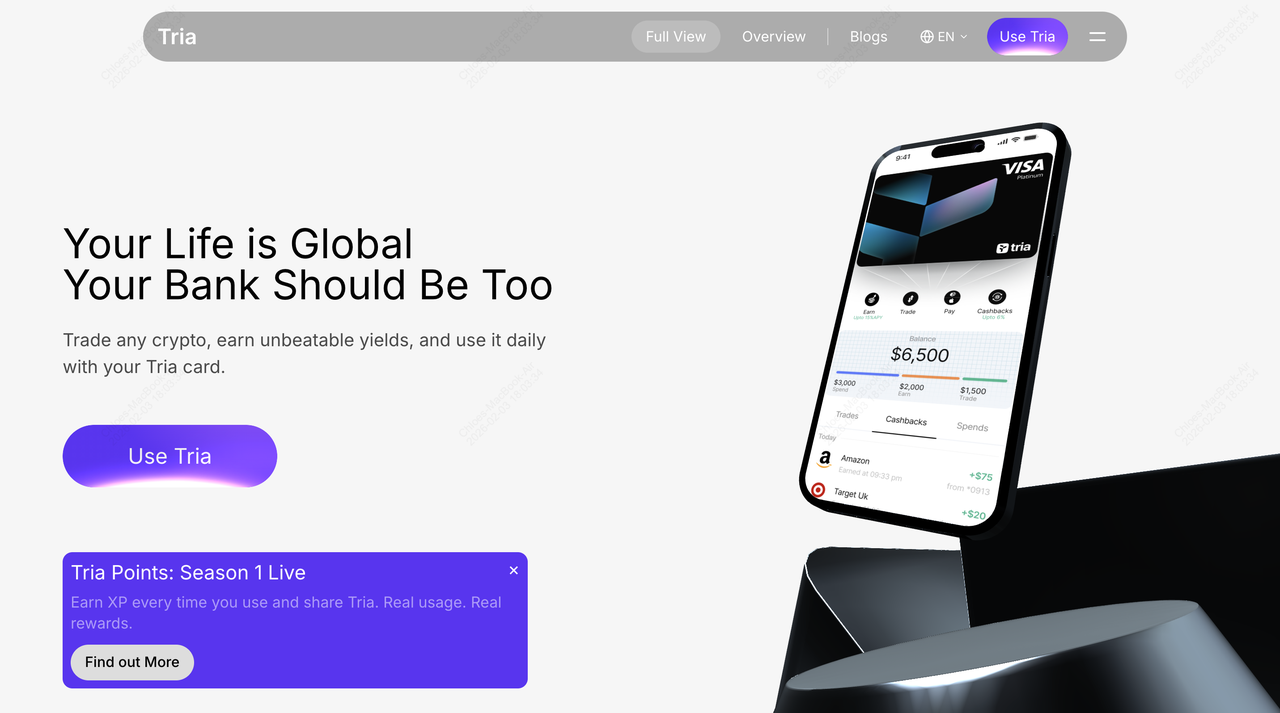

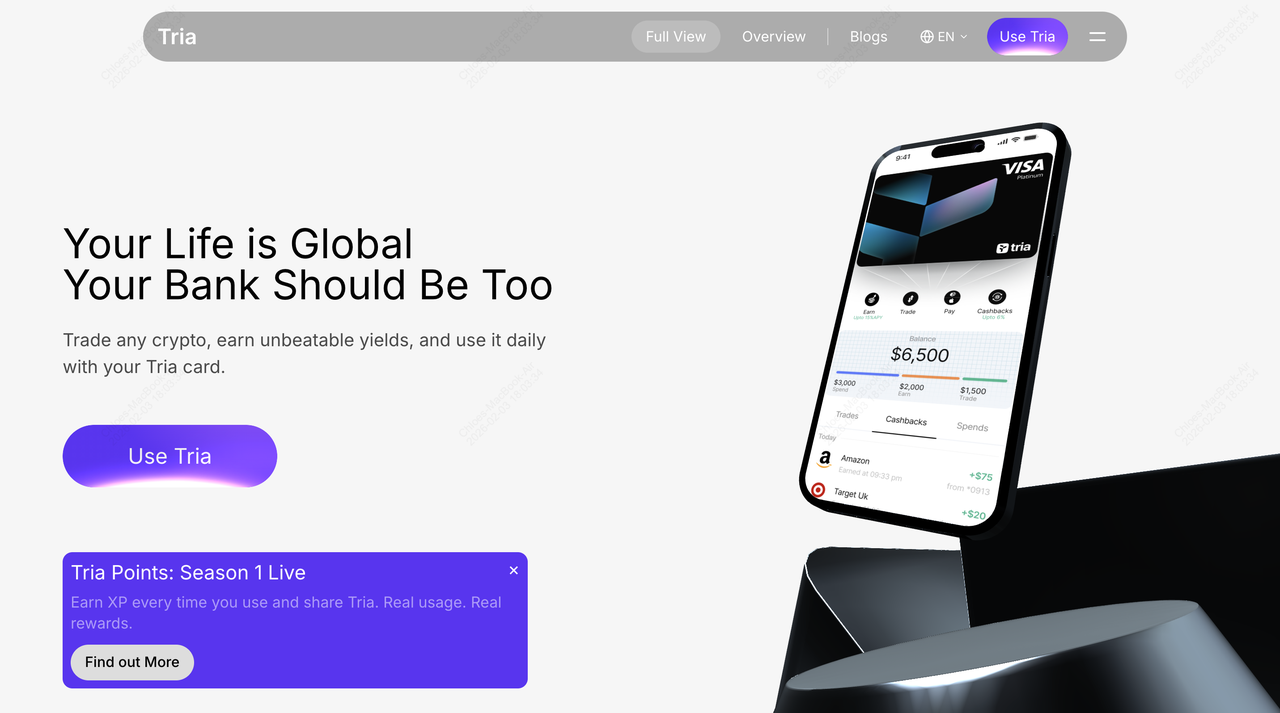

Tria (TRIA) is a pioneering self-custodial neobank launched in late 2025 that capitalizes on the growing demand for usable

on-chain finance, creating a utility-driven token ecosystem tied to real-world spending, trading, and earning across blockchains. By enabling seamless, gasless transactions, global Visa card payments, and programmable money flows, Tria powers a borderless financial layer where users and increasingly autonomous

AI agents can interact with crypto as everyday money without bridges, custodians, or complexity.

Tria is a

self-custodial crypto neobank platform that brings unified financial tools to users in a modern, app-like environment exclusively focused on preserving ownership while delivering practical usability. Tria was effectively launched for public access in late 2025 by co-founders Vijit Katta (CEO) and Parth Bhalla (CTO), building on years of development in

cross-chain infrastructure. It serves as a consumer-facing layer atop the BestPath AVS, a decentralized,

AI-optimized routing and settlement engine, allowing users to spend via a Visa card, execute cross-chain trades, earn

on-chain yields, and manage assets across 200+ chains, all while maintaining full self-custody and without manual interventions like seed phrases or gas payments. This article breaks down what the Tria self-custodial neobank actually is, the role of the TRIA token, its connection to the BestPath AVS framework, and a step-by-step guide on

how to buy TRIA tokens on BingX.

What Is Tria (TRIA)?

Tria is a self-custodial

crypto neobank that transforms on-chain finance into a practical, everyday tool. Unlike custodial neobanks or centralized exchanges, Tria ensures users maintain complete control over their assets without relying on third-party custodians. The platform supports spending crypto via a Visa card accepted at millions of merchants worldwide, earning yield through audited on-chain strategies, and trading assets across over 200 blockchains, all gasless, seedless, and with minimal friction.

Powered by its proprietary BestPath routing engine, Tria automates complex cross-chain transactions in real time, finding optimal paths for swaps, payments, and more. This abstraction layer hides blockchain intricacies, delivering an intuitive experience akin to modern digital banking while preserving true s

elf-custody and on-chain transparency.

