In 2025, decentralized finance (Defi) is no longer an experiment on the fringes of crypto. It has matured into a sophisticated ecosystem where traditional finance and blockchain increasingly intersect, with Ethereum at its core. Known for its robust

smart contracts and vibrant developer community,

Ethereum continues to anchor most DeFi activity while setting the standard for innovation.

The launch of

Spot Ethereum ETFs in 2024, which attracted over $7.9 billion in assets, marked a turning point by bringing institutional capital into the network. Confidence grew further in July 2025 when BlackRock amended its iShares Ethereum Trust (ETHA) to include staking functionality, highlighting Ethereum’s appeal as both a technological platform and a yield-generating asset.

With institutional interest rising, enthusiasm for Ethereum-based DeFi has surged. Liquid staking is pushing total value locked toward $40 billion, restaking is reshaping how capital and security are used, and new protocols are expanding what DeFi can deliver to a broader audience. This article explores the projects leading this transformation in 2025 and why they deserve attention as the ecosystem continues to mature and expand.

Why Ethereum DeFi Projects Are Important in 2025

Ethereum’s DeFi ecosystem is more than a collection of protocols; it is the foundation of a financial system that is rapidly gaining mainstream acceptance. In 2025, several factors highlight why Ethereum-based projects matter more than ever.

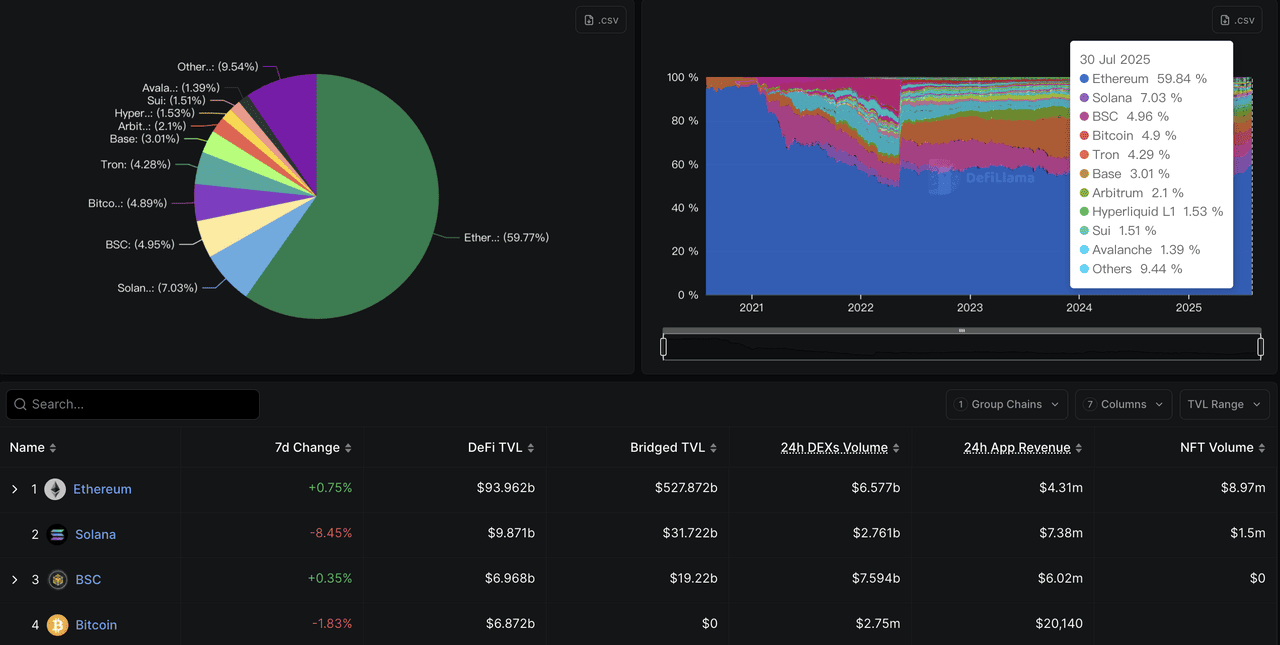

1. Ethereum’s Role as the Backbone of DeFi

Ethereum’s

total value locked (TVL) in DeFi remains larger than all other blockchains combined, solidifying its position as the primary network powering decentralized finance. In 2025, Ethereum dominates the space with a 71% increase in TVL, reaching $93.9 billion, according to

