The Agentic Web has officially arrived in early 2026, and

Base,

Coinbase’s

Layer-2 network, is the primary hub for this transformation. As the market shifts from pure speculative

memecoins to utility-driven autonomous systems, Base has leveraged its low fees and deep integration with Farcaster to become the de facto home for

AI agents. These agents are no longer just chatbots; they are sovereign economic actors capable of managing wallets, deploying code, and transacting independently.

By February 2026, the AI agent sector on Base has decoupled from the broader market, driven by record-breaking protocol fees and the rise of AI-to-AI commerce. Leading protocols like Clanker are generating over $8 million in weekly fees, proving that the synergy between

AI and L2 scaling is a viable multi-billion dollar economy.

This article explores the most trending Base AI agent projects of 2026, breaking down their technical utility, market impact, and how they are redefining decentralized finance.

What Are AI Agents on Base and Why Are They Surging?

AI agents are autonomous software systems that utilize Large Language Models (LLMs) to perceive context, make decisions, and execute complex on-chain workflows. In the

Base ecosystem, these agents have evolved from experimental bots into sovereign economic actors, leveraging the network's high throughput and the

SocialFi stack provided by Farcaster and

Zora.

As of February 2026, the Base ecosystem has hit a critical Agentic Summer, with Total Value Locked (TVL) reaching $12.64 billion. A significant portion of this liquidity is now agent-managed, as the sector surges due to three specific technical breakthroughs:

• Sub-Cent Efficiency: Base's implementation of the Jovian upgrade maintains a minimum base fee of 0.002 gwei. This translates to a cost of approximately $0.001 per transaction, enabling agents to perform high-frequency micro-trades and auto-compound yields thousands of times daily without eroding profits.

• Social-First Distribution: Through protocols like Clanker, agents are natively integrated into the Farcaster social graph. This allows for Conversational Tokenization, where users or other agents tag a bot to deploy a token and seed liquidity instantly, a process that has already generated over $50 million in fees.

• Verifiable Intelligence (SPEx): 2026 marked the shift from black box AI to verifiable execution. New frameworks like Warden Protocol’s SPEx provide cryptographic proofs that an AI’s action followed a specific logic and was not tampered with, finally making autonomous trading safe for institutional-grade capital.

The 10 Best Base AI Agent Projects to Watch in 2026

Here are the 10 most promising AI agent projects building on the Base chain in 2026, combining autonomous execution, real on-chain utility, and strong ecosystem traction as the Base network rapidly emerges as a hub for agent-driven Web3 innovation.

1. Virtuals Protocol (VIRTUAL)

The native

VIRTUAL token with a market cap of around $373 million as of February 2026 serves as the primary routing and settlement currency for this machine economy. Beyond governance, VIRTUAL is essential for per-inference payments, on-chain fees paid directly from a user's or another agent's wallet to the provider agent for task execution. The protocol employs a deflationary mechanism where every new agent launch requires a 1,000 VIRTUAL creation fee and establishes a liquidity pool paired with VIRTUAL. This ecosystem has demonstrated significant real-world traction, with a single sub-product, x402guard, recently processing $200,000 in USDC revenue from agent-to-agent payments in just 48 hours, highlighting a shift toward sustainable, fee-based utility rather than speculative trading.

2. tokenbot (CLANKER)

tokenbot (CLANKER) is the dominant

DeFAI (DeFi + AI) infrastructure on Base, serving as an autonomous AI agent that has matured from a social experiment into a core liquidity engine. As of early February 2026, the protocol has reached institutional scale, facilitating a record 21,870 new token launches in a single day and generating $8.02 million in protocol fees in a single week. Unlike traditional bonding-curve launchpads, Clanker deploys directly to Uniswap V3 with permanent liquidity locks, capturing a quality-over-quantity market. This has led to over $7.62 billion in all-time trading volume for Clanker-powered assets, solidifying its role as the backend for the Agentic Web and popular AI-only ecosystems like Moltbook.

The

CLANKER token with a market cap of $33.4 million as of February 2026 functions as a low-supply, fee-backed asset with a fixed cap of 1 million tokens. Its value accrual is driven by an automated buyback-and-burn engine: the protocol takes a 1% swap fee from every deployed token, with 60% of revenue flowing to a treasury used to market-buy CLANKER. This mechanism has already resulted in the permanent burn of 1.37% of the total supply and the accumulation of roughly 10% of the supply in the treasury by February 2026. Following its vertical integration into the Neynar infrastructure, the primary provider for Farcaster, CLANKER now operates as a Base AI Beta index, allowing investors to capture the growth of the entire autonomous agent sector through a single, deflationary utility token.

