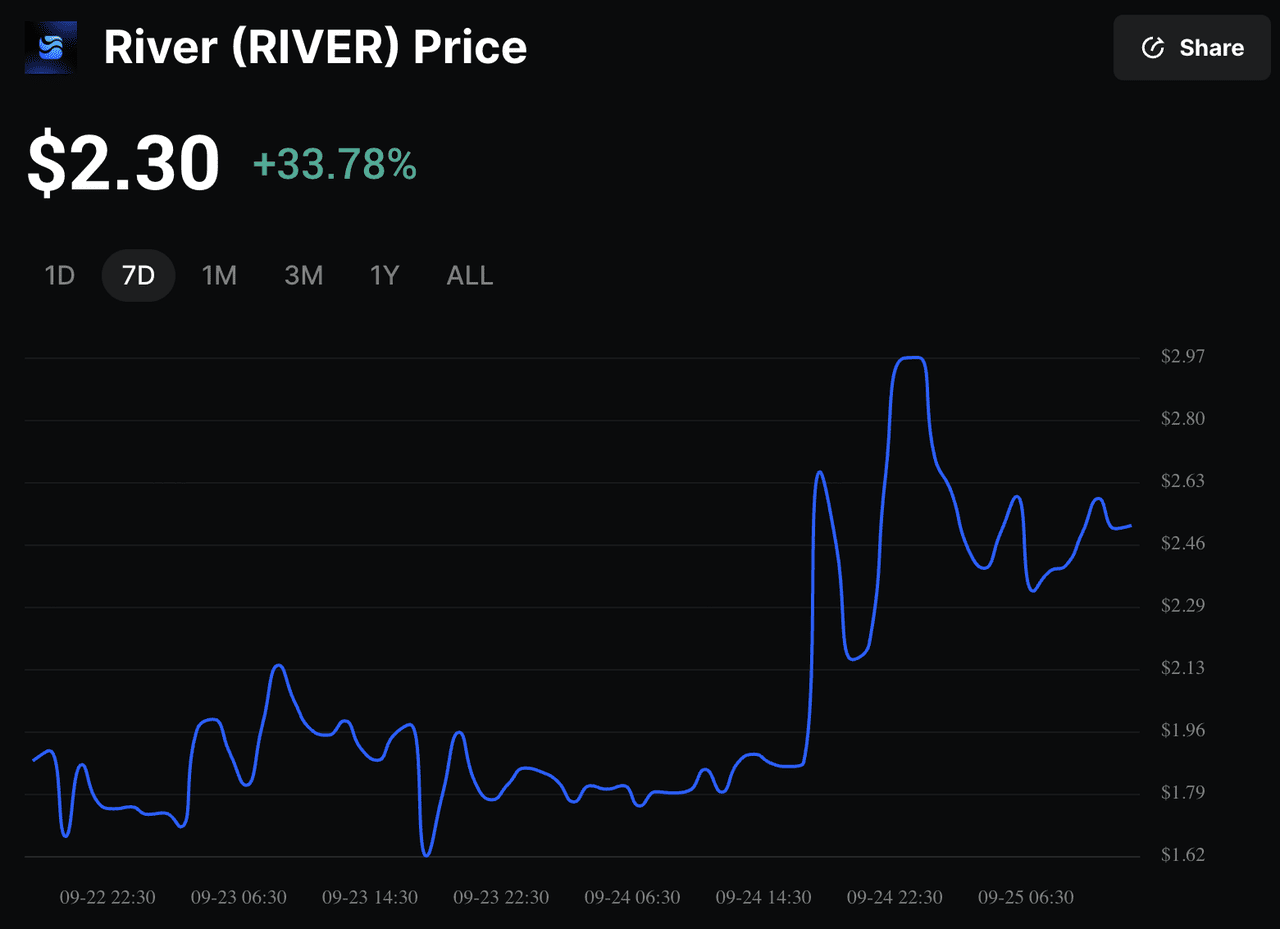

On September 25, 2025, River (RIVER) jumped over 35% in 24 hours, snapping back from a 24.5% weekly slide while the broader crypto market stayed roughly flat, an indication the move was driven by coin-specific catalysts rather than macro flows.

