Privacy coins matter again because price action says so.

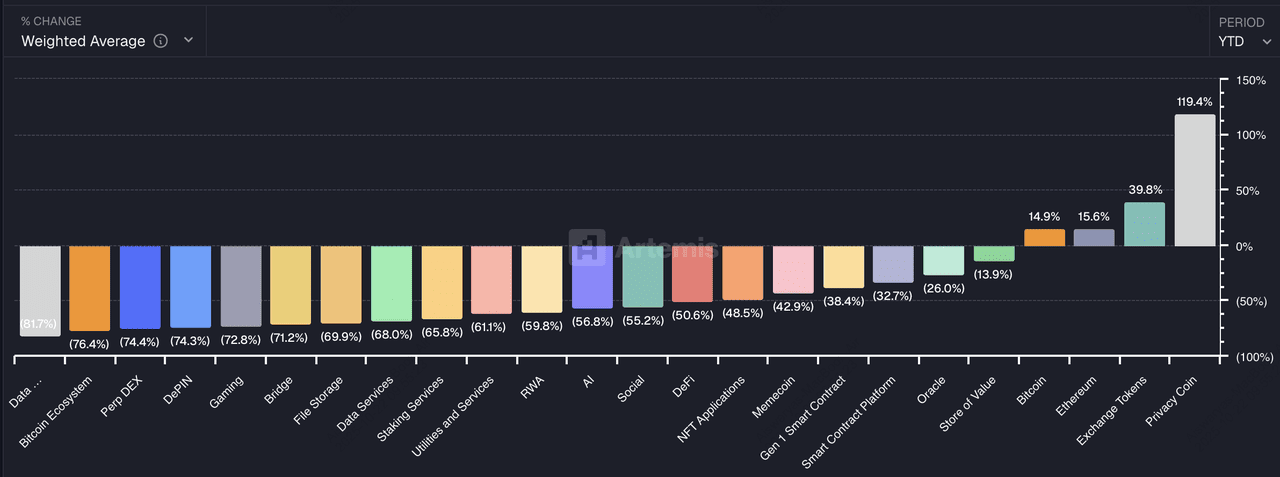

Artemis data shows the privacy sector up about 120% in 2025, outpacing

Bitcoin at roughly 28.5% and beating

Ethereum, exchange tokens, and “store-of-value” assets across the same window. Momentum accelerated in October after Naval Ravikant called Zcash “insurance against Bitcoin,” coinciding with a 400% hike in a month in ZEC price and fresh attention on private-by-design networks.

Privacy coins are up 120% in 2025 | Source: Artemis

At the same time, regulation is hardening. The EU’s new Anti-Money Laundering Regulation (AMLR) will ban anonymity-enhanced coins and anonymous crypto accounts from July 2027, and major exchanges in Europe have already restricted Monero. That’s the tension in a sentence: user demand for confidentiality vs. increasing compliance constraints.

In this article, you’ll learn how privacy coins work, why they matter, what’s moving prices right now, and the top privacy projects to watch, plus practical tips for trading privacy coins and managing risk.

What Are Privacy Coins and How Do They Work?

Privacy coins are cryptocurrencies that hide who’s paying whom and how much. Instead of showing everything on a public block explorer, they use cryptography to conceal sender, receiver, and amount right inside the protocol.

Common Models for Privacy Coins

• Private-by-default (e.g., Monero): Every transaction is private automatically. Monero combines ring signatures (hide the real signer among decoys), stealth addresses (one-time addresses so your wallet address never appears on-chain), and RingCT (conceals amounts). You can’t “forget” to turn privacy on—it’s built in.

• Optional privacy (e.g., Zcash): You choose between transparent addresses (work like typical crypto) and shielded addresses (private). Shielded transfers use zk-SNARKs, a proof that a valid transaction happened without revealing sender, receiver, or amount.

Privacy coins don’t depend on front-end tricks or third-party mixers to hide your data. Instead, the privacy is built into the blockchain itself, meaning the cryptography and consensus rules automatically conceal transaction details. This makes them far more secure and consistent because every transaction follows the same privacy standards. Some coins, like Zcash, even include “view keys,” which let you selectively share transaction data with trusted parties such as auditors or tax authorities without exposing your wallet publicly.

For everyday users, the key is choosing a coin that fits your needs. If you want privacy all the time, go for private-by-default coins like Monero. If you prefer flexibility or need to show transactions for compliance, opt for coins with optional privacy like Zcash. Always check whether your wallet or exchange supports shielded transactions, and test with a small amount first. Privacy transactions can have higher fees or slower confirmations, so plan accordingly, and if you need to report activity later, keep good records or use view keys to stay compliant.

