Cloud mining lets you

mine Bitcoin and other

proof-of-work (PoW) coins without buying hardware. Instead of running noisy ASICs at home, you rent hashrate from professional data centers and receive mining rewards to your wallet or exchange account.

Platforms like DeepHash, AutoHash, DNSBTC, HashBeat, ECOS, NiceHash, and Bitdeer are frequently cited as leading options for 2026, combining renewable-energy data centers,

AI optimization, and real-time dashboards.

This guide explains how cloud mining works, which platforms stand out, how to choose safely, if cloud mining is still profitable in 2026, and how to move your mined coins to BingX to trade or cash out.

What Is Cloud Mining and How Does It Work?

Cloud mining is a simple way to mine crypto without owning any hardware. Instead of buying expensive ASIC machines, you rent computing power or hashrate from a professional data center that runs and maintains the equipment for you. The provider uses this hashrate to mine proof-of-work coins such as Bitcoin (BTC),

Litecoin (LTC),

Dogecoin (DOGE),

Kaspa (KAS), and other mineable assets, depending on the platform.

In a typical setup:

1. You choose a provider and pick a plan, e.g. 30 TH/s for 30 days.

2. You pay a contract fee that bundles hardware, electricity, and maintenance.

3. The company points that hashrate at a mining pool.

4. Mining rewards (minus fees) are credited to your account daily or periodically.

5. You withdraw mined

BTC or other coins to your own wallet or an exchange like BingX.

This cloud mining setup lets beginners participate in mining with just an online account and a small contract, while the data center handles electricity, cooling, and technical maintenance in the background. Conceptually, it works like owning a share of a professional mining farm rather than building one yourself.

