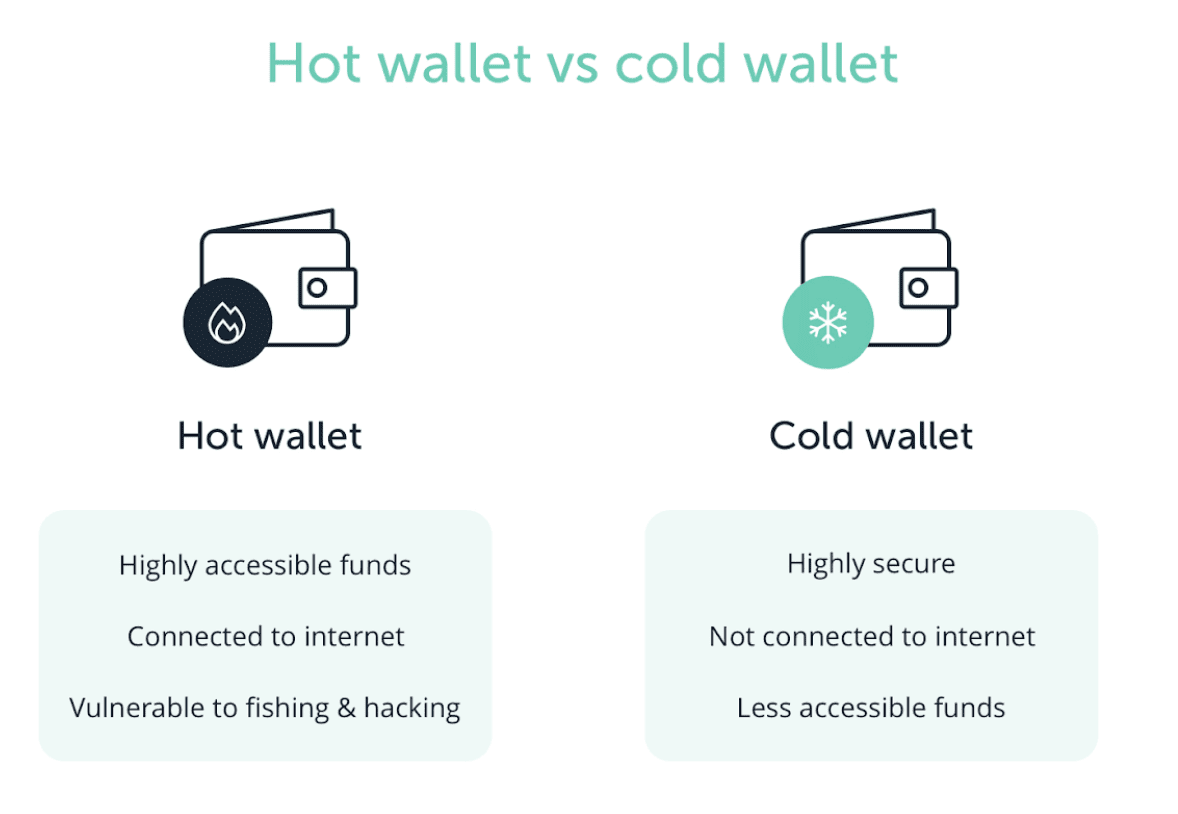

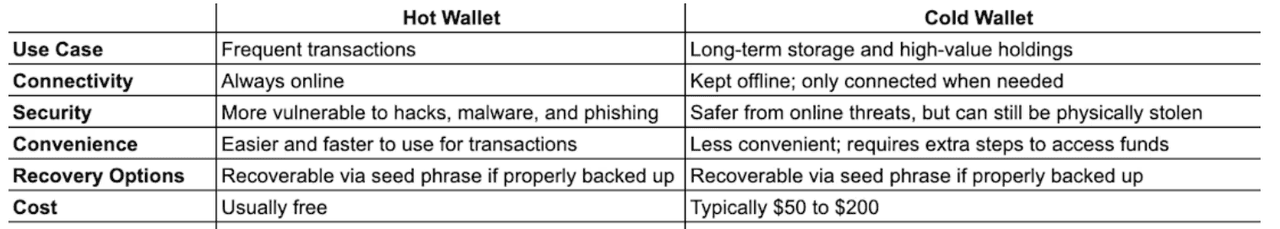

When stepping into the world of cryptocurrency, one of the first decisions you'll face is how to store your digital assets safely. The two main options are hot wallets and

cold wallets, and while both serve the same purpose,keeping your crypto secure, they differ in their setup, accessibility, and security. So, which one is right for you?

