The cryptocurrency market moves fast, with prices shifting in seconds. Crypto traders without a clear plan often react emotionally instead of strategically. A cryptocurrency trading plan gives structure to your decisions. It defines when to enter or exit, how much to risk, and which

trading strategy fits your goals.

In this guide, you’ll learn how to create a cryptocurrency trading plan that matches your style and risk tolerance. We’ll explore goal setting,

technical analysis,

risk management, and performance tracking using BingX charts and tools.

Whether you prefer

day trading, swing trading, or long-term investing, this guide helps you trade smarter, stay consistent, and make informed decisions in any market condition.

What Is a Cryptocurrency Trading Plan?

A cryptocurrency trading plan is a personal roadmap that guides every decision you make in the crypto market. It outlines what assets you trade, how you identify setups, and how you react when price movements don’t go your way.

For example, a trader might buy Bitcoin when the

Relative Strength Index (RSI) drops below 30 and sell when it nears 70, or use swing trading strategies to capture mid-term trends. The goal is to trade on purpose, not impulse.

A clear plan keeps you focused during volatility. It helps you manage risk, stick to proven crypto trading strategies, and refine your approach over time, turning every trade into a calculated step toward consistency.

Understanding the Crypto Market Landscape

The cryptocurrency market operates unlike traditional financial markets. It trades 24 hours a day, reacts instantly to

global news, and is shaped by both retail and institutional crypto traders. Understanding these dynamics helps you build a trading strategy that adapts to changing market conditions.

1. What Makes the Crypto Market Unique?

Unlike stock trading, crypto runs nonstop. You might see Bitcoin jump five percent or drop ten overnight. This constant motion creates opportunity but also high market volatility. Trading on

decentralized exchanges means no central authority controls cryptocurrency prices, so market sentiment and liquidity drive trends more than corporate earnings or reports.

2. Key Market Drivers and Sentiment Factors Affecting Crypto Prices

Crypto reacts sharply to information. News events, trading volume, and macro signals such as inflation or regulation often predict short-term price movements. When volume surges on

BingX BTC/USDT charts, it can confirm a breakout. Tracking market cycles, sentiment indexes, and fundamental indicators helps traders stay informed and ahead of

momentum shifts.

How to Set Your Crypto Trading Goals and Style

Every successful trading plan starts with clear goals. Without defined objectives, traders often chase noise instead of opportunity. Your trading goals determine how you trade, how much risk you accept, and what results you expect over time.

1. Define Your Financial Objectives

Decide what you want to achieve, steady income, long-term capital growth, or portfolio diversification. For instance, some crypto traders on BingX use short-term setups on BTC/USDT to earn regular returns, while others hold digital assets like ETH or SOL for longer trends. Align each goal with your total capital, time commitment, and risk tolerance.

2. Choose Your Trading Style

Your trading style reflects your pace and personality:

• Day Trading: Frequent trades to capture short-term volatility.

• Position Trading: Long-term trend following.

• Scalping: Quick, small trades based on micro movements.

Choosing the right style depends on your schedule, experience, and mindset. Once your goals are defined, your crypto trading strategy becomes much clearer.

How to Design Your Crypto Trading Strategy

Once your goals and trading style are defined, the next step is building a structured crypto trading strategy. A good plan combines technical analysis with fundamental insights, sets clear entry and exit rules, and adapts to different market trends.

1. Combine Technical and Fundamental Analysis

Fundamental and

on-chain analysis adds depth by assessing tokenomics, network growth, and developer activity. A project with strong fundamentals and rising on-chain engagement often has higher long-term potential.

2. Define Entry and Exit Rules

Before opening a trade, define:

• Your entry point based on breakout or trend confirmation.

• A stop-loss to protect capital.

• A take-profit level to secure gains.

For instance, buying BTC/USDT at $105,000 after a breakout and setting a

stop-loss at $102,000 keeps risk structured. Combining both analyses ensures every cryptocurrency trade is backed by data, not emotion.

