Index funds have long been one of the most popular investment choices for beginners and long-term wealth builders. Legendary investors such as Warren Buffett and Charlie Munger often recommend low-cost index funds, especially those tracking the broad U.S. market, because they tend to outperform most actively managed strategies over time. Historical data supports this view, showing that U.S. index funds have delivered annualized returns of about 10% across multiple decades.

Among all index funds, the

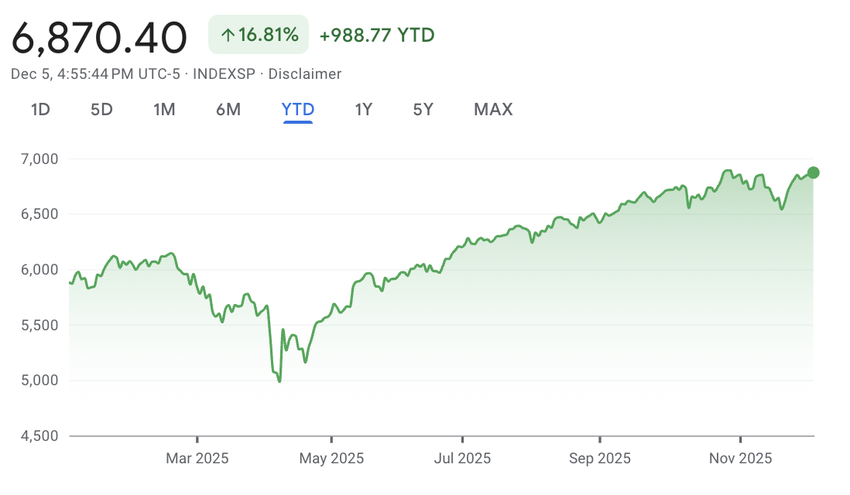

S&P 500 remains the most widely recognized benchmark. It tracks 500 of the largest publicly traded companies in the United States and serves as a core representation of the U.S. economy. In 2025, the index continued its strong trajectory, reaching a record closing high of 6,890.89 on October 28 and an intraday high of 6,920.34 on October 29. As of December 6, the index sits around 6,870.40, placing it within a fraction of a percent of its record level and signaling a strong rebound after a brief pullback.

This guide explains three practical ways to invest in the S&P 500 in 2026:

1. Traditional brokerage and ETF investing

2. Tokenized S&P 500 indexes such as

SPYX and

SPYON on BingX

3. Tokenized stock futures and other crypto-native instruments on BingX

Whether you prefer a traditional method or a blockchain-based approach, platforms like BingX make it easy for global investors to access index-linked assets.

What Is the S&P 500 (SPX) and How Does SPY Work?

Source: Google Finance

The S&P 500 is a stock market index created by Standard & Poor’s (S&P), a U.S. financial analytics firm known for credit ratings, market indices and investment research. The index, shown under the ticker SPX, tracks 500 of the largest publicly traded companies in the United States and represents nearly 80% of the total U.S. equity market. Because it includes companies across technology, finance, healthcare, consumer goods and energy, the S&P 500 is widely viewed as the best single measure of the U.S. stock market.

SPX itself is not tradable. It is only an index value. To invest in the S&P 500, most investors use SPY, the SPDR S&P 500 ETF Trust, issued by State Street Global Advisors (SSGA). SPY is designed to track the S&P 500 as closely as possible. It holds the same companies at the same weightings, so its performance closely mirrors SPX.

How SPY Works

• SPY holds the S&P 500 companies: The ETF owns shares of all 500 constituents and adjusts holdings when the index changes.

• SPY mirrors SPX performance: Its price moves in line with the S&P 500 on a percentage basis.

• SPY trades like a stock: It is listed on NYSE Arca and is one of the most heavily traded ETFs in the world.

• SPY uses a 1:10 price scale: SPY trades at roughly one tenth of the SPX index level, which makes it more accessible for investors.

• SPY distributes dividends: The ETF collects dividends from the underlying companies and pays them to shareholders quarterly.

SPY remains one of the most liquid, diversified and beginner-friendly ways to invest in the entire U.S. stock market through a single SSGA product.

What Companies Are in the S&P 500?

The S&P 500 includes 500 of the largest and most influential U.S. companies across sectors such as technology, finance, healthcare and consumer goods. Selection is based on market cap, liquidity, public float and profitability, making it one of the clearest representations of the overall U.S. market.

The index adjusts over time as companies rise or fall. In 2025,

Strategy Inc. met size and profitability requirements but was not added, likely because its Bitcoin-driven model differs from traditional operating businesses. This shows that meeting criteria does not guarantee inclusion.

