The XRP Ledger (XRPL) is a high-performance, enterprise-grade

Layer-1 blockchain known for 10+ years of uninterrupted uptime, fractions-of-a-cent fees, and the ability to settle thousands of transactions in seconds, making it one of the most reliable infrastructures for payments, tokenization, and on-chain financial services. Backed by a global developer ecosystem and powered by XRP, the network now supports a growing economy of

stablecoins, RWAs, and DEX/AMM trading, with over $267 million in stablecoin market cap, $193 million in 30-day RWA transfer volume, and 50+

tokenized real-world assets circulating on-chain as of December 2025.

This beginner-friendly guide walks you through how to buy XRP on BingX, set up a secure wallet, and understand the key opportunities and risks when investing in the XRP Ledger ecosystem.

What Is XRP Ledger (XRPL) and How Does It Work?

The XRP Ledger (XRPL) is a decentralized Layer-1 blockchain built for speed, low cost, and high reliability. Transactions settle in 3–5 seconds, fees are usually less than $0.001, and the network has operated for over 10 years without downtime, making it one of the most proven payment-focused blockchains in the world. These features make XRPL especially popular for remittances, on-chain payments, market-making, and tokenized asset transfers.

Unlike

Bitcoin or other proof-of-work blockchains, XRPL doesn’t rely on miners. Instead, it uses a consensus protocol, where globally distributed validators agree on new transactions every few seconds. This design keeps the network energy-efficient, secure, and capable of processing thousands of transactions quickly, which is crucial for financial applications.

At the center of the network is

XRP, its native cryptocurrency. XRP plays several key roles:

• Pays transaction fees so the ledger stays spam-resistant and efficient

• Acts as a bridge currency for fast, low-cost cross-border transfers

• Activates wallets via a small account reserve, reduced to just 1 XRP

What Is the Difference Between XRP Ledger (XRPL) and XRP (XRP)?

XRP and the XRP Ledger (XRPL) are closely related but not the same thing. The XRP Ledger is the underlying decentralized blockchain that processes transactions, runs the built-in DEX and AMM, and supports tokenization and payments.

XRP, on the other hand, is the native cryptocurrency of this network, used to pay transaction fees, provide liquidity, meet account reserve requirements, and act as a bridge asset for cross-currency settlement. In short, XRPL is the blockchain and XRP is the token that powers it.

How to Invest in the XRP Ledger (XRPL), and Why It Matters

You invest in XRPL because it remains one of the fastest, most cost-efficient, and most reliable blockchains in production, processing transactions in 3–5 seconds with fees measured in fractions of a cent and maintaining 10+ years of uninterrupted uptime. Beyond payments, XRPL now supports decentralized trading, tokenization, AMM liquidity pools, and early institutional-grade DeFi tools, positioning it as a high-utility Layer 1 for financial applications.

In 2025, XRP’s investment outlook strengthened dramatically with the rise of U.S.-listed

XRP ETFs, which became the fastest crypto ETFs to reach $1 billion in AUM since

Ethereum’s products. Roughly 477.93 million XRP is now held across regulated ETFs from issuers like Canary Capital with 166 million XRP, Grayscale with 104 million, Bitwise with 91.8 million, Franklin Templeton with 63 million, and REX-Osprey with 53 million. Combined daily ETF trading volume sits near $15 million, reflecting increasing institutional demand and broader accessibility through platforms such as Vanguard.

Because XRP is the native asset that powers fees, liquidity, and account activation, buying XRP is your gateway into the XRPL economy. For beginners, the investment path typically includes:

1.

Buy XRP on a trusted exchange like BingX.

2. Transfer XRP to an XRPL-compatible wallet if you want direct on-chain control.

3. Explore additional opportunities like the XRPL DEX, AMM pools, tokenized assets, and ecosystem projects.

With growing institutional products, accelerating tokenization activity, and a proven technical foundation, XRPL is becoming one of the most accessible financial-infrastructure blockchains to invest in, while still carrying the volatility and regulatory risks typical of the crypto market.

Why Invest in XRP Ledger?

