Espresso is a high-performance coordination layer purpose-built for rollups, enabling them to achieve the speed of centralized servers without sacrificing the security of decentralized networks. As of early 2026, Espresso has transitioned to a decentralized

Proof-of-Stake (PoS) network, providing real-time confirmations for industry giants like ApeChain,

Celo,

Arbitrum, and

Polygon. By acting as a "nervous system" for the modular stack, Espresso ensures that thousands of independent chains can work together as a single, unified internet.

In this article, you will learn what Espresso is, how its unique consensus and data availability layers function, the utility of the ESP token, why it is essential for the next generation of interoperable Web3 applications, and how to trade Espresso (ESP) on the BingX futures market.

What Is Espresso (ESP) Base Layer?

Espresso is a modular blockchain infrastructure project that provides a shared source of truth for

Layer 2 and Layer 3 scaling solutions. While rollups have successfully scaled

Ethereum's throughput, they have inadvertently created "silos" where liquidity and users are trapped on individual chains. Espresso fixes this by offering a decentralized, shared sequencing layer that allows different rollups to coordinate transactions simultaneously.

Espresso operates through three primary pillars:

1. Shared Sequencing: Replaces the single, centralized sequencers used by most rollups with a decentralized network of validators.

2. Fast Finality: Delivers transaction confirmations in roughly 2 seconds, compared to the 12+ minutes typically required for Ethereum L1 finality.

3. The Espresso Marketplace: A cross-chain builder market where rollups can auction transaction-ordering rights to specialized builders, maximizing revenue and enabling "atomic" cross-chain swaps.

In 2025, Espresso moved from internal devnets to a production-ready mainnet, onboarding a massive ecosystem of partners including Offchain Labs, Caldera, and AltLayer. By early 2026, it became the largest shared sequencer network by integrated chain count, facilitating seamless asset movement across the "Infinite Garden" of Ethereum.

How Does Espresso Network Work?

