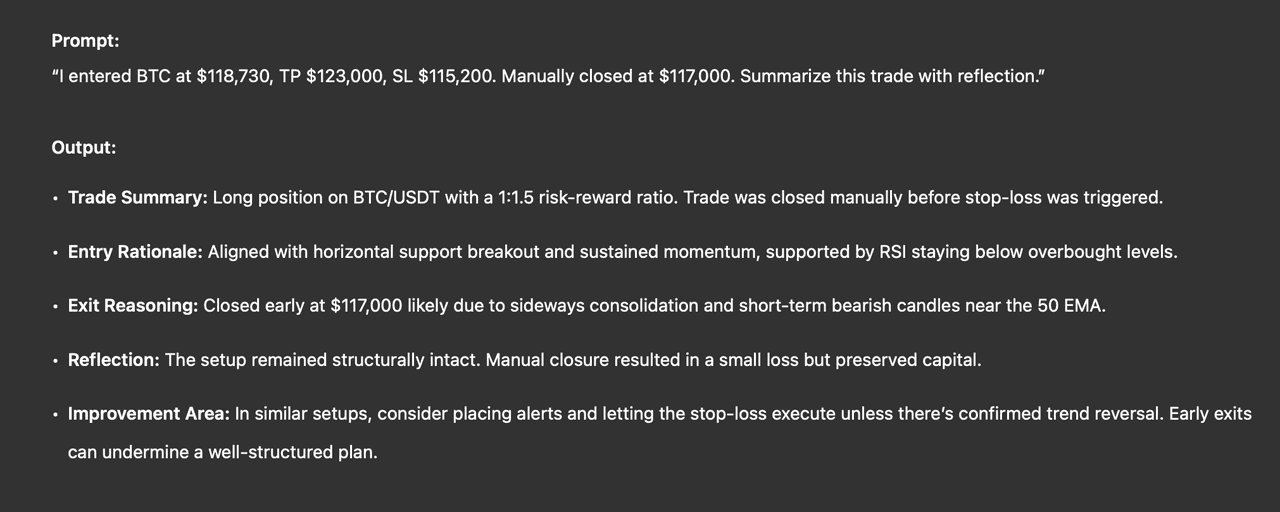

Real-World Example

Prompt: “I entered BTC at $118,730, TP $123,000, SL $115,200. Manually closed at $117,000. Summarize this trade with reflection.”

Output:

• Trade summary: BTC/USDT long with a solid risk-reward setup, manually closed early

• Analysis: Entry aligned with breakout strategy and bullish momentum

• Exit review: Manual closure preempted price invalidation; structure was intact

• Reflection: Early exit likely driven by fear of volatility. In future, consider holding unless stop level is broken on volume

• Lesson: Stick to plan unless clear invalidation occurs. Let strategy, not emotion, guide exit

Reflection: Entry was well-placed, but the trade was closed early before the stop-loss was hit. Consider trusting the setup and avoiding emotional exits unless the structure clearly breaks.

This structured feedback loop accelerates improvement without the emotional baggage of self-analysis.

Use Case 5: Watchlist Creation and Catalyst Tracking

With thousands of tokens in the market, it’s nearly impossible to track each one manually. Traders often miss opportunities simply because they weren’t watching the right coins at the right time.

How to Build a Trade Watchlist with ChatGPT

ChatGPT can help you build a smart watchlist tailored to your strategy. Ask it to scan for tokens with upcoming events, key unlocks, or ecosystem developments. You can also filter by volatility, market cap, or sector (e.g., DeFi, AI, L2s).

Real-World Example

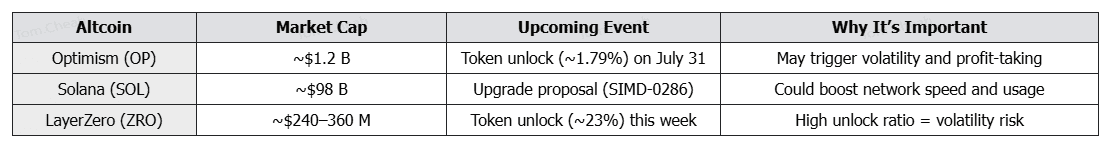

Prompt: "List 3 altcoins with upcoming events this week. Include market cap and reason for interest."

Output:

• Market Cap: ~$1.2 billion

• Event: Token unlock scheduled for July 31, releasing approximately 31.3 million OP, or 1.79% of total supply

• Reason for Interest: Token unlocks often create price volatility due to increased circulating supply. Traders may reposition ahead of the event.

• Market Cap: ~$98 billion

• Event: Proposed network upgrade (SIMD-0286) to increase block compute units from 60 million to 100 million

• Reason for Interest: The proposal is expected to improve transaction throughput and efficiency, which could enhance Solana’s competitiveness as a Layer-1 blockchain.

• Market Cap: ~$240–360 million

• Event: Approximately 23% of the total token supply is scheduled to unlock this week

• Reason for Interest: A large unlock like this can lead to heightened price fluctuations, especially for recently launched tokens with speculative demand.

Instead of tracking X (Twitter), calendars, and chain data separately, you now have a pre-qualified shortlist backed by real data, ready for deeper technical or fundamental analysis.

Conclusion

ChatGPT serves as a trading assistant, enhancing research speed, improving decision frameworks, and maintaining discipline. The most successful implementations combine AI tools with established trading strategies and risk management principles.

Start by incorporating one use case into your workflow this week. As you build comfort with the process, develop a personal prompt library tailored to your trading style. The goal isn't to automate trading decisions but to make them more informed, structured, and emotionally balanced.

Related Reading

FAQs on How to Use ChatGPT for Trading Crypto

1. Can ChatGPT actually help me trade crypto more effectively?

Yes, ChatGPT can help by summarizing news, generating trade setups, journaling past trades, and building watchlists. It streamlines decision-making, but final trade execution and risk management are still up to the trader.

2. How do I know if a news event is bullish or bearish?

You can paste the news into ChatGPT and ask:

“Summarize this crypto news. Is it bullish or bearish for [token]?”

It will analyze sentiment and provide a forecast based on historical behavior and current market context.

3. What’s the best prompt to generate a trade setup?

Use this:

“[News Event]. RSI is [value]. Price is near [level]. Build a trade setup for [pair].”

ChatGPT will return entry, stop-loss, take-profit, and reasoning.

4. Can I use ChatGPT to analyze my past trades?

Absolutely. Input your entry, TP, SL, and exit result, and ask ChatGPT to summarize the trade and provide reflection. This helps you improve without emotional bias.

5. Does ChatGPT offer real-time market data or live charts?

No, it doesn’t pull real-time prices or charts. But you can feed in your own data or chart notes, and ChatGPT will help interpret the situation logically.