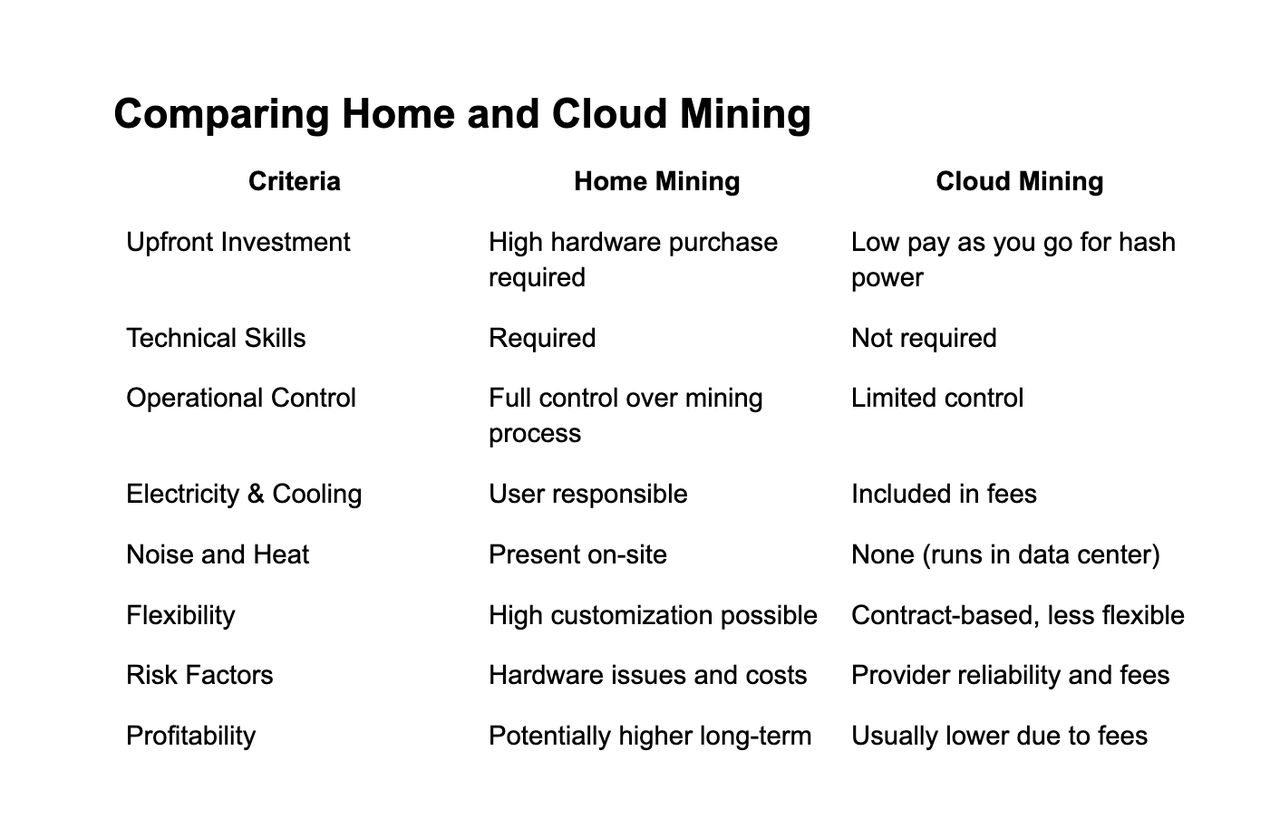

Cloud Mining vs. Hardware Mining: Key Differences

Cloud mining vs. owning your mining hardware | Source: ViaBTC

When you think about mining, you’re really choosing between cloud mining (renting hashrate) and solo mining (owning and running the hardware yourself). Here’s how they compare in practice.

1. Upfront Investment: Solo mining requires buying ASIC machines that typically cost $3,000–$6,000+ each, plus setup expenses for racks and ventilation. You bear all hardware depreciation. Cloud mining lets you start with small contracts from $50–$500, reducing upfront cost but offering no resale value since you’re renting hashrate, not owning equipment.

2. Operating Costs Like Power, Cooling, Maintenance: Running a home miner uses 3–4 kW continuously, often adding $200 to over $400 per month to electricity bills, not counting cooling or repairs. Cloud mining bundles these costs into a single contract fee and uses cheaper industrial or renewable power, but you can’t verify actual operating expenses.

3. Control and Transparency: Solo miners choose their own mining pool, settings, and uptime, with full visibility into real hashrate. Cloud mining removes this control, as the provider manages pools and hardware, and you rely solely on dashboards and payout reports, offering less transparency into actual mining activity.

4. Profitability and Risk Profile: Solo mining returns depend on electricity rates, hardware efficiency, and Bitcoin difficulty, and you absorb all hardware-related risks. Cloud mining avoids hardware management but adds counterparty risk, since profitability depends entirely on the provider’s honesty and contract pricing, often making direct BTC purchases more predictable.

5. Ease of Setup and Time Commitment: Solo mining requires sourcing equipment, installing firmware, cooling management, and constant monitoring. Cloud mining is plug-and-play: choose a plan, pay, and receive payouts, making it better for beginners, though it relies completely on the provider’s performance.

6. Suitability for Different Users: Solo mining suits people with cheap electricity, technical skills, and a desire for full control. Cloud mining suits users who want a hands-off, hardware-free way to participate in mining, but who understand the trade-offs of reduced transparency and higher counterparty risk.

Is Cloud Mining Still Profitable in 2026?

Cloud mining

can be profitable in 2026, but only under certain market and contract conditions. Profitability depends heavily on BTC price trends, network difficulty, which rose 35–45% in the 12 months after the 2024 halving, energy-adjusted contract pricing, and provider uptime. Short-cycle contracts often produce 2–8% gross returns in stable markets, but these returns can disappear if Bitcoin drops even 5–10% or if difficulty spikes unexpectedly. Many users find that in sideways or

bearish markets, buying BTC directly often outperforms most cloud mining contracts because it's not affected by rising difficulty or maintenance deductions.