In this guide, you’ll learn what River is and how it works, the role of its satUSD stablecoin, why RIVER is rallying, key risks and metrics to track, and practical strategies for trading it on BingX.

River also incorporates a participation layer through River4FUN, which rewards users for both on-chain engagement and social contributions. These rewards are distributed as River Points, which can be converted into the native RIVER token via a dynamic airdrop system. The conversion follows a time-based curve that incentivizes longer holding, giving participants the choice between early liquidity or higher token rewards later.

A Deep Dive Into River’s Building Blocks

1. Omni-CDP for Cross-Chain Borrowing: River’s Omni-CDP lets users deposit assets like BTC, ETH, BNB, or LSTs on one chain and mint satUSD on another. Powered by LayerZero’s OFT/OApp messaging, it keeps collateral and debt positions synchronized across chains. This design removes the need for third-party bridges, making capital deployment more efficient and secure.

2. satUSD and satUSD+ Stablecoins: The heart of River is satUSD, an over-collateralized stablecoin with a single, unified supply across chains. When transferred, satUSD is burned or locked on one chain and minted on another, avoiding fragmented liquidity. Users can also stake satUSD to earn satUSD+, a yield-bearing version that captures protocol revenue while staying liquid and composable in DeFi.

3. Bridge and Liquidity Routing: River relies on OFT-based transfers instead of external bridges. This ensures satUSD maintains a consistent supply as it moves across ecosystems, reducing risks of depegs or liquidity fragmentation. The result is a smoother and more reliable flow of stablecoin liquidity across supported blockchains.

4. Smart Vault and Prime Vault: River’s Smart Vault automates mint-and-stake flows, giving users fixed-period yields without liquidation risks. For institutions, the Prime Vault provides custodian support and predictable returns, helping attract large inflows. Together, these vaults expand River’s appeal to both retail users seeking safe yields and institutions looking for structured exposure.

Why Did RIVER Rally Over 35% in Late September 2025?

RIVER token rallied around 35% in September 2025 | Source: BingX

River’s rebound is partly fueled by its Dynamic Airdrop lockup and conversion system. At TGE, only 20% of tokens unlocked, while 80% vest linearly over 180 days. Holders get a higher conversion rate the longer they wait, up to 27× more by Day 180. This delays sell pressure and supports early price discovery, though accelerated claims after September 24 could test momentum.

The

PancakeSwap trading campaign from September 22–24 drove daily volumes to $56.7 million through a 10 million River Points reward pool. While this boosted short-term liquidity, volumes dipped afterward, raising the question of whether RIVER can sustain activity above key support levels or if momentum will fade post-event.