What Is a Hot Wallet?

What makes hot

wallets so popular among crypto beginners? A hot wallet is a software-based wallet that stays connected to the internet. It can be installed on devices such as smartphones, tablets, or laptops, making it quick and easy to access your funds whenever you need them. Hot wallets generate and store your seed phrases and private keys online, which streamlines the process of sending or receiving crypto.

The biggest advantage of hot wallets is convenience. They're ideal for frequent transactions, whether that's buying, selling, or transferring tokens. However, their constant online connection introduces a potential security risk. Once your private keys have touched the internet, there's always a chance they could be compromised. This makes hot wallets better suited for holding smaller amounts of crypto rather than your full portfolio.

Types of Hot Wallets

Some popular hot wallets include MetaMask,

Phantom, Coinbase Wallet, and exchanges like BingX.

•

MetaMask is widely used in the Ethereum ecosystem, making it a go-to choice for interacting with Ethereum-based tokens and decentralized apps (dApps)

• Phantom started as a

Solana wallet and has expanded to support Ethereum and Polygon, offering simple setup, in-app swaps, staking, and NFT management

• Storing your crypto on BingX supports a wide range of digital assets, giving users flexibility to manage multiple cryptocurrencies in one place.

What Is a Cold Wallet (Hardware Wallet)?

Why do long-term investors swear by cold wallets? On the other end of the spectrum are cold wallets, which store your private keys offline. Typically, these come in the form of hardware devices,often resembling a USB drive, that keeps your assets disconnected from the internet. Because they aren't exposed to online threats, cold wallets provide one of the highest levels of protection for your crypto. Examples of cold wallets include

Ledger and

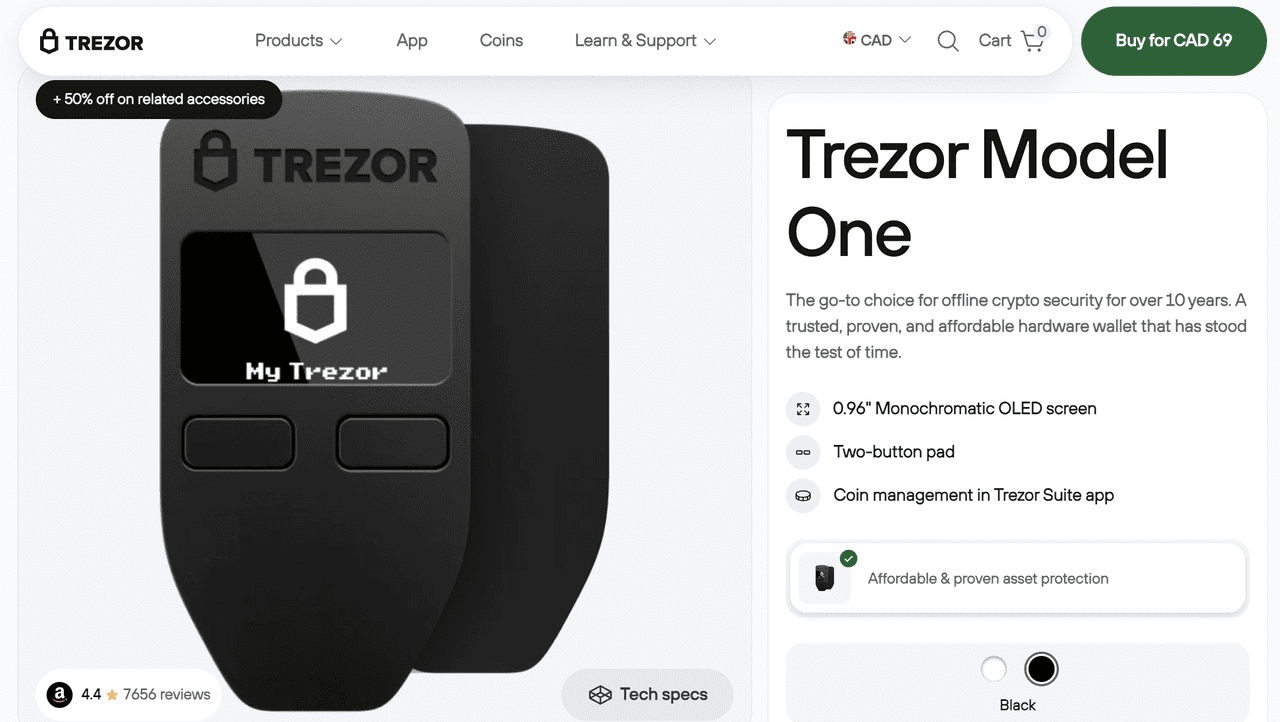

Trezor.