In practice, cloud mining is most profitable when Bitcoin is in a strong uptrend, allowing price gains to outpace rising network difficulty. Contracts priced above $0.08–$0.12 per TH/day, which are common on mid-tier platforms, often fail to break even unless BTC rallies sharply, while long-term 1–5 year plans can become unprofitable if difficulty increases faster than expected. Short-cycle contracts that last 1–5 days or 7–30 days sometimes perform better because they limit difficulty risk, but they require careful platform selection and tight

risk management.

Bottom line: Cloud mining is viable but unpredictable; profitability depends more on market momentum and contract pricing than on the platform itself. For users seeking stable, low-maintenance returns, simply buying and holding BTC is often a clearer, lower-risk alternative.

What Are the Most Popular Cloud Mining Platforms for 2026?

Below is a neutral overview of frequently-cited platforms as of December 2025. Being on this list does not make any platform risk-free or “recommended.” It’s a starting point for your own due diligence.

1. DeepHash

DeepHash is one of the most visible cloud mining providers, backed by nine renewable-energy mining farms across Europe, North America, and South America, AI-optimized pool switching, and 1–5 day high-yield mining contracts. Its model focuses on short-duration plans, some offering up to 8% ROI in 24 hours, allowing users to avoid long-term difficulty risk while maintaining predictable payouts. DeepHash also stands out for offering a $100 free mining bonus, real-time earnings dashboards, and a fully registered UK corporate entity, which adds transparency compared with anonymous operators.

Key Features of DeepHash Cloud Mining

• Nine global renewable-energy farms, including hydro in Norway, Bhutan, Paraguay, geothermal in Iceland, El Salvador, and wind-solar hybrids in Uruguay, Texas.

• Short contracts (1–5 days) with data-driven yields, e.g., $6,500 → $546 (4.2% in 2 days) or $39,500 → $3,160 (8% in 1 day).

• Regulatory transparency, legally registered in the UK under a named corporate entity.

• AI-powered optimization for farm selection and profitability adjustments.

• $100 free mining bonus for new users; no credit card or upfront payment required.

• Real-time dashboards showing active hashrate, daily payouts, and contract performance.

• Instant daily withdrawals, with the option to reinvest earnings automatically.

Good for: Users seeking high-yield, short-cycle BTC cloud mining, especially those wanting transparent mining stats, renewable-energy-backed operations, and a low-risk trial via the $100 free bonus before committing real capital.

2. AutoHash

AutoHash is a Swiss-registered mobile cloud mining platform that lets users mine Bitcoin, Dogecoin, and other PoW assets using fully compliant, renewable-energy mining farms across Iceland, Norway, Paraguay, and Uruguay. Operated by Blockchain Finance AG (Company No. CH-100.3.808.150-3), AutoHash emphasizes regulatory transparency, AI-driven profitability optimization, and mobile accessibility, with contracts that can reach up to $6,232/day when multiple plans are combined. New users receive a $100 free mining bonus to start mining instantly without hardware, deposits, or technical setup, making it one of the most beginner-friendly and legally structured cloud mining apps.

Key Features of AutoHash for Cloud Mining

• Swiss regulatory compliance, including adherence to FINMA, KYC, and AML standards, providing higher legal clarity and operator transparency.

• AI-powered “OptiHash” engine that automatically reallocates hashrate to the most profitable coin and mining pool in real time.

• High-yield mobile mining contracts, with the potential to scale up to $6,232/day by stacking plans.

• $100 free bonus (Solar Free 5 TH/s) for new users, with no upfront payment required to begin mining.

• Daily automated payouts credited directly to users' accounts, with principal returned at contract end.

• Renewable-energy mining infrastructure powered by hydro, wind, solar, and geothermal sources across multiple global data centers.

• Beginner-friendly mobile interface, allowing anyone to mine BTC or

DOGE with zero hardware, noise, or electricity cost.

Good for: Users who prioritize legal compliance, renewable-energy mining, and hands-off automated profit optimization, especially beginners who want a mobile-first, AI-driven BTC/DOGE cloud mining experience with low entry barriers and verifiable Swiss regulation.