Built for both humans and

AI agents, Tria enables programmable money flows, allowing autonomous transactions natively on-chain. In its early months, the platform demonstrated strong traction, processing over $100 million in transaction volume during closed beta, including significant real-world card spending and cross-protocol routing.

What Are the Key Features of Tria Crypto Neobank?

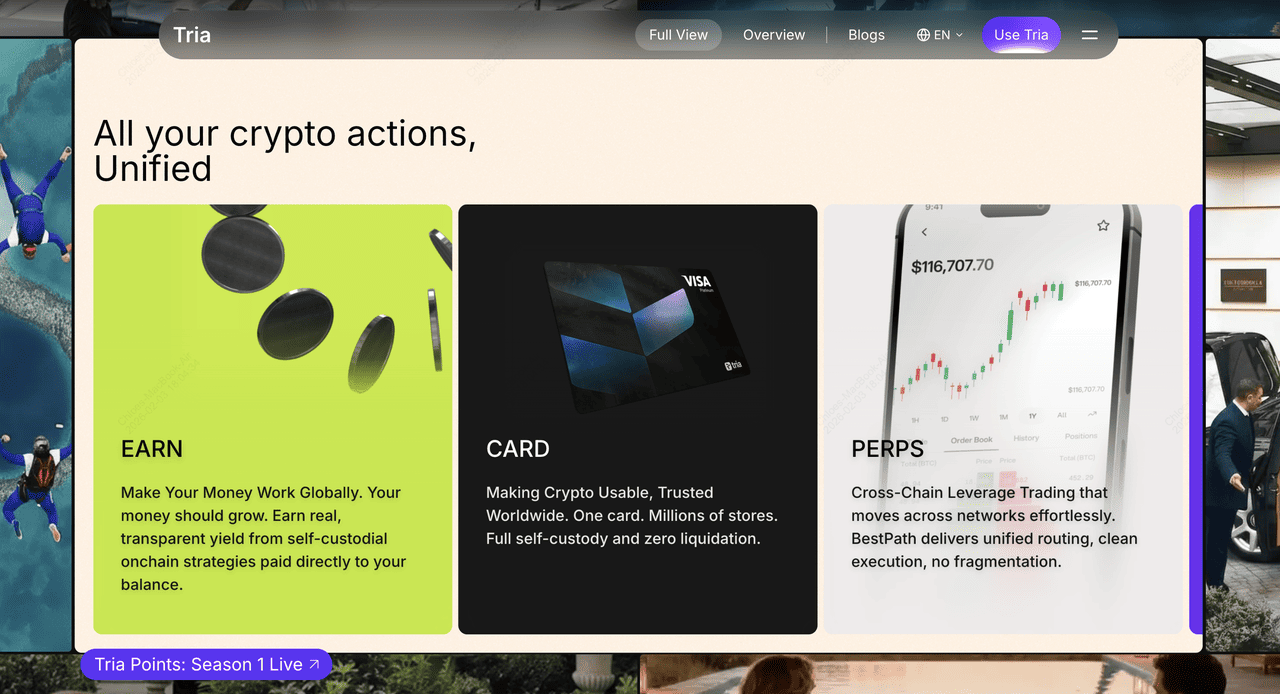

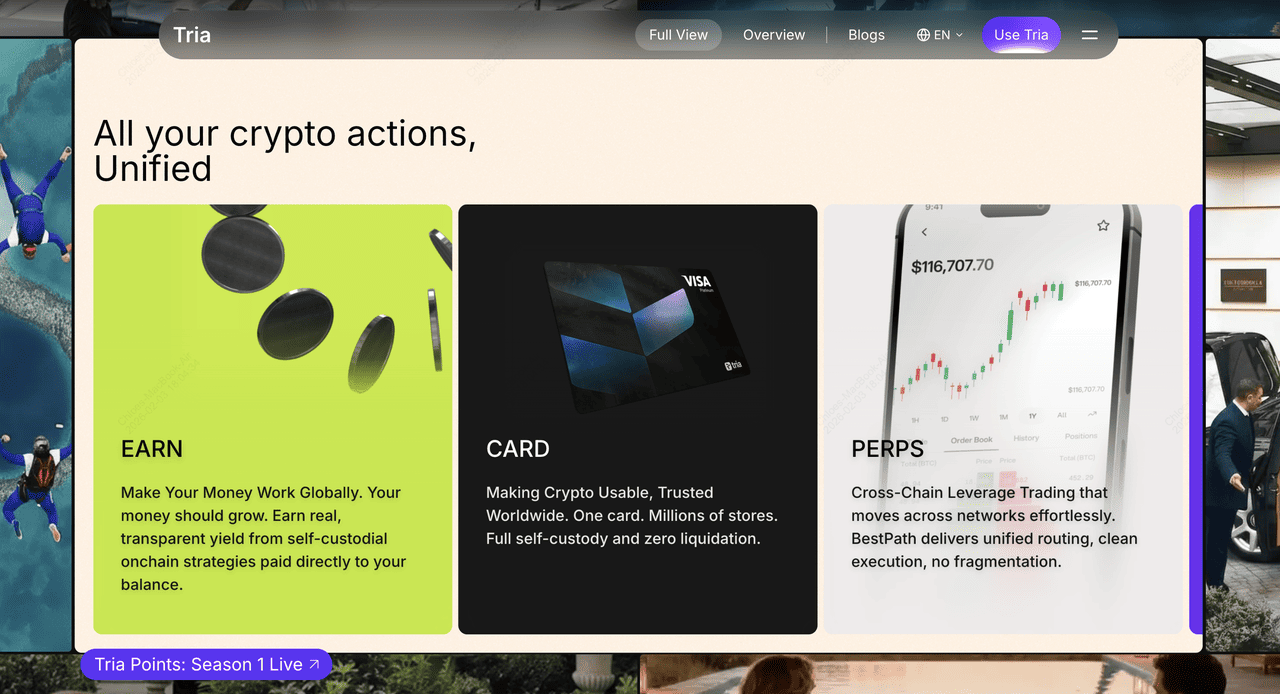

Tria's core strength lies in unifying crypto activities under a seamless, self-custodial framework. Key features include a

self-custodial wallet with secure abstractions like social recovery, eliminating manual seed phrase management while ensuring users retain full key control.

The BestPath engine, an AI-optimized, permissionless routing system and Actively Validated Service (AVS) built in collaboration with ecosystems like

EigenLayer, scans protocols and chains for the most efficient execution, enabling gasless and bridge-free transactions across EVM,

Solana (SVM), Move-VM,

Cosmos, and

Bitcoin L1 environments.

The Tria Card is a Visa debit card supporting Apple Pay and Google Pay, allowing spending from self-custodial balances across 150+ countries and over 130 million merchants, with real-time swaps and yield-earning potential until the point of purchase; it uniquely supports direct top-ups from self-custodied Bitcoin without custodial intermediaries. Users can also access

on-chain yield vaults for passive income, cross-chain perpetual trading, and automated yield application to card balances.

Additional perks encompass rewards programs, referral incentives through ambassador initiatives, XP-based usage rewards, and upcoming on/off-ramp services across 100+ countries, making Tria a comprehensive solution for global, programmable finance with integrations supporting over 1,000 tokens and partnerships with chains like Polygon, Arbitrum, Injective, and more.

Who Created Tria and When Did It Launch?

Tria was co-founded in 2022 by Vijit Katta, who serves as CEO, and Parth Bhalla, who leads as CTO and tech architect. Both founders bring significant experience from the blockchain and tech industries, with prior contributions to projects and companies including Binance, Polygon, OpenSea, Intel, Nethermind, the Ethereum Foundation, and Cardano. Their combined backgrounds in blockchain infrastructure,

DeFi protocols, and consumer product design shaped Tria’s vision to create a neobank that merges

Web3 ownership with fintech usability.

