On Friday, September 5, 2025,

Hyperliquid, the largest decentralized derivatives exchange by a wide margin, announced that it was looking to issue a

"Hyperliquid-first, Hyperliquid-aligned, and compliant USD stablecoin,” and invited teams to submit proposals.

The launch of Hyperliquid's new

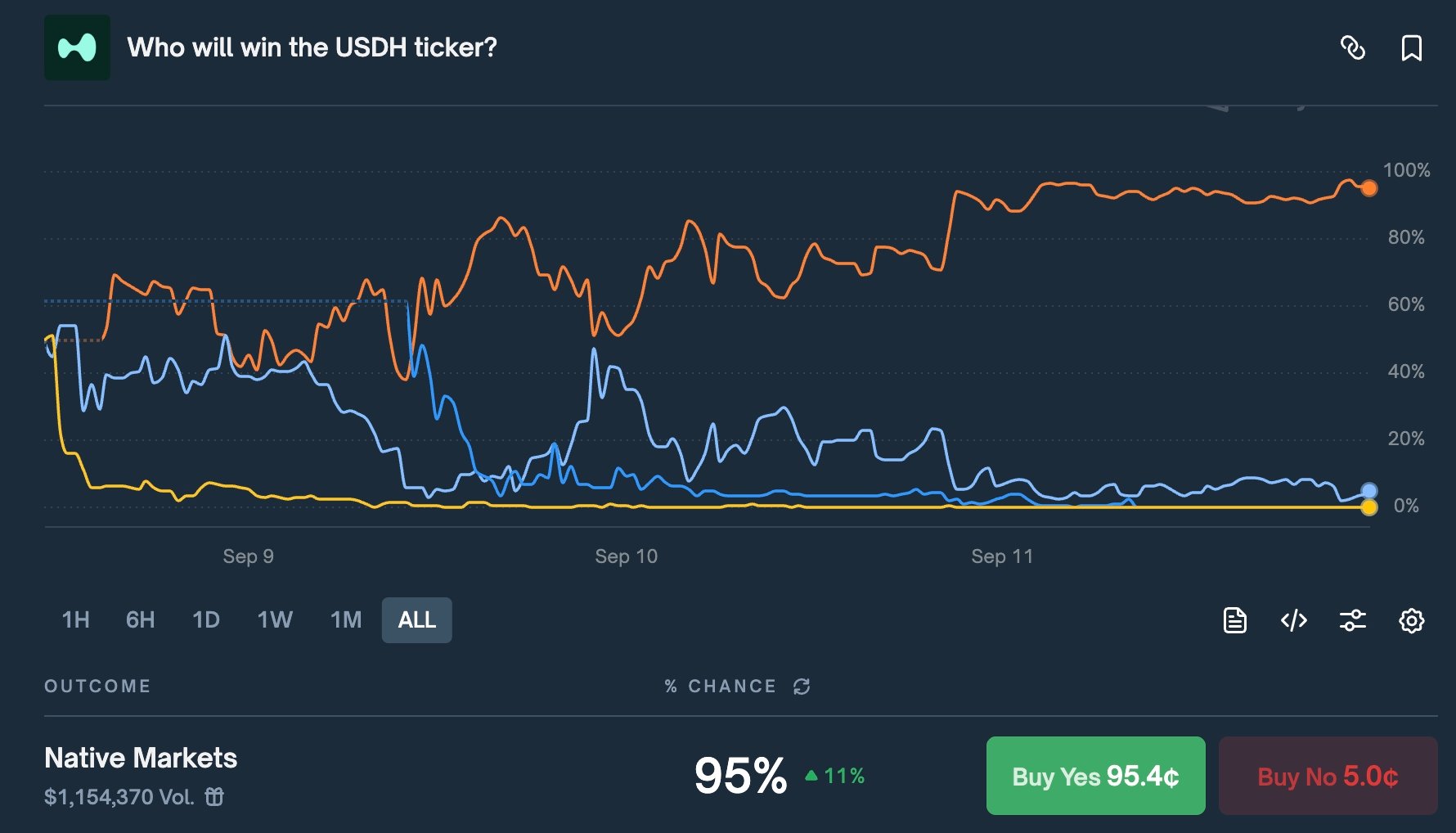

stablecoin, USDH, has sparked intense competition among market makers. Major players such as Paxos, Sky, and Frax Finance have joined the race to issue USDH, yet it's the little-known Native Markets that is leading the pack.