3. DNSBTC

DNSBTC is a US-based cloud mining provider founded in 2020 that has grown into one of the most widely referenced “best free cloud mining” platforms for 2026. Operating renewable-energy data centers across the United States, Canada, and Iceland, DNSBTC focuses on short-duration Bitcoin, Litecoin, and Dogecoin mining contracts, some lasting only a few days, designed to deliver predictable daily returns without hardware or electricity costs. New users receive a $60 free mining bonus, and the platform emphasizes energy efficiency, automated 24-hour payouts, and enterprise-level security, making it a low-barrier entry point during a year when BTC touched a new all-time high (ATH) above $126,000 and DOGE/

LTC demand is surging on account of

Dogecoin ETF and

Litecoin ETF launches.

DNSBTC's Key Features

• Founded in 2020 with data centers in the US, Canada, and Iceland, powered by renewable wind and solar energy.

• Short-term BTC/LTC/DOGE mining contracts, offering fixed, predictable daily payouts rather than long, difficulty-sensitive terms.

• $60 registration bonus for new users to begin mining risk-free with no upfront spend.

• Daily automated payouts, with mining rewards credited every 24 hours.

• Zero operational costs for users, no hardware, electricity, or maintenance fees.

• Security-focused infrastructure, including SSL encryption, DDoS protection, and insulated data centers.

• Optional affiliate rewards, offering up to 4% commission for referrals.

Good for: Users who want short-term, low-barrier BTC/LTC/DOGE cloud mining, especially beginners looking to test mining through a free-trial bonus, predictable returns, and eco-friendly data centers without managing hardware or long contracts.

4. HashBeat

HashBeat is positioned as one of the most beginner-friendly and trusted cloud mining platforms, backed by over 500,000 registered users, AI-driven profitability optimization, and public quarterly reports that show double-digit revenue growth and expanding data-center capacity. The platform offers both free-to-start mining credits and paid plans, ranging from small $15–$50 entry packages to high-yield short contracts, including premium offerings such as the BTC Ultra Plan for $100,000 for 3 days to earn $8,400/day, and $125,200 in total earnings. With renewable-energy-powered facilities and detailed dashboards showing fees, yields, and mining activity, HashBeat emphasizes transparency, flexibility, and sustainable operations.

Key Features of HashBeat's Cloud Mining Platform

• Large global user base: 500,000+ users reported across multiple reviews, indicating broad adoption.

• AI-powered mining engine that auto-selects the most profitable coin based on real-time market volatility and algorithm shifts.

• Quarterly transparency reports showing double-digit revenue growth and ongoing expansion of renewable-energy data centers.

• Low-entry mining options frequently recommended in comparison guides, starting from $15–$50.

• Free $15 sign-up bonus for new users, plus a 5% lifetime referral commission through the affiliate program.

• High-yield premium plans, including short-term BTC contracts such as the Ultra Plan.

• Clean, user-friendly control panel showing real-time mining stats, fee breakdowns, and payout history.

• Fast daily payouts, with automated crediting of mining rewards.

Good for: Beginners who want low-cost entry mining, users who value clear public reporting and transparent operations, and miners who prefer AI-driven optimization with visible performance metrics and renewable-energy support.

5. ECOS

ECOS is one of the longest-running and most regulation-focused cloud mining providers, operating since 2017 inside Armenia’s government-backed Free Economic Zone (FEZ). It combines difficulty-adjusted BTC cloud mining contracts, physical ASIC hosting, and an integrated investment app (exchange, wallet, portfolios). Mining contracts are based on real hardware, such as the Antminer S21 Pro (245 TH/s, 15 J/TH, 3,675W), and users can model long-term profitability using ECOS’s built-in calculator. Its FEZ licensing, multi-year contract options, and transparent service fee structure make ECOS one of the most compliance-friendly and institutionally recognized mining platforms.

ECOS's Key Features

• Operating since 2017, licensed within Armenia’s government-backed Free Economic Zone, offering a higher degree of regulatory oversight.

• Supports cloud mining + physical ASIC hosting, with contracts tied to real miners like the Antminer S21 Pro (245TH/s).