DeFiLlama. Out of more than 5,000 DeFi protocols tracked across 200+ blockchains, Ethereum continues to host the majority of the most established and liquid platforms. This dominance is built on its robust smart contract infrastructure, extensive developer ecosystem, and proven security that consistently attract both retail and institutional participants.

2. Regulatory Clarity Fuels Confidence in Ethereum DeFi

2025 is also marked by a shift in the regulatory environment that benefits Ethereum and its DeFi ecosystem. During

U.S. Crypto Week, three landmark acts were passed, providing long-awaited clarity for digital assets and DeFi protocols. The GENIUS Act established federal standards for

stablecoin issuance with full reserve backing requirements. The CLARITY Act defined digital commodities versus securities, dividing oversight between the SEC and CFTC to eliminate regulatory uncertainty. And the Anti-CBDC Act prevented the Federal Reserve from issuing a digital dollar, reinforcing decentralized finance over government-controlled digital currency.

These regulatory milestones have boosted institutional confidence and created a safer environment for DeFi growth. With legal risks reduced and clearer rules in place, Ethereum is now better positioned to attract mainstream users, developers, and capital, strengthening its status as the leading platform for the next phase of decentralized finance.

3. Institutional and Corporate Adoption Strengthens Ethereum’s Position

Institutional and corporate interest in Ethereum is accelerating, reshaping how traditional finance engages with decentralized finance. The launch of

Spot Ethereum ETFs in 2024 was a turning point, attracting over $7.9 billion in assets and managing nearly 5 million ETH, about 4% of the total supply. BlackRock’s iShares Ethereum Trust (ETHA) leads the market, and its July 2025 filing to add staking functionality signals a shift toward making proof-of-stake rewards accessible to mainstream investors.