Why Are Privacy Coins Surging in October 2025?

Source: Naval Ravikant on

X

The privacy coin rally in October 2025 was sparked by a strong narrative catalyst and reinforced by measurable on-chain accumulation. The immediate trigger came on October 1, when tech investor Naval Ravikant described Zcash (ZEC) as “insurance against Bitcoin.” Within 24 hours, ZEC jumped more than 60%, pulling the broader privacy sector up over 35% for the month. This narrative framed ZEC as both a speculative hedge and a philosophical statement about financial sovereignty, capturing trader and media attention during a period of low market confidence.

On-chain data reinforced that the rally wasn’t purely hype. As of late October 2025, Zcash’s shielded pool supply reached a record 4.5 million ZEC, now representing roughly 27.5% of the total supply. In the past three weeks alone, over 1 million ZEC were shielded, and a single day saw 959 new ZEC moved into private addresses, clear signs of long-term accumulation rather than short-term flipping. Similar patterns appeared in Monero and smaller privacy assets like Firo, where stable transaction counts suggested renewed user confidence despite tighter exchange rules.

Performance of top privacy coins over the past year | Source: CoinGecko

Macro and regulatory conditions added context to the rally. After a sharp market sell-off in September, traders rotated into so-called “dino coins,” older assets breaking multi-year downtrends, with ZEC and Dash leading the bounce. However, Monero’s liquidity lagged due to ongoing exchange delistings across the EEA, limiting upside for some investors. Meanwhile, the looming EU AMLR 2027 ban on anonymity-enhanced tokens kept institutional participation cautious, adding a persistent risk premium to European trading pairs.

What Are the Top 6 Privacy Coins to Watch in 2025?

Here are some of the most popular privacy tokens in the crypto market to watch this altcoin season:

1. Monero (XMR)

Monero is the most established privacy-by-default cryptocurrency, where every transaction automatically hides the sender, receiver, and amount using ring signatures, stealth addresses, and RingCT (Ring Confidential Transactions). Unlike optional privacy systems, Monero’s design eliminates the possibility of sending a traceable transaction by mistake. Launched in 2014, the network has processed over 32 million transactions to date, peaking at 8.8 million in 2021, and continues to evolve through protocol upgrades that improve scalability, wallet usability, and node efficiency.

As of October 2025, XMR is up about 7.1% over the past month and nearly 98% year-over-year, signaling renewed investor interest amid a broader privacy narrative rebound. Key developments to watch include improvements in light client performance, integration with hardware wallets, and exchange accessibility, especially in regions where privacy regulations are tightening. With infinite supply but tail emission fixed at 0.6 XMR per block, Monero maintains predictable inflation that supports long-term miner incentives, reinforcing its role as the benchmark for decentralized, private digital cash.

2. Zcash (ZEC)

Zcash is one of the earliest cryptocurrencies to integrate zero-knowledge proofs (zk-SNARKs), allowing users to send fully shielded or transparent transactions within the same network. This dual-mode design enables regulatory compatibility while preserving the option for complete privacy, though it also fragments liquidity between public and private pools. Launched in 2016 by the Electric Coin Company (ECC), Zcash introduced privacy as a choice rather than a default, laying the groundwork for many modern zk-based projects. The network’s ongoing upgrades, like Halo 2 recursive proofs and Unified Addresses, improve scalability, interoperability, and ease of use across wallets.

As of October 2025, ZEC has surged over 426% in the past month and 614% year-over-year, driven by a late-2025 rally fueled by investor interest in the Grayscale Zcash Trust and a spike in shielded pool adoption, which now represents roughly 27.5% of total supply. Trading volumes exceeded $860 million in 24 hours, showing renewed institutional curiosity amid the broader privacy coin resurgence. Key factors to watch include exchange support for shielded deposits/withdrawals, wallet defaults that simplify privacy, and the policy implications of the EU AMLR 2027 regulation, which could affect ZEC’s availability in regulated markets.

3. Firo (FIRO)

Firo (formerly Zcoin) is a privacy-preserving cryptocurrency that combines advanced cryptography with robust network security to achieve full transactional anonymity. Its core technology, Lelantus Spark, allows users to burn and later redeem coins, effectively breaking any traceable history between transactions. This creates “clean outputs” without forensic links, offering a higher degree of privacy than traditional mixers or shielded pools. At the network level, Dandelion++ hides users’ IP addresses and routing data, strengthening protection against deanonymization attacks. Firo’s hybrid Proof-of-Work (FiroPoW) and Chainlocks system also ensures near-instant finality and defense against 51% attacks, improving its reliability as a payment-focused blockchain.