The core team behind Tria is composed of engineers, product managers, and security specialists from a range of crypto-native and traditional companies. As of early 2026, the team includes alumni from Binance, OKX, HubSpot, Yext, OpenSea, and Nethermind, and consists of roughly 40 contributors globally. The project is operated by Threely Dimensions Inc. (now known as Tria), and has grown alongside a large ambassador program and early user community exceeding 200,000 users in some reports. This mix of deep crypto infrastructure knowledge and mainstream product experience is central to Tria’s approach: build for

Web3 power users, but make it work for everyone, including future AI-driven economies.

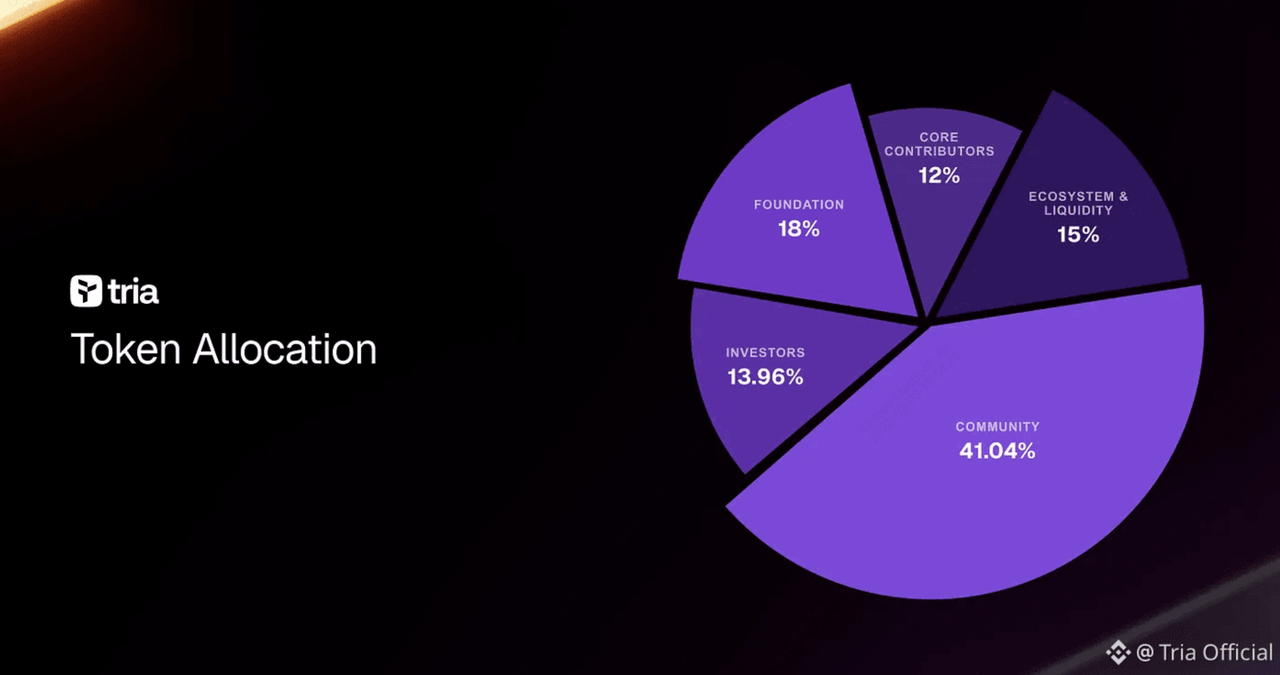

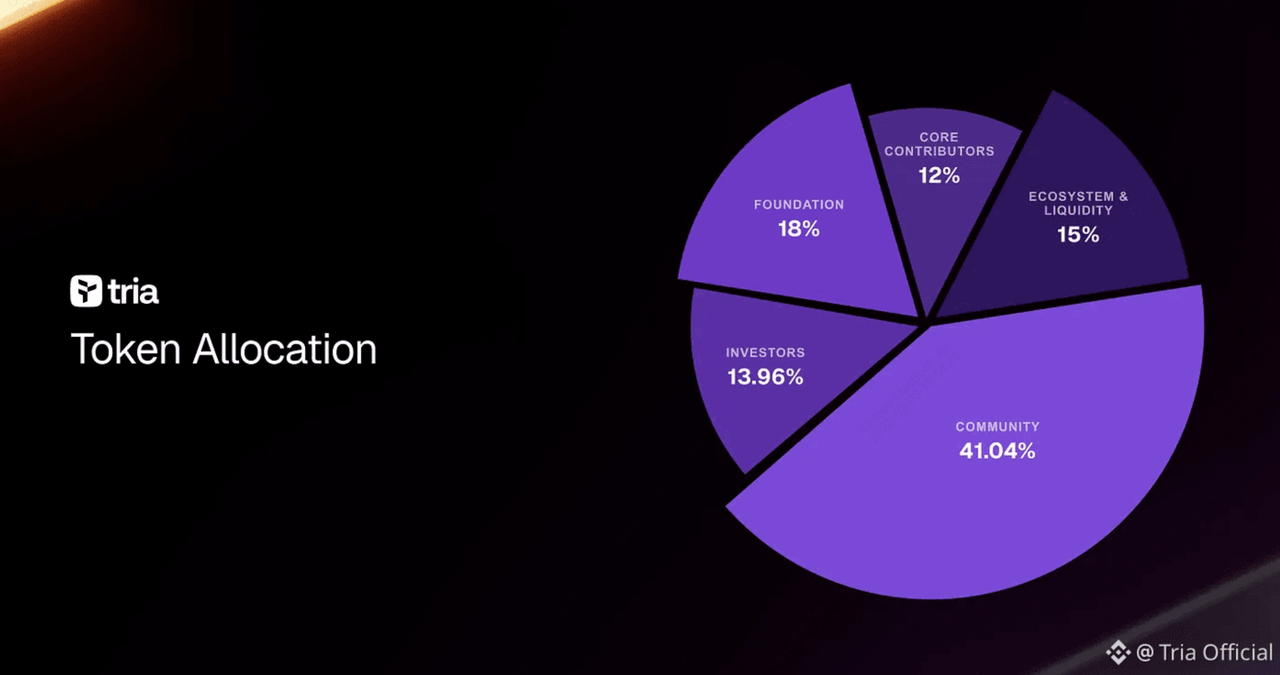

What Are the Tokenomics of TRIA?

TRIA serves as the native utility token powering the Tria ecosystem, facilitating settlement, staking, governance, and incentives. It is an ERC-20 token on Ethereum with a fixed total supply of 10B TRIA and zero inflation, as all tokens were pre-minted at genesis. The initial circulating supply at the Token Generation Event (TGE) in 2026 was approximately 2.19 billion TRIA (21.89%).

Distribution prioritizes community alignment:

1. 41.04% to community rewards and airdrops, with phased vesting and no cliff for much of it,

2. 18% to the foundation for operations and grants,

3. 15% for ecosystem and liquidity provisioning,

4. 13.96% to investors (with long-term vesting), and

5. 12% to core contributors (also vested).

Utilities include settling BestPath transactions, staking for PathFinder nodes to earn routing fees from the decentralized execution marketplace, subsidizing gas and other costs for gasless experiences, enabling governance voting on protocol parameters, and unlocking membership benefits like reduced fees and enhanced rewards. This structure emphasizes user-driven growth, with a substantial portion reserved for real network activity rather than early private allocations.