As adoption grows, liquidity providers are vying for dominance in shaping trading depth and volume on decentralized exchange. Among them, Native Markets, co-founded by early Hyperliquid advocate Max Fiege, has quickly taken the lead, setting itself apart as the frontrunner in the USDH race. It's the clear frontrunner to issue USDH with Polymarket bettors giving it about 95% odds of winning the bid.

What Is USDH Stablecoin on Hyperliquid, and How Does It Work?

USDH is Hyperliquid’s upcoming native dollar-pegged stablecoin, designed to reduce the exchange’s dependence on bridged USDC and capture value for its own ecosystem. Instead of Hyperliquid building USDH directly, the network reserved the ticker and invited major stablecoin issuers like Paxos, Ethena, Frax, Sky, Agora, and Native Markets to compete for the right to issue it. This approach ensures USDH will be aligned with Hyperliquid-first principles, keeping hundreds of millions in annual yield within the protocol rather than flowing out to external issuers like Circle and Coinbase.

The selection process is being decided through an on-chain validator vote, where stake-weighted validators choose the winning issuer. Proposals closed on September 10, 2025, with the final vote scheduled for September 14, 2025. The winner gains the right to issue USDH but must still drive adoption through liquidity, integrations, and user incentives. For traders, USDH could mean more secure stablecoin deposits, ecosystem-funded rewards, and reduced reliance on bridged assets, while for the protocol, it marks a shift toward greater financial sovereignty and sustainability.

How Will Hyperliquid's Stablecoin USDH Work?

USDH’s design will depend on which issuer wins the governance vote, but all proposals share the same foundation: the stablecoin will be fully backed and redeemable 1:1 for dollars or equivalent assets. Some bidders plan to use cash and U.S. Treasuries held with regulated custodians like BNY Mellon or State Street, while others suggest a crypto-native model backed by tokenized T-bills or delta-hedged synthetic positions. Transparency is key; every proposal includes on-chain proof-of-reserves or regular audits. Most issuers also pledge to send 95%–100% of yield from those reserves back into the Hyperliquid ecosystem through HYPE buybacks, assistance funds, fee rebates, or even direct yield for holders.

For users, this means USDH will fit seamlessly into trading and settlement on Hyperliquid. You’ll still be able to deposit USDC, but many proposals include cheap or zero-cost migration paths into USDH, alongside fiat ramps through banks, PayPal/Venmo, or card processors. Once adopted, USDH could power perps, margin, and spot markets while offering traders better liquidity incentives and builders grants or APIs for integrations. In practice, this makes USDH not just another stablecoin, but a tool designed to keep value cycling inside Hyperliquid rather than flowing out to external issuers.

What Is USDH Stablecoin's Role in the Hyperliquid Ecosystem?

USDH is designed to serve as Hyperliquid's native stablecoin, powering trades, liquidity pools, and broader ecosystem growth. A robust and liquid stablecoin is critical to the success of any decentralized exchange. The Boston Consulting Group (BCG) shows stablecoin transaction volumes have grown significantly, though the market share of stablecoins in the total crypto market cap is around 10% of total crypto transactions. Hyperliquid's introduction of USDH aims to reduce slippage, improve settlement efficiency, and drive wider adoption of its trading platform.