As of October 2025, FIRO trades with a market cap of around $22.4 million and 24-hour trading volume of about $428,000, ranking #1207 by market cap. Its price has risen 104% in the past month, reflecting renewed attention to smaller-cap privacy coins amid the broader sector rebound. However, liquidity remains thin, meaning slippage can be significant during larger trades.

Beyond payments, Firo’s Spark Assets feature extends privacy to tokenized assets, enabling confidential applications like private voting, asset issuance, or DAO treasury management. With over 3,900 masternodes and active R&D roots in innovations like Zerocoin and Sigma, Firo continues to serve as a technically ambitious yet under-the-radar player in on-chain privacy infrastructure.

4. Dash (DASH)

Dash is a payment-focused cryptocurrency designed for speed, usability, and governance, blending crypto utility with real-world payment efficiency. Its PrivateSend feature, inspired by CoinJoin, offers optional transaction mixing for added privacy, while InstantSend enables confirmations in under two seconds, making Dash competitive with fintech payment systems. Originally launched as Darkcoin in 2014 and rebranded to Dash (“Digital Cash”) in 2015, it pioneered a self-funding, two-tier governance model, where masternodes vote on development proposals funded directly from block rewards.

As of October 2025, DASH trades with a market capitalization of $564 million and 24-hour volume near $198 million, ranking #153 by market cap. The token has surged over 107% in the past month, driven by renewed interest in fast, low-fee payments and legacy “dino coins.” However, optional privacy remains less robust than default-private designs like Monero, and regional delistings have constrained liquidity. Watch for adoption of DashPay, the project’s app-layer initiative enabling usernames and contact-style payments, as well as evolving exchange policies around PrivateSend, which could influence future accessibility and retail traction.

5. Grin (GRIN)

Grin is a lightweight privacy cryptocurrency built on the MimbleWimble protocol, which combines scalability and confidentiality through a design that eliminates traditional addresses and merges transactions to obscure sender-receiver links. Its Cut-Through mechanism prunes old data, drastically reducing blockchain size and improving on-chain efficiency, a key advantage for users who prioritize minimal storage overhead and high throughput. With no fixed supply cap, Grin adopts an emission model of 1 GRIN per second, creating predictable inflation that encourages spending rather than hoarding.

As of October 2025, GRIN trades with a market cap of roughly $8.3 million and a modest daily trading volume of $17,000, ranking #1904 by market cap. The token has gained about 10.8% in the past month and 40% over the past year, though its liquidity remains thin across exchanges, causing sharp intraday price moves. Traders and developers should watch for improvements in wallet UX, DEX integrations, and core tooling updates, as these factors could determine whether Grin’s elegant privacy design can attract broader adoption beyond niche enthusiasts.

6. Secret Network (SCRT)

Secret Network (SCRT) extends blockchain privacy beyond payments to data and computation, enabling smart contracts, called Secret Contracts, that process encrypted inputs and outputs without revealing sensitive data on-chain. Built on the

Cosmos SDK, it powers use cases like private DeFi positions, sealed-bid auctions, and identity-protected applications, bridging confidentiality with programmability. The network uses Trusted Execution Environments (TEEs) to secure computations, though these enclaves come with hardware trust trade-offs that developers must evaluate carefully.

As of October 2025, SCRT trades with a market cap of $51 million, a 7-day gain of over 16%, and TVL above $5.6 million, showing steady growth in DeFi participation. The network’s momentum hinges on cross-chain integrations and app-layer adoption, particularly bridges to Ethereum, Cosmos, and

Solana ecosystems. However, its regulatory perception risk remains high, as policymakers often conflate computational privacy with transactional anonymity, which could affect listings and institutional interest. For developers and investors, Secret Network represents a next-generation privacy layer, one that shifts focus from hiding transactions to protecting the logic and data behind decentralized applications.

What Are the Key Use Cases of Privacy Coins?

Privacy coins have evolved beyond niche tech experiments, serving real-world use cases for individuals, businesses, and even humanitarian causes, offering both financial security and data protection in an increasingly transparent world.

1. Personal Finance and Safety: Privacy coins allow individuals to keep their salaries, balances, and donations confidential, preventing unwanted tracking or profiling. For example, Zcash’s view keys let you share transaction details privately with accountants or tax agencies, balancing privacy with compliance. In high-risk regions, this can reduce exposure to scams or identity theft tied to visible on-chain wealth.