3. Apply Strategy Frameworks

Once you understand market behavior, you can apply a structured cryptocurrency trading strategy that matches your goals and risk profile. Here are three proven approaches used by both beginners and experienced traders on BingX.

i. Trend Trading: Trend trading focuses on following the market’s main direction. Traders use moving averages, trendlines, or technical indicators like RSI to confirm momentum. Example: Buying Bitcoin when it breaks above the 50-day moving average and RSI rises above 50 often signals a strong uptrend. This approach works best during clear bull or bear markets and rewards patience.

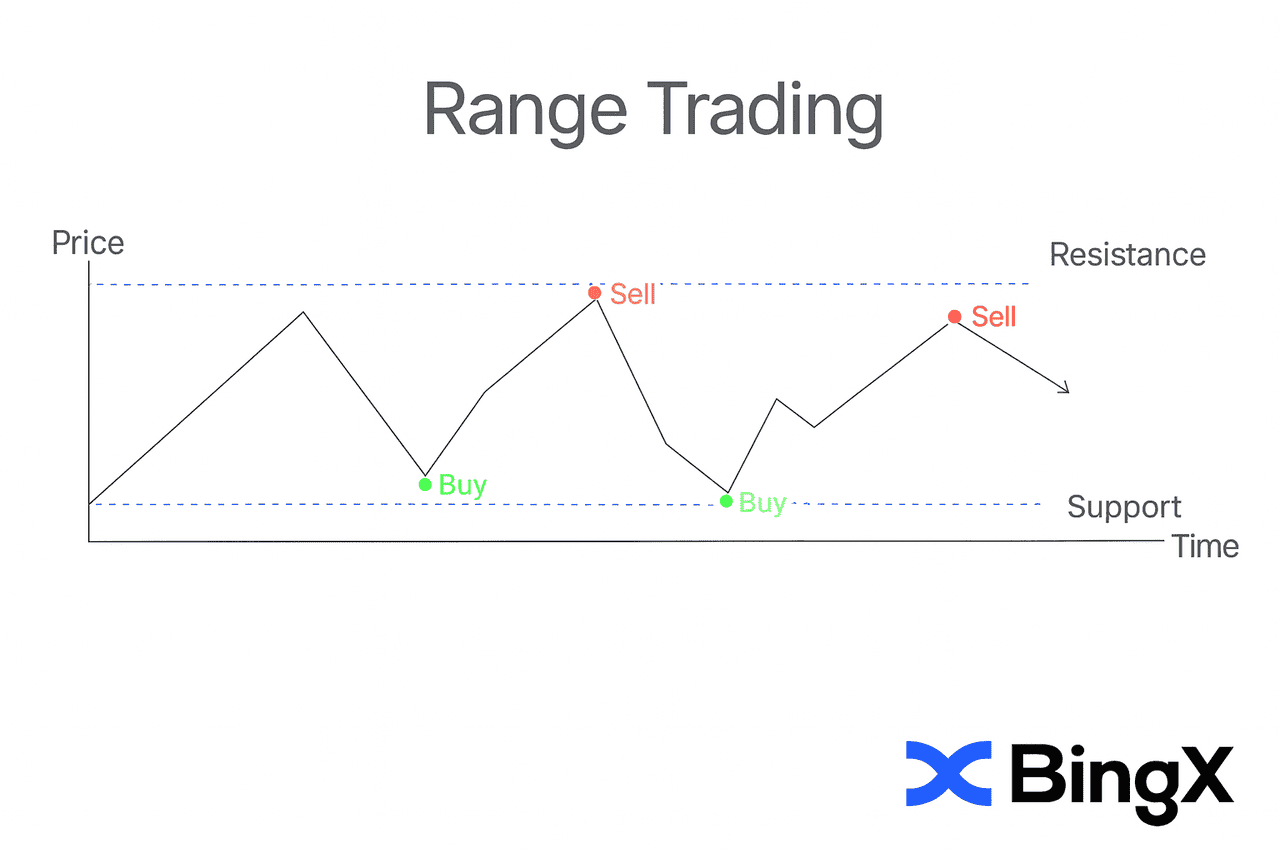

ii. Range Trading: Range trading fits sideways markets where prices move between support and resistance. Traders buy near the bottom and sell near the top of the range. Example: If ETH/USDT fluctuates between $3,200 and $3,500, a trader might enter near support and take profit near resistance, setting a stop-loss just below the lower boundary.

