Crypto markets move quickly, and that speed is exactly why short squeezes have such a strong impact. When a coin begins rising while many traders are holding short positions, the move can escalate fast. Short sellers are pushed to close their trades at higher prices, and that forces buying lifts the market even further. The result is a sharp price jump that often catches traders off guard.

These squeezes happen more frequently in crypto than in traditional markets because sentiment shifts quickly. Retail traders,

funding rates, and news events all influence direction.

Bitcoin has seen multiple squeezes after major announcements.

Solana and

XRP have also rallied sharply when negative sentiment flipped. Understanding these patterns helps traders avoid being trapped and recognise opportunities early.

What Is a Short Squeeze in Crypto?

A short squeeze occurs when the price of a crypto asset rises faster than short sellers expect.

Short traders borrow the coin, sell it at the current price, and hope to buy it back lower. When the market turns upward instead, the cost of holding a short increases. Traders must buy back the asset to limit losses. That buying pressure pushes the price higher, often creating a steep, fast breakout.

Because crypto markets run on leverage and react to real-time funding changes, short squeezes unfold quickly. When too many short positions build up, even a modest price rise can trigger a chain reaction of forced exits.

How Does Short Selling Work in Crypto?

A squeeze begins when a market expected to fall starts rising instead. Short sellers borrow the coin, sell it, and plan to buy it back at a lower level. If price rises, holding the position becomes more expensive. As the move continues, traders hit margin limits and start closing shorts. Since closing a short requires buying the asset, each exit adds more upward pressure.

Example: BTC trades near $100,000 with heavy short positioning. A regulatory update pushes it to $103,000. Early shorts close their trades, lifting BTC toward $105,000. More shorts are forced out, and the move turns into a full squeeze.

Key Points to Note About Short Squeezes

• Small moves against shorts can trigger early covering

• Forced buying adds upward pressure

• Leverage and thin liquidity make crypto squeezes sharper

What Causes a Short Squeeze in Crypto?

Short squeezes form when market conditions turn against heavily shorted positions. Rising sentiment is often the first signal. A coin can shift from bearish to bullish quickly when confidence improves. Unexpected events, such as regulatory updates or listings, can flip the narrative in minutes.

Whale buying or institutional flows often start the breakout. A shift in price discovery accelerates the move when spot buyers step in while shorts remain crowded. Thin liquidity in smaller tokens magnifies every buy order. When heavy short interest is in place, a sudden rise in demand forces positions to unwind, creating the feedback loop that powers a squeeze.

