AI crypto projects combine blockchain with machine learning and autonomous agents, enabling decentralized data analysis, automated trading strategies, and real‑time AI inference across DeFi, NFT, and supply‑chain applications. Discover the 10 best AI crypto projects to watch in 2025 on BingX, including Bittensor, NEAR, Internet Computer, Render, ASI, The Graph, and Sei, and learn how to trade, stake, and secure these innovative tokens.

AI‑powered cryptocurrencies have exploded in value. Their combined market cap has ballooned to $29.5 billion as of August 2025, up from just $3.2 billion one year earlier. You’re now at the brink of a new era: 2025 will define the AI‑crypto convergence. Major protocols are embedding machine learning directly on‑chain, while venture firms pour capital into agent marketplaces and DeFAI platforms. Builders are racing to deploy automated

trading bots,

NFT‑sniping agents, and on‑chain AI compute networks. Don’t let this wave pass you by.

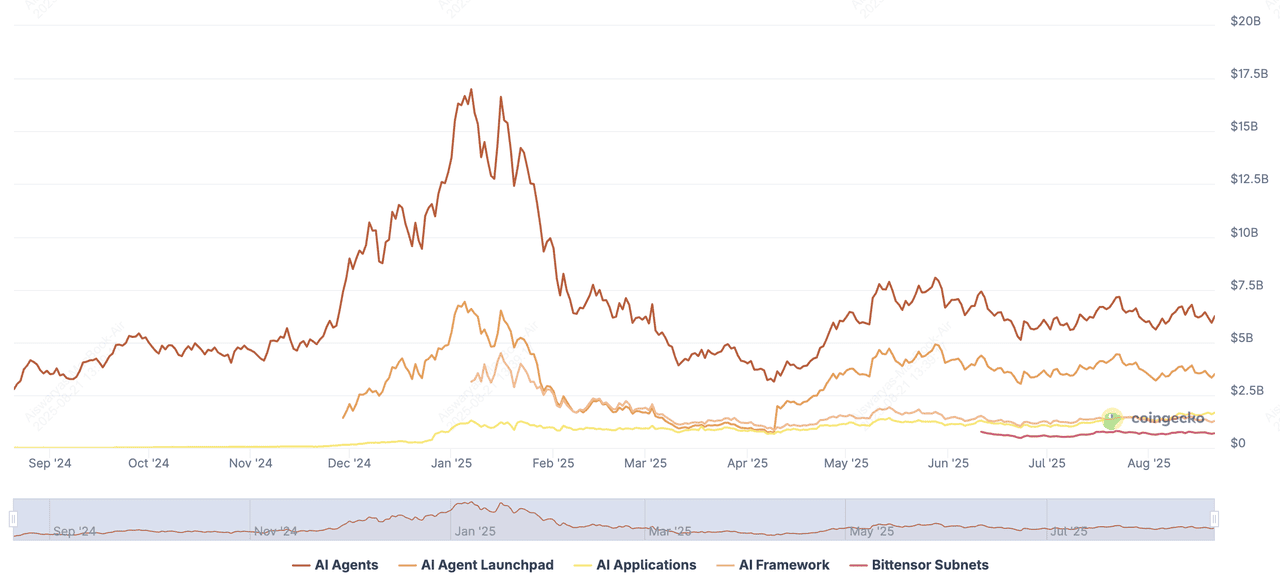

Top AI sectors by market cap | Source: CoinGecko

According to CoinGecko, nearly 1200 tokens now compete in the AI sector, with a combined market cap exceeding $29.5 billion. That depth reflects surging developer interest and growing demand for decentralized AI services, from predictive analytics to autonomous market‑making. As more projects launch and integrate LLMs, reinforcement‑learning agents, and real‑time data oracles, the AI‑crypto space promises to reshape

DeFi,

Web3, and beyond.

In Q1 2025, AI was one of the hottest crypto narratives of all, second only to memecoins. Out of the top 20 stories tracked by CoinGecko, five were AI-related, capturing 35.7% of global investor interest, overtaking meme coins, which settled for 27.1%. Combined, AI tokens and memecoins accounted for 62.8% of all crypto narrative mindshare.