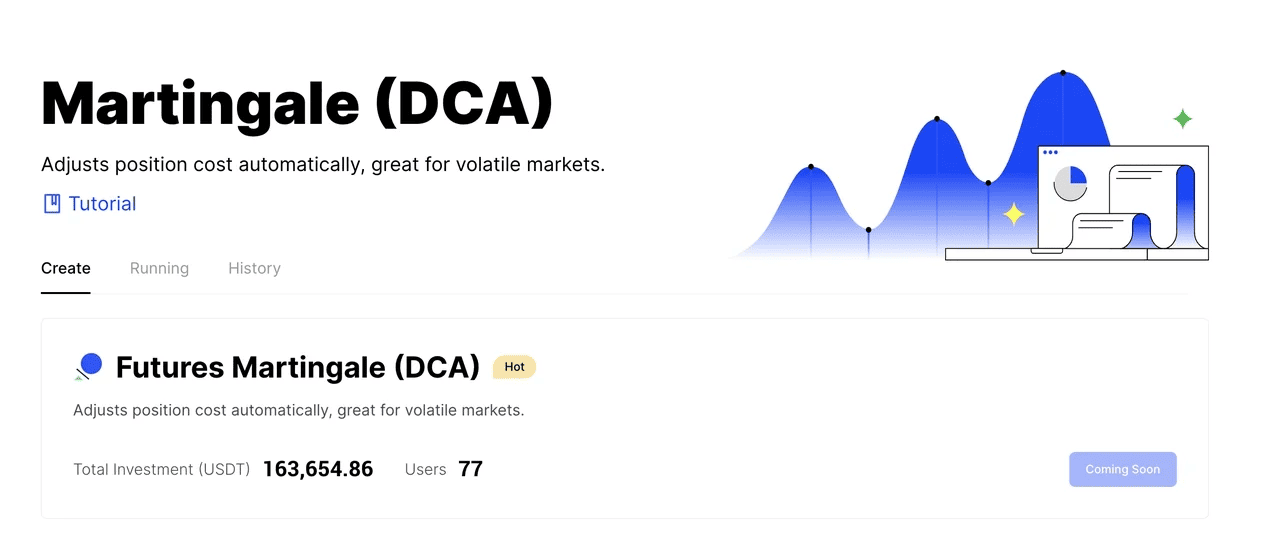

iii. Dollar Cost Averaging (DCA): DCA suits long-term investors who prefer steady accumulation. By investing a fixed amount regularly, you reduce the impact of volatility. Example: Setting weekly BTC purchases on BingX smooths out entry prices and builds crypto holdings over time.

Each strategy works best in specific market conditions. Choose one that fits your trading style, test it, and stay consistent.

Managing Risk and Position Sizing

Even the most effective crypto trading strategies fail without proper risk management. Controlling risk protects your capital, ensures consistency, and allows you to stay in the game when markets turn volatile.

1. Set Stop-Loss and Take-Profit Levels

Stop-loss and take-profit orders define how much you are willing to lose or gain on a trade. Together, they create your reward-to-risk ratio, showing how much you could earn compared to what you risk.

Key principles for effective order placement:

• Risk no more than 2 percent of total capital per trade.

• Use stop-losses beyond key support or resistance levels to avoid early triggers.

• Target a 2:1 reward-to-risk ratio to balance losses and gains.

• On BingX, precise execution ensures zero slippage when these orders trigger.

For example, if your BingX account holds $10,000, risking 2 percent means limiting losses to $200 per trade.