Real Short Squeeze Example: Bitcoin on BingX

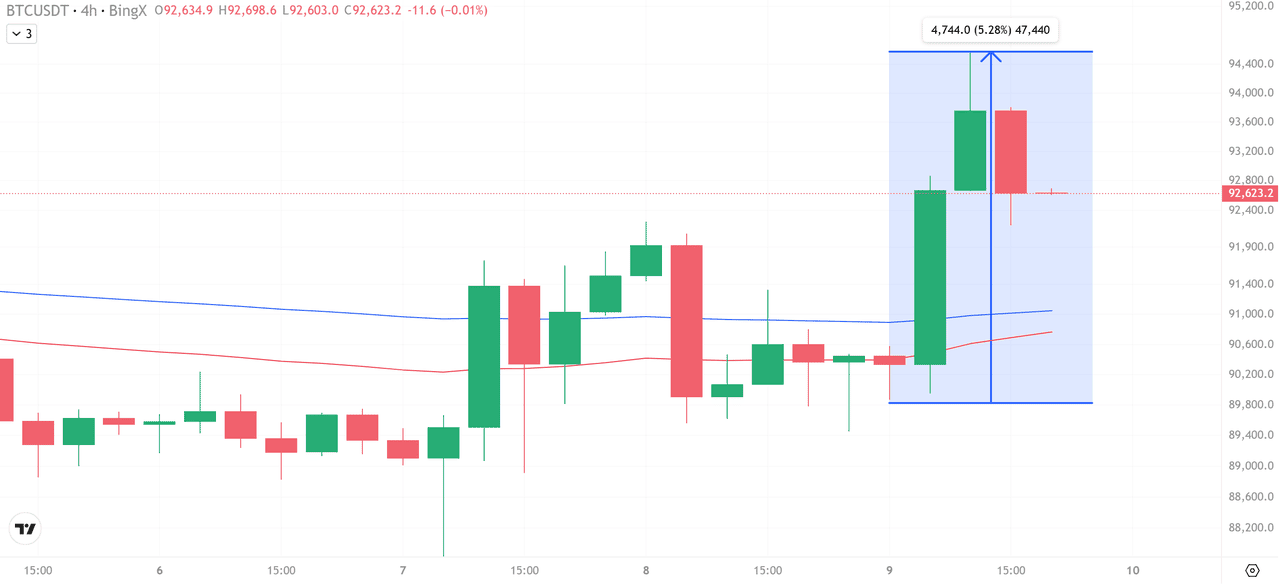

A recent

BTCUSDT move on BingX shows how a short squeeze develops. On the four-hour chart, Bitcoin jumped from $89,800 to $94,400, a 5.28% rise. The market was heavily short, and once BTC climbed, early shorts closed quickly, accelerating the move.

Bitcoin Price Chart - Source:

BingX

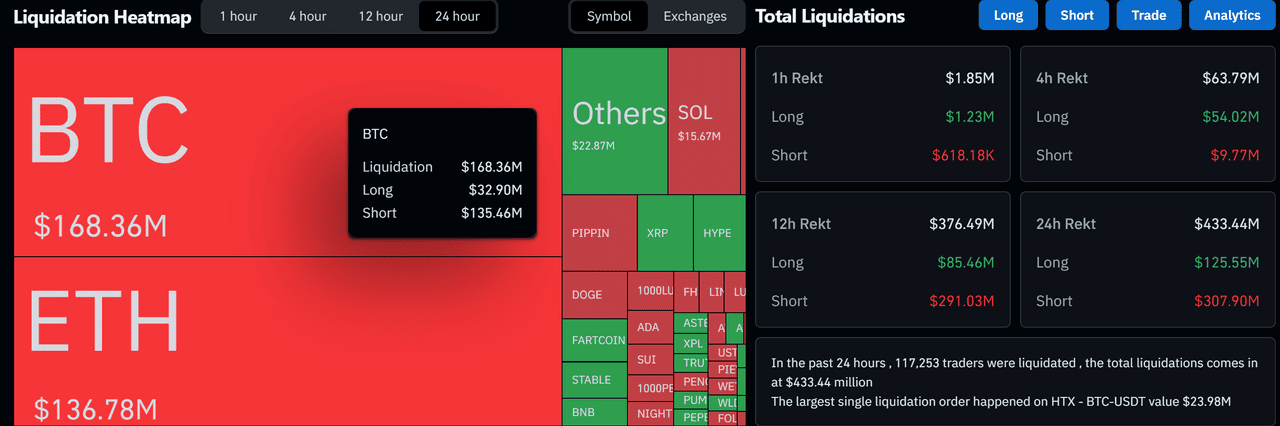

Liquidation data confirmed the squeeze.

Over twenty four hours, the market recorded $433.44 million in liquidations, including $307.90 million in shorts. Bitcoin alone accounted for $135.46 million. When short liquidations dominate, each forced exit adds buying pressure.

Coinglass Liquidation Data - Source: Coinglass.com

What this tells us

• Many traders were positioned for a drop

• BTC moved higher instead, pressuring shorts

• Forced buying from short covering added to the rally

• The price accelerated as more short positions were wiped out

This price-action plus liquidation pattern is the textbook signature of a short squeeze.

What Is Short Interest in Crypto and Why Is It Important?

Short interest shows how many traders are betting on a decline. In crypto, it is measured through funding rates, open interest, and borrow activity. When these indicators point in the same direction, short exposure is building. A small upward move can then force shorts to buy back their positions.

