The first U.S. spot XRP ETF, Canary Capital’s XRPC on Nasdaq, will launch at U.S. market open on on November 13, 2025, marking a watershed moment for regulated altcoin exposure beyond

BTC and

ETH. Nasdaq certification and SEC registration followed an 8-A filing and auto-effect language in the fund’s updated S-1/A, clearing the path to trade; the fund lists with an 0.50% management fee and Gemini/BitGo as custodians.

This article explores how the first U.S. spot XRP ETF, listed as ticker XRPC by Canary Capital, works, why it matters for mainstream crypto investors, and how you can buy XRPC ETF via a brokerage.

What Is XRP?

XRP is the native token of the XRP Ledger, a

Layer-1 blockchain optimized for fast, low-cost global payments. It is used for cross-border settlement, remittances, and liquidity bridges. Because of its utility and unique regulatory history, notably the legal case involving Ripple Labs and the U.S. Securities and Exchange Commission (SEC), XRP offers a different use-case than

Bitcoin and

Ethereum: for example, efficient value movement rather than purely store-of-value.

What Is a Spot XRP ETF and How Does It Work?

A Spot XRP ETF is a regulated investment fund that directly holds XRP tokens and lets you gain exposure to the token’s real market price, without managing crypto wallets or private keys. When you buy shares of a spot ETF like XRPC, you’re purchasing a small piece of a trust that owns actual XRP, securely stored with licensed custodians such as Gemini Trust or BitGo. You can trade these shares on traditional exchanges like Nasdaq through a regular brokerage account, just as you would with stocks or index ETFs.

The ETF’s price closely tracks the market value of XRP through a system called creation and redemption, where large trading firms deposit or withdraw XRP to balance supply and demand. The fund charges an annual management fee of around 0.50% that covers custody, administration, and trading costs. In short, a Spot XRP ETF gives beginners and traditional investors an easy, compliant way to invest in XRP, combining the transparency of traditional finance with exposure to the crypto market.

Spot vs. Futures-Based XRP ETFs: Key Differences

Earlier “crypto ETFs” often used futures contracts, agreements to buy or sell XRP at a later date, instead of holding the token itself. Futures ETFs can be more complex and less accurate because they:

• rely on derivative pricing,

• incur rollover costs, and

• may deviate from XRP’s actual market value.

An XRP spot ETF, by contrast, tracks XRP’s real price directly and offers a clearer, more transparent way to gain exposure through a traditional, regulated investment account.

What Is the Canary Capital Spot XRP ETF (XRPC)?

The Canary Capital Spot XRP ETF (XRPC) is the first U.S.-listed spot XRP fund, trading on Nasdaq and holding actual XRP tokens in custody with Gemini Trust and BitGo. Managed under SEC registration (Form S-1/A and 8-A), it offers regulated exposure to XRP’s price through traditional brokerages without the need for crypto wallets. This is the first U.S. spot ETF for XRP, structured under the Securities Act of 1933 and the Securities Exchange Act of 1934 via Form S-1/A and Form 8-A filings.

The ETF’s listing application was certified by Nasdaq on November 12, 2025, with trading expected at the U.S. market open on Nov 13, 2025. The ETF charges an annual management fee of 0.50%.

How Does an XRP Spot ETF Work?

Here is a simplified breakdown:

1. Fund setup: Canary Capital files an S-1 registration statement for the ETF; it also files a Form 8-A to register shares under the Securities Exchange Act and lists on Nasdaq.

2. Custody and benchmark: The ETF holds actual XRP tokens in custody using Gemini and BitGo's services. The fund tracks an XRP-USD benchmark index, e.g., the CCIXber XRP-USD index, to determine NAV (net asset value).

3. Creation/redemption mechanism: Authorized Participants (APs) deliver XRP tokens to the fund (creation) or receive XRP when redeeming shares, helping keep ETF share price aligned with underlying token.

4. Trading for investors: Once live, you can buy ETF shares via your brokerage during market hours, just like a stock or other ETF.

5. Ongoing management: The fund charges an expense ratio of 0.50% to cover custody, administration, trading costs. The fund’s holdings are reported, generally daily or periodic, to provide transparency.

What Is the Significance of the Spot XRP ETF Launch?

The launch of the XRPC spot-XRP ETF matters because it opens the door for major institutions, such as pension funds, RIAs, and brokerage-clients, to access XRP via familiar regulated channels rather than crypto exchanges. Analysts expect this move to help shift billions of dollars into XRP as a “payment-infrastructure” token, not just a speculative asset.

Additionally, the XRP ETF signals a broader shift in crypto investment: the first wave of U.S. spot crypto ETFs focused on Bitcoin and Ethereum, but with XRP’s inclusion, altcoins now gain a regulated access path. The fund’s structure, holding real tokens, proper custody, and brokerage-style share trading, could tighten circulating supply and boost market legitimacy, potentially shifting demand dynamics and price discovery in the crypto market.