The XRP Ledger (XRPL) appeals to investors because it combines enterprise-grade reliability, ultra-fast settlement, low fees, and a rapidly expanding ecosystem driven by payments, tokenization, and on-chain liquidity. Below are the most important reasons XRPL is gaining traction:

1. Proven, Enterprise-Level Reliability

XRPL has operated for over 13 years with zero network downtime, finalizing millions of ledgers with consistent performance. For investors, this positions XRP as one of the few digital assets anchored to a long-running, high-integrity blockchain infrastructure trusted by financial institutions.

2. Ultra-Fast and Extremely Low-Cost Transactions

Transactions settle in 3–5 seconds, with fees typically below $0.001, making XRPL one of the most cost-efficient L1 networks globally. This speed-and-cost profile is ideal for payments, DEX trading, remittances, and high-frequency settlement.

3. Native DEX and Protocol-Level AMM (XLS-30)

XRPL includes a built-in decentralized exchange plus a native Automated Market Maker (AMM), offering:

• Direct token swaps from your wallet

• Liquidity pools that pay out trading fees and arbitrage rewards

• No smart-contract deployment risks

These features give XRP real utility, not just speculative value.

4. Explosive Growth in Tokenization: RWAs, Stablecoins, and Institutional Assets

• $394.6 million in tokenized asset value as of December 2025

• 430%+ growth in payment volume YoY

• Stablecoins on XRPL crossed $267 million in market cap

• XRPL supports 50+ tokenized real-world assets (RWAs), including treasuries, commodities, and institutional settlement instruments

With global RWA tokenization forecast to reach $18.9 trillion by 2033, XRPL is positioning itself as a competitive settlement layer.

5. Surge in Regulated XRP ETFs and Institutional Demand

6. Expanding Enterprise and Developer Ecosystem

XRPL now supports over 400 open-source developer projects, major upgrades like Hooks, EVM sidechain, and MPTokensV1, and compliance-ready features like issuer controls, freeze and clawback. This makes the ledger attractive to fintechs issuing RWAs, stablecoins, or cross-border payment instruments.

7. Low Barrier to Entry for New Users

The XRPL account reserve was reduced to 1 XRP, allowing anyone to open a wallet at almost zero cost. Combined with low fees and beginner-friendly wallets, XRPL is one of the most accessible L1 ecosystems for new crypto investors.

How to Buy XRP on BingX and Invest in XRP Ledger (XRPL)

If you’re ready to invest in the XRP Ledger, BingX is one of the easiest and most reliable platforms to buy XRP, offering deep liquidity, fast execution, and low spot trading fees. The onboarding flow is simple, supports multiple payment methods, and includes secure storage options powered by BingX AI for smarter risk alerts and portfolio insights.

Whether you're buying XRP to hold long term or transferring it to an XRPL wallet to use the DEX, AMM pools, or tokenized assets, BingX provides a smooth, trusted, and beginner-friendly starting point.