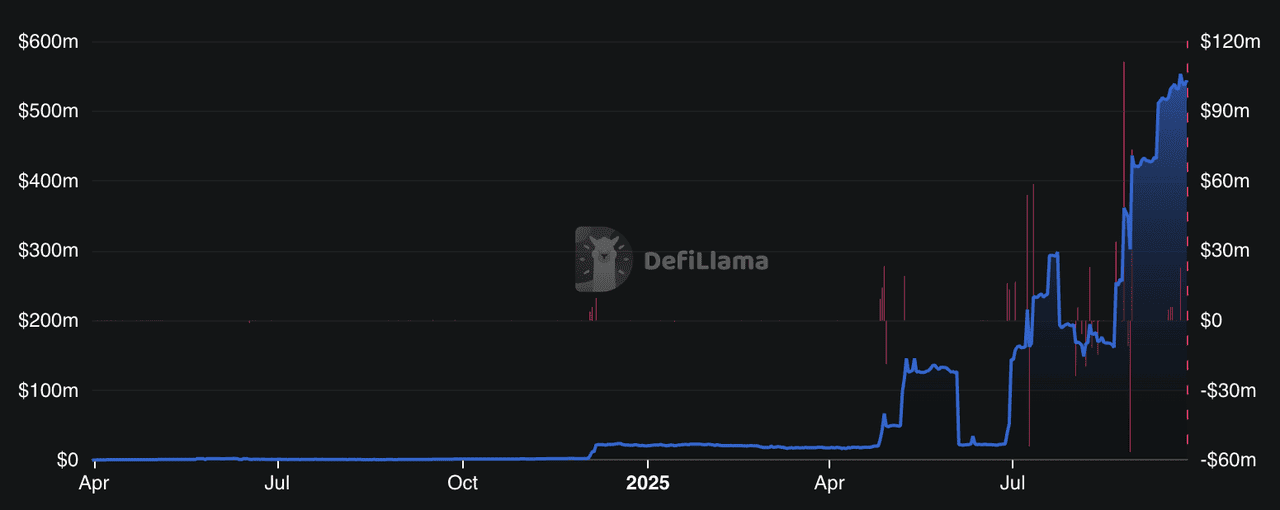

Finally, institutional inflows into Prime Vault, reported at $250 million TVL as of September 2025, have strengthened confidence in River’s chain-abstraction model. On-chain data shows broader TVL growth across ecosystems, validating satUSD demand and creating a more durable foundation for RIVER’s long-term value.

RIVER Token Utility and Tokenomics

The RIVER token powers every layer of the River ecosystem. It serves as:

• Governance: RIVER holders can vote on protocol parameters such as collateral ratios, vault incentives, and stablecoin policies, shaping how River evolves.

• Fee Capture & Distribution: A portion of protocol revenue from satUSD minting, redemption, and liquidation fees accrues to RIVER stakers and ecosystem rewards.

• Liquidity Incentives: RIVER is distributed to users who provide satUSD liquidity across supported chains and to participants in trading campaigns or River4FUN activities.

• Vault Participation: In Prime and Smart Vaults, RIVER can be staked or used to boost yields, aligning token holders with long-term adoption.

Together, these functions embed RIVER as the coordination and incentive layer of River’s chain-abstraction model, directly tying its value to satUSD adoption and vault growth.