How to Buy Spot XRP ETF: Canary Capital's XRPC

Here is a practical guide for U.S.-based investors interested in buying and owning XRP ETFs. International investors should check their brokerage access and regulatory restrictions.

1. Open or use an existing brokerage account that offers U.S. equities/ETFs, e.g., Fidelity, Schwab, Robinhood, E*TRADE, Interactive Brokers.

2. Search for ticker “XRPC” when it becomes available on Nasdaq.

3. Select your order type:

• Limit order – you set a maximum price; useful for new ETFs with possible wide spreads.

4. Check the expense ratio and fees: ~0.50% is the annual management fee for XRPC.

5. Monitor liquidity and spreads: In the first few days/months, check trading volumes and bid-ask spreads; higher liquidity generally reduces slippage.

6. Tax and reporting: As an ETF, XRPC will be reported on standard brokerage tax forms, e.g., Form 1099, rather than crypto exchange statements.

7. Position sizing and risk management: Because crypto remains volatile, allocate accordingly, set alerts, consider

stop-losses if trading actively, and align with your risk profile.

What Are the Pros and Cons of Investing in the XRP Spot ETF?

Before buying XRPC, it’s important to weigh both the advantages and potential downsides:

Pros of Spot XRP ETFs

1. Regulated access: The ETF is SEC-registered and trades on Nasdaq, giving you transparent, compliant exposure to XRP without crypto-exchange risks.

2. Simplified investing: You can buy and sell XRPC shares directly through your regular brokerage account, no wallets or private keys required.

3. Transparent structure: Daily NAV updates and public filings let investors track fund holdings and performance in real time.

4. Tax efficiency: Brokerage-handled reporting (Form 1099) simplifies record-keeping compared to tracking individual crypto trades.

5. Institutional momentum: Analysts estimate first-month inflows could reach $500 million–$2 billion, potentially tightening XRP’s supply and boosting liquidity.

Risks of XRP ETF

1. Volatility remains: The ETF mirrors XRP’s price, so sharp crypto-market swings can still impact your investment.

2. Tracking differences: Fees and custody costs can cause small deviations between XRPC’s share price and spot XRP value.

3. Early-stage liquidity: During launch weeks, bid-ask spreads may widen and trade volumes may fluctuate until institutional volume stabilizes.

4. Regulatory evolution: Future SEC or global policy changes could affect fund operations or XRP’s classification.

5. Custody concentration: Despite institutional security, reliance on a few custodians, e.g., Gemini, BitGo, poses operational and counterparty risk.

6. Market performance risk: If ETF demand slows, inflows could stall, limiting price upside despite broader approval.

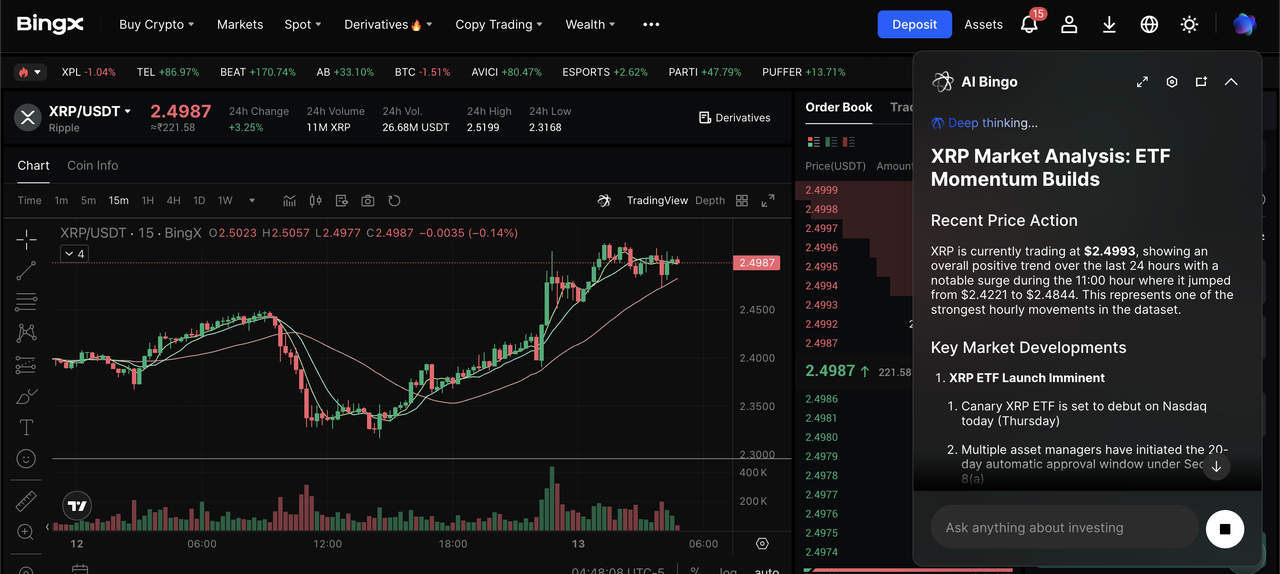

Alternative: Buying XRP Directly and Holding on BingX

XRP/USDT trading pair on the spot market powered by BingX AI insights

If you prefer owning XRP tokens directly, for trading flexibility, staking, or using them in the XRP Ledger ecosystem, you can easily buy them on BingX, one of the world’s leading crypto exchanges. Here’s a simple, practical guide for 2025:

1. Sign Up and Verify: Go to BingX.com, create an account using your email or phone, and complete KYC verification to unlock full trading and withdrawal limits.

