aPriori is a

MEV-powered liquid staking and order-flow coordination layer on

Monad: aprMON keeps staked

MON liquid for DeFi, while APR coordinates governance, incentives, and ecosystem growth.

This article covers how aPriori works, what sets it apart from other

liquid staking protocols, its tokenomics, and how to trade APR on BingX.

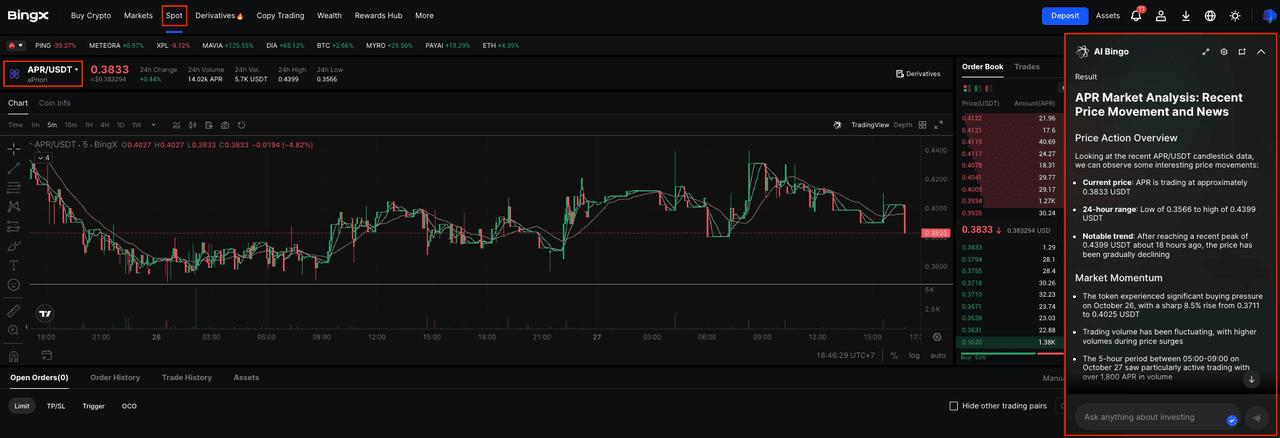

aPriori (APR) Price Chart 7 days | Source:

CoingeckoWhat Is aPriori (APR) and How Does It Work?

aPriori is a

liquid staking and order-flow coordination layer built for high-throughput chains, with an initial focus on Monad (MON). It lets you stake MON while keeping liquidity through aprMON, a freely transferable liquid

staking token that tracks your share of a vault. Instead of increasing the number of tokens in your wallet, aprMON follows a reward-bearing model: the token count stays constant while value per token rises as staking and MEV rewards accrue.

Under the hood, aPriori runs a

staking vault that delegates deposits across a curated set of high-performing validators and actively rebalances to support decentralization on

Monad. That removes the need to run a validator or hand-pick delegates.

Beyond staking, aPriori introduces an order-flow segmentation engine that classifies trades in real time and a routing layer that directs low-risk orders to efficient liquidity while isolating riskier flow along more resilient paths. MEV captured on Monad is redistributed so that value flows back to stakers and validators, aligning incentives between participants who secure the network and those who trade on it.

Together, these parts let you keep using aprMON across

DeFi for collateral, lending, and liquidity provision while the underlying MON continues to earn both consensus-level rewards and MEV-driven yield enhancements.

