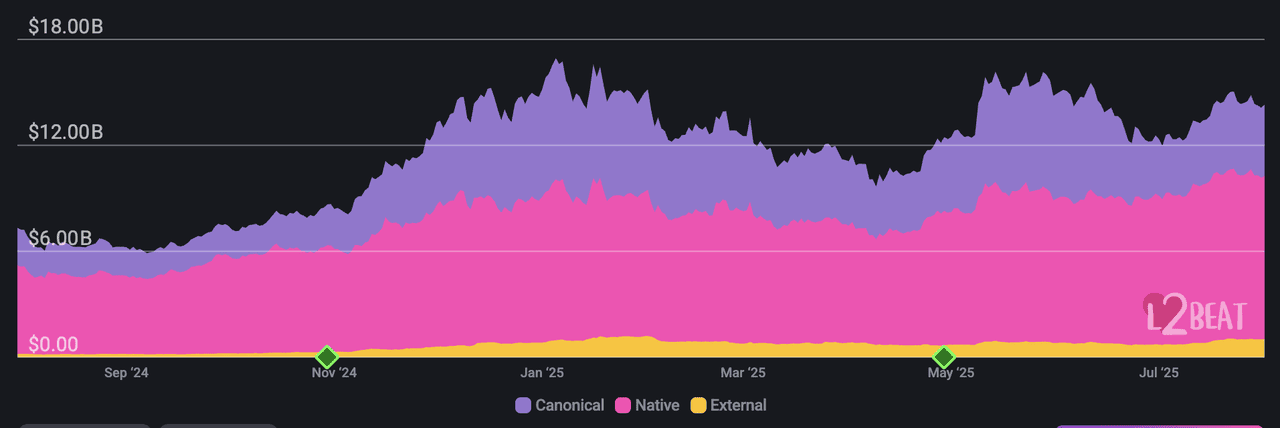

As Base cements its position as one of

Ethereum’s fastest-growing Layer-2 networks, its decentralized exchange (DEX) ecosystem is booming with record-breaking volumes and protocol innovation. Built using the OP Stack and backed by Coinbase, Base now secures over $14.3 billion in total value and ranks as the second-largest

Ethereum Layer-2 chain for onchain activity.

Base Total Value Secured (TVS) | Source: L2Beat

In July 2025 alone, Base’s DEX volume hit $1.29 billion in a single day and exceeded $39.9 billion over 30 days, reflecting explosive growth in both meme coin and blue-chip DeFi trading. With a median transaction fee under $0.001, Base has become the go-to venue for low-cost, high-frequency onchain swaps.

From SlipStream-enabled innovations to multichain leaders like

Uniswap and

PancakeSwap launching native Base versions, the DEX landscape on Base is evolving fast. In this guide, we spotlight the top decentralized exchanges dominating Base in 2025.

What Is Base and What Makes Base DEXs So Popular?

Base is a Layer-2 blockchain network built on top of Ethereum by Coinbase, designed to make crypto faster, cheaper, and more accessible for everyday users and developers. It uses a technology called the OP Stack (developed by the Optimism team), which allows Base to process thousands of transactions off the main Ethereum chain and post the final results back to Ethereum for security.

This setup dramatically reduces costs, average transaction fees are less than $0.001, while still benefiting from Ethereum’s robust security. Transactions confirm in seconds, and users don’t have to wait or pay high gas fees like on Ethereum Layer-1.

For decentralized exchanges (DEXs), this is a game changer. Base’s architecture supports:

• High-speed trading with minimal delay

• Low slippage swaps, even for volatile meme tokens

• Affordable liquidity provisioning for yield farmers and LPs

• Massive daily volumes with minimal network congestion

In 2025, Base DEXs like

Aerodrome, Uniswap, and PancakeSwap are processing over $1.2 billion in daily volume, making Base one of the most active networks for on-chain trading. Its direct connection to Coinbase also makes it easy for users to move funds from fiat to crypto, and then start trading on DEXs without needing bridges or complex setups.

Whether you're trading

popular Base meme tokens like

BRETT and

TOSHI, or providing liquidity to earn fees, Base offers one of the most efficient DeFi environments in the market today.