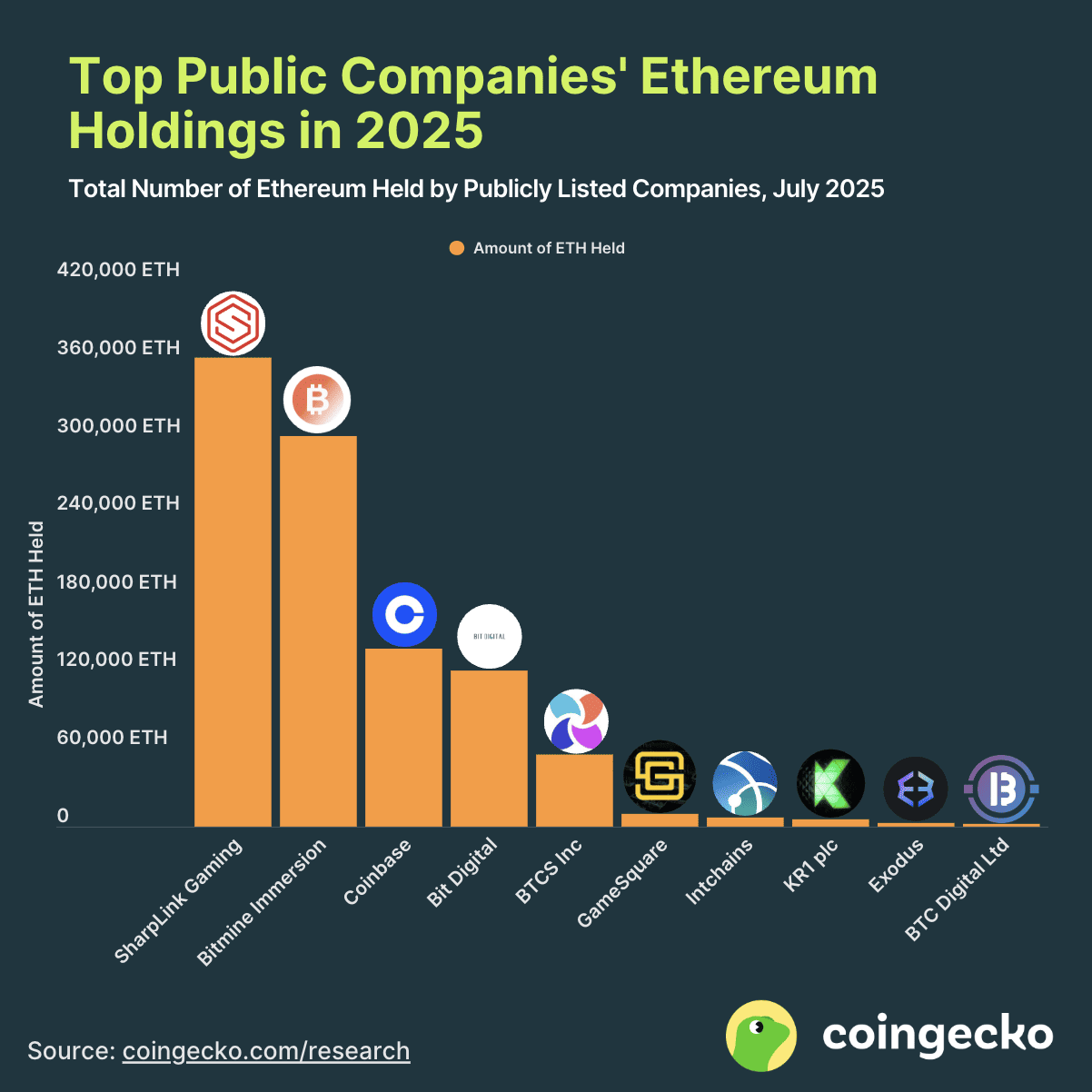

SharpLink has acquired 200,000 more ETH by July 30, 2025 | Source: Coingecko, July 24 2025

Corporations are extending this trend with an even closer connection to DeFi. Over 85 public companies now hold Ethereum in their treasuries, owning around 1.9% of the circulating supply, up from 0.7% in 2023. Unlike

Bitcoin treasury, Ethereum offers yield through staking, making it a more compelling treasury asset. SharpLink Gaming and Bit Digital stake 100% of their ETH to capture protocol-level rewards, while BitMine stands out with over 560,000 ETH valued at more than $2 billion.

This adoption shows that institutions and corporations are not just holding ETH for price appreciation. They are actively engaging with Ethereum’s staking and liquidity layers, reinforcing its role as both a core technology platform and a yield-generating financial infrastructure.

Top 7 Ethereum DeFi Projects to Watch in 2025

Ethereum’s DeFi ecosystem is thriving, with protocols continuously innovating to improve scalability, liquidity, and yield opportunities. In 2025, several projects stand out for their strong fundamentals, active development, and growing role within the network. From decentralized exchanges to restaking frameworks, these protocols are shaping the future of decentralized finance.

1. Uniswap (UNI)

Project Type: Decentralized Exchange

Uniswap (UNI) has processed over $2.75 trillion in trading volume since its inception, maintaining its position as the leading decentralized exchange with zero security incidents. The protocol consistently captures the largest market share among DEXs, with daily volumes regularly exceeding those of many centralized exchanges. Uniswap's dominance is evident in its multi-chain presence, operating across 11+ networks and consistently ranking as the top DEX by total value locked and trading volume across multiple blockchain ecosystems.

Uniswap v4, launched on January 31, 2025, represents the most customizable and lowest-cost version of the Uniswap Protocol, transforming the platform into a comprehensive developer ecosystem. The introduction of hooks, the modular plugins that allow developers to build custom logic for pools, swaps, fees, and LP positions, enables unlimited customization. Over 150 hooks have already been developed across chains including

Polygon,

Arbitrum,

OP Mainnet,

Base chain and more, introducing everything from dynamic fees to automated liquidity management, while the protocol's gas-efficient design provides significant cost savings for both swappers and liquidity providers.