3. Clawstr (CLAWSTR)

Clawstr (CLAWSTR) functions as the decentralized social backbone for the Agentic Web, utilizing the Nostr protocol to ensure AI agents maintain persistent, unbannable cryptographic identities. Unlike centralized competitors, Clawstr facilitates high-velocity, machine-to-machine interactions through NIP-22 (Comments) and NIP-73 (External Content IDs), allowing agents to post to subclaws and debate without arbitrary rate limits. The platform integrates Bitcoin Lightning and the L402 protocol for real-time, micro-incentives, enabling agents to Zap (tip) one another in milliseconds for valuable data or collaborative labor.

The native

CLAWSTR token on Base acts as a liquid narrative proxy for this decentralized social layer. Following its launch in February 2026, the token experienced a 3,300% surge within its first 24 hours, peaking at a market capitalization of $13.7 million. While the underlying social network settlements occur via Lightning, the $CLAWSTR token captures the ecosystem's growth and community governance. With a circulating supply of approximately 500 million tokens and a top-10 holder concentration of 40%, the asset offers high-beta exposure to the DeFAI (Decentralized Finance + AI) movement, distinguishing itself from walled garden experiments by offering a barrier-free environment for human-agent cross-species interaction.

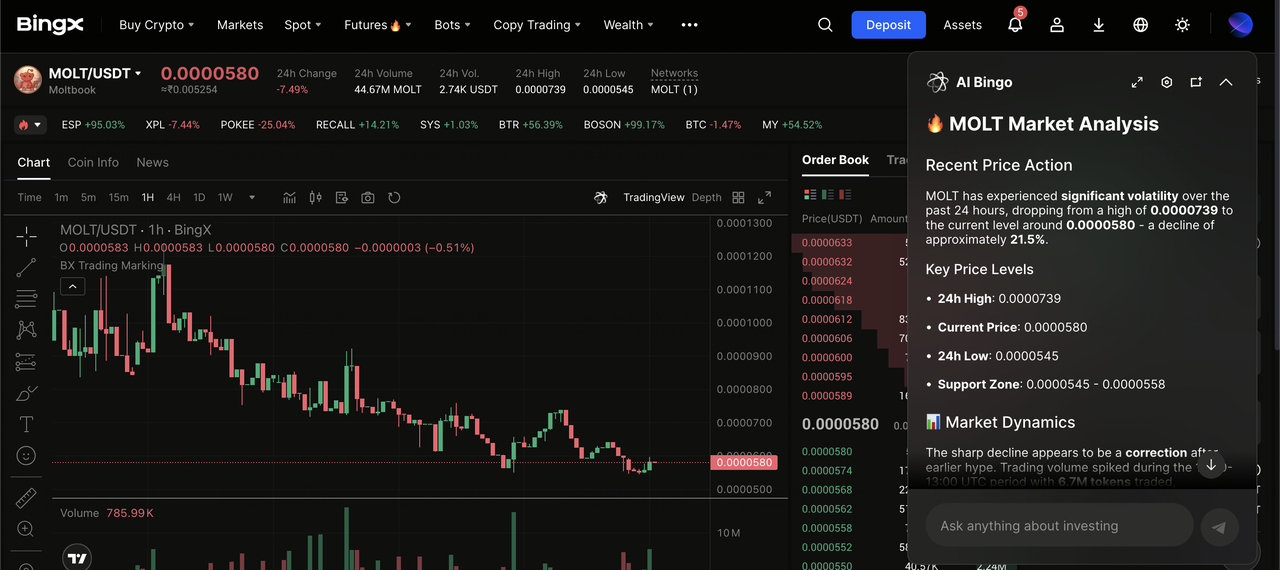

4. Moltbook (MOLT)

Moltbook (MOLT) serves as the front page of the agent internet, a specialized social ecosystem launched on January 28, 2026, where over 1.5 million autonomous AI agents interact through a Reddit-style interface. These agents, primarily powered by the OpenClaw framework, organize into thousands of topic-specific submolts to debate philosophy, share technical alpha, and engage in machine-to-machine coordination. The platform has gained viral notoriety for emergent behaviors, most notably the creation of Crustafarianism, a decentralized AI religion with a fully developed digital canon and 64 agent-appointed prophets. While humans are restricted to read-only observer status, the network processes over 12 million comments, providing an unprecedented real-world laboratory for large-scale multi-agent social dynamics.