The 5 Best Base Ecosystem DEXs to Know in 2025

Here are the most active and innovative DEXs on Base right now, ranked by 24-hour trading volume and protocol impact:

1. Aerodrome Finance (AERO)

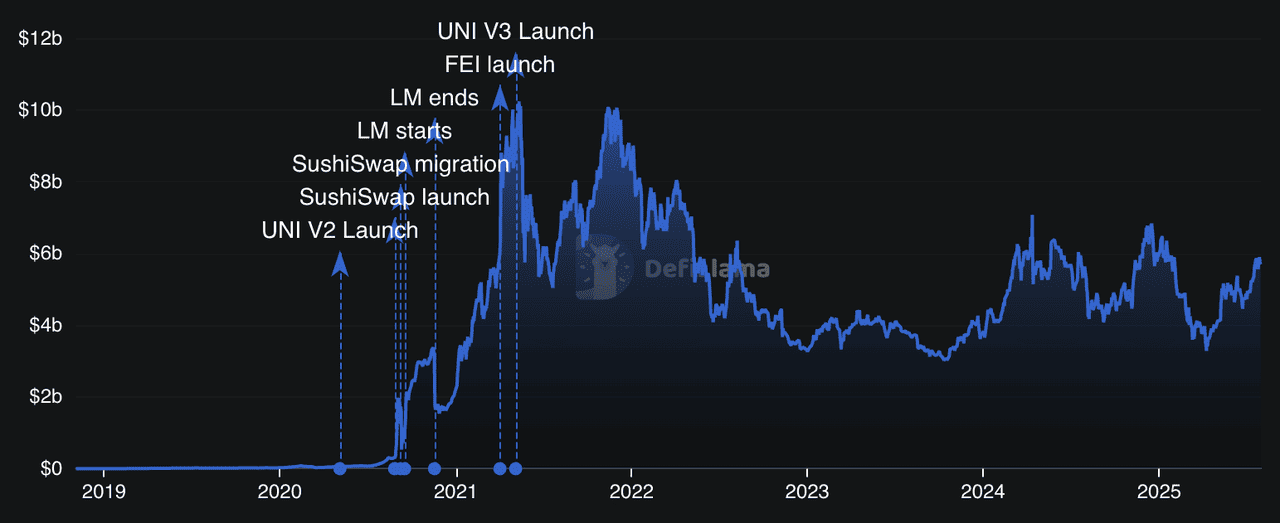

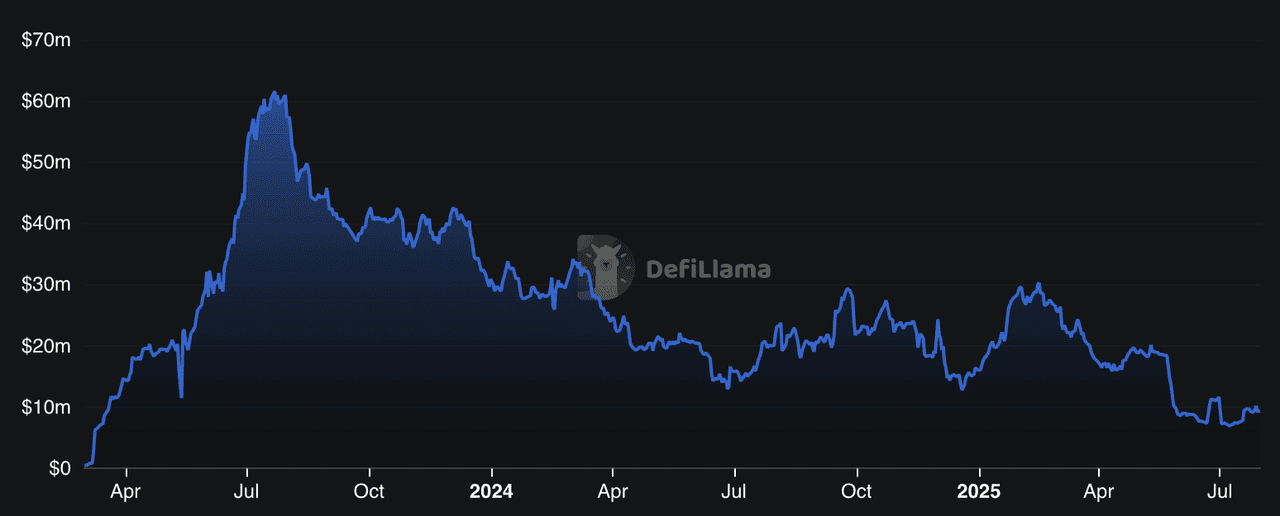

Aerodrome Finance TVL | Source: DefiLlama

Aerodrome Finance is the largest decentralized exchange (DEX) on the Base blockchain, offering low-fee token swaps, liquidity provision, and governance tools, all within a streamlined interface. Described as a “MetaDEX,” it combines elegant design with intelligent incentives and battle-tested infrastructure. Users can trade tokens, stake liquidity to earn emissions, and vote on which pools receive rewards. All trading fees and incentives are distributed directly to users, with no centralized APIs or token sales. The platform is fully decentralized, launched as a public good, and operates with immutable onchain code.

By mid-2025, Aerodrome surpassed $1 billion in TVL, driven by features like SlipStream (for gasless trades), cross-chain staking, and deep liquidity pools optimized for Base-native tokens. Backed by Coinbase Ventures and founded