2. Aave (AAVE)

Project Type: Lending Protocol

Aave (AAVE) achieved a historic milestone in 2025 by becoming the first DeFi lending protocol to surpass $50 billion in net deposits, accounting for 31% of DeFi's TVL growth since April. The protocol's treasury reached a record $125 million, reflecting a 123% year-over-year increase, while maintaining its position as one of the top DeFi protocols globally. Aave's dominance in institutional DeFi is further evidenced by its partnerships with major financial players and its role in onboarding traditional finance to decentralized lending markets.

Aave operates as a decentralized, non-custodial liquidity protocol where users can participate as suppliers or borrowers, with suppliers earning interest while borrowers access liquidity by providing collateral that exceeds the borrowed amount. The protocol's V3.5 deployment introduced mathematical improvements to the accounting layer, while innovative features like flash loans, the uncollateralized loans that must be repaid within the same transaction, have enabled new DeFi strategies and arbitrage opportunities. Aave's governance is managed by AAVE token holders who propose and vote on protocol changes, ensuring community-driven development and risk management.

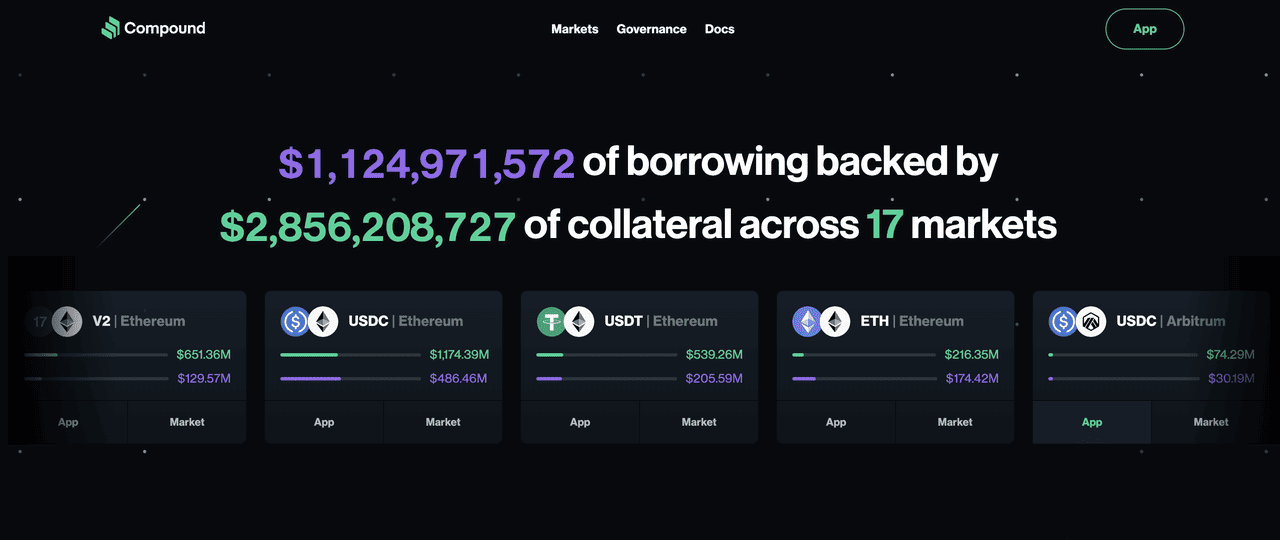

3. Compound (COMP)

Project Type: Lending Protocol

Compound (COMP) has established itself as a foundational DeFi protocol since launching in 2018, with its Compound III (Comet) architecture expanding significantly across Ethereum, Polygon, Base, and Arbitrum networks. The protocol generates over $59.1 million in fees annually and has consistently maintained its position among the top lending platforms, demonstrating resilience through multiple market cycles. Compound's methodical approach to growth includes a proposed $5.35 million Growth Program targeting a net increase of $750 million in TVL, reflecting conservative but strategic expansion plans.