That security comes at the cost of convenience. To access or move funds from a cold wallet, you need to connect the device to an online computer, transfer assets to a hot wallet, and then complete your transaction. This extra step makes cold wallets less practical for everyday use but far more reliable for long-term storage.

Types of Cold Wallets

Cold wallets come in different forms, each offering unique levels of security and convenience:

• Paper Wallet: A paper wallet is a printed document containing your public and private keys, often with a QR code for quicker transactions. While it's secure from online threats, it comes with physical risks - if the paper is lost, stolen, or damaged, you could lose access to your funds permanently.

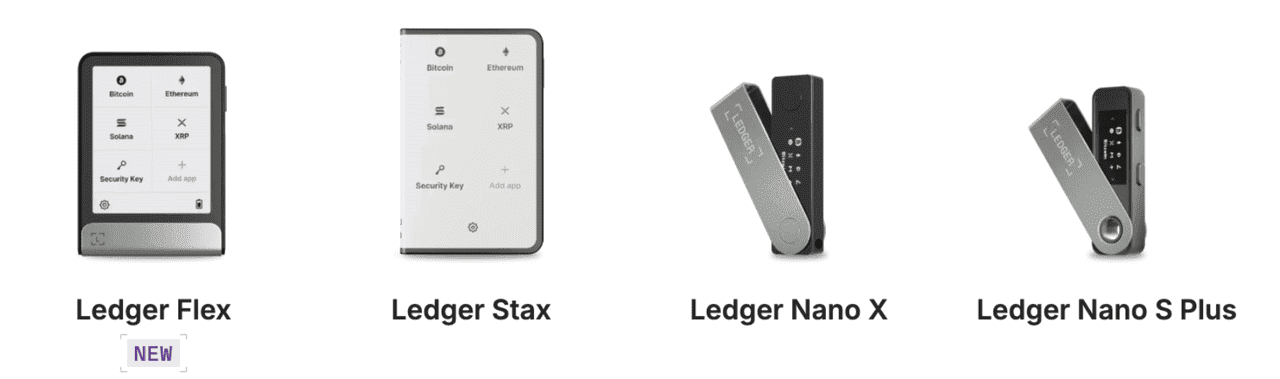

• Hardware Wallet: Hardware wallets are physical devices, usually resembling a USB stick, smart card, or even a small phone-like device. They store your keys offline, making them much safer than hot wallets. Popular examples include Trezor, Ledger, and KeepKey.

• Deep Cold Storage: This isn't a specific wallet but rather a technique for maximum security. It involves keeping your cold wallet in a highly secure location, such as a safe deposit box or vault. Since accessing it requires multiple steps, deep cold storage is best suited for long-term holders who don't need frequent access to their crypto.