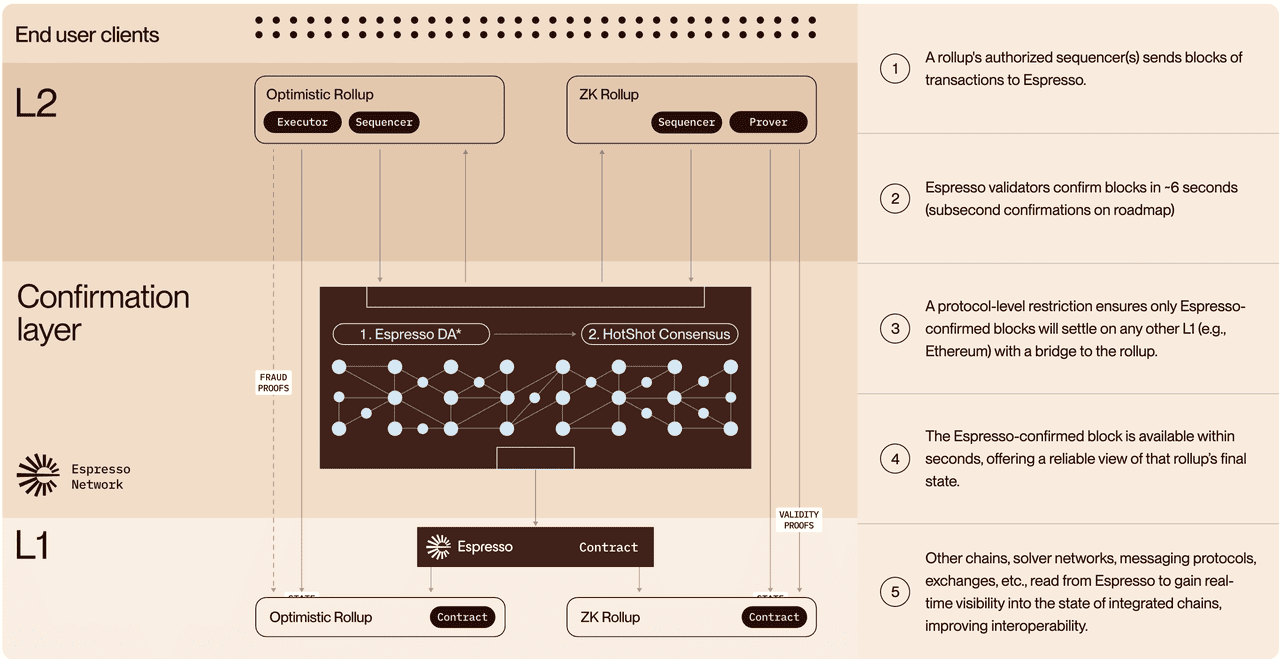

An overview of Espresso network's architecture | Source: Espresso

Espresso separates the tasks of ordering transactions and executing them. While a rollup like Arbitrum still handles the execution of its own smart contracts, it offloads the ordering and data storage to Espresso.

1. HotShot Consensus Protocol

HotShot is Espresso’s "engine," a state-of-the-art Byzantine Fault Tolerant (BFT) consensus protocol. Unlike traditional BFT systems that slow down as more nodes join, HotShot uses a specialized architecture to scale to tens of thousands of nodes while maintaining sub-2-second finality. It features optimistic responsiveness, meaning the network commits blocks as fast as the internet allows, rather than waiting for fixed, pessimistic block times.

2. Tiramisu Data Availability (DA)

For rollups to be secure, their data must be available for anyone to verify. Tiramisu is Espresso’s high-throughput

data availability (DA) layer. It ensures that transaction data is accessible to all nodes in the network without requiring every node to download the entire dataset, significantly reducing the cost for integrated rollups.

3. The Sequencing Flow

• User Submission: A user sends a transaction to an Espresso-integrated rollup.

• Espresso Ordering: The transaction is forwarded to Espresso validators who order it within a global block.

• HotShot Confirmation: Validators reach consensus, providing a "confirmation" that the transaction is finalized.

• L1 Settlement: The ordered batch is eventually posted to Ethereum, but because Espresso has already confirmed it, apps can act on the state in real-time.

What Are the Key Features of the Espresso Ecosystem?

Espresso offers a suite of tools designed to make the multi-chain experience feel like using a single, high-speed application.

Espresso Confirmations

Chains need a shared source of truth to confirm the state transitions of other chains quickly. Espresso Confirmations allow a bridge or a dApp on Chain A to trust that a transaction on Chain B is finalized in seconds. This eliminates the "waiting period" that plagues traditional cross-chain interactions.

Presto: Bridgeless Transactions

Launched in late 2025, Presto is a framework powered by Espresso that enables one-click cross-chain transactions. Users can pay for an item on ApeChain using funds located on Arbitrum without manually bridging assets. Presto leverages Espresso’s fast finality to settle these "intent-based" trades instantly.

The Espresso Marketplace

This is a permissionless market for sequencing rights. It allows rollups to capture more value from MEV (Maximal Extractable Value) by letting professional builders compete to order transactions across multiple chains, which is essential for arbitrageurs and liquidity providers who need to execute trades across different environments simultaneously.

What Is the ESP Token Used for?

The ESP token is the utility and governance heart of the Espresso Network. Issued as an ERC-20 token on Ethereum, it transitioned the network from a managed environment to a permissionless, community-validated system.

• Validator Staking: To participate in HotShot consensus, node operators must stake ESP. The top 100 validators by stake size are selected to secure the network.

• Delegation and Security: ESP holders can delegate their tokens to trusted validators, earning a share of protocol rewards and strengthening the network's economic security.

• Protocol Fees: Fees for data availability and sequencing are paid in ESP, creating a direct link between network usage and token utility.

• Governance: ESP holders participate in the Espresso Foundation's DAO, voting on protocol upgrades, reward schedules, and treasury grants.

What Is Espresso (ESP) Tokenomics?