• Difficulty-adjusted BTC mining contracts with terms up to 5 years, starting from $150, with optional bonus hashrate on higher plans.

• Built-in profitability calculator using real difficulty data and BTC growth projections (+10% to +35% scenarios).

• Integrated investment ecosystem: mobile wallet, portfolios, crypto exchange, and automated performance reporting.

• Transparent monthly service fees, e.g., ~$4.26 per month on starter contracts, and clear output estimates.

• Daily BTC payouts once the contract activates.

Good for: Users who prefer long-term, regulation-friendly mining contracts, transparent hardware-backed pricing, and an all-in-one investment app, rather than short, high-APR speculative cloud mining cycles.

6. NiceHash

NiceHash operates differently from traditional cloud mining providers. Instead of selling fixed contracts, it runs the world’s largest hashrate marketplace, where users rent mining power from real miners and direct it to any supported pool or algorithm. Buyers can mine BTC or any PoW coin supported by the algorithm they choose, with payouts primarily in BTC. With tools like EasyMining, algorithm profitability calculators, real-time marketplace pricing, and control over destination pools, NiceHash is a data-rich, flexible option suited for advanced users who want to customize their mining strategy rather than rely on preset plans.

NiceHash's Key Features

• Marketplace model: You rent hashrate from miners globally, with no fixed terms, no contract lock-ins.

• Supports dozens of mining algorithms like SHA-256, Scrypt, Ethash, KawPow, etc., and allows you to choose any compatible external pool.

• Pay-as-you-go pricing lets you set bid rates and order size, offering granular control over cost and duration.

• Payouts are mainly in Bitcoin, even if you mine other coins via chosen pools.

• Advanced tooling: profitability calculators, stratum generator, real-time marketplace charts, and enterprise-grade APIs.

• Optional EasyMining for one-click BTC mining, plus ASIC/GPU support for miners who want to sell hashrate instead.

• Operated by NiceHash AG (Slovenia), one of the industry’s longest-running brands (est. 2014).

Good for: Users who want maximum flexibility, prefer choosing their own algorithm, pool, bid price, and duration, and are comfortable managing the technical parameters of mining rather than buying fixed cloud mining contracts.

7. Bitdeer

Bitdeer is one of the most established, publicly listed Bitcoin mining companies (NASDAQ: BTDR) and a rare cloud-mining provider that owns the entire mining value chain, from ASIC chip design for Sealminer series and hardware manufacturing to global data-center operations and cloud mining services. Founded by Jihan Wu, co-founder of Bitmain, Bitdeer operates large-scale mining farms across the US, Norway, and Asia, offering users cloud mining plans backed by real, verifiable infrastructure. Its platform combines industrial-grade BTC mining, Minerbase cooling systems, and AI compute services, making it one of the most transparent and data-driven options in the industry.

Key Features of Bitdeer

• Vertically integrated: Designs its own ASICs (Sealminer A3), builds mining containers (Minerbase), and runs global data centers, rare among cloud mining providers.

• Public company: Listed on NASDAQ (BTDR), providing audited financials and operational transparency not found in typical cloud mining apps.

• Operates mining farms in the US at Texas, Norway, and Asia, with published power capacities and energy-efficiency metrics.

• Offers cloud mining, hashrate marketplace, and ASIC hosting, alongside profitability calculators and real-time performance stats.

• Provides optional access to AI cloud compute via H100/B100 GB200 NVL72 clusters, letting users rent machine-learning compute alongside mining.

• App ecosystem includes miner purchasing, contract management, reservations trading, and automated notifications.

• Suitable for institutional-scale miners as well as retail users through “Finger Miner” cloud plans.

Good for: Users who want maximum transparency, prefer working with a publicly traded, infrastructure-backed mining company, and are looking for long-term, industrial-grade BTC mining exposure rather than short-cycle promotional contracts.

How to Choose a Reliable Cloud Mining Provider: Step-by-Step

Use this checklist before sending any money to a mining site.

