AI-powered crypto exchanges are platforms that use

artificial intelligence (AI) to help you trade, manage risk, and make decisions more easily. Instead of staring at charts all day, these exchanges use AI to analyze price action, funding rates, news, and

on-chain data, then turn that into simple, actionable insights.

By 2026, this has become the fastest-growing segment of crypto trading. Beginners now expect their exchange to do more than just execute orders. They want guidance, automation, and protection built in. That’s exactly what AI-first exchanges deliver.

This guide breaks down the top AI-powered crypto exchanges for beginners in 2026, based on ease of use, automation, safety, and how much real help the AI actually provides.

What Makes an AI-Powered Crypto Exchange Different?

A traditional crypto exchange gives you charts, order books, and

indicators, but it leaves you to figure out what they mean. An AI-powered exchange acts like a built-in trading assistant that interprets the data for you and tells you what’s happening in real time.

Instead of staring at multiple screens, the AI continuously analyzes:

• Market sentiment from news, social media, and trader positioning

• Whale and on-chain activity to identify large money flows

• Liquidity and order book changes to see where price is likely to move next

• Your own trading history to understand your risk profile and habits

From this, it delivers clear, actionable guidance, such as:

• When a setup looks strong or risky

• Whether your position is over-leveraged

• Where smarter entry and exit levels may be

• How your portfolio is performing compared to the market

• Which strategies match your trading style

In simple terms, manual trading means you interpret the data yourself. AI-assisted trading means the exchange does the analysis for you, and helps you make better decisions faster, even if you’re just starting out.

Why Beginners Prefer AI-Powered Exchanges in 2026

Crypto markets are faster and more complex than ever. AI bridges the gap between beginners and professionals. Here’s why new traders choose AI-driven exchanges:

• Less guesswork – AI explains what’s happening in plain language

• Lower emotional mistakes – Bots and analytics reduce panic trading

• 24/7 monitoring – The market never sleeps, but AI never misses

• More efficient risk management – AI flags over-leverage,

liquidation risk, and bad entries

• Faster learning curve – You see why trades worked or failed

Instead of learning everything the hard way, AI gives you guardrails.

The Top AI-Powered Crypto Exchanges for Beginners in 2026

In 2026, these AI-powered crypto exchanges stand out for making trading easier, safer, and more accessible for beginners through intelligent automation and real-time market guidance.

1. BingX

BingX stands out in 2026 because it is not just an exchange with a few AI tools, it is an exchange built around AI from the ground up. Every major trading function, from market analysis to risk control, is powered by an intelligent system designed to help you trade smarter, not harder.

At the core of

BingX AI is a five-agent AI framework that works together like a professional trading desk:

1. Analyst reads price charts, candlestick patterns, funding rates, and market structure to explain what the market is doing.

2. Strategist suggests when to enter, exit, and how much to allocate based on trend, volatility, and your risk level.

3. Recommender identifies trending tokens and connects you with top-performing copy traders that fit your style.

4. Protector checks liquidation risk, over-leverage, and poor position structure before problems happen.

5. Monitor watches on-chain flows, whale movements, news, and liquidity 24/7 to detect hidden market shifts.

Instead of you manually checking ten indicators, BingX AI connects everything into one live decision engine that understands both the market and your account. Behind the scenes, BingX AI runs on a large-scale infrastructure that includes:

• Over 30 active AI engines

• More than 1,000 professional trading strategies

• 50+ institutional-grade trading tools

• Sub-8-second response time for real-time analysis

• Millions of trades and signals processed every day

This is what allows BingX AI to analyze both global market data and your individual positions at the same time, something most trading bots cannot do.