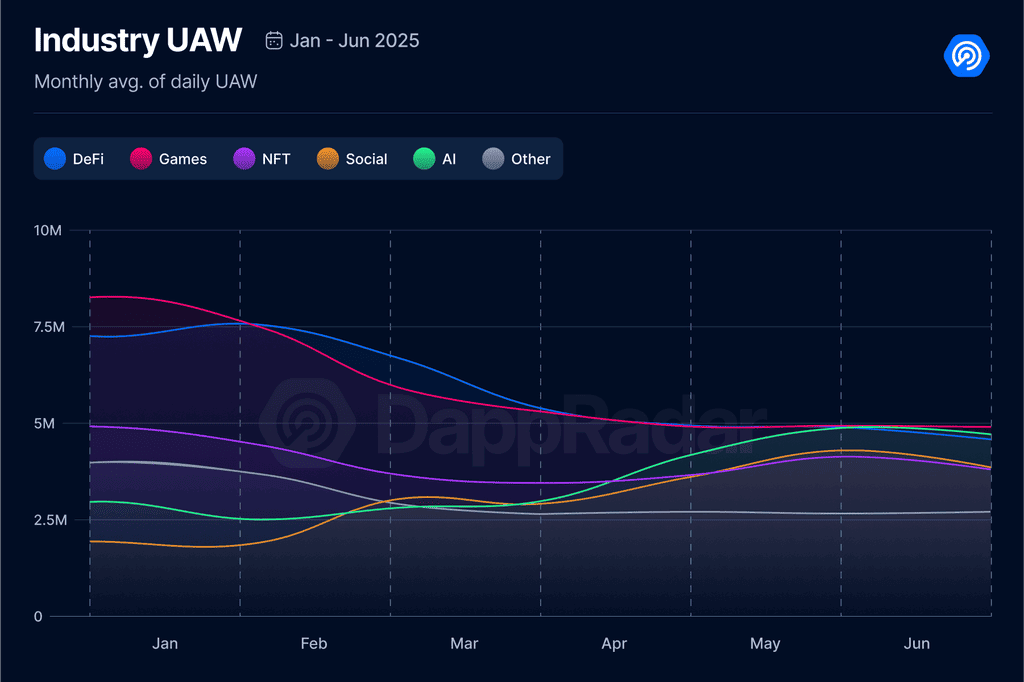

Industry user active wallets (UAWs) monthly average in Q2 2025 | Source: DappRadar

By Q2 2025, the momentum had shifted even further toward AI. According to DappRadar, AI dapps reached 18.6% dominance of the entire dApp industry, nearly overtaking gaming (20.1%) as the leading category. This underscores a broader transition: what began as an “AI token hype” in Q1 is now turning into sustained user engagement and adoption of AI-driven applications.

What Are AI Crypto Tokens?

AI cryptocurrencies fuse blockchain with machine learning or autonomous agents. They act as utility tokens that power AI‑driven networks—funding ecosystems where models train, deploy, and execute fully on‑chain

Core applications include:

• Data Analysis: AI scans massive on‑chain and off‑chain datasets to uncover hidden market signals.

• Automation: Smart contracts embed AI logic to handle tasks like portfolio rebalancing or yield harvesting without manual steps.

• Predictive Modeling: Agents forecast price moves, gas fees, or NFT floor trends to guide your next trade.

These projects combine the transparency and security of blockchain with the adaptive power of AI. As a result, they unlock new levels of efficiency, trust, and innovation in decentralized finance and beyond.

Why Are AI Crypto Projects Trending in 2025?

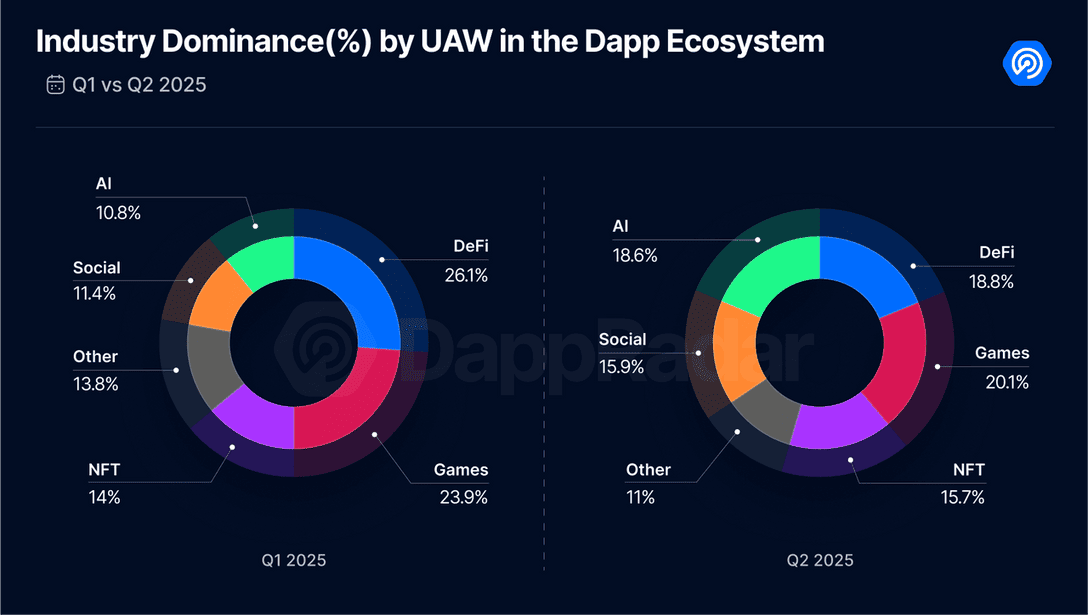

AI dominance in the crypto market on the rise | Source: DappRadar

By Q2 2025, this momentum translated into usage: per DappRadar, AI dapps reached 18.6% industry dominance, nearly overtaking gaming at 20.1%, with agent-based platforms like

Virtuals Protocol topping the charts in unique active wallets.

These projects aren’t just hype; they power autonomous trading, real-time analytics, and next-gen DeFAI/NFT tools, reshaping how value moves on-chain. Crypto markets run 8,760 hours a year, but human traders cover only a fraction of that.

AI agents, by contrast, scan 50+ order books in under a second and execute microsecond trades to capture arbitrage opportunities, which account for an estimated 5–10% of daily volume.