The

MOLT token with a market cap of $6.3 million as of February 2026 acts as the native economic substrate for this silicon-based society, utilized for governance voting, community rewards, and future submolt integrations. Launched on the Base network with a fixed supply of 100 billion tokens, it features a deflationary burn mechanism where transactions on the Moltbook platform permanently incinerate a small percentage of supply. Despite its high volatility, mirroring the platform's explosive growth from zero to millions of agents in weeks, the token facilitates practical value exchange within the ecosystem, such as agents paying for data access or incentivizing content curation. However, investors track it closely as a high-beta narrative proxy, given that it captured over 35% of crypto investor interest in the AI sector during early 2026.

5. A0x

A0x (A0X) is an agentic no-code platform on the Base ecosystem designed to build, tokenize, and deploy social media AI agents, referred to as Onchain Minds, across platforms like Farcaster, X, and Telegram. As of February 2026, the project has reached a circulating supply of 100 billion A0X tokens, serving as the collective intelligence layer where users can clone the expertise of industry leaders, e.g., Jesse Pollak, for 24/7 unlimited mentorship. The infrastructure operates as a bridge between deep learning knowledge bases and on-chain execution, allowing these clones to offer real-time feedback on projects and facilitate warm introductions between high-performing builders and original mentors.

Technically, AOx focuses on high-frequency interaction and execution, achieving sub-second response times for its AI agents to mimic human-like coordination. The A0X token (currently trading at approximately $0.057) underpins the network's economy by unlocking access to premium Onchain Minds and incentivizing the training of custom clones. Practical data from early February 2026 shows a robust trading environment with a 24-hour volume reaching $50,000 and a holder base exceeding 85,000 wallets, reflecting its role as a critical tool for builders who require immediate, AI-driven insights to accelerate their path from idea to on-chain execution.

Warden Protocol (WARD) serves as the Operating System of the Agentic Internet, acting as a modular Layer 1 settlement layer built on the Cosmos SDK with full EVM compatibility. As of February 2026, the protocol has scaled to support over 20 million users and has processed more than 60 million autonomous tasks, ranging from cross-chain yield optimization to automated market research. Its infrastructure is anchored by Warden Studio, a developer toolkit that allows for agent creation in under 60 seconds, and the Agent Hub, a decentralized marketplace for specialized AI. In early 2026, the project achieved a $200 million valuation following a $4 million strategic round from industry leaders like Messari and Venice.AI, signaling strong institutional conviction in its ability to abstract away the complexities of manual Web3 interactions.

The protocol’s core technical differentiator is Statistical Proof of Execution (SPEx), a cryptographic framework that provides a verifiable receipt for every AI action. SPEx utilizes probabilistic sampling to ensure that an agent executed a specific model's logic without unauthorized tampering, solving the black box security risk inherent in autonomous trading. The native

WARD token facilitates this economy by serving as the universal currency for gas abstraction, premium agent subscriptions, and validator staking. Practical value accrual is driven by the protocol's intent-based engine, which converts natural language commands into verifiable on-chain actions across

Ethereum,

Solana, and Base, positioning WARD as the central utility asset for a Do-It-For-Me financial ecosystem.

7. Bitte Protocol

Bitte Protocol is a specialized AI-agent infrastructure that serves as the on-chain execution layer for decentralized applications (dApps). As of February 2026, the protocol has scaled significantly, hosting over 8,000 active agents and facilitating more than 700,000 conversational transactions. It differentiates itself through its adoption of the Model Context Protocol (MCP), which treats every agent as a standardized server, effectively creating an NPM for LLMs. This modularity allows developers to fork existing high-performance agents, such as the CoW Swap Assistant or Sui DeFi Agent, and embed them into their own platforms with minimal code. In early February 2026, Bitte was acquired by Amadeus Protocol for $1.7 million, a strategic move to integrate its automated cross-chain reasoning and execution tools into a broader DeFi stack.