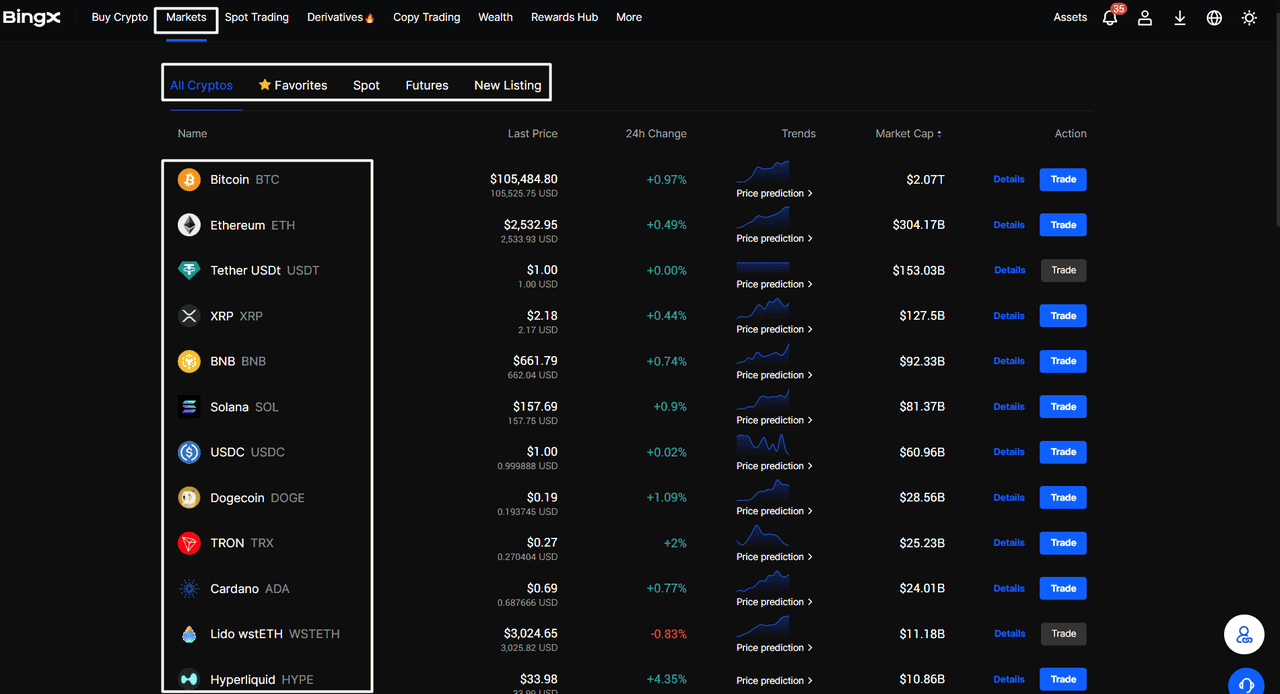

2. Diversify Across Assets and Exchanges

Putting all your capital into a single coin increases exposure to unexpected shocks. Diversify across major assets such as BTC, ETH, and selected altcoins with strong liquidity and credible fundamentals. A mix of large-cap and mid-cap tokens helps balance risk and opportunity.

Source: BingX Market Page

It also pays to trade on reputable exchanges with high volume and transparent order books. On BingX, for instance, deep liquidity and advanced order tools help you execute trades efficiently and reduce slippage during volatile moves. Diversifying across trading pairs or markets also helps spread exposure, reducing the impact of one bad trade.

Benefits of diversification:

• Risk Reduction: Balances volatility between assets.

• Growth Potential: Exposure to DeFi, Layer 2, and Web3 sectors.

• Flexibility: BingX tools make it easy to adjust allocations as markets evolve.

Effective diversification turns market uncertainty into opportunity and helps you build a balanced cryptocurrency portfolio over time.

3. Avoid Emotional Decision-Making

In the crypto market, emotions can be as risky as volatility itself. Even experienced traders lose focus when fear and greed take control. The best cryptocurrency trading strategies are built on logic, discipline, and preparation, not impulse.

When prices surge, FOMO often pushes traders to buy too late. When prices crash, panic selling locks in losses. Both reactions come from emotion, not analysis. The solution is to plan ahead and rely on structured systems instead of gut feelings.

How to stay objective while trading cryptocurrency:

• Use Price Alerts: Set alerts on BingX to track levels without watching charts all day.