2. Deposit Funds: Add funds through multiple options, bank transfer, credit/debit card, or zero-fee P2P trading for local currency deposits.

3. Buy XRP on Spot Market: Navigate to

Spot →

XRP/USDT, check the real-time price chart, enter the amount you wish to buy, and confirm your order.

4. Secure Your Assets: For long-term holding, you can keep XRP in your BingX Wallet, protected by cold storage and multi-signature security, or transfer it to a

self-custody wallet like

Ledger or Xumm for personal control.

5. Track and Manage: Use BingX’s Price Alerts, Portfolio Dashboard, and

Copy Trading tools to monitor XRP performance, set automated alerts, and learn from top traders.

Buying directly on BingX gives you 24/7 global market access, low fees, and the ability to send or use XRP on-chain, ideal for investors who want both control and utility beyond ETF exposure.

Buy and Hold XRP vs. Buying XRP ETF: A Comparison

Buying XRP directly on BingX gives you full control over your assets, 24/7 trading access, and the flexibility to use XRP for on-chain payments or DeFi applications, all with low fees and fast execution. In comparison, the XRPC ETF offers regulated exposure and brokerage convenience without wallets or private keys, but it trades only during U.S. market hours and charges an annual management fee.

Conclusion

The launch of XRPC ETF by Canary Capital ushers in a new chapter for altcoins in regulated markets. For investors seeking exposure to XRP via a brokerage environment, XRPC offers a practical and accessible vehicle. For others who want full control, on-chain uses, or 24-7 access, buying XRP directly remains valid.

Whether you choose the ETF or direct token ownership, understand the underlying exposure, fees, trading mechanics, and risks. As the crypto ETF ecosystem expands, XRPC stands as a key entry point into the broader altcoin narrative, especially for investors transitioning from traditional finance into crypto-native assets.

Related Reading

FAQs on XRP Spot ETFs

1. When is the XRP Spot ETF launch date?

The first U.S. spot XRP ETF, issued by Canary Capital, officially launched on November 13, 2025, under the ticker XRPC on the Nasdaq exchange. Other pending XRP ETF proposals, like those from Grayscale, Bitwise, and WisdomTree, have SEC decision deadlines ranging from October 2025 to early 2026, depending on their review cycles.

2. How many XRP ETFs have been filed so far?

As of November 2025, at least seven major issuers have submitted applications for XRP exchange-traded funds, including Canary Capital, Grayscale, Bitwise, 21Shares, Franklin Templeton, WisdomTree, and Volatility Shares. Most of these filings are structured as spot XRP ETFs, aiming to hold real XRP tokens rather than derivatives.

3. Has the SEC approved any XRP ETFs?

Yes, the SEC formally cleared Canary Capital’s XRPC ETF for listing in November 2025, making it the first approved and trading U.S. spot XRP ETF. Other applications remain under review within the SEC’s standard 240-day decision window, signaling ongoing momentum for broader approval across multiple issuers.

4. What is a Ripple or XRP ETF?

A Ripple or XRP ETF is an exchange-traded fund that tracks the price of XRP, the native token of the XRP Ledger, designed for instant, low-cost international payments. These ETFs give both retail and institutional investors a regulated, brokerage-based way to invest in XRP without handling crypto wallets or private keys.

5. Is XRP itself an ETF?

No, XRP is not an ETF, it is a cryptocurrency. However, ETFs like XRPC or proposed products from Grayscale and 21Shares allow investors to gain exposure to XRP’s price performance through regulated market shares rather than owning the token directly.

6. What’s the potential impact of XRP ETF approval on XRP price?

Market analysts forecast that a wave of XRP ETF approvals could significantly boost demand and liquidity, potentially leading to medium-term price targets between $5 – $10, with more optimistic projections extending to $20 if institutional inflows mirror Bitcoin’s ETF cycle.

7. How to invest in the XRP ETF or XRP directly?

To own XRP directly, sign up on

BingX, complete KYC, deposit funds, and

trade XRP/USDT on the spot market for 24/7 access and on-chain utility. To invest in the XRPC ETF, search the ticker “XRPC” on your brokerage platform, e.g., Fidelity, Schwab, Robinhood, and buy shares like any stock.