Key APR Token Utilities

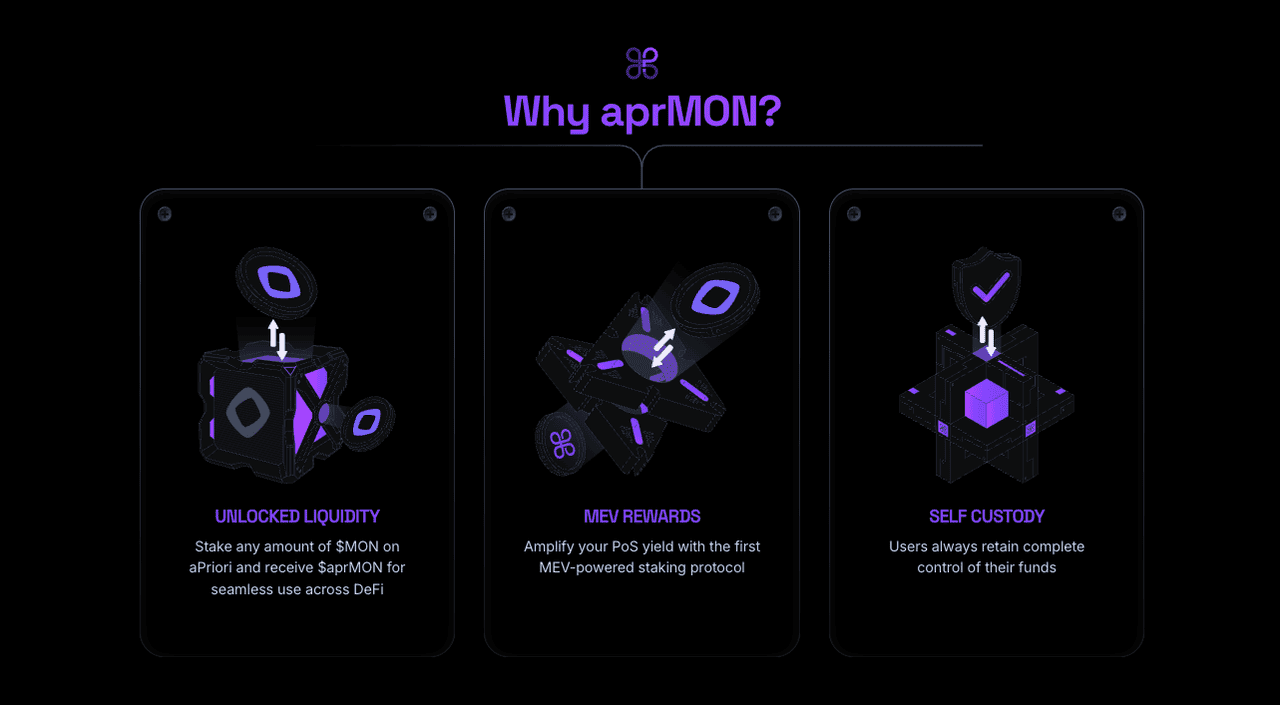

1. aprMON: Liquid Staking Utility

• Represents your staked MON and accrued rewards in aPriori’s vault.

• Reward-bearing model: balance stays constant; value per token increases with staking and MEV rewards.

• Usable across DeFi for collateral, lending, and liquidity provision.

• You retain full control of your

wallet; staking and unstaking are executed directly with aPriori’s staking vault contract.

2. APR: Coordination and Governance

• Represents participation in aPriori’s coordination layer that links order flow, data, and value redistribution.

• Governance: holders help set validator criteria, fee parameters, incentive programs, and upgrade priorities.

• Community and ecosystem programs: used for

airdrops, staking incentives, and partnerships that expand DeFi integrations.

• Cross-network footprint: launched on Ethereum with claims on Ethereum and BNB Chain; most airdrop allocation and remaining supply unlock on Monad.

What Is aPriori (APR) Tokenomics?