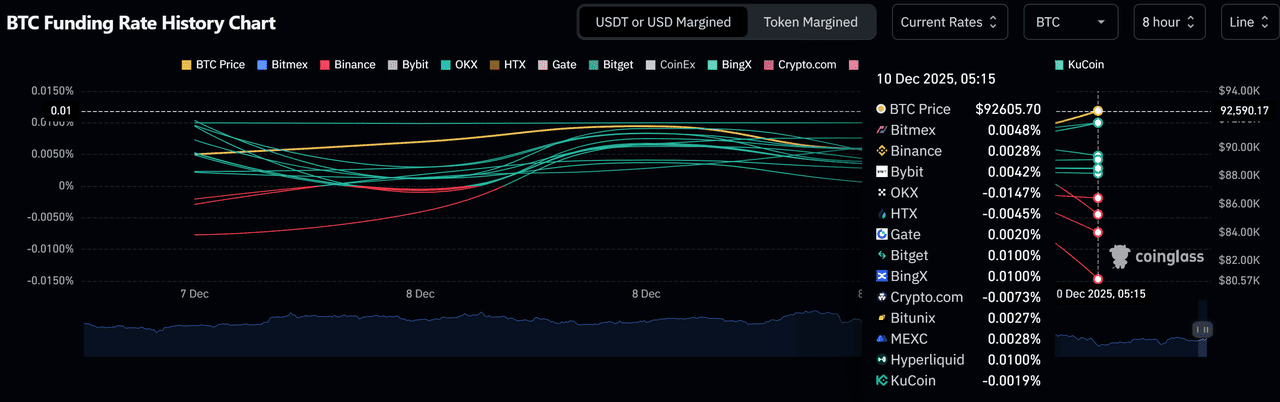

BTC Funding Rate History Chart - Source: Coinglass.com

On the BTC

funding rate chart, Bitcoin traded near $92,600 while funding rates dropped toward or below zero. Negative funding means traders are paying to hold shorts. Open interest remained high at the same time—an early sign of crowded short positioning.

• High short interest means the market is leaning one way

• Rising prices force shorts to unwind

• Forced buying accelerates rallies

When funding, open interest, and price diverge, the market often prepares for a strong move.

How Do Traders Measure Short Interest in Crypto?

Crypto has no central short interest report, but traders monitor three real-time metrics:

• Funding rates: Negative rates suggest shorts are dominant

• Open interest: Rising OI during price drops often means more short entries

• Borrow metrics: Higher borrow rates show increased demand to short

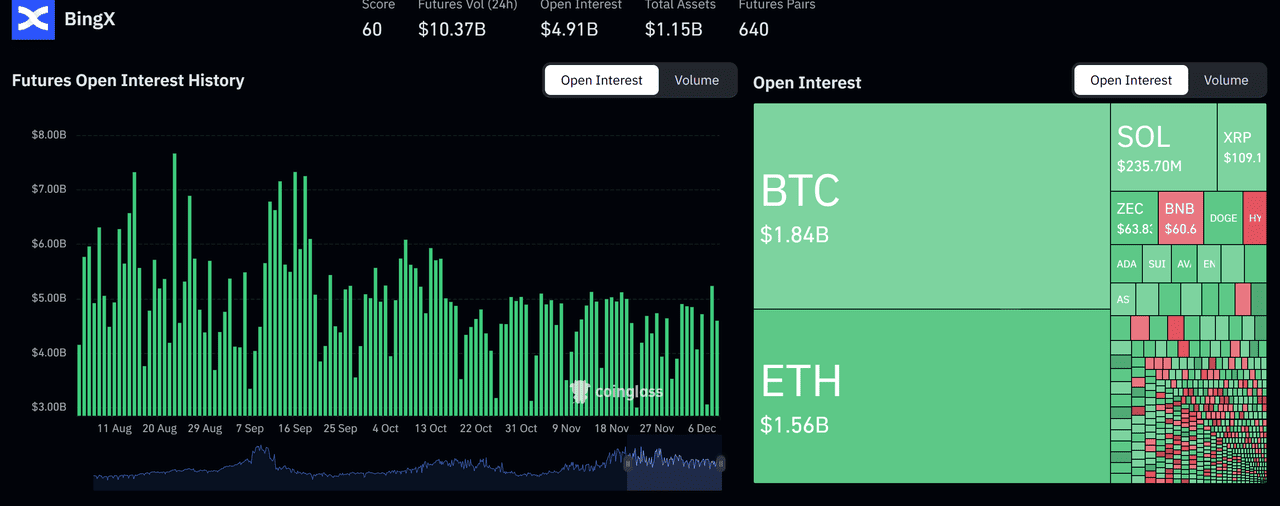

On BingX, BTC open interest sits around $1.84 billion, and ETH near $1.56 billion. High OI paired with negative funding typically signals crowded short positioning.

What Do the Short Interest Ratio and Days to Cover Tell Us?

The short interest ratio compares total short positions with average daily volume. Days to cover estimates how long shorts need to exit. High readings indicate that shorts cannot unwind quickly, making squeezes stronger.

A token trades $200 million daily but holds $500 million in short positions. Even a small price rise can force aggressive buying because the market cannot absorb exiting shorts smoothly.