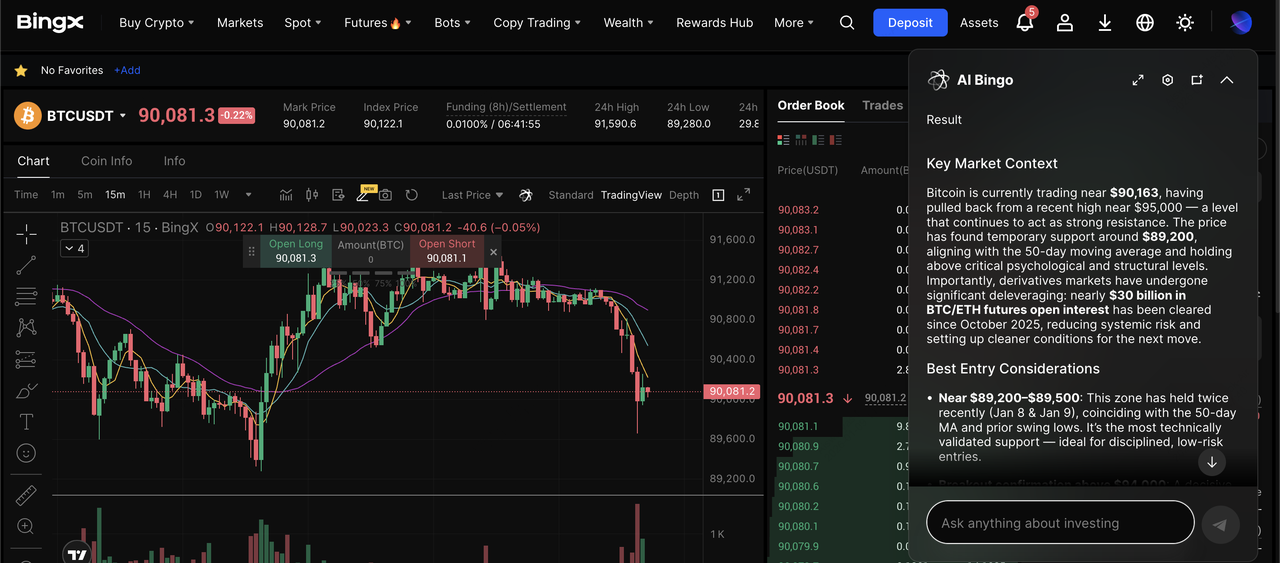

i. BingX AI Bingo AI Trading Assistant: BingX AI Bingo lets you ask natural-language questions about the market, your positions, and risk, and instantly get data-driven answers based on charts, funding rates, news, and on-chain activity. It turns complex market signals into simple, personalized insights so you always know what’s happening and why.

ii. BingX AI Master Personal Strategy Manager: BingX AI Master helps you choose, run, and optimize trading strategies using a library of over 1,000 strategies from professional investors. It adapts your strategy automatically as market conditions change, so even beginners can trade with a disciplined, professional-grade approach.

Fully integrated into the BingX platform, BingX AI works seamlessly across spot, futures, copy trading, bots, risk controls, and portfolio tracking without requiring any external connections or technical setup. Because everything runs inside the exchange, it delivers faster insights, stronger security, and real-time awareness of both the market and your account, giving beginners a safer and more intelligent way to trade in 2026.

2. Kraken Pro with Capitalise.ai Integration

This makes advanced strategy automation accessible to traders of all backgrounds, but unlike some AI-first platforms, Kraken’s AI currently focuses more on automating strategy execution rather than portfolio-wide

risk protection or personalized market guidance found on exchanges built around AI-native ecosystems.

3. Pionex

Pionex is one of the world’s largest bot-first crypto exchanges, processing over $60 billion in monthly trading volume and serving more than 5 million users globally. Its core strength is AI-powered grid and futures

grid bots, which automatically buy low and sell high in volatile markets without manual trading. With as little as $10, beginners can deploy futures grid bots that rebalance positions, lower liquidation prices, and adjust exposure automatically as price moves, making it a popular entry point for hands-off crypto trading.

Beyond pre-built bots, Pionex also supports custom AI strategy creation through PionexGPT and TradingView integration. You can describe a strategy in plain language, convert it into Pine Script, backtest it in TradingView, and then connect it to Pionex’s Signal Bot for live execution. This gives technically inclined beginners a powerful way to automate trading ideas. However, Pionex focuses primarily on bot execution, not real-time market interpretation, portfolio-level risk analysis, or AI-driven trade guidance, which means it lacks the full-spectrum intelligence and position-aware protection offered by platforms like BingX.