• Automate Orders: Let your stop-loss and take-profit execute as planned.

• Stick to the Plan: Don’t adjust mid-trade unless market conditions genuinely change.

• Review, Don’t React: Analyze mistakes later instead of chasing instant revenge trades

A calm mindset protects both your capital and consistency. Keep a trading journal to spot emotional patterns, take breaks after major trades, and trust your system. On BingX, preparation and automation help remove emotion from execution, turning volatility into opportunity.

How to Build a Trading Routine and Journal

A strong crypto trading routine builds consistency, while a detailed trading journal turns data into progress. Both help traders make informed, objective decisions instead of relying on emotion or chance.

What Is The Role of a Trading Journal for Crypto Traders?

A journal records your entry and exit points, strategy, and reasoning behind each trade. Over time, it reveals what works and what doesn’t.

Key details to include:

• Setup: Why you entered the trade (technical or fundamental signals).

• Execution: Entry, exit, stop-loss, and take-profit levels.

• Market Context: Volatility, news, or market sentiment during trade.

• Outcome: Profit, loss, and what you learned.

Continuous Learning and Market Awareness

Set aside time each week to review your results and identify trends in your performance. Tools like TradingView, CoinMarketCap, and CryptoQuant help analyze market cycles, trading volume, and fundamental indicators. Stay updated with credible crypto market news and on-chain data to adjust your strategy when needed.

Putting It All Together: The Complete Crypto Trading Plan

A trading plan brings your goals, strategy, and mindset together into a clear system. It removes emotion from decision-making and keeps you consistent across changing market conditions.

Define your objectives, set capital limits, and choose a trading style that fits your time and experience. Include clear risk management rules with predefined stop-loss and take-profit levels.

Record your trades, review results, and refine your process regularly. A written plan builds discipline, clarity, and confidence, helping you stay consistent through all market conditions.

Common Mistakes to Avoid When Creating a Trading Plan

Even skilled crypto traders make avoidable mistakes. The most common is overleveraging or trading without a stop-loss, which can quickly drain capital. Always define risk before entering a trade. Ignoring market sentiment or major economic events is another error. The cryptocurrency market reacts fast to news, so combine technical setups with broader context.

Many traders also switch strategies too often or skip journaling. Without tracking performance, it’s impossible to improve. Consistency matters more than perfection. Review results regularly, adjust when needed, and stay focused on your long-term goals, that’s how successful trading plans are built

Final Thoughts: Trade Crypto with a Plan, Not Emotion

Success in the crypto market comes from discipline, structure, and patience, not prediction or luck. A clear trading plan keeps you focused when volatility strikes and helps you make decisions based on logic, not emotion.

Treat your plan as a living document that evolves with your experience and the market itself. Each trade, win or loss, teaches something valuable about your strategy and mindset.

Quick profits fade, but consistency lasts. Use BingX tools and charts to stay organized, manage risk, and trade with purpose. Plan every move, stay patient, and let discipline guide your path to long-term success.

Related Reading

FAQs on Creating a Crypto Trading Plan

1. What is the best cryptocurrency trading strategy for beginners?

Beginners should start with simple, structured strategies such as swing trading or dollar-cost averaging (DCA). Both approaches help you understand market behavior without constant monitoring or emotional stress.

2. How much capital should I start with in crypto trading?

There’s no fixed amount, but it’s best to start with funds you can afford to lose. Many traders begin with $100 to $500 to test strategies and learn risk management before scaling up.

3. How do I track my crypto trades effectively?

Maintain a trading journal that records each entry and exit, your reasoning, and the outcome. Tools like BingX’s trade history, combined with spreadsheets or journaling apps, make this process simple and insightful.

4. What technical indicators are best for swing trading crypto?

Common choices include the Relative Strength Index (RSI), Moving Averages, and MACD. These help identify trends, momentum shifts, and strong entry or exit points on BingX charts.

5. How often should I update my crypto trading plan?

Review your plan at least once a month or after every 20 to 30 trades. Adjust strategies as markets evolve, but avoid changing your plan based on short-term emotions or a few losing trades.