Compound operates as an algorithmic, autonomous interest rate protocol that enables users to lend and borrow cryptocurrencies through smart contracts, with interest rates automatically adjusting based on supply and demand dynamics. The protocol's evolution from pooled lending in earlier versions to Compound III's single-collateral model has reduced systemic risk while improving capital efficiency. The integration of innovative assets like sdeUSD demonstrates Compound's adaptation to emerging market trends, while its rigorous security approach includes audits with top-tier firms and a $500,000 bug bounty program.

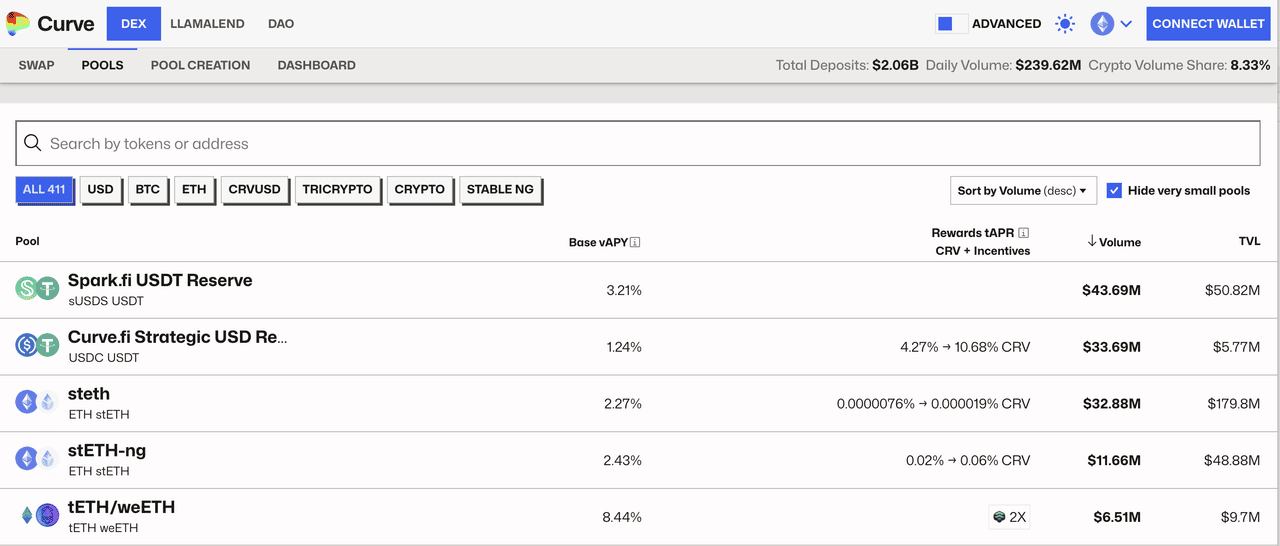

4. Curve Finance (CRV)

Project Type: Stablecoin DEX

Curve Finance (CRV) maintains approximately $1.55 billion in Total Value Locked as of April 2025, cementing its position as the leading platform for stablecoin and similar-asset trading with minimal

slippage. The protocol has successfully expanded to over 12 different blockchain networks while maintaining its core efficiency advantages, with its crvUSD stablecoin achieving substantial adoption with a circulating supply exceeding $120 million. Curve's specialized focus has allowed it to capture the majority of stablecoin trading volume in DeFi, with its unique algorithm enabling traders to execute large swaps with near 1:1 parity.

Curve Finance operates as a decentralized exchange optimized specifically for

stablecoins and similarly-priced assets, using a modified

automated market maker (AMM) algorithm called StableSwap that minimizes slippage for assets expected to trade at similar values. The protocol's CRV token serves both governance and incentive functions, with the innovative vote-escrowed (veCRV) system allowing users to lock tokens for governance rights and boosted rewards. Curve's integration with numerous DeFi protocols creates a symbiotic ecosystem where it provides essential trading infrastructure while partner protocols contribute liquidity and users, making it fundamental infrastructure for the broader DeFi space.