Do Large and Small Crypto Assets React Differently?

Large-cap coins like BTC and ETH absorb short covering more smoothly due to deeper liquidity. Smaller coins react sharply because thin liquidity magnifies forced buying. A low-cap altcoin with $10 million volume and heavy short interest can jump 20 to 30 percent in a squeeze, while BTC may move 3 to 6 percent.

Short Squeeze in Crypto vs. Stock Markets: Key Differences

Short squeezes happen in both crypto and stocks, but the way they develop is very different. Crypto markets move faster and react more sharply because the structure of the market itself creates more room for sudden price swings.

• Higher volatility in crypto: Crypto prices can move several percent within minutes. This volatility makes short squeezes more explosive compared to traditional equities, where moves are slower and more regulated.

• Markets trade 24/7: Crypto never closes. Because there is no overnight pause, news events and whale activity can trigger squeezes at any hour, which often leads to sudden major price movements.

• No circuit breakers: Stock markets pause trading when volatility becomes extreme. Crypto has no protective halt. When a squeeze begins, nothing slows it down, which is why rallies can become vertical.

• Greater influence from retail sentiment and whales: Crypto markets respond quickly to social sentiment, community trends, and large wallet activity. A single whale order or a shift in funding rates can push shorts into liquidation faster than in stocks.

• Lower liquidity in altcoins: Smaller crypto assets have thin order books. When a short squeeze starts, limited liquidity magnifies every buy order. This is why altcoins often experience sharper and more dramatic squeezes compared to large-cap stocks.

How Can Crypto Traders Spot a Potential Short Squeeze?

Traders can spot potential squeeze candidates by watching a few key signals. The first is high short interest. Deeply negative funding rates or a high short interest ratio often show that many traders are positioned for a drop. The next step is comparing short positioning with average daily volume. When volume is thin, even a small rally can trigger sharp moves because shorts cannot exit quickly.

Open interest also helps. If OI rises while the price starts moving up, it often signals pressure building on the short side. Fundamentals matter as well. Heavily shorted coins with strong project news or undervalued layer-one narratives tend to squeeze harder. Finally, catalysts such as listings, partnerships, or whale buying can spark the first leg of a squeeze.

How Should Traders Enter and Exit a Short Squeeze in Crypto?

A potential squeeze often appears when price breaks above a resistance level with strong volume. Traders also watch for liquidation spikes and funding rates moving back toward neutrality, as these signs show short pressure beginning to unwind.

When the breakout holds, momentum can build quickly.

Entry signals: Exits become clearer when the market shows signs of exhaustion. Leading technical indicators such as

Relative Strength Index (RSI) reaching overbought levels, a drop in buying pressure, or long wicks near resistance often signal that the move is slowing and profit-taking is increasing.

Exit signals: Risk control is essential. Keep position sizes small,

place stop-losses, and avoid chasing vertical candles. Reviewing fundamentals helps confirm whether the move is based on real demand or a temporary squeeze driven by forced buying.

Conclusion

Short squeezes form when too many traders bet against the market at the same time. By reading funding rates, open interest, and sentiment early, traders can identify when short pressure is stretched. This helps them prepare for potential breakouts instead of reacting late.

Knowing where short tension builds also prevents traders from being trapped in a losing short. When these metrics align with price strength, a squeeze becomes easier to anticipate and easier to trade with confidence.

Related Articles

FAQs on Short Squeeze in the Crypto Market

1. What causes a short squeeze in crypto?

A short squeeze happens when many traders are short and the price begins rising unexpectedly. As shorts hit margin limits, they are forced to buy back the asset, which pushes the price even higher.

2. How can I tell if a crypto token is heavily shorted?

Look for negative funding rates, rising open interest during a price drop, and high borrow demand. When these signals align, short exposure in the market is usually elevated.

3. Why are short squeezes more common in crypto than in stocks?

Crypto trades 24 hours a day, has no circuit breakers, and often has thinner liquidity, especially in altcoins. These conditions make forced buying stronger and faster.

4. What indicators help identify a potential short squeeze on BingX?

Watch for breakouts above resistance, liquidation spikes, funding turning neutral, and open interest rising while price begins to climb.

5. Is trading short squeezes risky for beginners?

Yes. Squeezes move quickly and can reverse just as fast. Beginners should use small positions, set

stop-losses, and avoid chasing vertical candles.