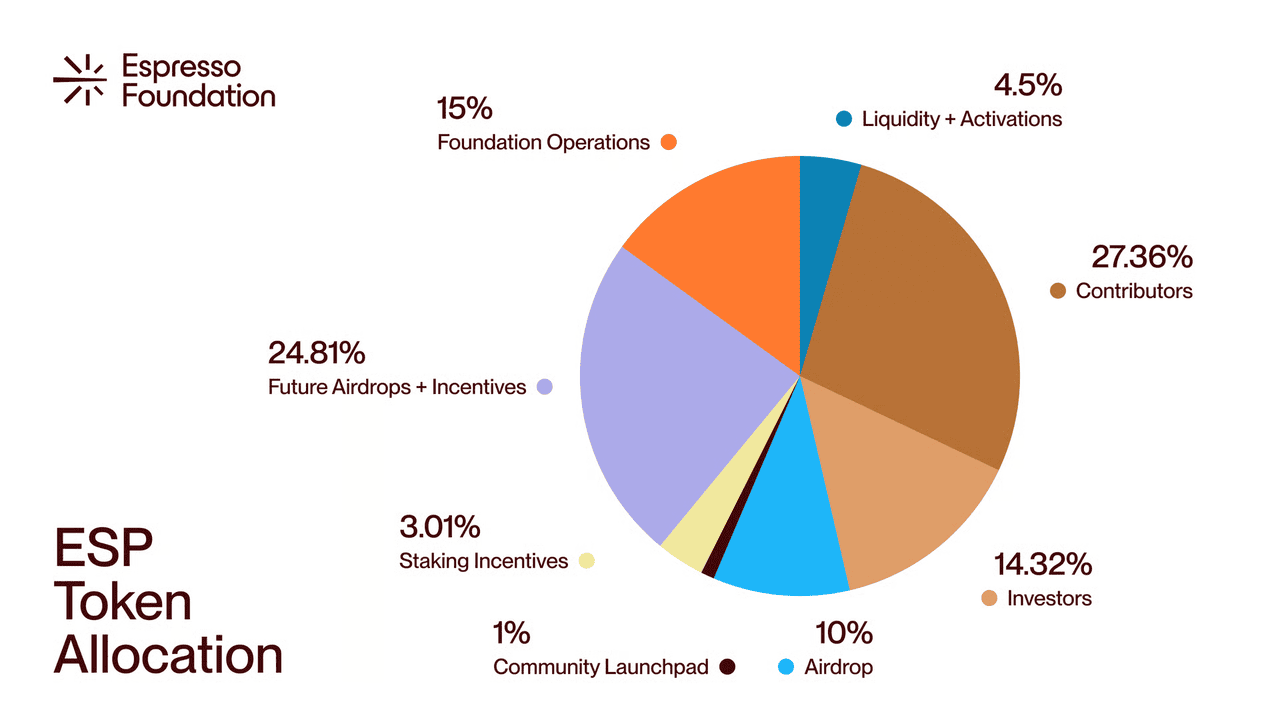

ESP token distribution | Source: Espresso blog

The $ESP token is an ERC-20 utility asset on the Ethereum mainnet with an initial total supply of 3.59 billion tokens and no fixed maximum supply due to its dynamic staking reward mechanism.

• Contributors (27.36%): Allocated to the research and development teams behind Espresso since 2020; subject to a 1-year cliff and 4-year linear vesting.

• Investors (14.32%): Reserved for early backers across multiple funding rounds; subject to a 1-year cliff and 4-year linear vesting.

• Future Airdrops, Grants, and Incentives (24.81%): Earmarked for long-term ecosystem development and community growth, vesting over a 6-year period.

• Foundation Operations (15.00%): Dedicated to the Espresso Foundation’s ongoing legal, administrative, and research efforts; subject to a 6-year linear unlock.

• Airdrop (10.00%): Distributed to over 1 million eligible community members and partner ecosystem users; fully unlocked at TGE.

• Liquidity Provisioning (4.50%): Reserved for market making and ensuring deep liquidity across exchanges; fully unlocked at TGE.

• Staking Bonuses (3.01%): Extra incentives for early airdrop recipients who stake their tokens, offering up to a 420% boost for a 2-year commitment.

• Community Launchpad (1.00%): Allocated to participants in the July 2025 community offering; subject to a 2-year linear vest with a 1-year cliff.

What Is the Espresso Airdrop and How to Claim ES Tokens?