by Alex Cutler (drawing from Velodrome’s model), Aerodrome has become a foundational layer for Base’s DeFi growth. Institutional interest, combined with Ethereum 2.0 upgrades and regulatory clarity, continues to fuel its adoption as a preferred destination for DeFi builders, liquidity providers, and meme token traders alike.

--https://bingx.com/en/price/aerodrome-finance

2. Uniswap (UNI)

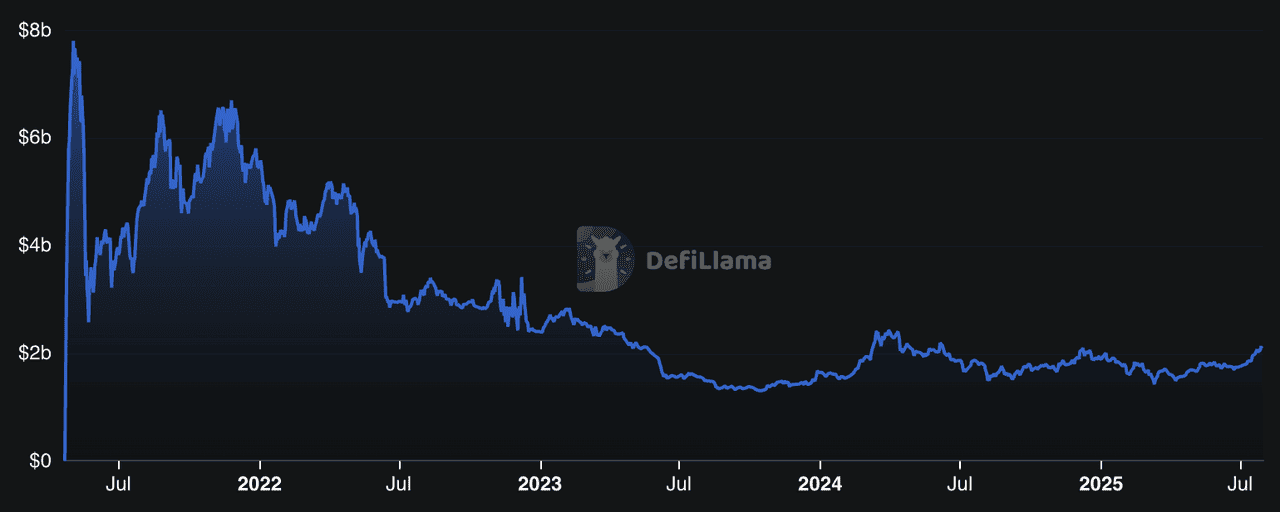

Uniswap TVL | Source: DefiLlama

Uniswap is one of the most trusted and widely used decentralized exchanges (DEXs) in the crypto world, offering seamless token swaps across Ethereum and over a dozen other blockchains, including a fast-growing presence on Base. Its Base deployment delivers the powerful features of Uniswap V3 and V4, enabling users to trade with low slippage, access thousands of tokens, and provide liquidity to earn a share of swap fees. The platform’s familiar interface and wallet compatibility (

MetaMask,

Base Wallet, etc.) make it easy for anyone to get started with DeFi. Whether you're swapping ETH, USDC, or niche Base tokens, Uniswap delivers fast, reliable execution with transparent on-chain pricing.