4. Crypto.com with CoincidenceAI Integration

Crypto.com has entered the AI-powered trading space by integrating CoincidenceAI, a conversational automation platform that lets traders build, test, and execute custom strategies using plain-language commands. Instead of coding or writing scripts, you can tell the system what you want, for example, when to buy, sell, or rebalance, and the AI converts it into a live, automated strategy connected directly to your Crypto.com Exchange account. CoincidenceAI emerged in early 2025 and quickly secured partnerships with other major exchanges, making Crypto.com part of a fast-growing AI-trading network serving one of the largest user bases in crypto.

With more than 100 million global users, Crypto.com brings significant scale to AI-driven automation, especially for traders who want to experiment with custom, rule-based strategies without technical barriers. However, its AI integration is focused mainly on strategy execution and automation, rather than providing full-spectrum market intelligence, portfolio-level risk monitoring, or position-aware protection. That makes Crypto.com a strong option for users who want to automate their own trading logic, but less comprehensive than AI-native exchanges like BingX that continuously analyze markets, risk, and portfolio health in real time.

Why Is BingX the Best Choice for Beginner Crypto Traders in 2026?

BingX stands out in 2026 because it is the only major crypto exchange built around a full AI operating system, not just a collection of add-on tools. Its AI framework runs across 30+ active engines, 1,000+ trading strategies, and 50+ professional-grade analytics modules, allowing it to continuously monitor both the global crypto market and your individual account in real time. This means BingX AI does not just generate signals but it also actively tracks your open positions, funding rates, liquidation thresholds, and on-chain liquidity, warning you before risks escalate and explaining exactly why the market is moving.

Unlike platforms that only automate trades, BingX AI functions as a multi-role trading intelligence system. It acts as your analyst by decoding charts and sentiment, your strategist by optimizing entries and exits, your risk manager by monitoring leverage and drawdowns, your market scanner by tracking whales and news 24/7, and your trading coach by reviewing past performance and adjusting your risk profile over time. This level of position-aware, portfolio-level intelligence is not available on any other major exchange, making BingX uniquely suited for beginners who want professional-grade guidance without professional-level complexity.

How to Start Trading with BingX AI

Using BingX AI to analyze BTC/USDT perpetual contract on the futures market

Getting started with BingX AI is designed to feel more like using a smart trading assistant than learning complex trading software.

1. Create or log in to your BingX account. Sign up on BingX and complete basic verification so you can access

Spot,

Futures, and AI trading tools.

2. Open BingX AI Bingo or AI Master. Use AI Bingo if you want real-time market answers and risk checks, or AI Master if you want AI to help you select and manage a trading strategy.

3. Choose what you want to trade. Pick a market like

BTC,

ETH, altcoins, or USDT-margined futures. BingX AI will immediately start analyzing price action, funding rates, and liquidity for that pair.

4. Let AI evaluate the setup. BingX AI scans trends, volatility, order flow, and on-chain activity to tell you whether conditions look bullish, bearish, or risky before you enter a trade.

5. Apply AI-recommended strategies or copy a master trader. You can follow AI-suggested entry and exit levels, or let AI Master connect you with a professional strategy that matches your risk profile.

6. Trade with built-in risk protection. As your trade runs, BingX AI continuously watches liquidation levels, leverage, and market shifts, alerting you if your position becomes unsafe.

You stay in control of every order, but now you trade with machine-level market awareness guiding every decision.

Key Considerations When Using AI to Trade Crypto

Before relying on AI-powered trading features, it’s important to understand the key risks and limitations that still apply in fast-moving crypto markets.

1. Sudden market shocks like liquidations, hacks, or macro news can overwhelm even advanced AI models.

2. Extreme volatility may cause bots to overtrade or enter positions at poor prices.

3. Model limitations mean AI can misread rare or unusual market conditions.

4. Leverage amplifies losses, even when AI helps optimize entries and exits.

5. Position sizing and

stop-losses remain essential to control downside risk.

6. Human oversight is still required, since AI supports decisions but does not replace them.

Final Thoughts: Should You Trade Crypto with AI?

In 2026, leading crypto exchanges have evolved into intelligent trading platforms that combine execution, analytics, and automation in one place. Among them, BingX stands out by offering AI agents, strategy guidance, risk monitoring, portfolio-level insights, and full exchange integration, giving beginners access to professional-grade trading support without added complexity.

That said, AI does not eliminate market risk, and crypto trading remains highly volatile, so it’s important to manage position sizes, use risk controls, and only trade with capital you can afford to lose.

Related Reading