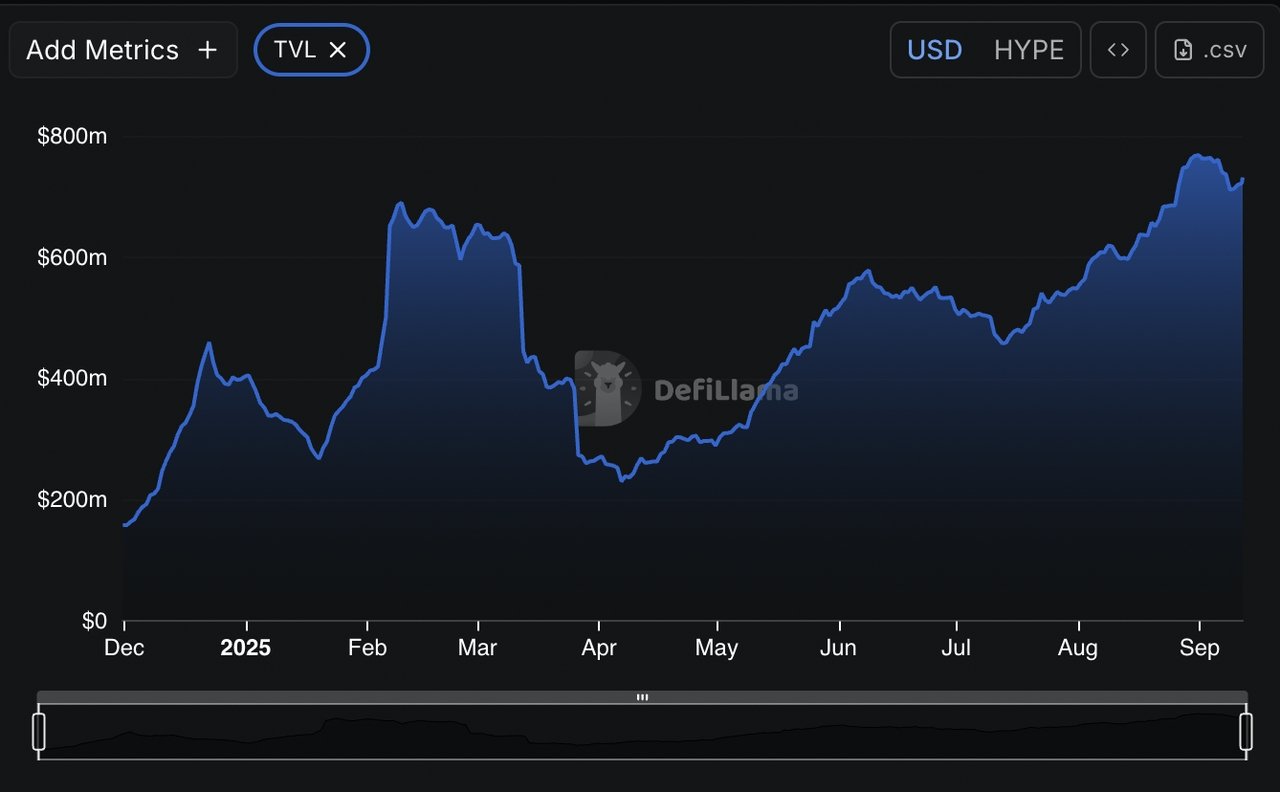

Hyperliquid has established itself as the clear leader among on-chain perpetual DEXs, commanding nearly 80% market share, over $1 trillion in cumulative trading volume, and more than $5 billion in TVL (total value locked). Yet this dominance highlights a critical vulnerability: the ecosystem's heavy dependence on Circle's

USDC.