How to Buy XRP on BingX Spot: Step-by-Step

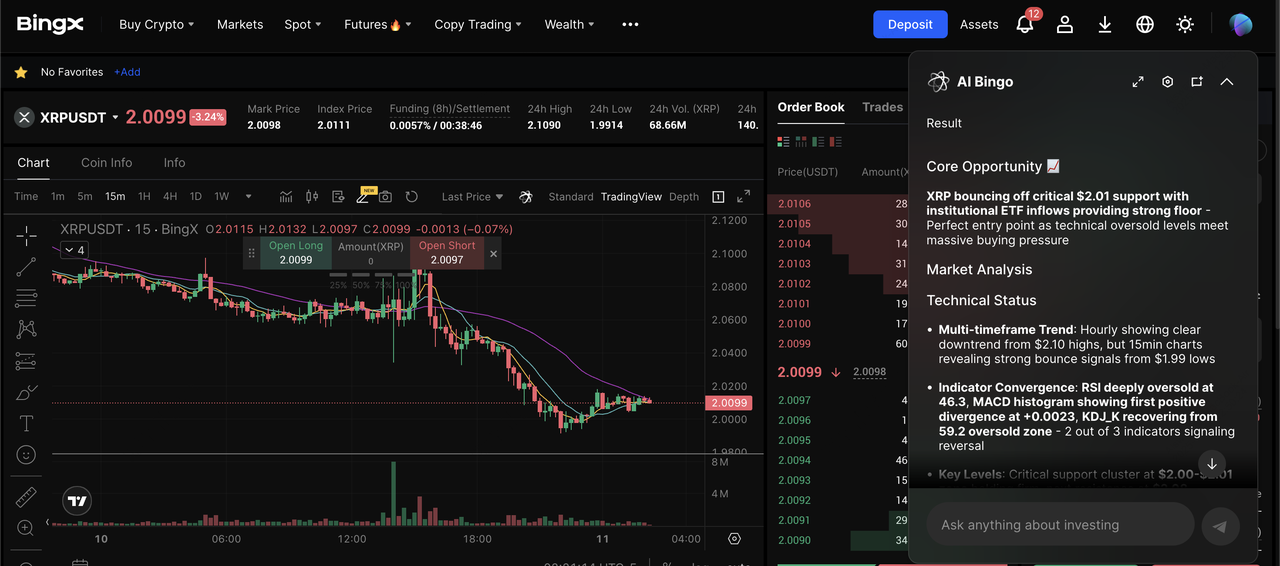

XRP/USDT trading pair on the spot market powered by BingX AI insights

Step 1: Create and Verify Your BingX Account

Sign up on the official BingX website or app using your email or phone number and set a strong password. Complete the

KYC verification so you can deposit funds and access full trading features. Verification also enhances account security and withdrawal limits.

Step 2: Deposit Funds into Your BingX Account

You can deposit by

buying USDT with a bank card or local payment method, or by sending crypto like

USDT,

USDC,

BTC, or

ETH from another wallet or exchange. Once the payment or blockchain confirmation is complete, your balance will appear in Funds → Spot. You’re now ready to start trading.

Step 3: Find the XRP Spot Market

Go to Trade → Spot and search for “XRP.” Select the

XRP/USDT trading pair, which offers the deepest liquidity and tightest spreads. This opens the main interface where you’ll place your order.

Step 4: Choose Your Order Type and Place the Trade:

Select a

Market Order for an instant XRP purchase or a Limit Order to set your own price. Enter the amount you want to buy, review the cost and fees, and tap Buy XRP to submit.

Market orders execute immediately, while limit orders fill when the market reaches your price. You can track or manage open orders directly in the trading interface.

Step 5: Check Your XRP Balance

Go to Assets → Spot to confirm your purchased XRP. You can hold XRP on BingX for easy trading or withdraw it to an XRPL wallet if you want to use the XRPL DEX, AMM, or other on-chain features.

How to Trade XRP Futures on BingX Futures Market: Step-by-Step

Trading XRP futures on BingX lets you profit from both rising and falling prices using leverage, and the steps below show you exactly how to open, manage, and close positions safely as a beginner.

1. Transfer Funds: Deposit USDT into Spot, then go to Assets → Transfer and move funds from Spot to Futures.

3. Set Margin & Leverage: Choose Cross or Isolated margin and select leverage; beginners should stick to 2x–5x.

4. Choose Long or Short: Select Buy/Long if you think XRP will rise or Sell/Short if you expect a price drop.

5. Pick Order Type and Set Size: Use Market for instant entry or Limit to set your price, then enter position size and add

TP/SL (take-profit, stop-loss) orders for risk control.

6. Open and Manage Position: Confirm the order, monitor PnL under Positions, and close or adjust TP/SL as needed. After closing, you can transfer realized PnL (profit and loss) back to your Spot wallet.

Note: Only trade futures if you understand leverage, margin, liquidation risk, and funding fees. Start small and avoid high leverage as a beginner.

How to Store XRP After Buying on BingX

After buying XRP on BingX, the simplest option is to store it directly in your BingX Spot Wallet, which offers secure custody, withdrawal protection, and seamless access to trading if you plan to buy, sell, or convert XRP frequently. Keeping XRP on BingX is convenient for active traders because you avoid network fees and can manage your portfolio in one place with real-time price tracking and risk tools.