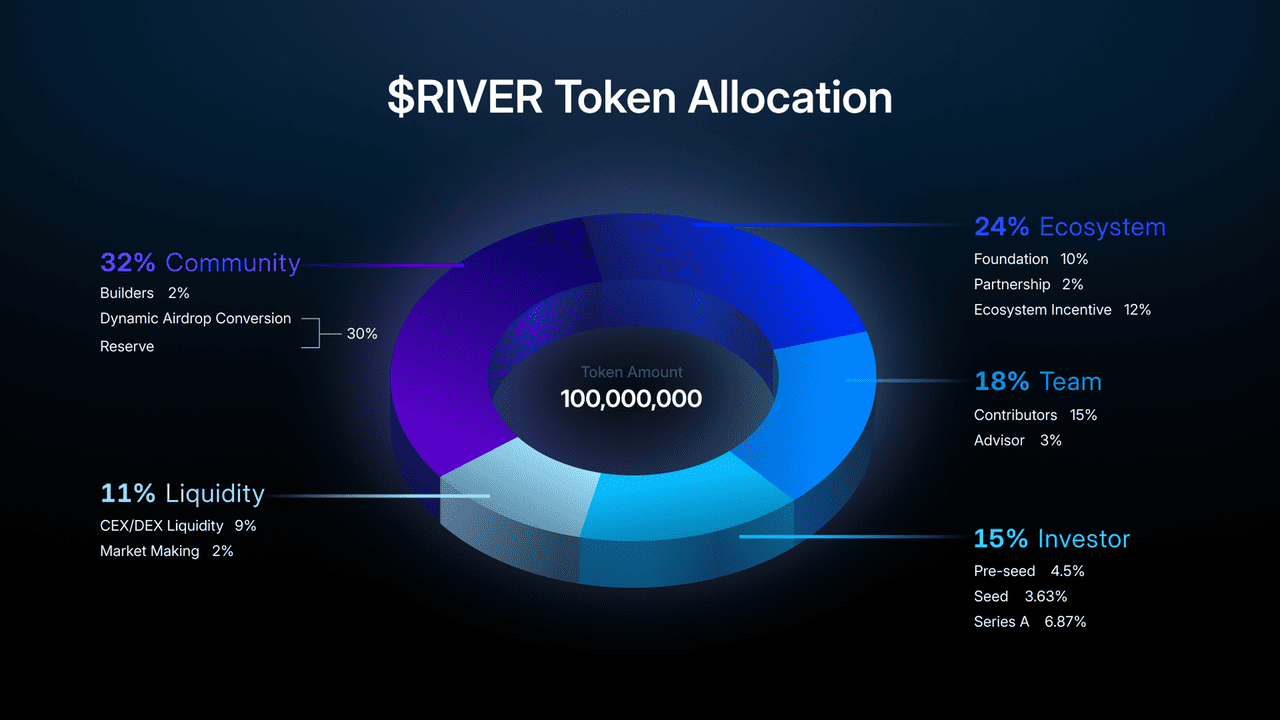

RIVER Token Allocation

RIVER token distribution | Source: River docs

RIVER has a fixed total supply of 100 million tokens. At launch, circulation was limited by the Dynamic Airdrop model, with only 20% unlocked at TGE and the remaining 80% vesting gradually over 180 days.

• Airdrop Allocation: ~30% reserved for the 180-day conversion of River Points → RIVER.

• Community Incentives & Liquidity: A large share allocated to ecosystem growth, liquidity mining, and campaign rewards.

• Team & Investors: Locked with multi-year vesting schedules to ensure long-term alignment.

• Treasury/Reserves: For future partnerships, institutional vault integrations, and ecosystem expansion.