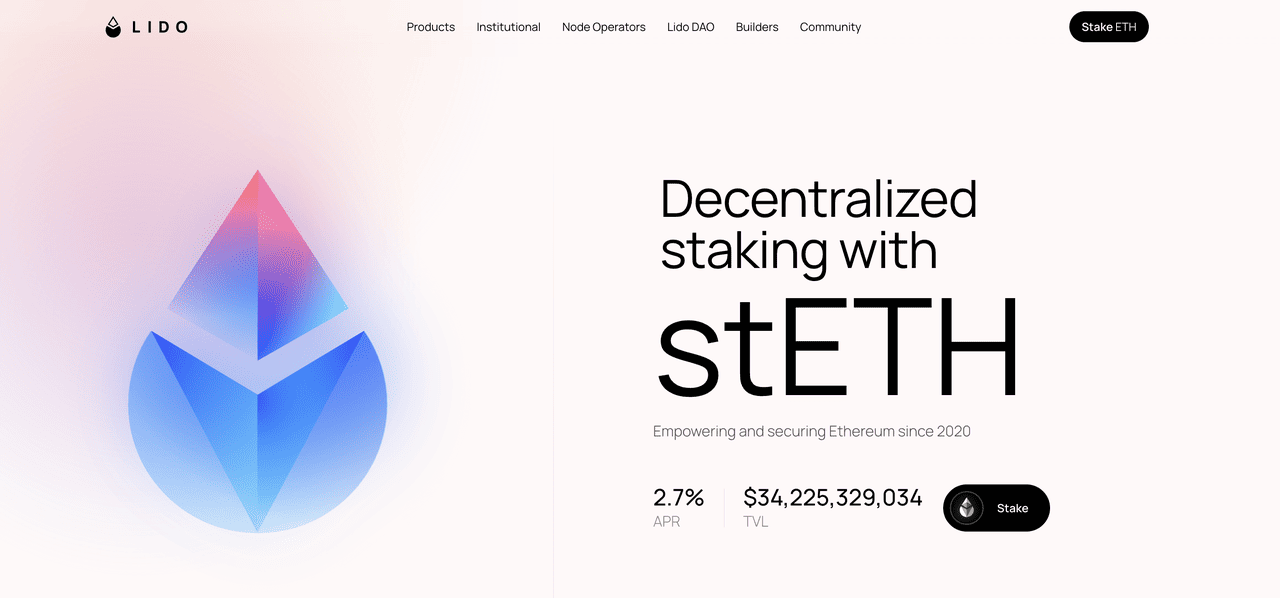

5. Lido Finance (LDO)

Project Type: Liquid Staking

Lido (LDO) dominates the liquid staking sector with over $10.2 billion in Total Value Locked, representing approximately 62% market share in liquid staking and becoming responsible for nearly one-third of all ETH staked on Ethereum at its peak. The protocol has demonstrated remarkable growth, reaching this scale while maintaining a perfect security record and expanding beyond Ethereum to support

MATIC and

SOL staking. Lido's stETH token has achieved unprecedented integration across the DeFi ecosystem, being supported by over 90 applications and becoming a fundamental building block for yield strategies.

Lido Finance operates as a liquid staking solution that allows users to stake any amount of ETH without the traditional 32 ETH minimum requirement or the need to manage validator infrastructure. Users receive stETH tokens in return for their staked ETH, which automatically rebase daily to reflect staking rewards and can be used across DeFi applications just like regular ETH. The protocol employs a diverse set of 36 professional node operators to minimize staking risks, while its governance is managed by the Lido DAO, with a 10% fee on staking rewards split equally between operators and the

DAO treasury.