S&P 500 vs. Fortune 500: What’s the Difference?

The S&P 500 is a stock market index tracking 500 large publicly traded U.S. companies, selected based on market capitalization and financial criteria to represent overall stock market performance.

The Fortune 500, by contrast, ranks the 500 largest U.S. companies by annual revenue and includes both public and private firms. Many companies appear on both lists, but they serve different purposes: the S&P 500 reflects how leading stocks perform in the market, while the Fortune 500 reflects which companies generate the most revenue.

S&P 500 Historical Returns: How Much Can You Make With the S&P 500?

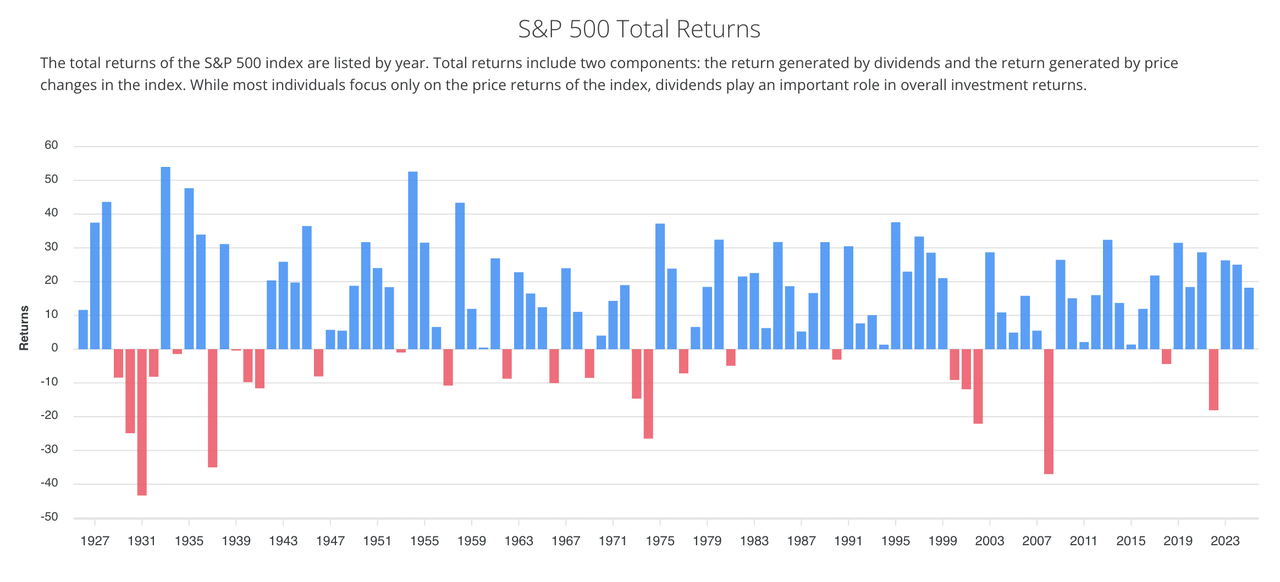

Source: Slickchart

The S&P 500 has historically delivered strong long-term performance, averaging about 10% a year since 1957 when dividends are reinvested. This track record reflects the consistent growth of the U.S. economy and the compounding effect of holding a broad market index.

Returns over the past decade were even higher. From 2015 to 2025, the S&P 500 generated an estimated 12% to 14% annualized return, driven largely by the expansion of major technology and AI-related companies.

The shorter 2020–2025 period shows more volatility, but the index still produced around 10% to 11% annualized returns, in line with historical averages. These figures are based on total-return data from Slickcharts and other market sources.

Looking forward, most analysts expect more moderate growth, with projected annual returns of 6% to 8% through 2030 as earnings normalize and interest rates remain higher, though

AI and productivity gains could support upside.

| Time Horizon |

Annualized Return |

Notes |

| Full Historical (1957–2025) |

~10% |

Supported by SmartAsset and long-term total return datasets |

| Last 10 Years (2015–2025) |

~12%–14% |

Strong tech and AI-driven decade |

| Last 5 Years (2020–2025) |

~10%–11% |

Volatile period but aligned with long-term trend |

| Expected to 2030 |

~6%–8% |

Moderate outlook based on analyst forecasts |

How to Invest in the S&P 500: A Step-by-Step Guide in 3 Different Ways

There are now more ways than ever to gain exposure to the S&P 500. Whether you prefer a traditional brokerage account or you invest through crypto platforms, the goal is the same: track the performance of the 500 largest publicly traded companies in the United States. Below are the three simplest methods available in 2026.