Step 1: Verify the Company Is Real

• Look for verifiable registration in a recognized jurisdiction, e.g., UK company registry for DeepHash, Swiss commercial registry for AutoHash, FEZ licenses for ECOS.

• Check whether the operator’s name and address appear consistently across the website, legal documents, and third-party articles.

• Search for independent reviews and user feedback, e.g. Trustpilot entries for DeepHash and HashBeat.

Red flag: No company name, no address, or only anonymous domains.

Step 2: Understand the Cloud Mining Contract Model and Fees

Carefully read:

• Contract duration - days vs months vs years.

• Maintenance / management fees - flat, percentage, or variable.

• Withdrawal fees and minimum payout thresholds.

Use their profitability calculators with conservative BTC price and difficulty assumptions and assume lower than advertised output.

Step 3: Check Energy Source and Infrastructure

While green energy doesn’t guarantee profitability, it matters for sustainability. DeepHash, AutoHash, HashBeat, BitDeer, and several others emphasize hydro, geothermal, or wind-solar farms to keep operating costs low.

Ask yourself:

• Does the platform show any photos, videos, or third-party reports of their sites?

• Do they publish quarterly or annual reports with hashrate and revenue metrics?

Step 4: Start Small and Test Withdrawals

Before committing larger sums to the cloud miner you select:

1. Choose the smallest reasonable contract or use free hash power if available.

2. Wait for the first payout cycle.

3. Withdraw your mined BTC or other crypto to your own wallet or an exchange like BingX.

4. Confirm that funds arrive on-chain and that there are no “extra” hidden conditions.

Only scale up if everything works exactly as promised.

Step 5: Compare Returns to Simply Buying BTC

A simple question:

“If I just bought BTC directly on BingX and held it, would my expected returns be better or worse than this cloud mining contract?”

Because cloud mining adds operational risk, fees, and counterparty risk, it often makes sense only if:

• You’re specifically bullish on mining as a business model, or

• You want diversified exposure to hashrate, not just coin price.

How to Start Cloud Mining in 2025

Before committing real capital, you should treat cloud mining like a staged experiment. Start small, validate payouts, verify withdrawals, and only scale once the provider proves reliable under real market conditions.

1. Pick 2–3 platforms that look credible after your research. Begin by shortlisting a few providers that pass basic checks: verifiable company registration, clear contract terms, transparent dashboards, and consistent third-party reviews. This reduces the chance of relying on a single untested provider.

2. Compare minimum contract sizes, energy claims, regulatory status, and user reviews. Study each platform’s entry costs, whether electricity/maintenance fees are included, and whether they operate renewable-energy farms or licensed facilities. Cross-check user feedback about payout speed, uptime, and withdrawal reliability to identify platforms with real operating history.

3. Create accounts and enable 2FA everywhere. Set up accounts on your chosen platforms and immediately activate

two-factor authentication (2FA) to protect payouts and withdrawal permissions. This is crucial because cloud mining sites hold balances that can be targeted by phishing or credential theft.

4. Fund the smallest contract(s) you’re comfortable testing. Start with minimal risk, buy the lowest-cost contract or trial package to test the provider’s performance. This helps you evaluate real output and interface stability without exposing significant capital.

5. Track daily payouts and note how they respond to BTC price moves and difficulty. Monitor earnings closely for at least several days. Compare actual payouts with your calculator estimates, and observe whether returns fluctuate in line with Bitcoin’s price and network difficulty, an important sign that you’re receiving legitimate mining output.

6. Withdraw regularly to reduce counterparty risk. Once you accumulate enough for a minimum withdrawal, move mined BTC to your personal wallet or BingX. Frequent withdrawals protect you from platform failures and confirm that the provider’s payout infrastructure is functioning correctly.

Once you’re confident in the platform’s reliability, consolidate into one or two providers that consistently deliver accurate payouts, smooth withdrawals, and stable contract performance aligned with your risk tolerance.