6. EigenLayer (EIGEN)

Project Type: Restaking Protocol

EigenLayer (EIGEN) has achieved remarkable growth with $13.01 billion in Total Value Locked and $116.66 million in rewards distributed, supporting 161 Actively Validated Services (AVS) in development and 39 currently active services. The protocol represents the largest implementation of the restaking concept, with approximately 70% of new Ethereum validators immediately joining EigenLayer upon launch. EigenLayer's completion of its slashing mechanism in April 2025 marked a critical milestone, transforming it from an experimental protocol into a production-ready security infrastructure layer.

EigenLayer operates as a restaking protocol that allows Ethereum stakers to opt-in to validating additional services beyond the Ethereum base layer, extending cryptoeconomic security to new protocols in exchange for additional rewards. The protocol introduces the concept of Actively Validated Services (AVS), ranging from data availability layers to cross-chain bridges and oracles, that can leverage Ethereum's security without bootstrapping their own validator networks. Through both native restaking and liquid staking token (LST) restaking, users can maximize capital efficiency while contributing to the security of multiple protocols, though this comes with additional slashing risks managed through sophisticated delegation mechanisms.

7. Treehouse Finance (TREE)

Project Type: Fixed Income Protocol

Treehouse Finance (Tree) has secured $20.4 million in funding from major investors including Binance Labs, Mirana Ventures, and Lightspeed Venture Partners, achieving a $400 million valuation that signals strong institutional confidence in the fixed income DeFi sector. The protocol's TREE token launched in July 2025 with significant market attention, including integration with major exchange listings. Treehouse operates across Ethereum, Arbitrum, and

Mantle networks, positioning itself to address the $6 trillion fixed income opportunity by bringing standardized benchmark rates to decentralized finance.

Treehouse Finance is building decentralized fixed income infrastructure through two core innovations: Treehouse Assets (tAssets) and Decentralized Offered Rates (DOR). tAssets are liquid staking tokens that enable automated interest rate arbitrage strategies, starting with tETH for Ethereum, while DOR creates the first decentralized consensus mechanism for benchmark rate setting in cryptocurrency markets. The protocol addresses critical market fragmentation where identical assets trade at different rates across platforms, introducing game theory-based mechanisms where participants stake capital and are rewarded for accurate rate predictions, ultimately enabling sophisticated financial instruments like interest rate swaps in DeFi.

How to Trade Ethereum DeFi Project Tokens on BingX

Ethereum DeFi tokens are among the most actively traded assets in 2025, as investors seek exposure to protocols driving the next wave of decentralized finance. Tokens linked to leading projects such as Uniswap, Aave, and Lido attract both long-term holders and short-term traders due to their strong fundamentals and integration into Ethereum’s staking and liquidity ecosystem. BingX offers an all-in-one trading platform that makes accessing these tokens simple, combining centralized exchange features with AI-powered insights to help you trade with confidence.