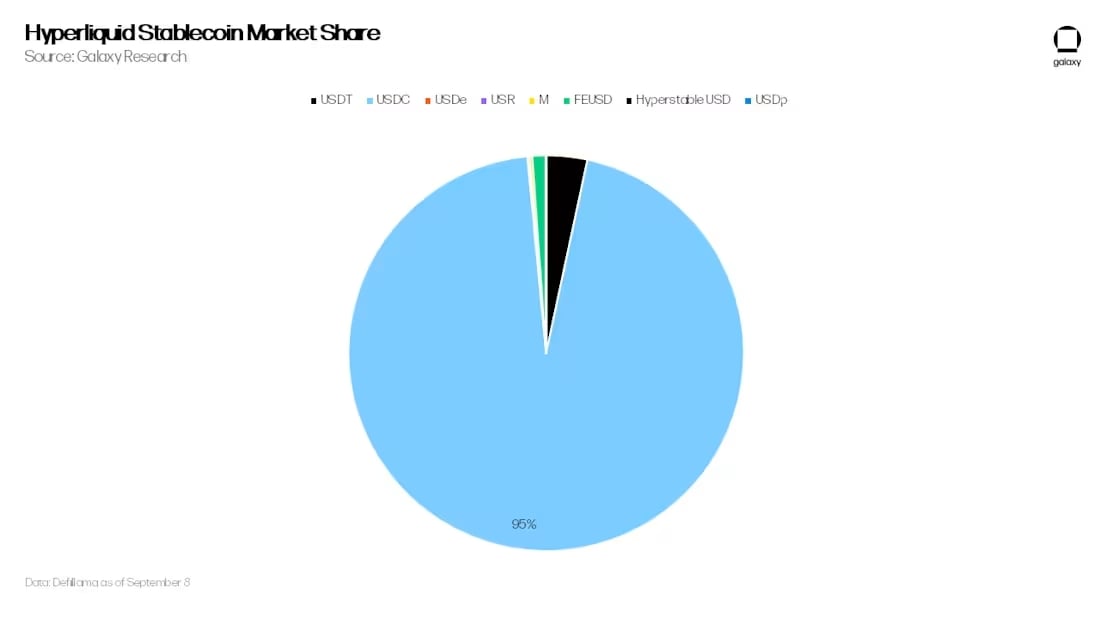

Currently, around 95% of Hyperliquid's $5B TVL is held in USDC, most of which are located in the U.S. Treasuries. According to CoinDesk, this generates an estimated $200M in annual yield for Circle, none of which benefits Hyperliquid directly, effectively funneling revenue away from the platform to strengthen an external entity. USDH aims to fix this problem. By creating a stablecoin native to Hyperliquid, the platform can reclaim liquidity as a revenue-generating asset, supporting HYPE buybacks, additional validator rewards, and user incentives, all while reinforcing the ecosystem's economic model.

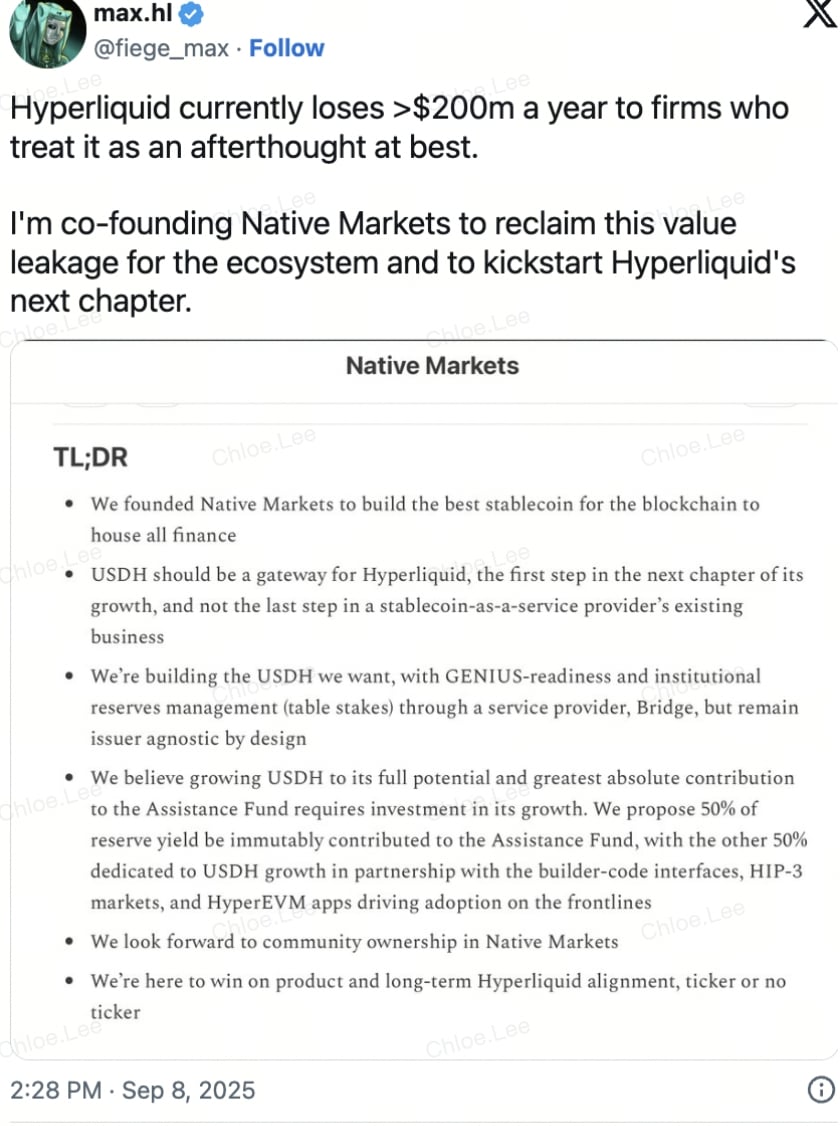

Native Markets Takes the Lead to Issue USDH

Source: X via Max Fiege

Why is Native Markets suddenly dominating the race? Native Markets has emerged as the top liquidity provider in Hyperliquid's USDH ecosystem. According to

DefiLlama, Native currently accounts for the majority of USDH liquidity, capturing well over 60% of the market share among trading pairs.