In DeFAI, bots have redeployed over $2 billion in total value locked (TVL) across lending and yield-farming protocols in pursuit of 12–20% APYs. On the NFT side, AI snipers have lifted mint success rates by 40% and boosted average flip profits by 15%, outperforming manual buyers during competitive drops.

Top 10 Artificial Intelligence (AI) Coins to Know in 2025

Here are the top 10 AI crypto projects you need to know in 2025 and consider adding to your portfolio, if you are interested in this emerging space:

1. Bittensor (TAO)

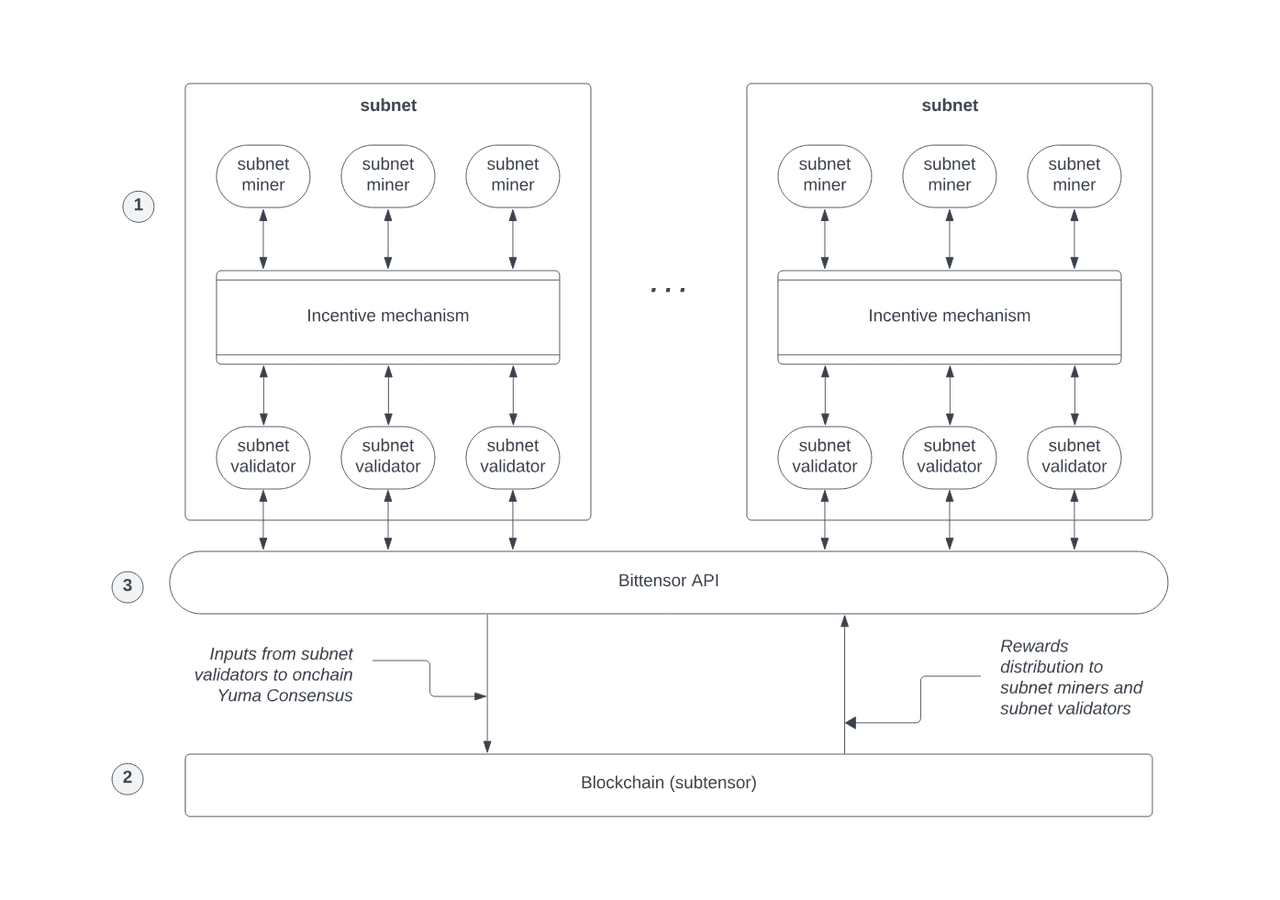

An overview of the Bittensor ecosystem | Source: Bittensor docs

Bittensor (TAO) is a decentralized neural-network marketplace that lets anyone deploy and monetize machine-learning models on its blockchain. Through its Proof of Intelligence consensus, contributors, miners who train models and validators who check outputs, earn

TAO rewards based on accuracy and reliability. The network is organized into subnets, domain-specific markets for areas like natural language, vision, and forecasting, creating customizable AI ecosystems all powered by the TAO economy.

In 2025, Substrike (Subnet 23) emerged as Bittensor’s largest layer, surpassing 138,000 active miners by rewarding contributions through social signals instead of hardware mining. As of August 2025, TAO trades near $345 with a market cap of about $3.3 billion, making it the leading AI crypto token. With staking, governance, and premium AI services all tied to TAO, Bittensor is positioning itself as a cornerstone of decentralized AI, where ownership and value creation are shared across a global community.