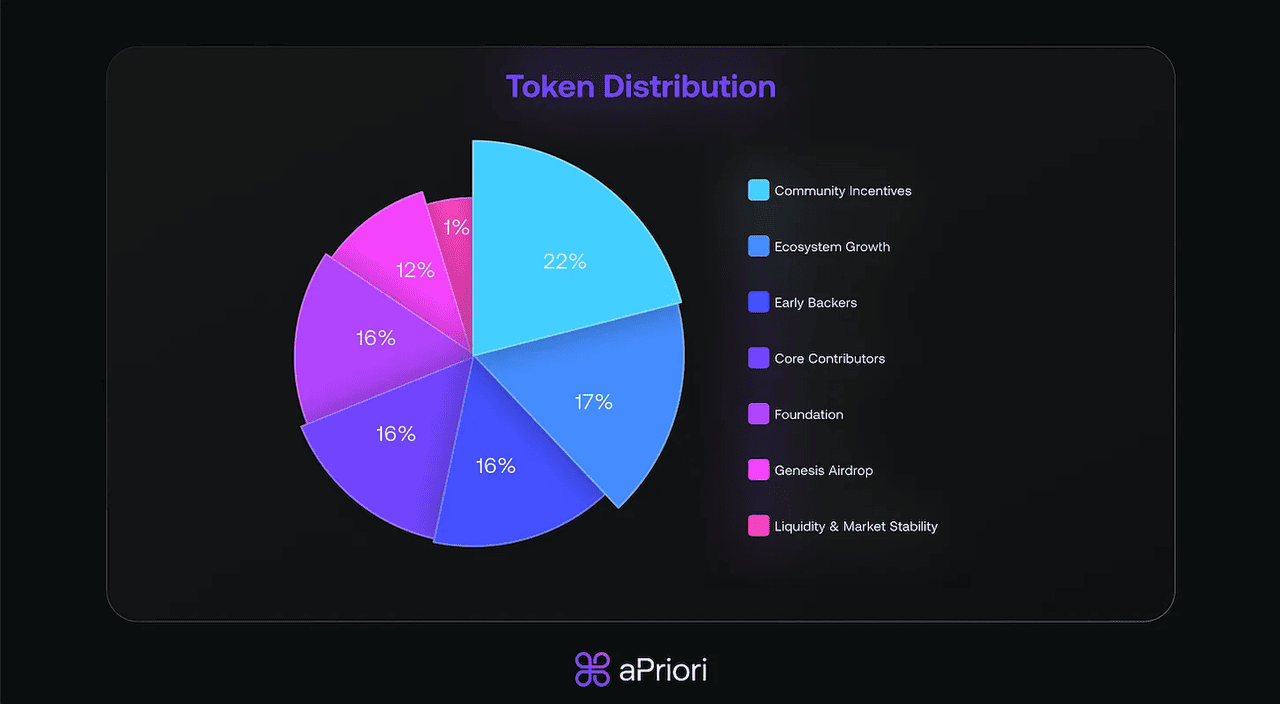

The supply of APR is fixed at 1,000,000,000, with an initial circulating amount of 185,000,000. Distribution is structured to balance early buildout with long-term alignment:

• Early Backers 16%: capital that funded core infrastructure and team expansion.

• Core Contributors 16%: developers, researchers, and coordinators maintaining the protocol and governance stack.

• Foundation 16%: operations, community programs, and grants for ecosystem development.

• Genesis Airdrop 12%: recognition of early contributors and expansion of the aPriori community, including meaningful on-chain and data contributions.

• Community Incentives 22%: future airdrops, staking rewards, governance incentives, and partnership programs.

• Ecosystem Growth 17%: adoption initiatives and strategic collaborations.

• Liquidity and Market Stability 1%: exchange liquidity to reduce early volatility.

How Does aPriori Differ From Other Liquid Staking Protocols?

Liquid staking often looks similar at first glance, but aPriori adds three pillars that change outcomes: a reward bearing LST (aprMON), an MEV aware order flow layer that redistributes value, and active validator rebalancing on Monad.

The table below contrasts aPriori with typical LSTs across value capture, token model, validator strategy, yield drivers, governance, DeFi utility, networks, exits, risk, and accounting so you can see where it differs in practice.

| Feature |

aPriori (APR + aprMON) |

Typical LSTs |

| Value capture |

MEV-aware order flow with redistribution to stakers and validators |

Consensus rewards only |

| LST model |

Reward-bearing exchange rate. Token balance stays constant |

Rebase or index models that change balances |

| Validator strategy |

Curated Monad validators with active rebalancing |

Static sets or user-picked validators |

| Yield drivers |

Consensus rewards plus realized MEV |

Mostly consensus rewards |

| Governance |

APR as governance and utility token for protocol parameters |

Governance often limited to basic parameters |

| DeFi utility |

aprMON designed for collateral, lending, and LP while MON keeps earning |

Varies by protocol and chain |

| Cross-network |

Airdrop claims on Ethereum and BNB Chain, larger unlock options on Monad mainnet |

Often single-chain focus |

How to Trade aPriori (APR) on BingX

Whether you are building a long-term APR position, trading short-term volatility, or reacting to major news events, BingX provides flexible ways to trade the token. With

BingX AI integrated directly into the trading interface, you can access real-time insights to support smarter trading decisions across both spot and futures markets.