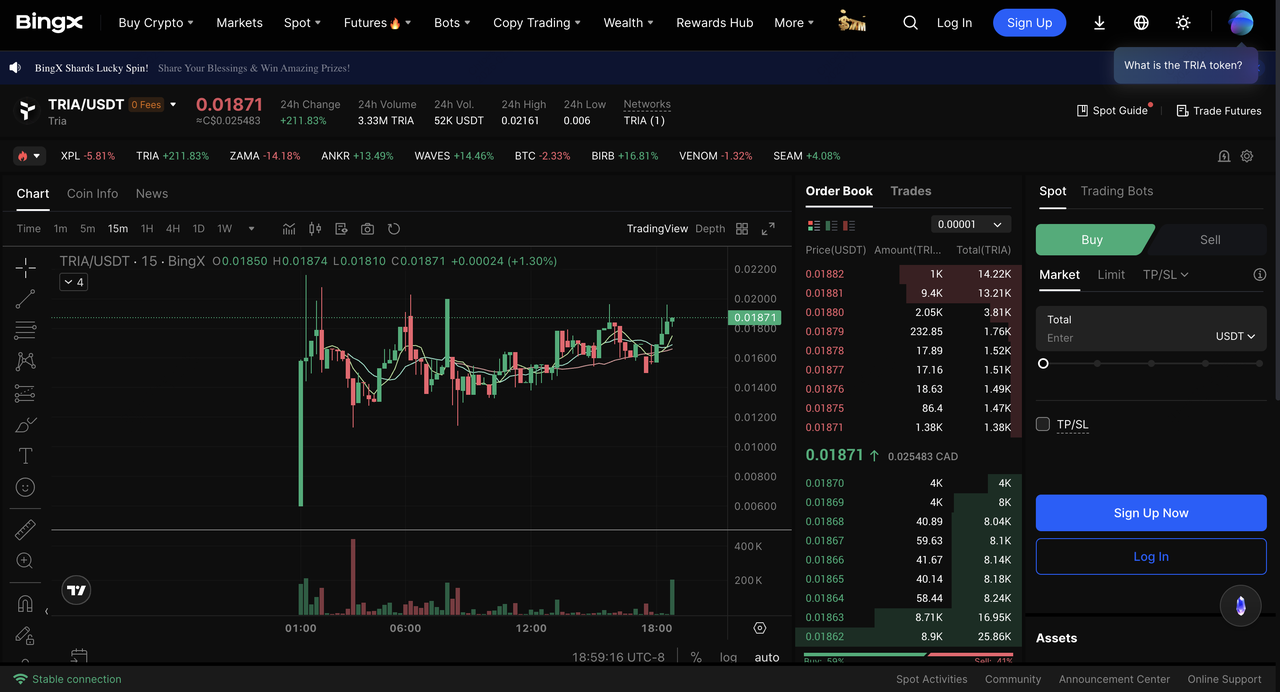

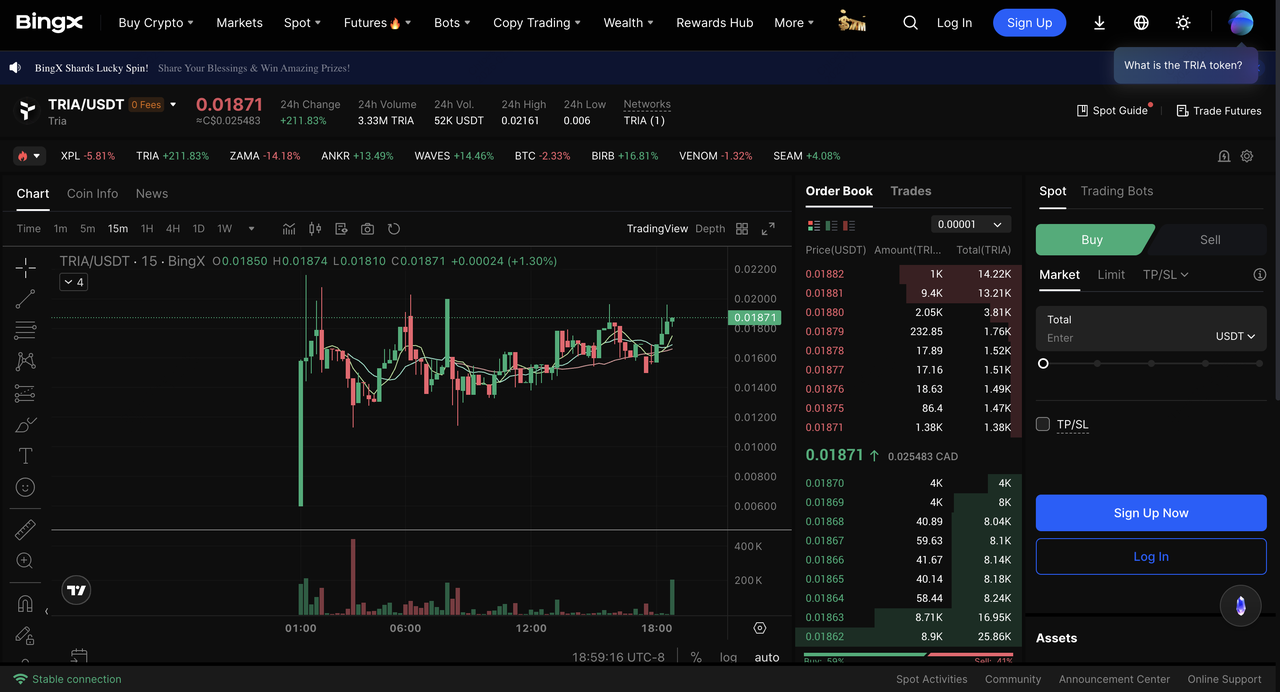

How to Buy Tria (TRIA) on BingX: A Step-by-Step Guide

You can access TRIA through the spot market and use them within their respective ecosystems. Here's a step-by-step guide on how to buy TRIA on BingX Spot Market:

Step 1: Log in or Create a BingX Account

Log in to your BingX account. If you don't have one, you can register using an email or mobile number. Completing

identity verification (KYC) is required for full access to trading features.

Step 2: Deposit Funds

Go to the Buy Crypto section to deposit funds into your account. BingX supports several payment options such as bank transfer, credit or debit card, and

peer-to-peer (P2P) transactions.

Step 3: Find the TRIA/USDT Pair

Navigate to the

Spot trading section and search for

TRIA/USDT and select the pair to view the trading interface. Use

BingX AI tools to analyze TRIA trends and make smarter trading decisions.

Step 4: Place Your Order

Choose between a

Market Order to buy at the current price or a Limit Order to set your preferred entry. Enter the amount and confirm the order.

Key Considerations Before Trading $TRIA

Before trading $TRIA, it's important to understand the risks associated with Solana-based meme tokens. While strong community momentum and viral attention can drive rapid gains, they can also amplify losses. The following considerations can help traders better assess potential risks and make more informed decisions.

1. Highly Speculative and Volatile: $TRIA's price is largely driven by community hype and market sentiment, not fundamentals. Expect rapid swings, both up and down, and never invest more than you can afford to lose. New memecoins can be targeted by pump-and-dump schemes or coordinated trades that move prices quickly. Always check trading volume and liquidity before entering.