1. Buy S&P 500 ETFs on a Brokerage Platform

The simplest way to invest in the S&P 500 is through a brokerage account that offers index-tracking ETFs. The most common choice is SPY, which closely mirrors the index and offers high liquidity. Low-cost alternatives such as VOO (Vanguard) and IVV (iShares) provide the same exposure with lower expense ratios, making them attractive to long-term investors.

Buying an S&P 500 ETF works just like purchasing any stock. Most brokerages support fractional shares, recurring deposits and automatic dividend reinvestment, which makes this method beginner-friendly and easy to maintain. For many investors, S&P 500 ETFs remain the most reliable and cost-efficient way to build a diversified portfolio.

Step 1: Choose a brokerage: Select a regulated platform that offers U.S.-listed ETFs, transparent fees and reliable trading tools. Examples include Fidelity, Charles Schwab, Vanguard and Interactive Brokers.

Step 2: Verify your account: Complete registration and KYC by submitting identification and required tax documents, especially if you are a non-U.S. investor.

Step 3: Fund your account: Deposit USD using bank transfer, card or supported funding methods. Some platforms allow you to convert local currency directly inside the app.

Step 4: Buy an S&P 500 ETF: Search for SPY, VOO or IVV, review market data and place a market or limit order. Many brokers support fractional shares, allowing you to invest with smaller amounts.

2. Buy Tokenized S&P 500 Indexes (SPYON/ SPYX) on BingX

Step 1: Create and secure your BingX account: Register on BingX,

complete KYC verification and enable security features such as two-factor authentication.

Step 2: Deposit USDT or supported assets: Transfer

stablecoins to your BingX wallet, confirm you are using the correct network and review any deposit fees or minimums.

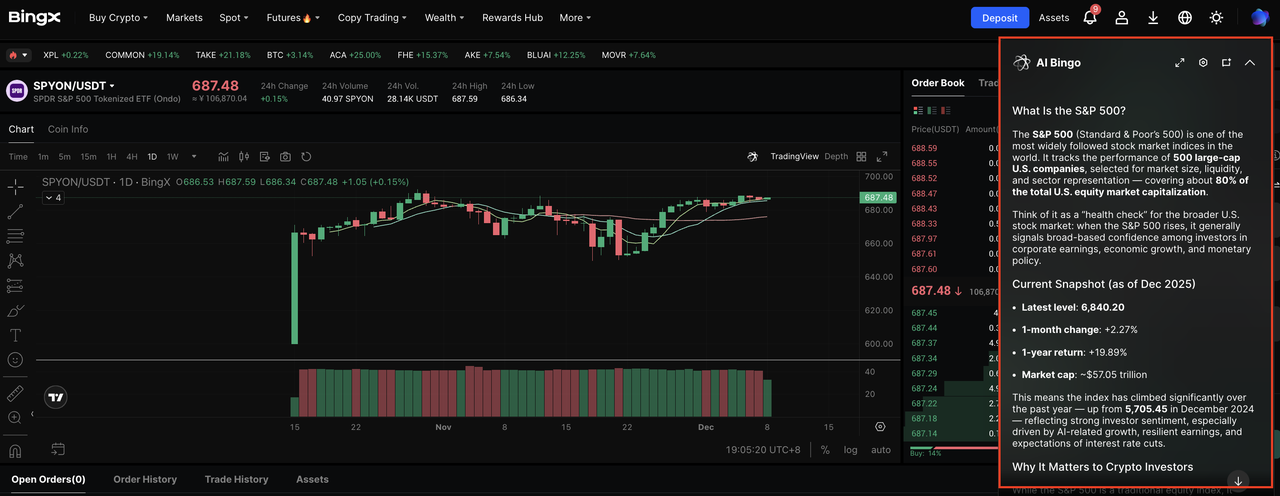

Step 3: Search for the S&P 500 token: Open the Spot market and search for

SPYX or

SPYON, the tokenized index products supported on BingX.

Step 4: Use BingX AI for market insights: Tap the AI icon to activate

BingX AI to ask about price trends, support and resistance levels or recent index movements before placing your trade.

Step 5: Place your buy order: Choose a

market or limit order, enter your preferred amount, check available liquidity and confirm your purchase.

Note: Availability of tokenized indexes such as SPYON depends on your country or region. Tokenized assets may be restricted or unavailable in certain jurisdictions due to regulatory requirements. Always confirm eligibility before trading.

