The XRP Ledger has rapidly emerged as one of the most active environments for

tokenized assets, supported by accelerating institutional demand, expanding real world asset integrations, and major technical upgrades. Tokenization is becoming a central growth engine for the network because businesses and financial institutions increasingly rely on infrastructures that can finalize transactions in 3 to 5s at fees of just $0.01 while maintaining transparent record keeping and predictable performance.

By late 2025, total tokenized asset value reached about $394.6 million and weekly payment transactions had increased more than 430%, surpassing 8 million transactions for the year. The approval of the MPTokensV1 amendment in October 2025 and the surge of

spot XRP ETFs (exchange-traded funds), which gathered nearly $1 billion in assets under management within weeks of their November launch, further accelerated adoption. This guide explains why tokenization on the XRP Ledger is growing rapidly, how it works, and what its expansion means for the remainder of 2025.

What Is XRP (XRP)?

XRP is the native token of the XRP Ledger, a

Layer-1 blockchain optimized for fast, low-cost global payments. It is used for cross-border settlement, remittances, and liquidity bridges. Because of its utility and unique regulatory history, notably the legal case involving Ripple Labs and the U.S. Securities and Exchange Commission (SEC), XRP offers a different use-case than

Bitcoin and

Ethereum: for example, efficient value movement rather than purely store-of-value.

What Is Tokenization on the XRP Ledger?

Source: XRP Ledger

Tokenization on the XRP Ledger refers to the process of creating digital representations of assets directly on the network using native ledger functionality that has operated since the ledger's inception in June 2012 under David Schwartz, Arthur Britto, and Jed McCaleb. The broader

RWA tokenization market has grown to $35–36 billion on-chain, nearly 10x since 2022, with tokenized public equities alone reaching $660 million in value and generating $1.22 billion in monthly transfer volume.

XRPL supports native tokenization without smart contract complexity through built-in ledger objects that allow issuers to create, manage, and track custom tokens with deterministic behavior, predictable fees, and low operational risk. XRPL also includes a built-in decentralized exchange that automatically provides order book based liquidity for issued tokens, allowing seamless swaps between tokenized assets, XRP, and stablecoins. These features collectively make the ledger well suited for common tokenization use cases such as digital dollars, real world asset representation, treasury assets, and high frequency settlement flows.

Why Financial Developers Choose XRPL as an RWA Tokenization Platform

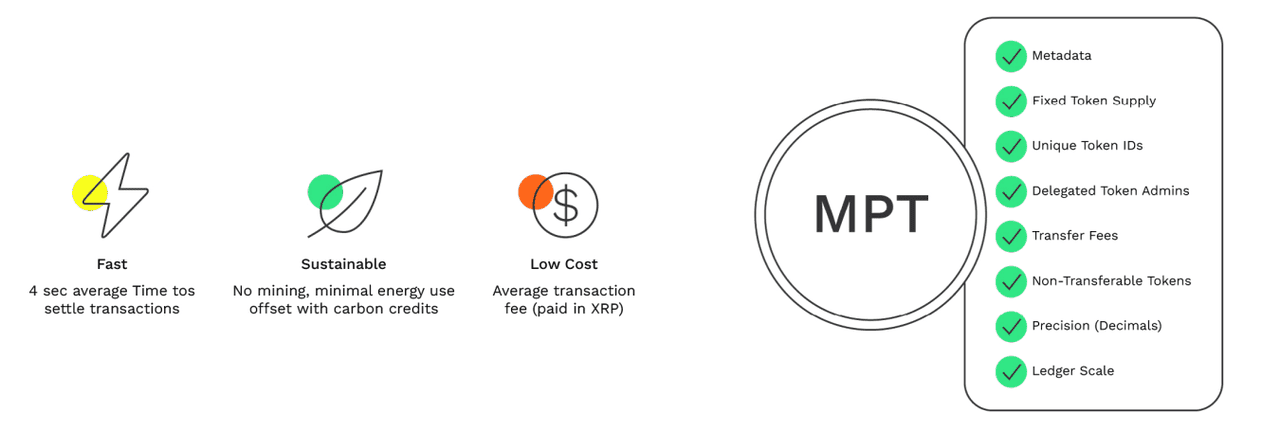

Source: XRP Ledger

Financial developers pick the XRP Ledger because it delivers institutional grade features out of the box, making real world asset tokenization technically simple, cost efficient, and compliant. Transactions settle in 3 to 5 seconds at fees of just a fraction of a cent, which makes high volume trading or frequent settlement economically viable.