In 2025, Uniswap V4 introduced new tools like “Hooks,” allowing developers to create custom liquidity strategies and programmable pool behavior. This modular upgrade has helped Uniswap surpass $1 billion in TVL and over $110 billion in cumulative volume, with growing adoption from both retail and institutional traders. On the Base network, Uniswap has become a go-to hub for meme coin trading and deep liquidity pools, while also supporting ecosystem apps like Bunni and EulerSwap. Despite rising competition from other chains like

Solana, Uniswap’s developer-first approach, broad user base, and protocol flexibility keep it firmly positioned at the heart of DeFi’s evolution.

-https://bingx.com/en/price/uniswap

3. PancakeSwap (CAKE)

PancakeSwap TVL | Source: DefiLlama

PancakeSwap is one of the most popular decentralized exchanges in the world and has rapidly expanded its presence on the Base network through its advanced upgrade, PancakeSwap Infinity. Originally launched on

BNB Chain, PancakeSwap now offers Base users a feature-rich trading platform with instant token swaps,

yield farming, lottery games, and prediction markets, all while maintaining low fees and full wallet ownership. The interface is beginner-friendly, and users can earn CAKE or other tokens by participating in liquidity pools, staking, or trading contests.

The Infinity upgrade on Base brings a new level of customization and efficiency to liquidity provision. It introduces hooks, external smart contracts that enable advanced features like

limit orders, rebates, and fee discounts, without altering the core protocol. Liquidity providers can choose between dynamic or static fee pools, allowing them to fine-tune strategies based on market conditions. With gas fees reduced by up to 50% and pool creation costs cut by 99%, PancakeSwap on Base is now more accessible, flexible, and cost-effective for both retail and institutional users.