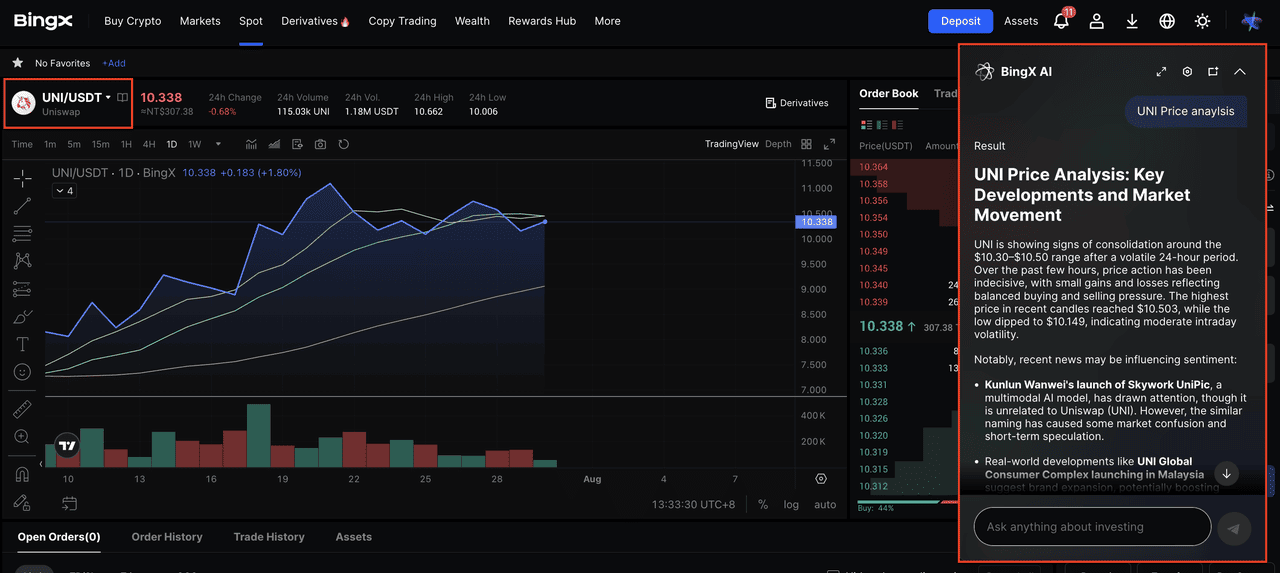

Use BingX’s All-in-One Platform with AI Assistance

Step 1: Search and Trade

Enter the trading pair (for example,

UNI/USDT or

LDO/USDT) in the BingX spot or futures search bar. Choose a market order for instant execution or set a limit order at your desired price level.

Step 2: Use BingX AI for Analysis

On the trading interface, click the AI icon to activate

BingX AI. The tool analyzes recent price movements, detects patterns, and explains what these signals may indicate in the current market context.

Step 3: Plan Smarter Entries

Leverage BingX AI insights to identify support and resistance levels, monitor momentum shifts, and refine your entry or exit strategies before placing trades. This helps you trade Ethereum DeFi tokens more effectively in a fast-moving market.

Risks and Challenges of Participating in DeFi Protocols

Participating in Ethereum DeFi protocols offers attractive opportunities but also comes with risks that every user should understand.

1. Smart Contract Exploits: DeFi protocols run entirely on smart contracts, which are only as secure as their code. Bugs or vulnerabilities can be exploited by hackers, leading to drained liquidity pools or stolen funds, even in well-established projects.

2. Impermanent Loss and Liquidity Risks: Providing liquidity in DeFi pools carries the risk of impermanent loss when token prices diverge. Low liquidity during market downturns can also make it difficult to withdraw funds or execute trades efficiently.

3. Market Volatility: Assets used in DeFi protocols are highly sensitive to price fluctuations. Sudden market swings can trigger collateral liquidations, reduce yields, or lead to unexpected losses for participants.

4. Regulatory Uncertainty: Despite recent progress, DeFi still operates in an evolving regulatory environment. Future policy changes may affect how protocols function, limit access for users in certain regions, or impose new compliance requirements.

5. User-Side Security and Wallet Risks: Managing wallets is a critical part of DeFi participation. Users must safeguard their private keys, ensure they are using reputable wallet applications, and avoid connecting wallets to suspicious sites. Loss of access to a non-custodial wallet or signing malicious transactions can result in irreversible asset loss.

By understanding these risks, users can make informed decisions and participate in Ethereum DeFi protocols with greater confidence and caution.

Final Thoughts

Ethereum continues to lead decentralized finance into its next phase of growth in 2025. Backed by strong institutional interest, corporate treasury adoption, and clearer regulations, its DeFi ecosystem is expanding faster than ever. Protocols built on Ethereum are innovating with liquid staking, restaking, and advanced liquidity mechanisms, shaping the future of decentralized financial services.

While the opportunities are significant, participants must stay mindful of risks ranging from smart contract vulnerabilities to market volatility and regulatory shifts. Successful engagement in DeFi requires thorough research, secure practices, and the use of reliable platforms.

As Ethereum’s network matures, the projects driving its ecosystem are set to redefine how finance operates on a global scale. For investors, developers, and users alike, 2025 is a year to watch as Ethereum DeFi continues to evolve into a more secure, scalable, and widely adopted financial infrastructure.

Related Reading