How to Trade APR on Spot

APR/USDT trading pair on the spot market powered by Bingx AI

2. Plan the trade: On the chart, click the AI icon to view support and resistance, breakout zones, and suggested entry areas. Decide your entry, stop loss, and take profit.

3. Place and manage the order: Choose Limit or

Market, set size, and confirm. Add your stop loss and take profit immediately. If needed, deposit APR or USDT and verify the correct network before trading.

Always conduct your own research (

DYOR). Diversify your portfolio and never invest more than you can afford to lose.

How to Trade APR Perpetual Futures

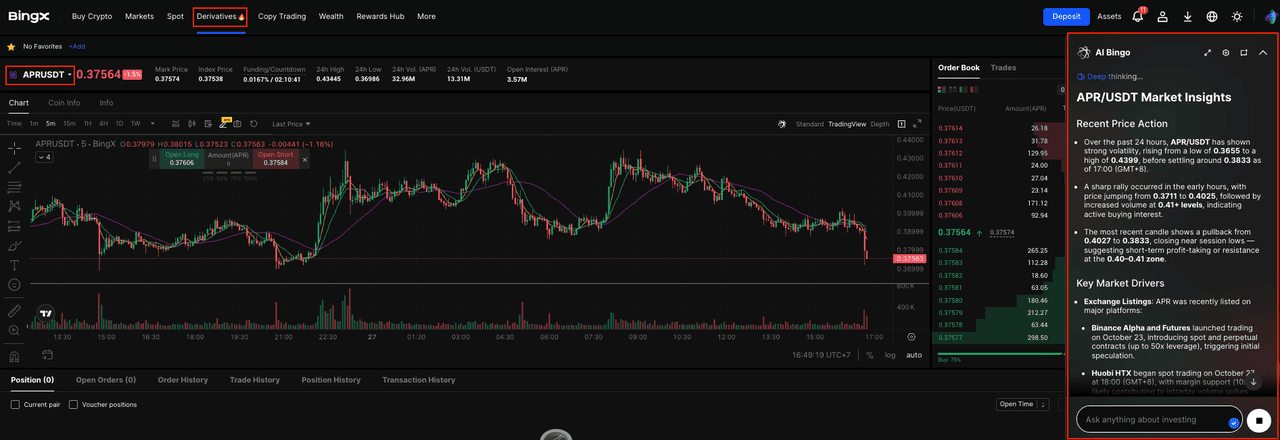

APR/USDT perpetual contract on BingX futures powered by AI BingX

Futures, especially perpetual futures, let you trade APR price movements with leverage; you don’t necessarily need to hold the underlying APR. You can go long (betting price will rise) or short (betting price will fall). BingX offers an

APR-USDT perpetual contract.

1. Switch to the futures/perpetual trading section in BingX: Navigate to

Futures and locate APR-USDT perpetual contract.

2. Review contract specifications: Things to check include:

• Leverage limits, e.g. 5×, 10×, etc.

• Maintenance margin and initial margin rates

• Funding rate (periodic payments between longs and shorts)

• Mark price, index price, and settlement rules

3. Choose direction (Long or Short) and leverage: Based on your market view, open a long or short position. Leverage amplifies both gains and losses, so use with caution.

4. Set entry, exit & risk controls

• Use take-profit orders

• Monitor your margin level

• Be mindful of liquidation risk, if losses push margin below maintenance

5. Monitor funding and rollovers: As a perpetual contract, there will be a funding rate mechanism (to keep contract price close to the spot). Depending on whether you're long or short, you may either pay or receive funding periodically.

6. Close the position: When your target is hit (or your stop), close the position, and your P&L (profit/loss) will be settled in USDT.

Final Notes

Use only aPriori’s verified links on the correct chain. aprMON is reward bearing: your token count stays the same while the exchange rate increases; exits can involve queues or fees, so check terms before unstaking.

Yields vary with fees, gas, and MEV, and there is smart contract and leverage risk; use a hardware wallet, limit approvals, watch funding on perps, keep records, and never invest more than you can afford to lose.

Related Reading