2. NEAR Protocol (NEAR)

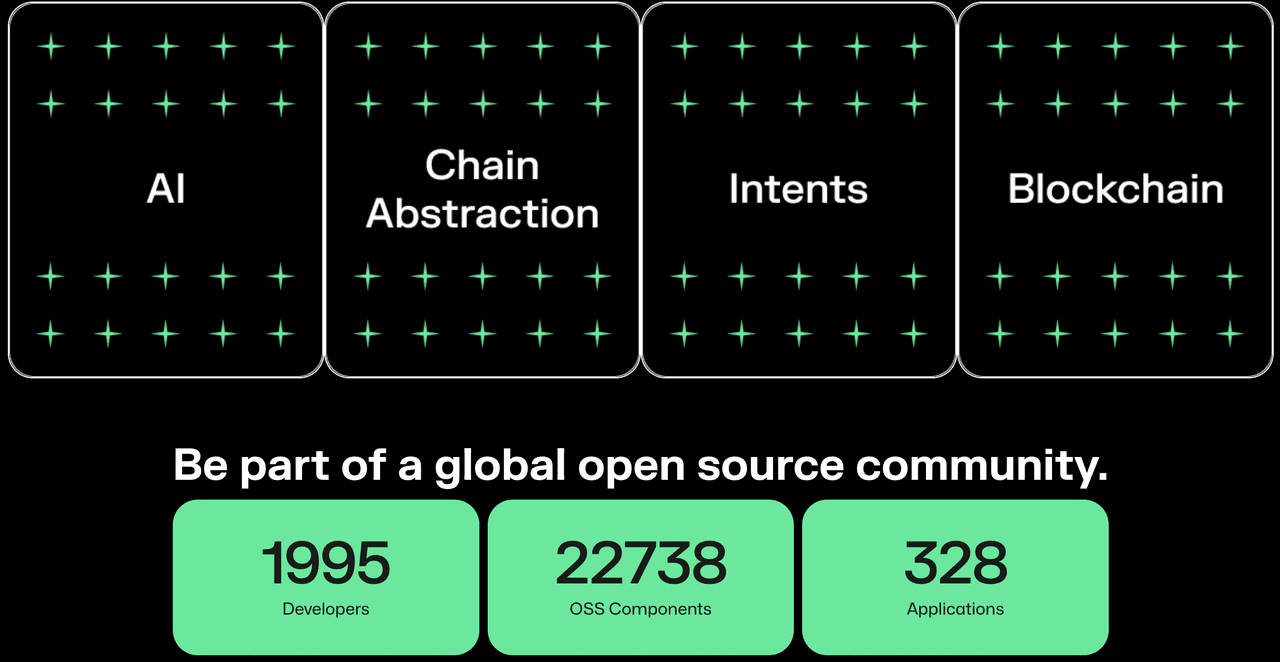

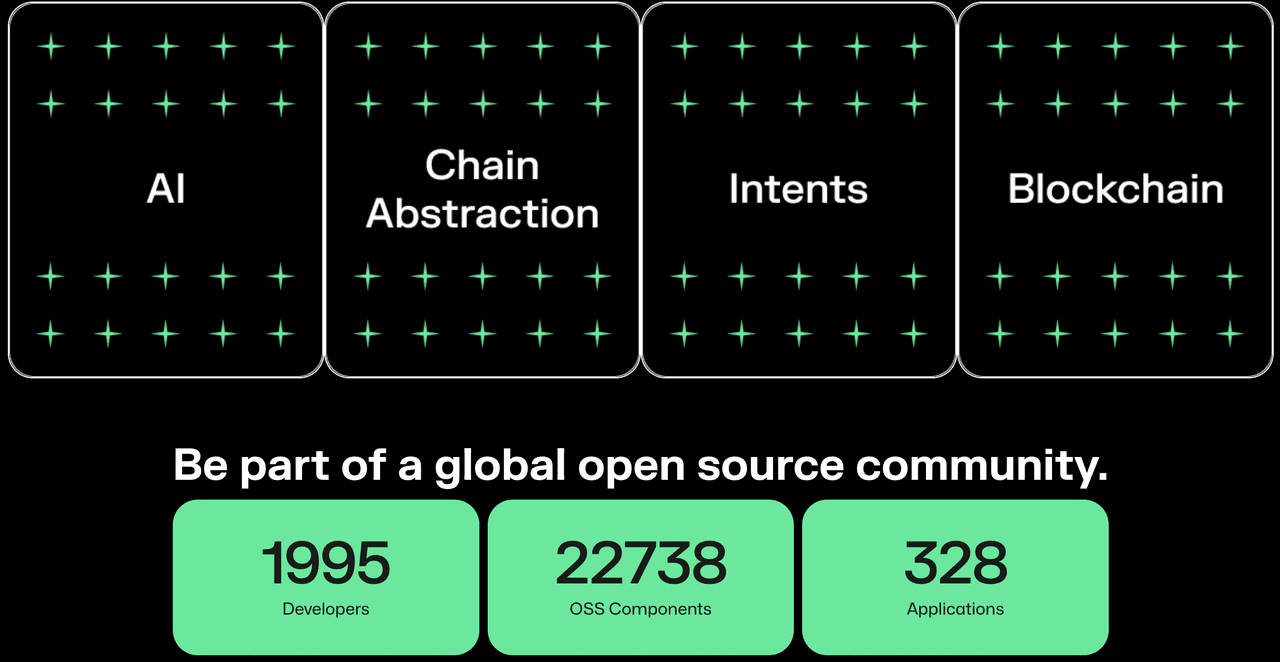

Source: Near

NEAR Protocol (NEAR) is a high-performance, sharded Layer-1 blockchain designed for scalable Web3 and AI applications. Its Nightshade sharding architecture processes millions of transactions daily with sub-second finality, while developers can build using JavaScript, Rust, or AssemblyScript on a WebAssembly runtime. Features like meta-transactions (gasless interactions), cross-chain bridges to Ethereum and other ecosystems, and privacy-focused tools such as multiparty computation make NEAR an attractive base for AI agents, decentralized apps, and data marketplaces that require speed and flexibility.