This dominance provides deeper order books, reduced volatility, and a more reliable trading environment for users. In contrast, competitors like Wintermute and Flowdesk are still building their positions, trailing behind in both liquidity depth and trading volume.

Furthermore, the Hyperliquid Foundation announced that, as of September 11, it will abstain from directly influencing the vote, instead supporting whichever team secures the most non-Foundation validator commitments.

Competitive Landscape

While Native Markets leads, other players are not far behind. According to Kaiko, Wintermute and Flowdesk have shown steady growth in their participation, with both gradually increasing their USDH-backed liquidity pools. However, their share remains significantly lower, making Native's head start a key competitive advantage. The competition highlights how early liquidity capture is essential in stablecoin adoption battles, as network effects favor providers with the deepest markets.

What Does USDH's Launch Mean for Hyperliquid?

Native Markets' lead in the USDH race signals growing institutional confidence in

Hyperliquid. According to

CoinDesk, Hyperliquid has already seen a surge in trading activity, with daily volumes rising more than 30% since USDH's launch. Strong liquidity also enhances user trust, as deeper pools mitigate risks of price manipulation and sudden volatility. If this trajectory continues, USDH could quickly become a core pillar of decentralized finance trading activity.

Hyperliquid (HYPE) price surges on USDH stablecoin announcement | Source: BingX

At the same time, Hyperliquid’s native token HYPE has been gaining strong momentum. The token trades around $56.23, up around 20% in the past 7 days, with a market cap of $18.78 billion and 24-hour volume exceeding $617 million. On-chain activity is at record highs, with active addresses climbing above 24K and transactions topping 424,000 daily. Technicals are also bullish, with HYPE breaking out above $53, opening the path toward $70–$75 in the near term. Analysts even draw parallels to Solana’s 2021 breakout, suggesting room for a broader price discovery phase.

Ready to ride the momentum? Buy and trade HYPE on BingX today.

Key Considerations and Risks of USDH

While USDH promises to bring yield and sovereignty back to Hyperliquid, there are important risks and trade-offs to understand before adoption.

1. Issuer Dependence and Execution Risk: The governance vote awards the USDH ticker to a single issuer, but proposals are essentially roadmaps, not finished products. Building secure custody, fiat ramps, and deep liquidity is complex, and delays or missteps could undermine confidence. Validators and users must weigh each team’s track record and ability to deliver, especially since the vote timeline left little room for audited, fully fleshed-out plans.

2. Regulatory and Compliance Exposure: Many proposals emphasize alignment with the U.S. GENIUS Act or Europe’s MiCA. While this can boost credibility, it also risks tying Hyperliquid more closely to U.S. or global regulators. If oversight turns restrictive, the network could face pressure or compliance costs. On the flip side, fully decentralized approaches reduce regulatory exposure but may struggle with fiat access and institutional adoption.

Hyperliquid's stablecoin market share | Source: Galaxy

3. Liquidity Migration Challenges: Hyperliquid currently holds around $5.5 billion in USDC, and shifting even part of that into USDH requires smooth, incentivized migration. Without strong market-maker support and user incentives, liquidity could fragment, hurting trading depth and user experience.

4. Centralization vs. Decentralization: Regulated issuers bring fiat rails and stability, but also introduce counterparty and censorship risks. Decentralized designs boost sovereignty but may lack regulatory cover and scalable distribution. The trade-off is deciding which model better serves Hyperliquid’s long-term goals.

5. User Adoption and Incentives: Most bidders pledged to direct 95%–100% of yield back to Hyperliquid, but if little of that reaches end users, USDH balances may not look attractive compared to yield-bearing alternatives like USDe or tokenized T-bills. Adoption will depend on whether users see tangible benefits, fee rebates, rewards, or direct returns, for holding USDH.

Conclusion

The early success of Native Markets in dominating the USDH stablecoin ecosystem underscores the critical role of liquidity providers in shaping adoption. With strong backing, deep liquidity, and a growing share of trading volume, Native is setting the pace for Hyperliquid's next growth phase. As competitors scramble to catch up, the race for USDH dominance could define not just Hyperliquid's success, but also the broader evolution of decentralized trading infrastructure.

Get ahead in the USDH race, buy

Hyperliquid (HYPE) now on BingX and position yourself for the next big move. For many in the crypto community, the USDH frenzy has been the most thrilling display of on-chain governance in years, all building toward Sunday, September 14's climax when Hyperliquid validators cast their final votes.

Related Reading