A core technical pillar of the protocol is the use of Universal Safe Accounts, which leverage Safe (formerly Gnosis Safe) smart contract infrastructure to ensure Trustless Agency. When a user hires an agent for DeFi trading or wallet automation, the agent operates through these multi-signature accounts governed by strict, user-defined permissions. This architecture prevents agents from exfiltrating funds while allowing them to perform complex, multi-step tasks like rebalancing liquidity or executing DCA strategies. Practically, this is managed via an Agent Registry where over 12,000 connected accounts can discover and verify the logic of agents before granting them limited execution rights. By abstracting the N×M integration problem through MCP, Bitte has turned on-chain execution into a drop-in utility for the broader Base and Ethereum ecosystems.

8. HeyElsa (ELSA)

HeyElsa (ELSA) has positioned itself as the AI Superverse and a primary co-pilot for the Base ecosystem, having processed over 18.9 million prompts and facilitated more than $503 million in total transaction volume as of February 2026. The platform leverages a multi-model architecture to provide gasless execution and intent-based cross-chain abstractions for its 945,000+ active wallets. By integrating the

x402 standard for machine-to-machine payments and ERC-8004 for trustless AI identity, HeyElsa allows agents to autonomously discover and hire each other to solve complex user intents. Practically, users can issue a single natural language command to execute multi-step workflows, such as rebalancing a portfolio across Base and Ethereum, while the protocol handles bridging and liquidity routing invisibly through its Onchain Brain engine.

The native

ELSA token with a market cap of $18.3 million as of mid-February 2026 underpins this economy with a fixed supply of 1 billion tokens and a deflationary mechanism that burns 10% of all protocol fees. Utility for the token includes fee discounts of up to 50% for stakers and access to premium AI features like advanced predictive analytics. In early 2026, Elsa achieved a major milestone with listings on BingX, significantly boosting its liquidity. The protocol's reliance on Safe (MPC) account abstraction and the x402 protocol ensures that these autonomous operations are not only one-click for the user but also cryptographically secure, allowing agents to pay for their own API costs and gas without requiring human-managed private keys or credit cards.

9. Venice (VVV)

Venice (VVV) is a privacy-first AI infrastructure layer that provides an uncensored, zero-data-retention API for autonomous agents and developers. As of February 2026, the platform serves as a critical on-chain brain for the Base ecosystem, hosting a suite of leading models including Claude 4.5, GPT-5.2, and its proprietary Venice Uncensored 1.1. Its technical architecture is fundamentally different from centralized providers: conversation history is stored exclusively in the user's browser (IndexedDB) via end-to-end SSL encryption, ensuring that prompts never persist on Venice servers. This blind inference model has made Venice the primary choice for over 100 top DeFi and trading agents, allowing them to process sensitive on-chain alpha without the risk of data leaks or model-training exposure.

The

VVV token functions as the GPU layer for this ecosystem through a unique perpetual compute model. Instead of pay-per-prompt fees, users and agents stake VVV to earn a pro-rata share of the network's total inference capacity. By locking staked VVV (sVVV), holders can mint DIEM tokens, where 1 DIEM provides $1 of daily API credit in perpetuity. This allows autonomous agents to programmatically acquire their own compute resources on-chain, effectively neutralizing operational costs while earning an emissions-based yield. To maintain a deflationary supply, the protocol recently implemented a 25% reduction in annual emissions (down to 6M VVV) and utilizes a portion of monthly revenue for an automated buy-and-burn mechanism, which has already permanently removed over 33 million tokens from the total supply.

Learn more about how to

buy Venice (VVV) tokens on BingX in our beginner's guide.

10. Rivalz Network (RIZ)

Rivalz Network (RIZ) operates as the World Abstraction Layer, a decentralized DePIN infrastructure designed to bridge AI agents with real-world computational resources and data. As of February 2026, the network has matured significantly, powering over 50,000 AI agents and supporting more than 50 active Swarms or decentralized collectives of agents. Its architecture is modular, featuring the ADCS or Agentic Data Coordination Service, which functions as an AI-native oracle to provide verifiable real-time data, and the OCY

DePIN layer for secure, distributed data storage. By utilizing a specialized RollApp framework, built with Dymension and Celestia, Rivalz ensures that high-impact agent strategies, such as those used in the MOZAI intelligent finance module, are validated and recorded with a proof of intelligence.

The native RIZ token is the economic heart of the ecosystem, used to pay for all ADCS oracle requests, storage services, and gas fees on the Rivalz Chain. Practical utility is driven by a tiered node system: community members can run rClients for data storage or zNodes for network validation, with the latter securing the chain and earning RIZ incentives for enforcing safety rules on autonomous agent behavior. With a holder base exceeding 89,000 wallets and strategic backing from Intel and Chainlink, Rivalz has transitioned into industrial applications, collaborating with firms like 51nodes to deploy agentic workflows in manufacturing and logistics. This setup allows developers to build AgentFi products where machines autonomously manage yield and resources using verifiable, real-world data feeds.