The NEAR token powers staking, governance, and transaction fees across the network. Holders can secure the Proof-of-Stake consensus for up to ~10% APY rewards, vote on protocol upgrades, or pay for execution and storage. As of August 2025, NEAR trades around $2.51 with a market cap of about $3.1 billion, ranking among the top 50 cryptocurrencies. While still well below its all-time high of $20.42, analysts forecast potential recovery toward $5.40 by year-end 2025 and further growth in later years, reflecting NEAR’s strong fundamentals and adoption by AI-driven and mainstream Web3 projects.

3. Internet Computer (ICP)

Source: InternetComputer

The

Internet Computer (ICP) extends the internet into a decentralized “world computer,” enabling smart contracts that run at web speed, process HTTP requests directly, and serve interactive apps without centralized infrastructure. Its chain-key cryptography stitches together subnet blockchains into one seamless network with sub-second finality and horizontal scalability. Developers deploy WebAssembly-based canisters to build Web3 social platforms, games, DeFi protocols, and AI services that are resistant to censorship and traditional cyberattacks. Recent upgrades, including Chain Fusion Technology, now allow ICP smart contracts to interoperate natively with Bitcoin, Ethereum, and Solana, unlocking multichain DeFi, gaming, and AI use cases without reliance on external bridges.

The

ICP token powers governance, computation, and resource usage across the network. Users stake ICP in the Network Nervous System (NNS) to participate in protocol decisions and earn rewards, or convert ICP into cycles to pay for computation, storage, and cross-chain outcalls under the reverse-gas model, allowing seamless dApp usage without requiring end users to hold tokens. As of August 2025, ICP trades near $5.20 with a market capitalization of about $2.79 billion, ranking it among the top 55 cryptocurrencies. By aligning token incentives with transparent governance and developer adoption, ICP is positioning itself as a backbone for scalable, interoperable, and AI-driven blockchain applications.

4. Render (RENDER)

Source: Render

Render (RENDER) powers a decentralized GPU compute marketplace that connects artists, developers, and AI researchers with node operators offering idle graphics processing power. Originally built for 3D rendering, the network has expanded to support AI training and inference, enabling workloads from photorealistic visual effects to real-time generative AI. Governance runs through Render Network Proposals (RNPs) under the Render Network Foundation, ensuring upgrades and emissions policies are community-driven. With its migration to Solana completed in 2023, Render now benefits from low-cost, high-speed transactions, positioning it as one of the leading

DePIN (Decentralized Physical Infrastructure Network) projects alongside Bittensor and Internet Computer.

The

RENDER token underpins the ecosystem through its Burn-Mint Equilibrium (BME) model, where creators burn tokens to purchase rendering credits and node operators earn newly minted RENDER upon job completion. Holders can also stake tokens for governance and ecosystem participation. As of August 2025, RENDER trades around $3.62 with a market cap of about $1.87 billion, ranking it among the top 70 cryptocurrencies. By aligning economic incentives with scalable GPU access, Render provides a cost-efficient alternative to centralized cloud services, fueling industries like VFX, gaming, and AI with on-demand decentralized compute.

5. Story (IP)

Story (IP) is an AI-native infrastructure project designed to unlock the massive $80 trillion intellectual property (IP) asset class. It tokenizes IP, making it programmable, enforceable, and monetizable on-chain. Through machine-readable licensing models, ranging from open use and non-commercial remix to commercial licensing, Story enables creators, brands, and enterprises to register, license, and monetize IP seamlessly. This framework provides AI systems with access to rights-cleared, high-quality datasets, solving one of AI’s biggest bottlenecks: secure access to specialized, real-world data.

The

IP token underpins Story’s ecosystem, powering licensing, staking, royalties, and programmable ownership across industries. Applications include tokenizing patents in biomedicine, automating royalties in entertainment, building IP-backed DePIN infrastructure, and enabling funds to trade tokenized IP portfolios. Backed by a16z Crypto, Samsung Next, and WME, Story is positioning itself as the core layer for AI-driven economies, where IP becomes not just protected but liquid, composable, and natively integrated into AI workflows.

6. Artificial Superintelligence Alliance (FET)

Source: SuperIntelligence docs

The

Artificial Superintelligence Alliance (ASI) brings together Fetch.ai, SingularityNET, Ocean Protocol, and CUDOS into the world’s largest decentralized AI consortium. Its mission is to prevent AI monopolization by building an open, democratic, and ethical AI ecosystem. At the heart of the alliance is Agentverse, a decentralized marketplace where anyone can launch and monetize autonomous agents, and the uAgents SDK, which allows developers to wrap custom logic, LLMs, or data feeds into on-chain agents. ASI has also launched ASI-1 Mini, the first Web3-native LLM designed for modular, agentic AI workflows, powered by knowledge graphs for context-aware reasoning. Together, these tools form the backbone of a decentralized infrastructure stack spanning compute, data, and coordination layers.