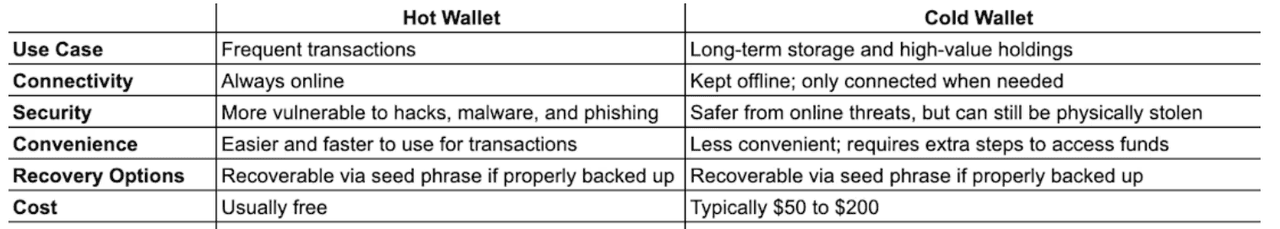

Hot vs. Cold Wallets: Pros and Cons

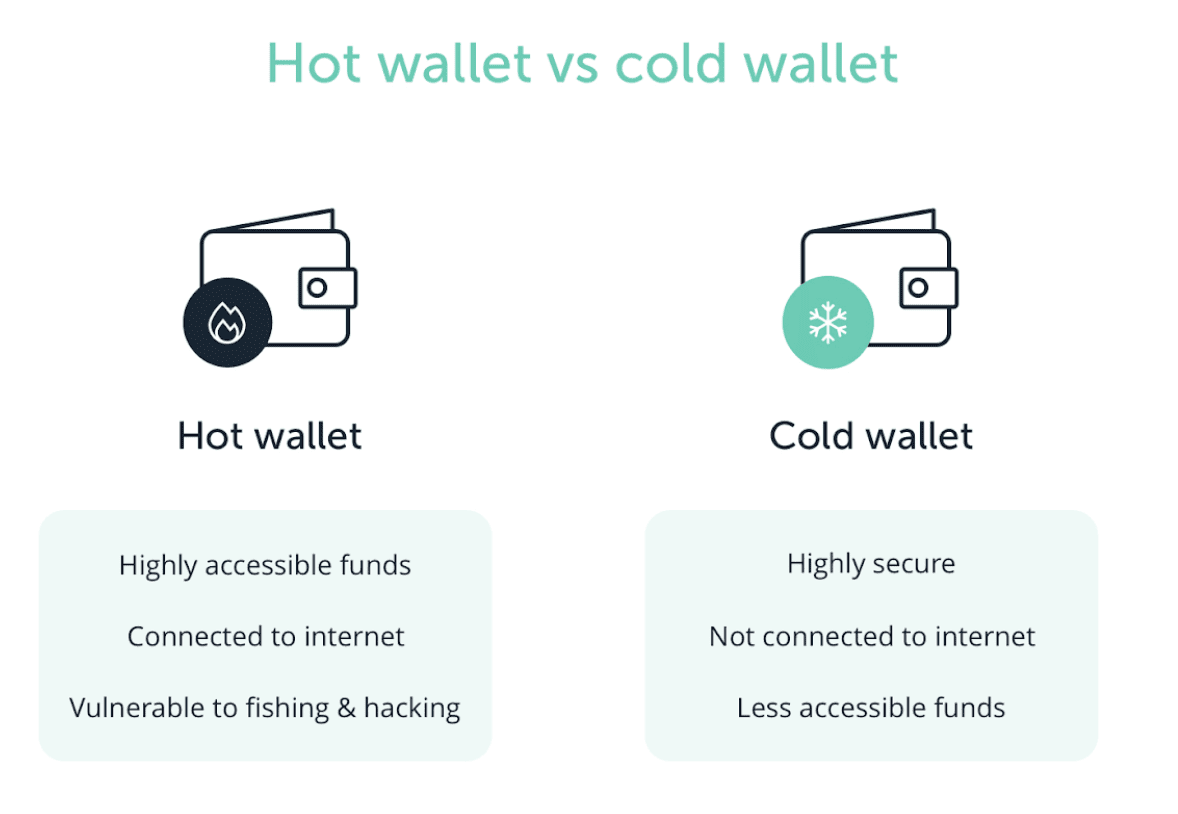

So, how do hot and cold wallets stack up against each other? Each type of wallet has strengths and weaknesses.

• Hot wallets: Convenient, user-friendly, and accessible from anywhere with an internet connection. Perfect for newcomers or those who trade frequently. The downside? They are more vulnerable to hacks, phishing, and malware.

• Cold wallets: Extremely secure due to their offline nature, making them the preferred option for storing large amounts of crypto. The trade-off is that they aren't as convenient for quick transactions.

The choice often comes down to how often you plan to access your funds and how much risk you're willing to accept.

How to Choose Between Hot and Cold Wallets

Which type of wallet matches your crypto habits? If you're an active trader or someone who moves crypto frequently, a hot wallet may be the better choice. It provides the accessibility and speed you need without the hassle of plugging in a hardware device each time.

On the other hand, if your primary goal is to hold crypto for the long term and keep it as safe as possible, a cold wallet is the way to go. The peace of mind of knowing your private keys never touch the internet is often worth the trade-off in convenience.

Are Cold Wallets More Secure Than Hot Wallets?

In terms of protection from online hacks, cold wallets are generally more secure because they aren't connected to the internet. That said, they come with their own risks. A cold wallet can be lost, stolen, or physically damaged.

It's also worth noting that not all cold wallets are completely “offline.” Some include features like Bluetooth or wireless connectivity, require companion software, or rely on mobile apps. While these add convenience, they also introduce potential vulnerabilities. The rule of thumb is simple: the more features and ease of use a wallet offers, the more it tends to compromise on security.