2. Lack of Liquidity: Low trading volume or shallow order books can make it difficult to sell without affecting the price. This can trap traders during sudden market shifts.

3. Smart Contract and Security Risks: Some tokens launch without audits or proper security checks. Vulnerabilities could lead to loss of funds, so stick to well-known platforms and verified contracts.

4. Protect Yourself with Stop-Losses: Given $TRIA's volatility, using stop-loss orders can help limit potential losses. Decide in advance how much you're willing to risk and stick to it.

Conclusion

Tria represents a practical step toward making cryptocurrency more usable in everyday financial activity by combining self-custody with banking-style features such as cross-chain routing and crypto card payments. By reducing friction through tools like BestPath and the Tria Card, the platform aims to simplify how users spend, earn, and move digital assets globally without relying on traditional intermediaries. Early adoption signals, including beta-phase transaction volume exceeding $100 million, suggest growing interest in Tria’s user-centric approach, while the TRIA token plays a central role in aligning incentives across the ecosystem.

However, like all crypto-based projects, Tria’s long-term success depends on sustained user growth, effective product execution, and broader market conditions. TRIA remains exposed to volatility, regulatory developments, and competitive pressure within the crypto neobank and DeFi sectors. Potential users and investors should assess these risks carefully and conduct independent research before engaging with the platform or the token.

Related Reading