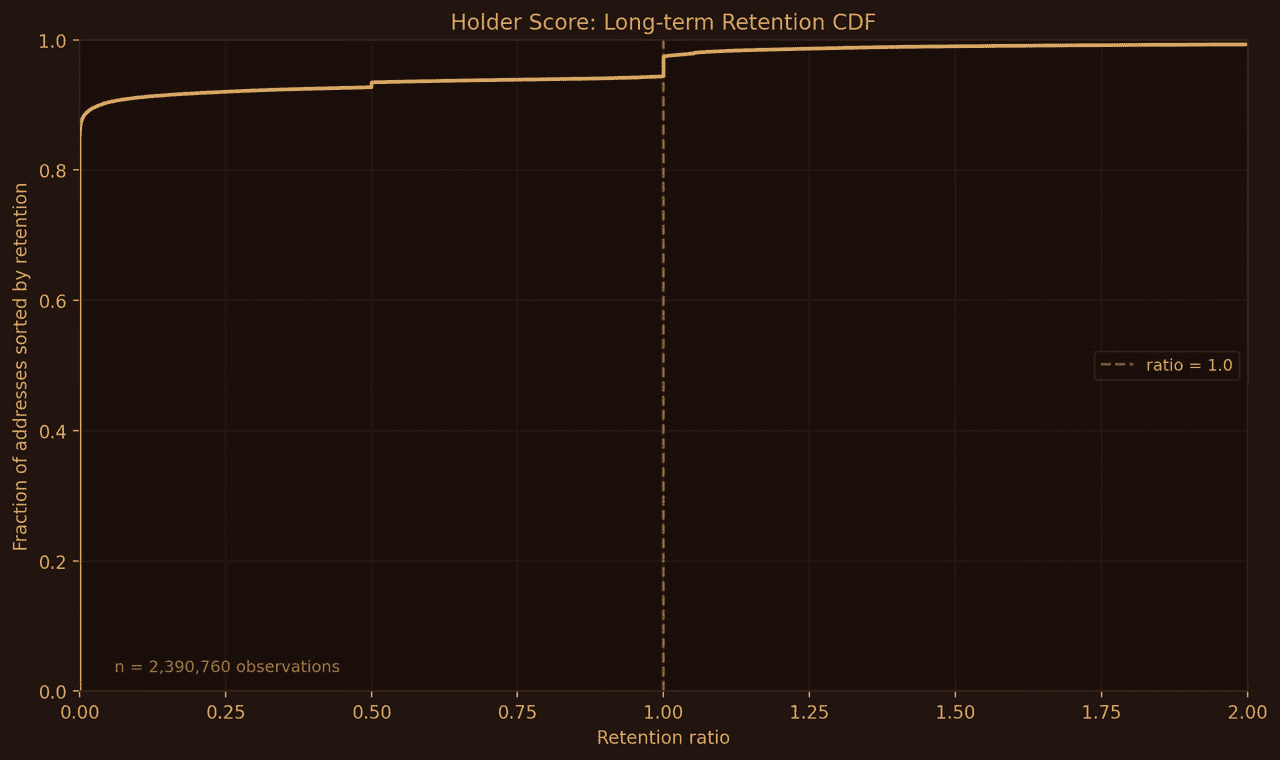

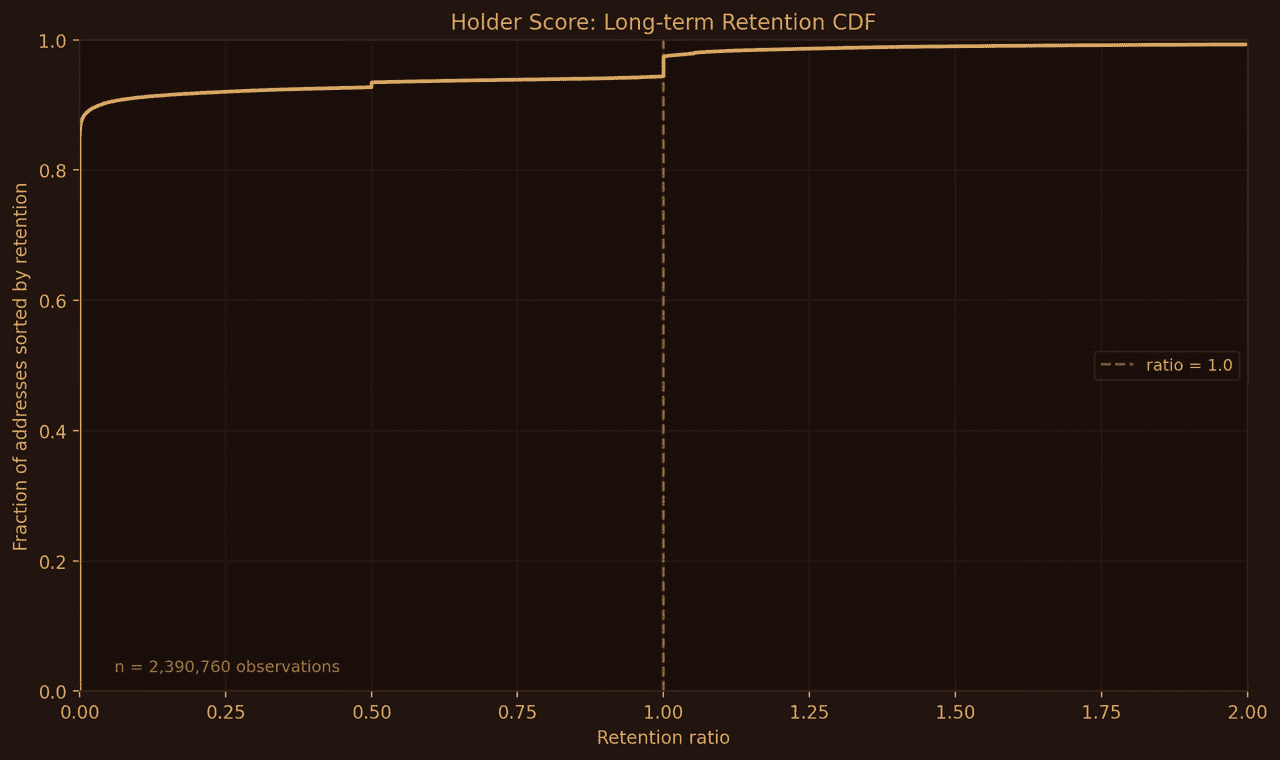

How holder scores work for the Espresso airdrop | Source: Espresso blog

As of February 2026, the Espresso Network has officially transitioned into its Token Generation Event (TGE), opening the portal for eligible participants to claim their share of the 359 million ESP allocated for the first community airdrop.

To secure your tokens, follow these essential steps:

1. Visit the Official Portal: Navigate to the verified

Espresso airdrop claim site. Always double-check the URL to avoid phishing attempts, as scammers often target TGE events with fake claim links.

2. Connect Your Wallet: Use the EVM-compatible wallet, such as MetaMask, that you used to interact with Espresso testnets or partner ecosystems like ApeChain, Celo, or Arbitrum.

3. Complete Proof-of-Humanity (PoH): Espresso utilizes the Authena verification system to filter out bots. You may need to sign a gasless transaction or mint a PoH NFT on a supported network like Base to finalize your registration.

4. Check Your Allocation: Once connected, the dashboard will reveal your base allocation and your Holder Score bonus, a unique multiplier that rewards users for holding previous airdrops rather than selling them immediately.

5. Execute the Claim: Confirm the transaction on Ethereum Mainnet. Ensure you have a small amount of ETH for gas fees, though many eligible cardholders or specific campaign participants may benefit from "gasless" claiming features if applicable. You can buy ETH tokens on BingX to fund your wallet.

Learn more about the eligibility criteria and the innovative Holder Score mechanism in our comprehensive

Espresso (ESP) airdrop guide.