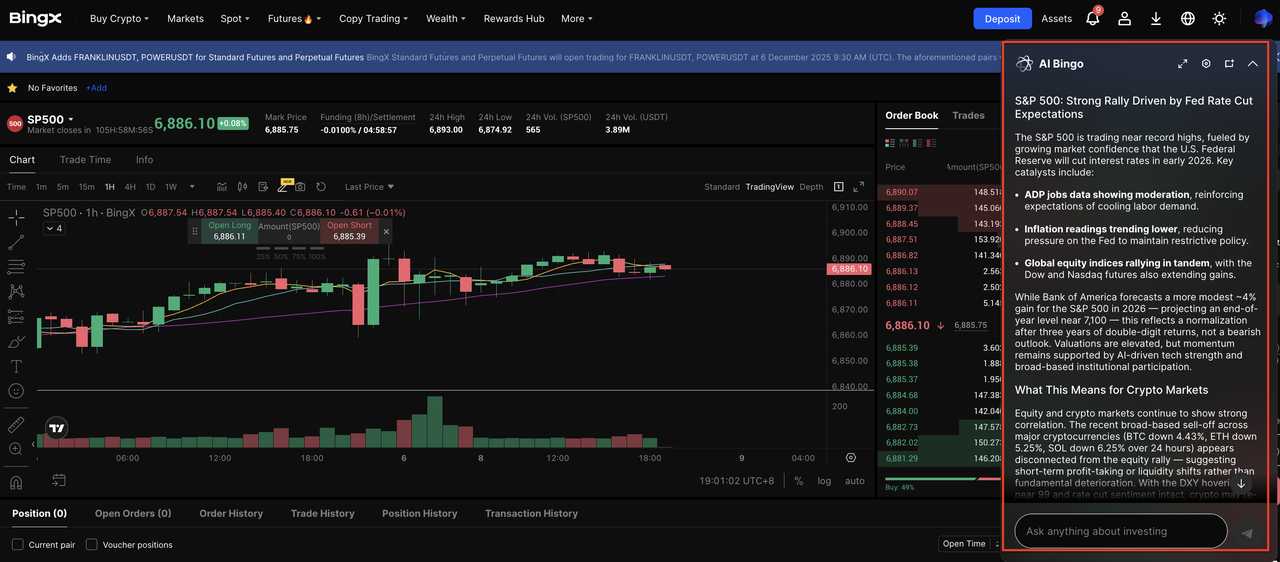

3. Trade S&P 500 Perpetual Futures (SP500-USDT) on BingX

For investors who want more flexibility than spot investing, S&P 500 perpetual futures (SP500-USDT) on BingX offer a crypto-native way to trade the index around the clock. These contracts track the price performance of the S&P 500 and allow you to go long or short, apply leverage and hedge your existing equity exposure without needing a traditional brokerage account.

Perpetual futures never expire. They are ideal for short-term strategies, volatility trading and downside protection during uncertain markets.

Step 1: Create and secure your account: Register on BingX, complete KYC verification and enable two-factor authentication to protect your trading account.

Step 2: Deposit USDT: Transfer

USDT into your

BingX Futures wallet. Check network compatibility and confirm transaction details before depositing.

Step 3: Open the SP500-USDT market and review with BingX AI: Go to the Perpetual Futures section and search for SP500-USDT. Use BingX AI to analyze

funding rates, recent price trends and

key support or resistance levels before entering a trade.

Step 4: Choose long or short: If you expect the S&P 500 to rise, open a long position. If you expect it to fall, open a short position. Beginners typically start with low or zero leverage to reduce risk.

Step 5: Place your order: Select a market or limit order, set the leverage level, review your liquidation price and confirm the trade. Use

stop-loss or take-profit tools to manage risk.

Perpetual futures carry higher risk than spot investing, so understanding margin requirements, leverage impact and volatility is essential before trading.

Note: Perpetual futures linked to tokenized indexes may not be available in certain countries or regions due to local regulatory restrictions. Access to SP500-USDT or similar index-based futures products depends on your jurisdiction. Always check product availability before opening or trading a futures position.

What Are S&P 500 Tokenized Indexes (SPYON, SPYX) and How Do They Work?

S&P 500 tokenized indexes are blockchain-based assets that replicate the economic performance of the S&P 500. Instead of buying an ETF like SPY through a brokerage, investors can gain similar exposure on-chain using stablecoins such as

USDC. Popular examples include SPYON (Ondo Global Markets) and SPYX (xStocks/Backed), both designed to track the value of an underlying S&P 500 ETF while remaining transferable across public blockchains.

These tokens are backed by regulated financial instruments held by licensed custodians, allowing them to mirror the index’s movements. Tokenized indexes offer global accessibility through stablecoins, around-the-clock trading, lower barriers to entry, fast settlement, self-custody and integration with

DeFi applications such as

lending,

staking or

liquidity pools.