The ledger supports on chain metadata storage so issuers can embed key asset attributes such as maturity dates, interest rates, or ownership conditions, or link to off-chain data for transparency and auditability. XRPL provides native compliance tools so token issuers can enforce investor eligibility, restrict transfers, freeze or claw back tokens when needed, and preserve full provenance, all without building custom smart contracts. Its built-in

decentralized exchange (DEX), combined with upcoming Automated Market Maker (AMM) support, allows tokenized assets to trade directly on ledger with continuous liquidity and minimal overhead.

Delegated token management lets trusted third parties handle administration while issuers retain control. For developers and institutions seeking to tokenize real estate, government bonds, money market funds, commodities, or stablecoins, the XRPL offers a mature, regulatory aware, efficient infrastructure that reduces complexity, cuts costs, and accelerates speed to market.

What Is the Current State of XRP Ledger Tokenization?

Tokenization on the XRP Ledger has grown rapidly, supported by rising institutional involvement and significant ecosystem milestones. Total tokenized value reached about $394.6 million by November 2025, with distributed assets up 6.1% and represented assets climbing 7.6% for the quarter. Stablecoin adoption and real world asset tokenization are expanding in parallel, highlighted by Ripple's RLUSD stablecoin, which surpassed $1.2 billion in market capitalization and strengthened liquidity for XRPL-based instruments.

Spot XRP ETFs quickly attracted nearly $1 billion in assets under management, signaling robust demand for regulated investment options. Regulatory clarity, following a U.S. ruling confirming that secondary market XRP transactions are not securities, has further encouraged enterprise integrations and ETF filings. Assets being tokenized include United States treasuries, real estate instruments, commodity-backed tokens, and stable value assets, while the developer ecosystem supports over 400 open source projects, driven by upgrades like Hooks and the

EVM compatible sidechain.

What Is Driving Tokenization Growth on the XRP Ledger?

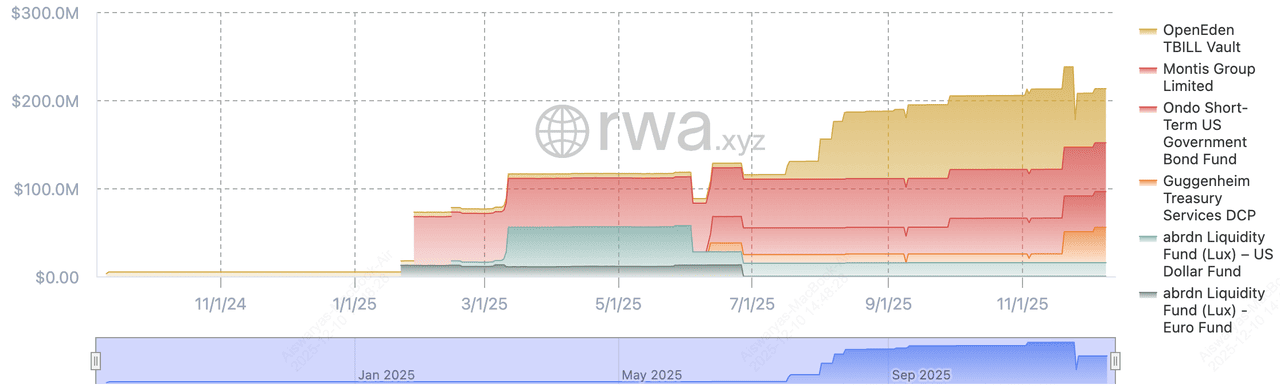

Total value of assets on the XRP Ledger | Source: RWA.xyz

Growth on XRPL is driven by institutional participation, regulatory progress, enterprise adoption, and improved interoperability. Institutions such as Ondo Finance, Guggenheim Treasury Services, and Archax have increased engagement as tokenized treasuries, commercial paper, and money‑market funds come online, with RLUSD‑backed instruments and institutional‑grade

stablecoins enabling nearly $1 Billion in early token issuance activity.