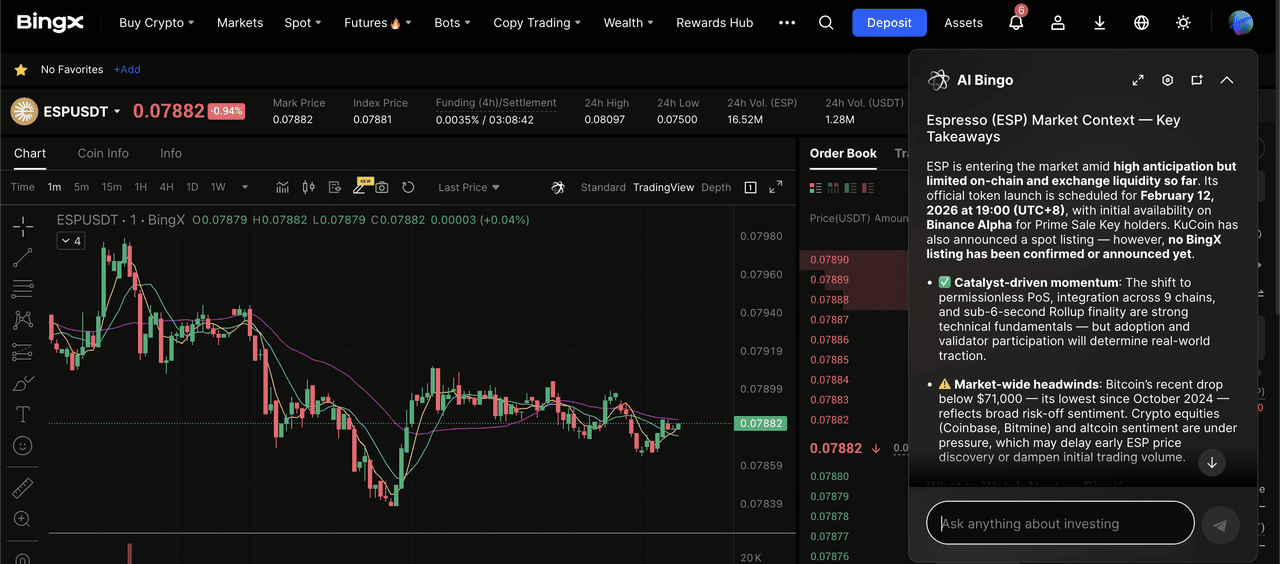

How to Trade Espresso (ESP) on BingX: A Step-by-Step Guide

ESP/USDT perpetuals on the futures market powered by BingX AI insights

With ESP’s launch on February 12, 2026, BingX provides the most liquid environment for trading the token using AI-enhanced market insights. Whether you are looking to hold the asset or trade its volatility, follow these steps to get started.

Long or Short ESP with Leverage on the Futures Market

For experienced traders, BingX offers ESP Perpetual Futures with up to 10x leverage. This allows you to hedge your airdrop or speculate on the network's growth as more rollups integrate into the Espresso ecosystem.

1. Transfer Funds: Move USDT from your Spot Account to your Perpetual Futures Account.

3. Set Your Margin Mode:

• Isolated Margin: Limits your risk to the specific amount allocated to that trade.

• Cross Margin: Uses your entire futures balance to prevent liquidation.

4. Choose Leverage and Direction: Select your leverage, e.g., 2x or 5x. Click Long if you expect the price to rise, or Short to profit from a price decline.

3 Key Considerations Before Using Espresso (ESP)

Before using Espresso (ESP), it’s important to understand a few core factors that can affect your experience, including how the protocol works, the risks involved, and whether it aligns with your goals and risk tolerance.

1. Network Specialization: Espresso is a base layer for other chains, not a general-purpose blockchain for users to deploy dApps directly. Its value comes from the volume of rollups it supports.

2. Economic Security: As a PoS network, the security of the sequencing depends on the total value of ESP staked. A higher ESP price generally correlates to a more secure rollup ecosystem.

3. Ecosystem Adoption: Espresso's success is tied to the "Modular" thesis. Its growth depends on developers choosing shared sequencing over the centralized sequencers provided by default by some L2 stacks.

Final Thoughts: Is Espresso the Future of Ethereum?

Espresso (ESP) addresses the critical "silo" bottleneck by providing the infrastructure for real-time interoperability and shared security, essential for a unified rollup ecosystem. By decentralizing the sequencing process and offering fast finality through the HotShot protocol, Espresso facilitates the "Infinite Garden" vision where chains operate as a single, cohesive network. For those focused on the long-term scalability and composability of the Ethereum ecosystem, Espresso represents a foundational coordination layer.

Espresso carries protocol and adoption risks tied to its early-stage infrastructure and reliance on rollup integration, while the ESP token remains highly volatile and subject to regulatory uncertainty, always assess these factors and your risk tolerance before participating.

Related Reading