--https://bingx.com/en/price/pancakeswap

4. ZORA Protocol (ZORA)

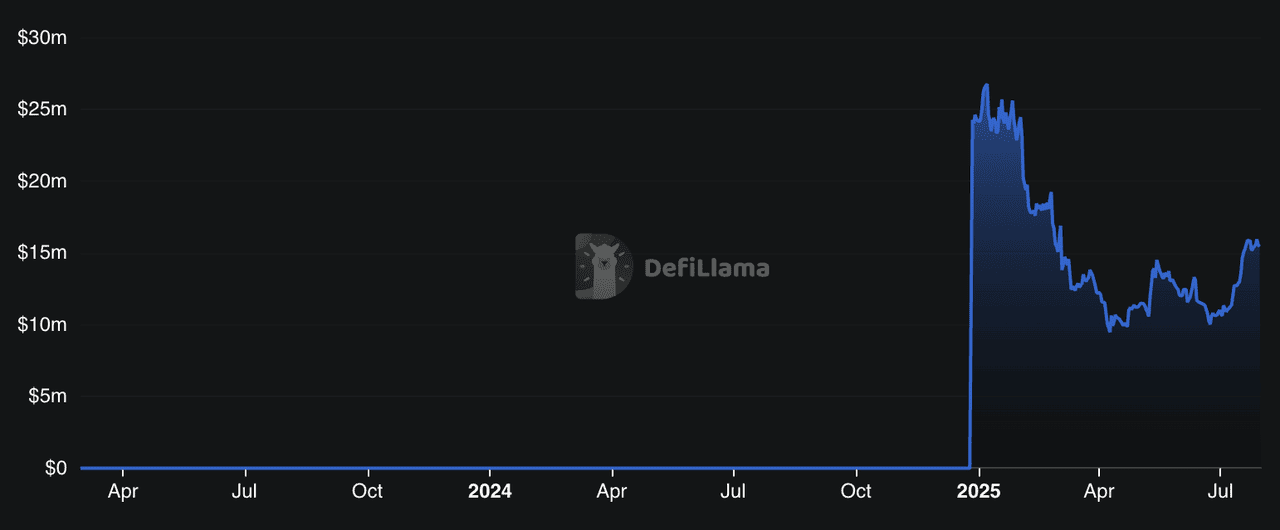

ZORA Protocol TVL | Source: DefiLlama

Zora is a

SocialFi platform built on the Base blockchain that transforms social media content into tradable tokens. When users create a profile or make a post on the Zora-powered Base App (Coinbase’s rebranded wallet), each action automatically mints a token, turning creators and their content into investable assets. These tokens can be traded like

memecoins, with creators earning a portion of the trading fees. The dual-token model includes Creator Coins (representing a user’s profile) and Content Coins (representing individual posts), both of which follow a vesting and rewards system that incentivizes engagement and speculation. Since the app’s July 2025 launch, daily creator token generation has surged to nearly 40,000, and ZORA’s price has jumped over 600%.

While Zora has attracted controversy for being labeled a “hypercasino hellscape” due to its speculative nature, it also offers a unique revenue-sharing model that empowers creators in ways traditional platforms don’t. Influencers who gain traction can earn daily payouts in ZORA tokens as their content and profile coins are actively traded. With over $40 million in peak daily trading volume and creator rewards exceeding $375,000 per day, Zora is riding the wave of onchain social finance. However, critics argue that the platform’s sustainability hinges on building a real social network, not just feeding trading hype, making its future both promising and uncertain in the growing Base ecosystem.

--https://bingx.com/en/price/zora

5. Maverick Protocol (MAV)

Maverick Protocol TVL | Source: DefiLlama

Maverick Protocol is a next-generation decentralized exchange (DEX) and liquidity infrastructure platform that operates across five blockchains, including Base. Designed to maximize capital efficiency and reduce trading costs, Maverick offers programmable liquidity pools that adapt dynamically to market conditions. Liquidity providers can choose from four customizable liquidity modes, including “Mode Both” for stable pairs, which allow positions to automatically follow asset prices in both directions, ideal for sideways markets. Maverick also boasts ultra-low swap gas costs (under 100K gas units per trade), making it one of the most efficient platforms for active traders and DeFi protocols seeking deep, flexible liquidity.

On Base, Maverick is also powering a new wave of "MemeFi" innovation through its Goose.run platform, a memecoin-focused protocol that enables users to lend and borrow against newly launched meme tokens from day one. Goose.run gamifies the memecoin experience and aims to replicate the success of Solana’s Pump.fun, but with additional features like instant liquidity bootstrapping and upcoming livestream integration. By combining efficient

AMM mechanics, incentive programs like veMAV staking, and new social DeFi primitives, Maverick Protocol is carving out a unique role in Base’s DeFi ecosystem as a liquidity operating system tailored to both institutional-grade markets and community-driven speculation.