Regulatory developments reduced uncertainty, boosting market confidence and enabling broader corporate deployment. Enterprise adoption is also rising through partnerships with firms such as Archax and Zoniqx, which prepared hundreds of millions of dollars in real world assets for issuance. Developer activity continues to surge, with more than 400 open source projects in progress, aided by the Hooks upgrade and early adoption of the EVM compatible sidechain. These factors collectively create a strong foundation for XRPL as a platform for asset issuance, trading, and settlement.

What Are the Key Tokenization Use Cases on the XRP Ledger?

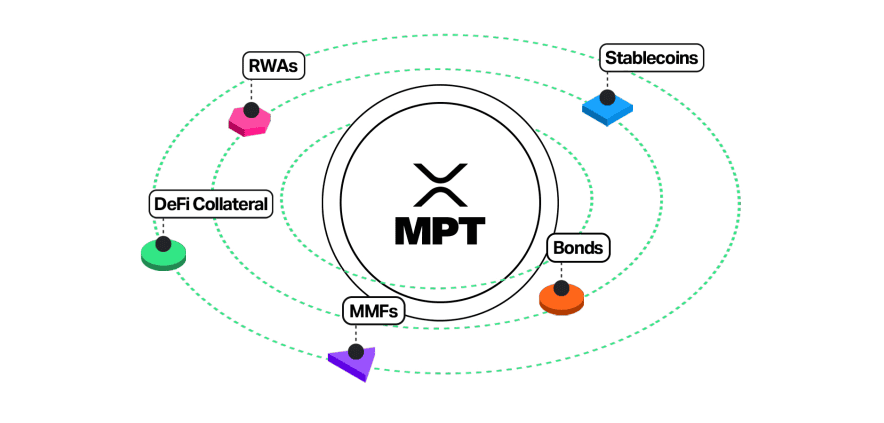

Source: XRP Ledger

XRPL supports a wide range of tokenization use cases, including stablecoins, real world assets, tokenized commodities, gaming assets, NFTs, and high speed payment and treasury applications. Stablecoins, particularly RLUSD, have exceeded $1.2 billion in market capitalization and deepened liquidity for payment flows. According to

Messari, real world assets on the XRP Ledger reached about $364.2 million by Q3 2025, reflecting a 215% quarter‑over‑quarter increase.

Commodity tokenization is also rising as institutions explore fractionalized metals and agricultural products for on-chain settlement. Gaming projects continue adopting NFT-based items due to low fees and fast confirmations, while fintech firms leverage XRPL to manage real time payments and treasury operations through the network's built-in decentralized exchange.

What Are the Benefits of Tokenizing Assets on the XRP Ledger?

Tokenizing assets on XRPL provides several measurable advantages including high speed settlement, extremely low costs, built in liquidity, and transparent security guarantees. Liquidity benefits come from the built-in decentralized exchange that allows every issued asset to interact with native order books without additional smart contract layers, enabling immediate market formation for newly issued tokens. Security and transparency are supported by deterministic ledger rules, an established validator ecosystem, and a transaction history that extends back to June 2012, allowing enterprises to meet audit and compliance requirements more efficiently than on networks with variable contract execution risk.

What Are the Challenges and Limitations of XRPL Tokenization?

Despite rapid expansion, the XRPL tokenization ecosystem faces challenges including global regulatory requirements, liquidity fragmentation across chains, and strong competition from larger programmable networks. Regulatory considerations remain complex as issuers must navigate jurisdiction‑specific rules for tokenized securities, commodities, and treasury instruments.

In 2025, federal guidance clarified these frameworks, including the GENIUS Act establishing reserve and audit requirements for stablecoins, FIT21 providing distinctions between utility, payment, and security tokens, and the SEC formally dropping its appeal in the Ripple case, reaffirming that XRP traded on public exchanges is not a security. Liquidity fragmentation persists because tokenized assets are distributed across networks including

Ethereum,

Solana,

Avalanche, and various institutional sidechains, requiring bridges and interoperability standards to reach deeper markets.

Competition remains active as Ethereum continues to dominate programmable asset issuance with a significant share of global tokenized value and Solana attracts high throughput applications that rely on parallel transaction processing. These limitations create strategic constraints on how quickly XRPL can expand into certain market segments.