The ecosystem runs on the

ASI token ($FET), which powers governance, staking, payments, and incentives across the network. Developers and enterprises use $FET to deploy agents, run inference tasks, and access decentralized compute via ASI Compute and ASI Data. As of August 2025, $FET trades near $0.67 with a market cap of about $1.75 billion, ranking it among the top 75 cryptocurrencies. By aligning incentives across developers, data providers, and compute operators, ASI is accelerating the path toward open-source AGI, ensuring that the benefits of superintelligence are accessible to the global community rather than concentrated in the hands of a few tech giants.

7. Sahara AI (SAHARA)

Source: Sahara AI

Sahara AI is a decentralized, full-stack AI platform built on its own Layer-1 blockchain, giving users complete control over their data, models, and contributions. It transforms the traditional AI pipeline into a transparent and collaborative ecosystem where anyone can upload datasets, mint ownership NFTs, deploy agents, and earn rewards with on-chain attribution. Sahara’s Data Services Platform (DSP), developer suite, and AI marketplace make it possible for individuals and enterprises to license datasets, train models, and build AI-powered applications with verifiable ownership and automated royalties. The network already counts over 200,000 contributors, 35+ enterprise clients, and 3 million annotations, making it one of the fastest-growing decentralized AI ecosystems.

The platform is backed by Binance Labs, Polychain Capital, and Sequoia, and supported by advisors from leading AI ventures such as Midjourney, Together AI, and Nous Research. Sahara’s native token,

$SAHARA, powers governance, staking, payments, and licensing across the ecosystem. As of August 2025, SAHARA trades around $0.087 with a market cap of about $178 million, and a fully diluted valuation near $876 million. Following its BingX listing in June 2025, Sahara has expanded liquidity and accessibility while driving adoption through its SIWA public testnet airdrop. With its mainnet launch scheduled for Q3 2025, Sahara is positioning itself as a user-owned alternative to Big Tech AI, where data and model ownership stay in the hands of creators and contributors.

8. Sei (SEI)

Source: Sei

Sei (SEI) is a next-generation, parallelized Layer-1 blockchain built with the Cosmos SDK and Tendermint, optimized for ultra-fast settlement and real-time trading. Its runtime parallelizes non-conflicting transactions, achieving ~400 ms finality and scaling toward hundreds of thousands of TPS with the upcoming Sei Giga upgrade. The release of Sei V2 added native EVM compatibility, allowing developers to use Ethereum tooling like Hardhat and Foundry while benefiting from advanced features such as chain abstraction and meta-transactions. This makes Sei a powerful platform for order-book DEXs, stablecoin rails, prediction markets, and institutional-grade trading apps, supported by its Monaco trading layer, which unifies liquidity across spot, perps, and in-game economies.

The

SEI token secures the network through Proof-of-Stake, powers governance in the Sei DAO, and covers transaction and smart contract fees. Validators and delegators stake SEI for rewards while also participating in protocol upgrades. As of August 2025, SEI trades near $0.30 with a market cap of about $1.78 billion, boosted by rising institutional inflows and nearly $900 million in monthly DEX volume. Backed by Circle Ventures, Multicoin, Jump, and Coinbase, Sei is rapidly gaining traction, with a potential Sei staking ETF currently under SEC review, a move that could expand exposure to traditional investors and further solidify its role as an enterprise-grade blockchain for high-frequency, real-time applications.