If you prefer full ownership and want to interact directly with the XRP Ledger, you can withdraw your XRP to an XRPL-compatible wallet such as Ledger, Bitget Wallet, or Xumm. These wallets give you control of your private keys and allow you to use XRPL features like the built-in DEX, AMM pools, and tokenized assets. Just remember to back up your recovery phrase securely and keep at least 1 XRP reserve in your wallet to keep the account active.

Security Best Practices for XRPL Investors

Security should be part of your investment plan from the moment you buy XRP. When storing funds on exchanges like BingX, use a strong, unique password, enable 2FA with an authenticator app or hardware key, and stay alert to phishing attempts or fake support messages. Regularly review your account activity and withdrawal settings to ensure no unauthorized changes have been made.

If you withdraw XRP to an XRPL wallet, treat your recovery phrase as your master key; never share it, store it offline, and keep backups in secure locations. Consider a hardware wallet for larger balances, double-check addresses before sending funds, and remember that a small portion of your XRP will remain locked as the account reserve. Following these simple habits dramatically reduces your risk of hacks, scams, or irreversible mistakes.

How to Activate an XRPL Account Reserve

To activate a new XRPL address, the network requires a small locked balance known as the account reserve. As of December 2024, XRPL validators reduced the base reserve from 10 XRP to 1 XRP, and the owner reserve from 2 XRP to 0.2 XRP per object like trustlines or offers. This 1 XRP is locked while the account is open. it’s a spam-prevention measure, not a fee.

For most beginners, this means you can start using your own XRPL wallet with very small amounts, instead of needing 10–20 XRP as in previous years.

How to Create and Secure Your XRPL Wallet

1. Download and install a reputable XRPL-compatible wallet.

2. Create a new wallet and write down the recovery/seed phrase on paper.

3. Back up and store this phrase in a safe, offline location.

4. Enable extra security such as PIN, biometrics, and if available, passphrase features.

5. Receive XRP from your exchange to the wallet address. Make a small test transfer first.

Once the first transaction lands and the reserve is met, your XRPL account is active.

What Are the Different Ways to Invest in the XRP Ledger Ecosystem?

Once you hold XRP and have an XRPL wallet, you can explore several investment paths:

1. Buy and Hold XRP

A simple long-term investment strategy is to buy and hold XRP based on the growth of the XRP Ledger ecosystem, such as rising adoption in payments and remittances, new upgrades like XLS-30 AMM and Hooks that expand DeFi capabilities, and increasing regulatory clarity and enterprise partnerships in cross-border finance. Much like holding other major Layer-1 tokens, this approach focuses on XRPL’s role as a fast, reliable financial-infrastructure network and its potential to capture more real-world payment flows over time.

2. Trading on XRPL’s Built-In DEX

The XRP Ledger features a built-in DEX that allows you to trade XRP against issued tokens, such as stablecoins, utility tokens, and other on-ledger assets, or swap token-to-token pairs directly on-chain. It uses a native order-book system for placing limit orders, and every trade is transparently recorded on the ledger, offering a trustless, fully auditable trading experience. Most XRPL-compatible wallets provide an integrated DEX interface, making it easy to trade assets without leaving your wallet or relying on external platforms.

3. Providing Liquidity via XRPL AMM (XLS-30)

In 2024, the XRPL community introduced XLS-30, a native AMM that operates alongside the traditional order-book DEX, allowing each token pair to have its own on-ledger liquidity pool. Users can deposit XRP and other tokens into these pools to earn a share of trading fees and arbitrage rewards, similar to DeFi platforms on other blockchains. Because the AMM is integrated directly at the protocol level, early research indicates it can reduce slippage and synchronize pricing more efficiently with external markets, creating a smoother and more liquid trading environment for XRPL users.

Important: AMM participation involves impermanent loss, smart-contract/protocol risk, and market volatility. It’s an advanced strategy, not a starting point for beginners.

4. Investing in XRPL-Issued Tokens and NFTs

The XRP Ledger also supports the creation of custom tokens and NFTs, ranging from stablecoins to utility, governance, and XLS-20 NFT collections, which can all be traded directly on the XRPL DEX or used in emerging DeFi, gaming, and tokenized-asset applications. While these assets expand the ecosystem’s opportunities, they typically carry higher risk and lower liquidity than XRP itself, making them more suitable for experienced investors who can evaluate issuer credibility, tokenomics, and on-chain activity before participating.