How to Trade Bitcoin and PoW Coins on BingX After Cloud Mining

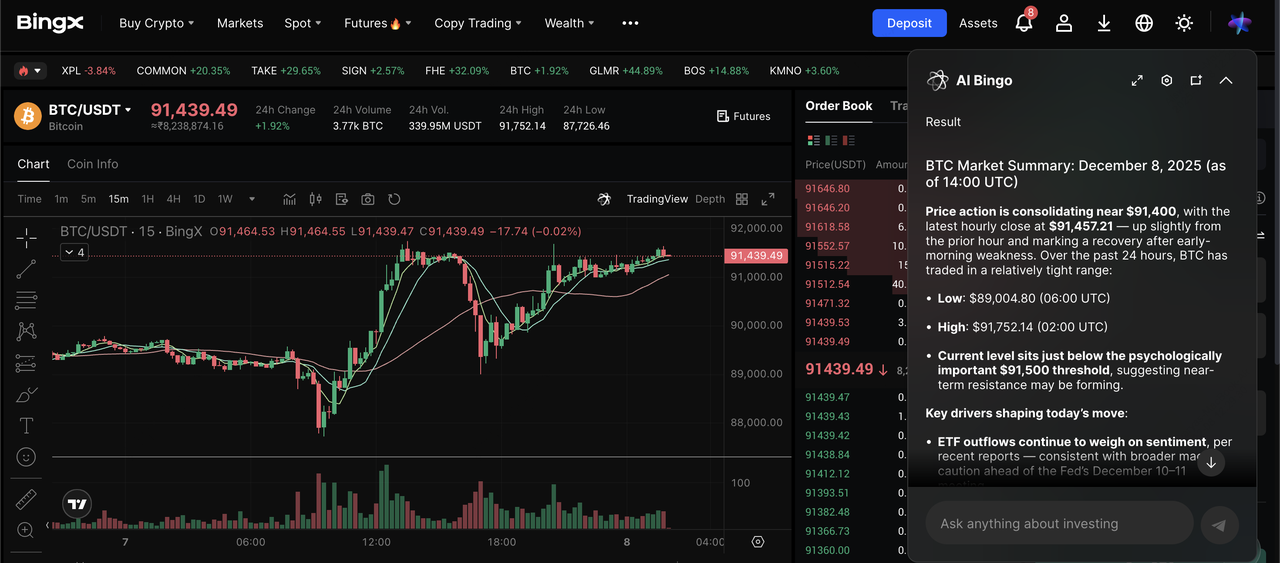

BTC/USDT trading pair on the spot market powered by BingX AI insights

After you withdraw mining rewards, usually in BTC, sometimes DOGE, LTC or others, you can trade them on BingX or cash out your coins. Here's how:

1. Deposit to BingX: Copy your BingX BTC or other coin deposit address. Send funds from the cloud mining platform, ensuring you pick the correct network. Wait for on-chain confirmations.

2. Trade or hedge

• If supported, use

Futures to hedge your BTC exposure, e.g. open a short position while holding spot coins from mining.

3. Convert to local currency: Use

P2P or other off-ramp methods supported by BingX to convert to your local currency. Always follow local tax rules; mining rewards are treated as taxable income in many countries.

Cloud mining can be one way to feed BTC into your BingX trading stack, but it’s not required; many users prefer to

DCA directly into BTC instead.

What Are the Top Risks of Cloud Mining Bitcoin and Other Crypto Coins?

Cloud mining carries significantly higher uncertainty than simply buying and holding Bitcoin, and most of the risks come from factors you cannot directly control.

1. Scams, Ponzi Schemes, and Phishing Attacks: Many cloud mining sites advertise unrealistic returns, fake renewable farms, or fabricated registrations, and some run no real miners at all, relying on new deposits to pay earlier users until they collapse.

Phishing scams are also common, with attackers creating fake platform websites or support messages to steal logins and deposits, making strict due diligence and URL checks essential.

2. Uncertain Profitability: Even legitimate cloud miners cannot guarantee earnings because profitability depends on volatile variables like Bitcoin’s price, global mining difficulty, block rewards, and uptime. A contract that looked profitable on day one can turn negative after a difficulty spike or price correction, meaning buyers often receive far less BTC than projection models suggest.