2. Business and Institutional Use: Companies use privacy coins to shield sensitive financial flows, such as payroll data, vendor lists, or treasury transfers. By using private-by-default coins like Monero, enterprises can protect trade secrets and operational data while maintaining verifiable audit trails through cryptographic proofs, rather than public transaction records.

3. Censorship Resistance and Humanitarian Aid: In countries facing financial surveillance or capital controls, privacy coins provide a lifeline for activists, NGOs, and journalists who need to receive or send funds securely. For instance, during regional crackdowns, Monero and Zcash transactions have helped preserve access to funds without exposing recipient identities, though availability remains limited on some regulated exchanges.

4. Portfolio Diversification: Historically, privacy coins have shown low short-term correlation with Bitcoin and Ethereum during certain rotations. In 2025, the privacy sector rose over 120% YTD, compared to Bitcoin’s 28%, showing their ability to outperform in narrative-driven phases. However, these gains often reverse quickly with regulatory headlines, so position sizing, stop-losses, and venue liquidity checks are essential.

Key Considerations Before Investing in Privacy Coins

Before investing in privacy coins, it’s important to understand the unique blend of regulatory, technical, and liquidity risks that define this niche sector. While projects like Monero (XMR) and Zcash (ZEC) offer powerful privacy features and long-term potential, they also face stricter compliance scrutiny, thinner liquidity, and sharp sentiment swings compared to large-cap assets like Bitcoin or Ethereum.

Privacy coins have historically delivered strong upside during late-cycle rotations, the sector is up over 120% in 2025, according to Artemis data, but their rallies are often short-lived due to headline risk and exchange restrictions. The best approach is limited, informed exposure paired with strict risk management.

1. Regulation and Availability: The EU Anti-Money Laundering Regulation (AMLR) will ban anonymity-enhanced coins and private accounts from July 2027, with several exchanges expected to delist early. For instance, Kraken removed Monero trading for EEA clients in late 2024, reflecting a broader trend of regulatory pre-compliance. Always confirm that your exchange supports deposits, withdrawals, and trading for privacy coins before committing capital.

2. Technology Model: Choose the privacy model that suits your goals. Monero offers full privacy by default, while Zcash provides optional shielding so users can select between transparent and private transfers. If you anticipate needing transaction records for audits or taxes, opt for tokens or wallets that support view keys or selective disclosure tools.

3. Liquidity and Volatility: Most privacy coins trade on fewer venues and feature 3–5% bid–ask spreads—a sign of shallow order books. Use limit orders and avoid illiquid hours or sudden breakouts. Volatility spikes are common: in October 2025, ZEC surged over 380% in one month, followed by a 20–35% pullback as traders locked in profits.

4. On-chain Health: Track active addresses, transaction velocity, and shielded pool growth to assess real user adoption. For example, Zcash’s shielded supply hit a record 4.5 million ZEC (27.5% of total) in October 2025, with over 1 million ZEC shielded in just three weeks—a strong sign of accumulation rather than speculative churn. Favor projects that publish auditable, time-stamped metrics rather than opaque dashboards.

5. Security and OPSEC: Privacy doesn’t replace good security. Avoid address reuse, store seed phrases offline, and use privacy-preserving networks (e.g., Tor or VPNs) if permitted in your jurisdiction. Remember: if your endpoint is compromised, on-chain privacy won’t protect you.

6. Taxes and Reporting: Keep full transaction logs. Many jurisdictions require proof of transfer, even for shielded assets. Use wallets with view keys where possible to simplify reporting and avoid compliance issues later.

7. Position Sizing and Risk Management: Treat privacy coins as high-beta, narrative-driven assets that can outperform in rotation phases but reverse just as fast. Limit exposure to under 5% of your portfolio, use dollar-cost averaging (DCA) for entries, and size trades based on liquidity depth. Set stop-loss levels and regularly review exchange policies and regulatory updates to adjust exposure when conditions change.

Conclusion

Privacy coins earned real attention in 2025, but the lane is still narrow. Liquidity remains patchy, exchange rules can shift quickly, and headlines move prices faster than fundamentals. If you need strict on-chain confidentiality, Monero and Zcash make the clearest product case. If your priority is ease of access, liquidity, and exchange support, the trade-off becomes less favorable.

While short-term opportunities exist, especially during narrative rotations or market dislocations, success in this sector demands thorough research, strong risk controls, and awareness of regulatory timelines like the EU AMLR 2027 rule set.

In short, privacy coins remain one of crypto’s most polarizing yet resilient sub-sectors. Demand for financial confidentiality is real, but so are the risks. Smart investors treat privacy coins as a hedge, not a core position, balancing conviction in privacy technology with respect for regulation, liquidity constraints, and volatility cycles.

Related Reading