Combining Hot and Cold Wallets

Do you really have to choose just one? Many experienced crypto users choose to combine both hot and cold wallets. A common strategy is to keep a small amount of crypto in a hot wallet for day-to-day transactions while storing the bulk of their assets in a cold wallet for maximum security. This hybrid approach allows you to enjoy the best of both worlds, convenience when you need it and peace of mind knowing your larger holdings are protected.

Choosing the Right Crypto Wallet for Your Needs

Now that you know the key differences between hot and cold wallets, the next step is figuring out which option best fits your needs. Here are a few considerations based on different types of users:

For Beginners

If you're just starting out, a hot wallet is usually the easiest choice. They're simple to set up, have user-friendly interfaces, and make sending or receiving crypto straightforward. Popular options like

MetaMask and

Trust Wallet support a wide range of crypto and offer built-in features for quick use. Just remember: only keep small amounts in a hot wallet and enable extra security settings like two-factor authentication.

For Advanced Users

If you're managing a larger portfolio or want stronger protection, a cold wallet is a safer bet. Hardware wallets are especially popular among experienced users because they keep private keys offline. Cold wallets also support many lesser-known cryptocurrencies that big hot wallets don't. For example, the Ledger Wallet supports over a thousand different tokens, giving advanced users more flexibility.

For Long-Term Storage

If your plan is to hold crypto long-term, cold storage is the most reliable option. Since your keys stay offline, your assets are better protected against online threats. Look for features like durable design (some wallets are waterproof and fireproof), backup options, and strong chip security. The Ledger Wallet is built with a passport-grade chip, resistant to dust, water, and extreme temperatures (–25° to 50°C), and designed to last for decades when used properly.

Conclusion

So, what's the takeaway? Your ideal wallet depends on your priorities. If convenience matters most, stick with a hot wallet. If maximum security is your goal, a cold wallet is the safer choice. And if you're holding for the long run, go with a hardware wallet designed for durability and backup protection. Hot wallets shine in accessibility, while cold wallets excel in security.

The right choice depends on your trading habits, risk tolerance, and overall investment strategy. For many, a combination of both is the smartest move, offering the flexibility to transact easily while keeping their wealth secure in the long run.

Related Reading

FAQs About Hot vs. Cold Wallets

1. What is a hot wallet in crypto?

A hot wallet is an internet-connected digital wallet that lets you store, send, and receive cryptocurrencies quickly.

2. What is a cold wallet in crypto?

A cold wallet is an offline storage method, usually a physical device, that keeps your private keys safe from online threats.

3. Which is more secure: a hot wallet or a cold wallet?

Cold wallets are more secure because they are offline and less vulnerable to hacking or phishing attacks.

4. Are hot wallets safe to use?

Yes, but only for smaller amounts or daily use. Since they're always online, they are more vulnerable to cyberattacks.

5. Can I use both hot and cold wallets together?

Yes. Many users store the bulk of their assets in a cold wallet for safety while keeping smaller amounts in a hot wallet for quick access.

6. Do hot wallets cost money?

Most hot wallets are free to use. However, some may charge transactions or network fees.

7. Do cold wallets cost money?

Yes. Hardware wallets typically cost between $50 and $200, depending on the brand and features.

8. Which wallet is best for beginners?

Hot wallets are easier to set up and use, making them ideal for beginners who are just starting with crypto.

9. Which wallet is best for long-term storage?

Cold wallets are the best choice for long-term storage because they provide maximum security for your private keys.

10. Can I lose my funds if I lose my wallet device?

Not necessarily. As long as you've backed up your recovery phrase or seed phrase, you can restore access to your funds.

11. Do I need an internet connection to use a cold wallet?

No. Cold wallets work offline, though you'll need to connect them briefly when making transactions.

12. Can hot wallets be hacked?

Yes. Since hot wallets are connected to the internet, they're more susceptible to hacking, malware, and phishing attempts.

13. Can cold wallets be hacked?

It's extremely difficult. Since they're offline, the risk is minimal, but physical theft or damage is still possible.

14. Are cold wallets difficult to use?

They can be more complex to set up than hot wallets, but once configured, they're relatively straightforward to use.

15. How do I decide which crypto wallet is right for me?

If you trade often and value convenience, a hot wallet may suit you. If security and long-term storage are priorities, a cold wallet is the better choice. Many investors use a mix of both.