3. Counterparty Risk: With cloud mining, you hand full operational control to a third-party operator. Your payouts rely entirely on their honesty, solvency, security practices, and infrastructure maintenance. If the company mismanages funds, experiences downtime, or shuts down unexpectedly, you have no hardware to reclaim and limited recourse to recover losses.

4. Opaque or Hidden Fee Structures: Many contracts include electricity, maintenance, pool, or “management” fees that are not obvious upfront. These recurring deductions can significantly reduce daily earnings, and in some cases, result in contracts producing close to zero net output once all fees are applied.

5. Withdrawal and Liquidity Risks: Some platforms impose minimum withdrawal thresholds, delays, or high network fees, while others quietly restrict withdrawals when liquidity tightens. If you cannot consistently withdraw your mined BTC, your returns exist only on-screen, not on-chain, which increases the risk of losing accumulated balances if the operator fails.

Bottom line: Treat cloud mining as speculation, not passive income. Start with small contracts, verify payouts and withdrawals early, diversify across providers, and only scale after a platform proves reliable under real market conditions.

Final Thoughts: Should You Use a Cloud Mining Platform?

Cloud mining platforms in 2025 are more polished than in previous cycles, offering cleaner dashboards, renewable-energy sourcing, and clearer corporate disclosures. Providers such as DeepHash, AutoHash, DNSBTC, HashBeat, ECOS, NiceHash, and StormGain appear frequently in independent reviews, but sophistication does not remove core risks, profitability remains uncertain, transparency varies widely, and counterparty risk is always present. For most users, cloud mining should be viewed as a speculative tool rather than a predictable income model.

If you choose to try cloud mining, approach it incrementally: begin with the smallest contracts, test payout accuracy, and verify that withdrawals reach your own wallet or BingX without delay. Continuously compare expected returns against the simpler alternative of

buying and holding BTC, and use BingX to store, trade, or hedge any mined coins. Above all, remember that cloud mining carries meaningful financial and operational risk, and success depends more on disciplined evaluation and risk management than on finding a “perfect” platform.

Related Reading

FAQs on Bitcoin (BTC) Cloud Mining Platforms in 2025

1. Are “free” cloud mining platforms real?

Some platforms offer limited free hash power or app-based miners as a promotional feature, allowing users to test the interface without paying. These free tiers typically come with low earning caps and require upgrading to paid contracts for meaningful output. They’re best treated as demos rather than genuine income sources.

2. What is the minimum investment for cloud mining?

Minimum investment levels differ across platforms: some mobile “free miners” require no upfront payment, while budget-friendly services like HashBeat or BeMine start around $15–$50. More established platforms such as AutoHash, DNSBTC, DeepHash, or ECOS often have higher entry tiers but may offer occasional promotional discounts. Always confirm whether maintenance or electricity fees are included before funding a plan.

3. How fast will I receive my first payout when cloud mining BTC?

Most cloud mining platforms distribute rewards once per day after your contract becomes active, though some update internal balances more frequently. Actual withdrawals may take longer due to minimum thresholds, internal processing rules, or blockchain congestion. It’s wise to test a small withdrawal early to verify the platform’s payout reliability.

4. Can I mine altcoins like DOGE or LTC with cloud mining?

Yes, many cloud mining services support multiple proof-of-work assets, including Dogecoin and Litecoin, and some AI-driven platforms automatically shift your hashrate to whichever coin is most profitable at the time. However, even when altcoins are mined, payouts are often converted into BTC or USDT by default. Make sure to review the platform’s payout methods before choosing a plan.

5. Are cloud mining earnings taxable?

In most countries, mined coins are treated as taxable income at the moment they are credited to your account, and any later sale or trade may also incur capital gains tax. To stay compliant, keep records of payout amounts, timestamps, BTC prices at receipt, and all associated fees or contract costs. Always check local regulations or consult a tax professional for jurisdiction-specific guidance.