What Is the Future Outlook of XRPL Tokenization Growth?

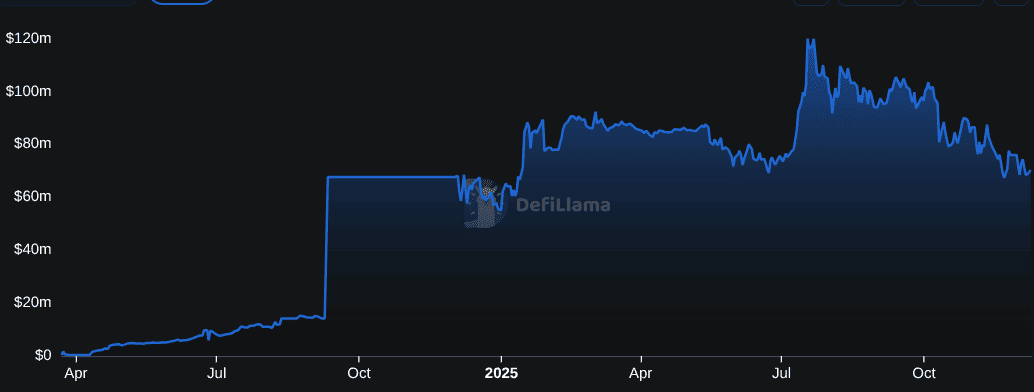

XRPL TVL | Source: DefiLlama

The future outlook for XRPL tokenization is strongly positive as market projections suggest the global real world asset tokenization sector could reach as much as 18.9 trillion dollars by 2033 and XRPL is positioning itself to capture a rising share of that value. The introduction of Hooks, continued development of the EVM compatible sidechain, and optimization of token standards following the MPTokensV1 approval in October 2025 are expected to support more flexible issuance and broader enterprise deployment.

On-chain payment volume has already risen more than 430% in under two years and the trajectory indicates continued expansion as more institutions settle operations directly on the ledger. With RLUSD surpassing $1.2 billion in circulating value, ETF assets approaching one billion dollars in their first weeks, and tokenized asset value reaching about $394.6M by late 2025, XRPL is expected to see accelerating adoption especially across treasury products, cross border payments, and regulated asset issuance throughout 2026.

How to Buy XRP Directly on BingX

XRP/USDT trading pair on BingX spot market

If you prefer owning XRP tokens directly, for trading flexibility, staking, or using them in the XRP Ledger ecosystem, you can easily buy them on BingX Spot Market, one of the world's leading crypto exchanges. Here's a simple, practical guide for 2025:

1. Sign Up and verify: Go to BingX.com, create an account using your email or phone, and complete KYC verification to unlock full trading and withdrawal limits.

2. Deposit Funds: Add funds through multiple options, bank transfer, credit/debit card, or zero-fee P2P trading for local currency deposits.

3. Buy XRP on Spot Market: Navigate to

Spot →

XRP/USDT, check the real-time price chart, enter the amount you wish to buy, and confirm your order.

4. Secure Your Assets: For long-term holding, you can keep XRP in your BingX Wallet, protected by cold storage and multi-signature security, or transfer it to a

self-custody wallet like

Ledger or Xumm for personal control.

5. Track and Manage: Use BingX's Price Alerts, Portfolio Dashboard, and

Copy Trading tools to monitor XRP performance, set automated alerts, and learn from top traders.

Buying XRP directly on BingX gives you 24/7 global market access, low fees, and the ability to send or use XRP on-chain, ideal for investors who want both control and utility beyond XRPL exposure.

Conclusion

The XRP Ledger has emerged as one of the fastest expanding tokenization platforms by late 2025, supported by strong institutional participation, rising stablecoin liquidity, and continually improving technical capabilities. Total tokenized value of nearly $395 million, rapid ETF inflows approaching $1 billion, stablecoin market capitalization above $1.2 billion, and a 400 project developer surge all demonstrate that XRPL is becoming a significant settlement and issuance layer for real world and digital assets. With clear regulatory progress, fast settlement, minimal fees, and upcoming upgrades such as Hooks and the EVM compatible sidechain, the network is positioned for continued growth as global demand for tokenized assets moves toward the multitrillion dollar range over the next decade.

Related Reading