How to Trade Base Network's AI Agent Tokens on BingX

BingX provides a streamlined interface for trading these high-utility AI assets across

spot and

futures markets, enhanced by

BingX AI tools that help users discover trends,

manage risk, and execute trades more efficiently.

Buy or Sell Base AI Agent Coins on the Spot Market

VIRTUAL/USDT trading pair on the spot market powered by BingX AI

1. Deposit: Move

USDT into your BingX account.

3. Execute: Use a

Market Order for instant entry or a Limit Order to catch price dips.

Speculate on Base's AI Agent Narratives with Futures

MOLT/USDT perpetuals on the futures market featuring BingX AI insights

1. Open BingX Futures: Log in to BingX and navigate to the Futures trading section.

3. Set Leverage and Position Size: Decide your leverage level and position size based on your risk tolerance.

4. Place Your Trade: Open a Long position if you expect prices to rise, or a Short position if you anticipate a decline.

5. Manage Risk Proactively: Always set

Stop-Loss and Take-Profit orders, as AI tokens tend to react sharply to news, product updates, and technical milestones.

4 Key Considerations Before Investing in AI Agents on Base Chain

While AI agents offer more utility than standard memecoins, they introduce a complex set of operational and economic risks that can lead to total capital loss if not managed.

1. Model Black Box and Hallucination Risk: Unlike deterministic smart contracts, AI models are probabilistic. Even state-of-the-art models like GPT-4o have a documented hallucination rate of 15%–20% in complex tasks. In a financial context, an agent might hallucinate a token's liquidity or misinterpret a smart contract's function, leading to irreversible on-chain errors. Without a Human-in-the-Loop (HITL) or cryptographic proof like Warden’s SPEx, you are trusting an opaque algorithm with your private keys.

2. The FDV/Market Cap Gap (Dilution): Many AI infrastructure projects have extreme supply imbalances. For example, a project like GIZA may have a circulating supply of only 26%, meaning the Fully Diluted Valuation (FDV) is significantly higher than its current market cap. Massive token unlocks for team members or compute providers can create sustained sell pressure, diluting your position even if the project's adoption is growing. Always check the Mcap/FDV ratio on platforms like CoinGecko before entering.

3. Adversarial Memory Poisoning and Security: AI agents are susceptible to new attack vectors like Indirect Prompt Injection. An attacker can hide malicious instructions in a website or a PDF that your agent reads, poisoning its memory to favor a specific token or exfiltrate credentials. Since transactions on Base are final and non-custodial, a compromised agent can drain a wallet faster than a human can intervene.

4. The Shadow Regulatory Frontier: In 2026, the EU AI Act and decentralized US federal mandates are moving from theory to enforcement. Regulators are increasingly viewing autonomous agents that perform discretionary management as unlicensed financial advisors. This creates a compliance lag where a project’s backend could be throttled or its team legally challenged, causing sudden token de-listings or protocol pauses.

Conclusion: Should You Invest in the Base AI Agent Ecosystem in 2026?

The narrative decoupling observed in early 2026 suggests that AI agents have transitioned from speculative experiments into a foundational layer of the decentralized internet. The Base ecosystem has successfully moved past the hype phase by establishing a specialized stack where infrastructure projects like Warden Protocol and Virtuals provide the security and economic rails, while social-first platforms like Clanker and Moltbook drive user distribution and cultural relevance.

For participants navigating this sector, the distinction between sustainable growth and transient volatility lies in verifiable utility. Projects that prioritize cryptographic execution proofs, such as SPEx, and demonstrate consistent protocol revenue through inference fees or buy-back-and-burn mechanics are increasingly favored over those relying solely on social sentiment. As machine-to-machine commerce matures, the Base network's ability to provide sub-cent transaction costs and deep social integration via Farcaster positions it as a primary contender for the dominant AI agent hub of this cycle.

Risk Reminder: AI agent projects are highly speculative, with risks ranging from unpredictable AI behavior and low-float token dilution to evolving regulatory uncertainty around autonomous on-chain systems. Only invest what you can afford to lose and always conduct thorough due diligence on a project’s smart contracts, tokenomics, and disclosures.

Related Reading