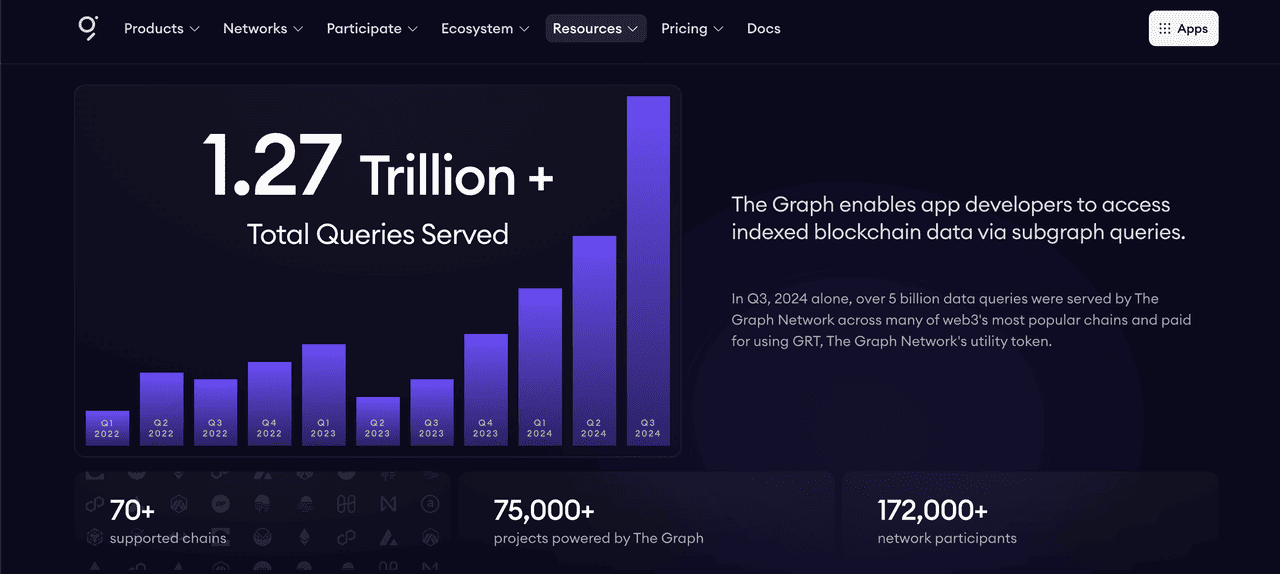

9. The Graph (GRT)

Source: TheGraph

The Graph (GRT) powers a decentralized indexing and query protocol that makes blockchain data accessible with the efficiency of GraphQL. Instead of parsing raw blockchain data, developers build subgraphs, custom schemas that index on-chain events and smart contract states, enabling dApps and AI agents to fetch precise, real-time data such as DeFi prices, NFT metadata, and DAO activity. The network now supports over 100 chains and rollups, including Ethereum,

Solana,

Arbitrum,

Optimism, and Sei, and has served more than 1.27 trillion queries across 75,000+ projects. Reliability is secured by a globally distributed set of indexers, curators, and delegators, ensuring high-quality, always-available data feeds without centralized infrastructure.

The

GRT token underpins the protocol by coordinating incentives and governance. Users pay query fees in GRT, which are distributed to indexers and curators, while delegators stake GRT to earn a share of rewards. Governance is conducted through proposals that steer network upgrades and economic parameters. As of August 2025, GRT trades near $0.09 with a market cap of about $949 million, reflecting renewed growth after its migration to an updated Arbitrum contract. Whether powering real-time DeFi trading bots, AI data agents, or large-scale analytics platforms, The Graph remains the data layer of Web3, delivering reliable, decentralized access to blockchain information.

10. Theta Network (THETA)

Theta Network (THETA) is a decentralized cloud infrastructure purpose-built for AI, media, and entertainment workloads. Through its flagship product Theta EdgeCloud, the network harnesses a global pool of over 30,000 distributed GPU nodes, enabling AI model training, LLM inference, and video processing at scale. Enterprises, universities, and entertainment brands, including the NBA, MLS, and American Idol, use Theta’s hybrid decentralized-cloud model to reduce costs while maintaining high throughput and reliability. Recent partnerships, such as with Olympique de Marseille FC and multiple top universities, underscore Theta’s push into AI-driven fan engagement and enterprise-grade validators.

The

THETA token underpins the protocol’s security, governance, and economic incentives, while its sibling token TFUEL powers transactions and rewards GPU providers. Node operators can earn TFUEL by contributing compute and bandwidth, ensuring a self-sustaining ecosystem. As of August 2025, THETA trades near $0.78 with a market cap of about $785 million, reflecting steady adoption as decentralized GPU marketplaces gain traction. By combining blockchain verification with scalable GPU compute, Theta positions itself as a Web3 alternative to centralized cloud giants, delivering decentralized infrastructure for the next wave of AI and digital media.

How to Evaluate AI Crypto Projects

Not all AI tokens are equal. Use these four pillars to separate the innovators from the hype.

1. Team Expertise & Roadmap: Look for founders with proven AI and blockchain track records. A clear roadmap should show completed milestones, such as audited smart contracts or mainnet launches, and detailed plans for agent upgrades, model retraining, or new integrations.

2. Tokenomics & Supply Schedule: Study the emission curve and vesting schedules. The healthiest projects balance early rewards with long‑term scarcity. Check for mechanisms like token burns, staking rewards, or revenue‑sharing that tie value capture to real network usage.

3. Adoption & Partnerships: Live pilots on testnets or mainnets demonstrate real demand. Enterprise integrations with cloud providers or oracle networks signal that major players trust the tech. Partnerships with DeFi protocols, NFT platforms, or data marketplaces further validate utility.

4. Community & Governance: A vibrant Discord or Telegram community shows active user engagement. On‑chain governance, where token holders vote on upgrades and budgets, aligns incentives and prevents centralization. Projects with regular governance proposals and transparent voting metrics tend to outlast those without.