How Tokenized S&P 500 Indexes Work

1. Economic exposure: Tokens like SPYON and SPYX track the value of an underlying S&P 500 ETF. Their prices rise and fall in line with the index.

2. Regulated backing: Issuers rely on licensed custodians to hold the underlying assets, ensuring real, audited backing.

3. On-chain issuance: Tokens can be held, transferred or traded directly on Ethereum, Solana and other networks without traditional intermediaries.

4. Transparent reserves: Supply, backing assets and attestations are publicly disclosed for verification.

SPYX (xStocks) vs. SPYON (Ondo): Key Differences between the S&P Tokenized Index Funds

SPYON and SPYX both provide on-chain exposure to the S&P 500, but they come from different issuers and operate on different networks. SPYON is issued by

Ondo Global Markets as an

Ethereum-based ERC-20 token, while SPYX is issued through the xStocks framework by Backed Finance and exists on both Ethereum and

Solana. Although both track the economic performance of the SPY ETF, their custody structure, transparency level and wallet compatibility differ.

| Category |

SPYON (Ondo) |

SPYX (Backed / xStocks) |

| Issuer |

Ondo Global Markets |

Backed Finance / xStocks |

| Underlying Exposure |

Tracks SPY ETF (S&P 500) |

Tracks SPY ETF (S&P 500) |

| Blockchains |

Ethereum (ERC-20) |

Ethereum (ERC-20) and Solana (SPL) |

| Wallets |

MetaMask, Rabby, Ledger |

MetaMask (ERC-20), Phantom/Solflare (SPL) |

| Transparency |

High, with regular reserve attestations |

Varies by issuer/platform |

| Custody Model |

Regulated custodians under Ondo’s RWA framework |

Licensed custodians; structure varies by issuer |

| Use Case |

Ethereum-native RWA exposure |

Multi-chain flexibility across ETH + Solana |

Risks and Considerations Before Investing in Tokenized S&P 500 Indexes

Tokenized S&P 500 products like SPYON and SPYX offer flexible, on-chain access to traditional market exposure, but they also come with unique risks investors should understand.

1. Regulatory limitations: Tokenized indexes may not be available in all jurisdictions. Some exchanges restrict access based on local regulations.

2. No shareholder rights: Holders do not receive voting rights, direct ETF ownership or dividend entitlements.

3. Issuer and custody risk: Tokenized assets depend on custodians and issuers to maintain proper backing, and transparency varies by provider.

4. Smart contract and network risks: Vulnerabilities, outages or wallet security issues can impact access or value.

5. Lower liquidity: Tokenized versions of SPY may have thinner liquidity than the actual ETF, causing wider spreads or slippage.

6. Tracking differences: Prices may temporarily deviate from SPY due to supply-demand dynamics or exchange-specific factors.

Final Thoughts

The S&P 500 remains one of the strongest foundations for long-term investing. Its diversified exposure to leading U.S. companies and consistent historical performance make it a reliable core holding for both beginners and experienced investors. Whether you prefer traditional ETFs like SPY, tokenized

real-world assets (RWA), or a fully crypto-native approach, the index continues to offer accessible and resilient market exposure.

With tools ranging from brokerages to tokenized indexes such as SPYON and SPY-based perpetual futures on BingX, investors now have more flexibility than ever in how they participate. The key is choosing the method that fits your goals, risk tolerance and preferred trading environment. As 2026 approaches, the S&P 500 remains a straightforward and dependable path for building long-term wealth across both traditional and on-chain ecosystems.

Related Reading

Frequently Asked Questions (FAQs)

1. What is the S&P 500?

The S&P 500 is a stock market index created by Standard & Poor’s that tracks 500 of the largest publicly traded companies in the United States. It is one of the most widely used benchmarks for evaluating U.S. market performance.

2. What is the difference between SPX and SPY?

SPX is the index level and cannot be traded. SPY is the SPDR S&P 500 ETF Trust issued by State Street Global Advisors, designed to mirror the performance of SPX and tradable like a regular stock.

3. What are SPYON and SPYX?

SPYON and SPYX are tokenized versions of S&P 500 exposure issued on public blockchains. They track the economic performance of the index but trade using stablecoins and can be held in crypto wallets.

4. Can I invest in the S&P 500 using crypto?

Yes. Platforms like BingX allow you to buy tokenized S&P 500 indexes such as SPYON or trade S&P 500 perpetual futures (SP500-USDT) using USDT. These provide on-chain or leveraged exposure without a traditional brokerage account.

5. Do tokenized S&P 500 indexes include dividends?

No. Tokenized S&P 500 indexes do not distribute dividends because holders are not shareholders of the underlying ETF. Any dividend value is typically retained or reflected internally by the issuer.