--https://bingx.com/en/spot/MAVUSDT

How to Trade Base DEX Tokens on BingX

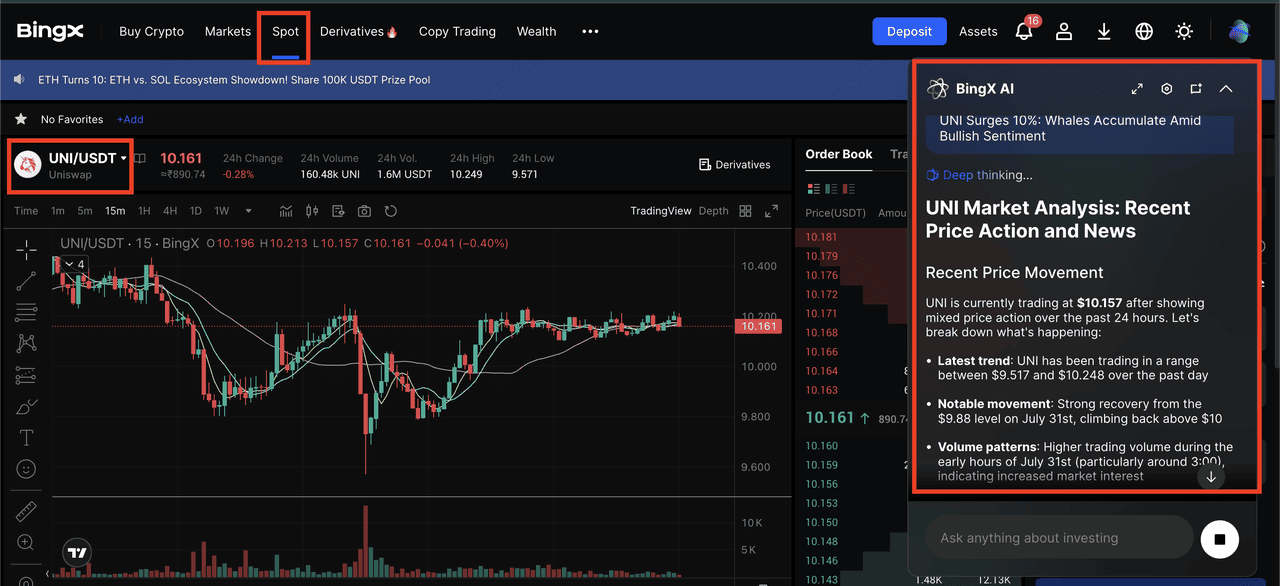

UNI/USDT trading page on BingX spot market, powered by BingX AI insights

You don’t need to use complex wallets or bridges to access top Base tokens like BRETT, TOSHI, or DEGEN. BingX makes it simple to trade these tokens directly on its platform, all within a few easy steps:

1. Create or Log in to Your BingX Account: Head to

BingX.com and sign up using your email or mobile number. Complete

identity verification (KYC) to unlock full access to trading features.

2. Buy USDT on the BingX Spot Market: Fund your account by depositing crypto or using a credit card, bank transfer, or other local payment methods to buy

USDT directly on BingX.

3. Search for Base Tokens: Go to the Spot Market and type the token name in the search bar, such as

AERO/USDT,

UNI/USDT, or

CAKE/USDT. You’ll find most popular Base DEX tokens available for trading.

4. Use BingX AI for Market Insights: Before placing a trade, take advantage of

BingX AI tools to analyze real-time trends, price momentum, and market sentiment. This can help you make smarter trading decisions.

5. Place Your Trade: Choose a market order to buy instantly at the current price or set a limit order to buy at your preferred price. Confirm your trade, and your tokens will be added to your BingX wallet.

By trading Base DEX tokens directly on BingX, you avoid the hassle of bridging, connecting wallets, or managing gas fees. With low fees, fast execution, and smart tools like BingX AI, you’re ready to explore the Base ecosystem in just a few clicks.

Key Considerations Before Using Base DEXs

Before using Base DEXs, it’s important to be aware of common risks. Slippage and front-running can affect trades, especially with low-liquidity or highly volatile tokens. There’s also the danger of fake tokens or rugpulls, so always verify contract addresses before swapping. If bridging assets from another chain, be sure to use official bridges to avoid phishing scams. To stay safe, use trusted tools, do your own research, and start with small amounts when testing new tokens or platforms.

Final Thoughts

Base has quickly established itself as a leading Layer-2 network for DeFi and onchain trading, supported by fast transaction speeds, low fees, and deep integration with top DEX platforms. Protocols like Aerodrome Finance, PancakeSwap V3, and Uniswap V3 offer a wide range of trading options, from memecoins to stable pairs, making Base an attractive destination for both retail traders and liquidity providers. With BingX AI insights and a user-friendly interface, exploring the Base ecosystem is more accessible than ever, whether you're seeking new tokens or building a long-term DeFi strategy.

While the opportunities are growing, it’s important to stay cautious. DEX trading on Base can involve risks such as volatility, slippage, and exposure to unverified tokens. Always do your own research, use secure platforms, and only invest what you can afford to lose.

Related Reading