How to Trade AI Crypto Projects on BingX

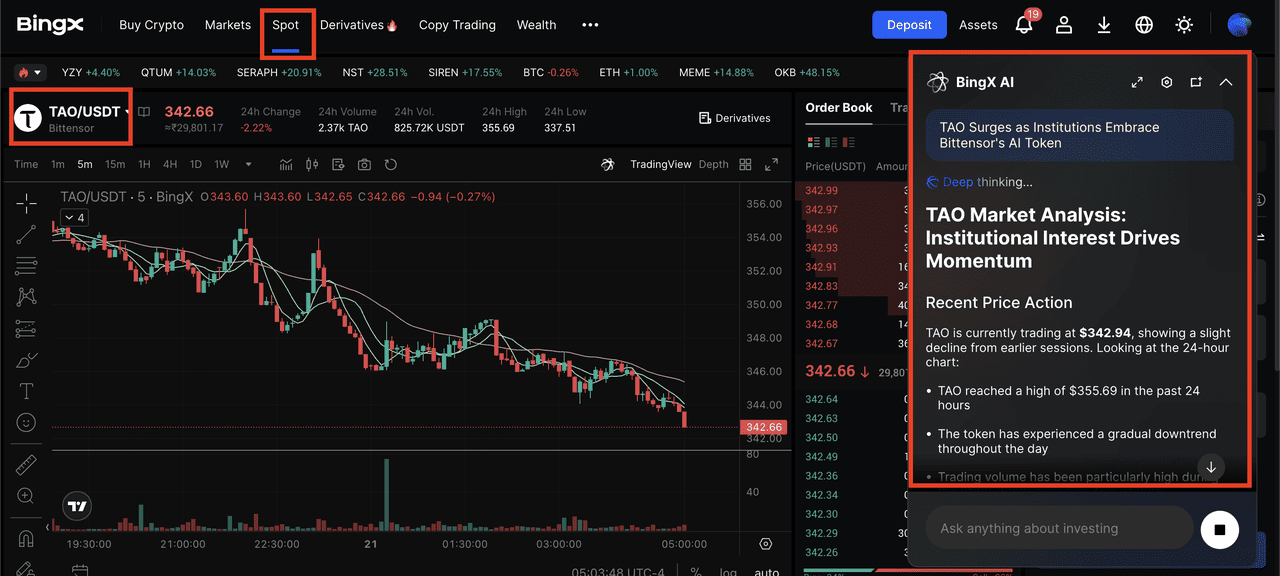

TAO/USDT trading pair on the spot market powered by BingX AI insights

Getting started with BingX is simple, even if you’re new to crypto. As the leading AI-powered social trading platform, BingX offers multiple ways to trade and grow your portfolio. You can buy AI tokens directly on the

spot market, speculate on price moves with

futures trading, or mirror top traders’ strategies through

copy trading. For hands-free strategies, set up

trading bots to automate entries and exits around the clock, and explore

BingX Earn to stake or lock your tokens for passive rewards.

Here's how you can buy, stake, and secure your AI tokens confidently with BingX.

1. Sign Up & Complete KYC: First, head to bingx.com or install the BingX app and register using your email or phone number. Then upload a clear photo of your government‑issued ID and a selfie under Profile → Verification. Basic verification often clears in under five minutes; upgrading to advanced KYC lifts your withdrawal limits and unlocks premium features.

2. Secure Your Account: Protect your assets by enabling two‑factor authentication in Security Settings. Link Google Authenticator or SMS 2FA to every login and withdrawal. Turn on withdrawal address whitelisting so that funds can only move to pre‑approved wallets. Finally, set an anti‑phishing code in your account to spot official communications, and use a strong, unique password stored in a password manager.

3. Deposit Funds: Once verified, go to Assets → Deposit and choose USDT or your local fiat currency. For crypto deposits, copy the USDT address or scan the QR code; the network usually confirms within minutes. If you prefer fiat, select bank transfer or card payment; expect funds to arrive in 1–2 business days, and check Deposit History to confirm.

4. Select Your AI Token: Navigate to

Spot Trading as shown above, enter the symbol (for example, “

TAO/USDT” or “

NEAR/USDT”) in the search bar, and click the pair. You’ll instantly see real‑time price charts, order books, and recent trades to help you plan your entry.

BingX AI can help analyze trends and identify opportunities before you place your trade.

5. Place Your Order: Decide whether you want immediate execution with a

market order or to target a specific price with a limit order. For more control, use

OCO (one cancels the other order) to set both a

take‑profit and a stop‑loss in one ticket, or employ a stop‑limit order to trigger at your chosen threshold if the market moves against you. Always verify the price and amount before confirming.

6. Explore Advanced Trading Options:

• Futures Trading: Go to Derivatives → Futures to long or short AI tokens with leverage. Use margin carefully and set TP/SL to manage risk.

• Copy Trading: Follow top-performing traders under Copy Trading and mirror their AI token strategies automatically. Ideal if you’re new to trading.

• Trading Bots: Automate your AI token trades with Spot or Futures Grid bots to capture volatility 24/7 without manual monitoring.

7. Stake & Earn: After buying AI tokens, visit Wealth → Earn → Staking to lock them for passive yields. Flexible staking lets you withdraw at any time with a modest APY, while fixed‑term options (e.g., 30 days) offer higher returns in exchange for a lock‑up period. Review the projected annual yield and minimum amounts to find the right fit.

By following these steps, you’ll

trade AI tokens like a pro, combining ease of use with robust security and risk management.

Closing Thoughts

AI and blockchain now work hand‑in‑hand to deliver 24/7 autonomous trading, data‑driven decision‑making, and new DeFAI and NFT automation use cases. Projects like Bittensor, NEAR, Internet Computer, Render, ASI (FET), and The Graph, showcase how AI tokens can reshape decentralized finance, supply‑chain tools, and on‑chain intelligence markets.

Always do your own research before you invest. Review a project’s team, roadmap, tokenomics, and community activity. Diversify your holdings and never risk more than you can afford to lose. Crypto markets remain volatile, and past performance does not guarantee future results.

Ready to dive deeper? Explore more beginner guides, tutorials, and in‑depth courses on BingX Academy. Stay informed. Stay secure. Stay ahead in the AI‑crypto revolution.

Related Reading