Key Considerations Before Investing in XRP or XRPL Assets

Before buying XRP or exploring XRPL-based tokens, it’s important to understand the fundamentals and risks that can influence performance over time.

1. Technology and Roadmap: XRPL is built for payments, fast transfers, and on-ledger trading through its native DEX and AMM. Upcoming upgrades like Hooks and institutional-grade DeFi features may expand utility, so staying aware of the roadmap helps you understand long-term potential.

2. Adoption Metrics: Monitor daily transactions, active wallet counts, and DEX/AMM volumes to gauge real usage. Growing participation from fintechs, payment partners, or enterprises can signal strengthening network demand.

3. Regulatory Environment: How XRP is treated in your country, and how global rules evolve around stablecoins, tokenized assets, and DeFi, can impact investor access and market sentiment. A clearer regulatory landscape generally reduces uncertainty but can also introduce new compliance obligations.

4. Token Dynamics: XRP’s supply, escrow unlocks, and overall liquidity conditions influence how the market absorbs new tokens. For XRPL-issued assets, review token allocations, vesting schedules, and unlock timelines to understand dilution risks and early-investor incentives.

5. Volatility Awareness: Like all crypto assets, XRP and XRPL tokens can experience sharp price swings. Only invest what you can afford to lose and be prepared for both rapid gains and sudden corrections.

Conclusion: Is XRP Ledger a Good Investment for Beginners?

The XRP Ledger can be an approachable starting point for new crypto investors thanks to its fast, low-cost transactions, long operational history, and built-in features like the DEX and AMM that let users experiment with on-chain trading in a controlled environment. Its evolving roadmap, which includes upgrades aimed at institutional-grade DeFi and compliance-aware tooling, adds to its appeal for those interested in the intersection of payments and blockchain infrastructure.

However, XRP and XRPL-based tokens remain volatile, regulatory interpretations may change, and many ecosystem projects are still in early development. As with any crypto investment, beginners should build exposure slowly, diversify where possible, and only commit capital they are prepared to lose.

Related Reading

FAQs on Investing in XRP Ledger (XRPL)

1. What is the minimum amount I need to invest in XRPL?

Technically, you can start with just a few dollars’ worth of XRP. The XRPL base reserve is 1 XRP per account, which must stay locked to keep your wallet active. On exchanges, minimum order sizes vary, so check your platform’s XRP trading rules.

2. Do I need my own XRPL wallet to invest in XRP?

No, you don’t need your own wallet to invest in XRP, because you can gain full price exposure simply by holding XRP on a centralized exchange like BingX. However, if you want to use XRPL features such as the DEX or AMM, hold XRPL-issued tokens or NFTs, or prefer full self-custody over your assets, then setting up your own wallet is the better choice.

3. Can I stake XRP on the XRP Ledger?

The XRP Ledger does not use proof-of-stake, so there is no traditional staking or validator rewards like on other PoS blockchains. Instead, users who want to earn yield can provide liquidity to XRPL AMM pools or join centralized “earn” or lending programs, each of which carries its own market and counterparty risks. These options are not equivalent to base-layer staking and should be evaluated carefully before participating.

4. Can I mine XRP instead of buying it?

No. XRP cannot be mined. The total supply was created at launch, and XRP is released over time via various mechanisms (including escrow managed by Ripple and other entities). To get XRP, you need to buy it on an exchange, earn it, or receive it from someone else.

5. What are the fees for trading on XRP Ledger?

XRPL transaction fees are extremely low, usually just a fraction of 1 XRP, often measured in “drops,” which are millionths of an XRP. Fees can rise slightly during periods of heavy network load to prevent spam, but they remain far cheaper than most congested smart-contract chains. If you trade XRP on a centralized exchange, you’ll also pay the platform’s standard trading fees.

6. Is XRP Ledger safe to use?

The XRPL has maintained strong security and uptime for more than a decade, supported by its globally distributed validator network and reliable consensus model. But your personal safety depends on how well you protect your wallet and seed phrase, whether you use reputable platforms and verified token contracts, and how carefully you review every transaction before signing. The network is secure, but combining it with good user security practices is essential to keep your funds safe.