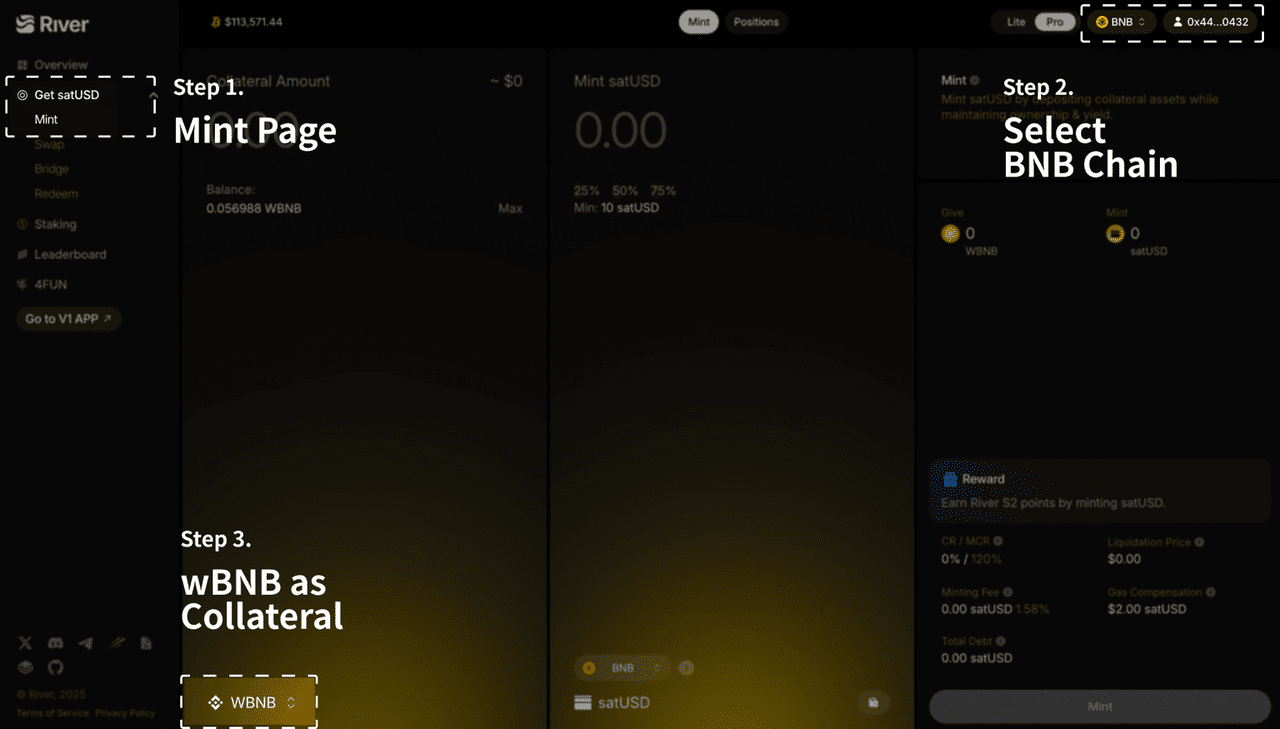

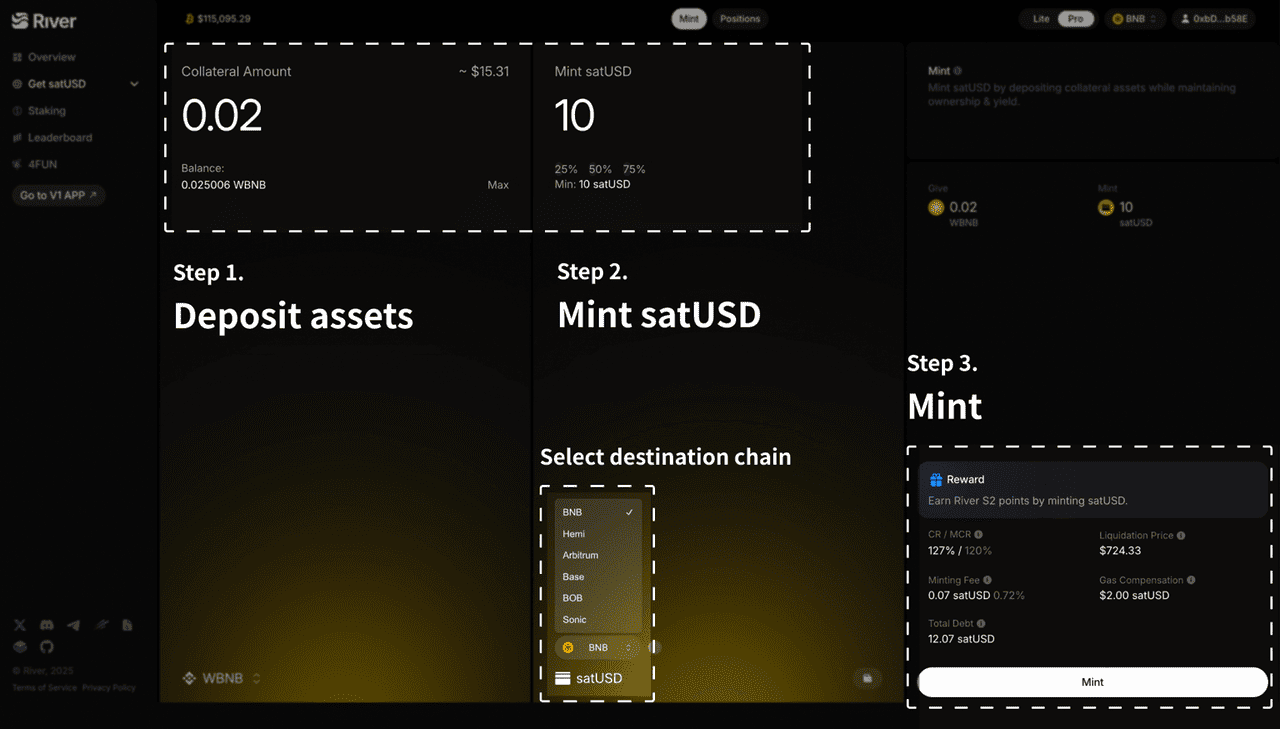

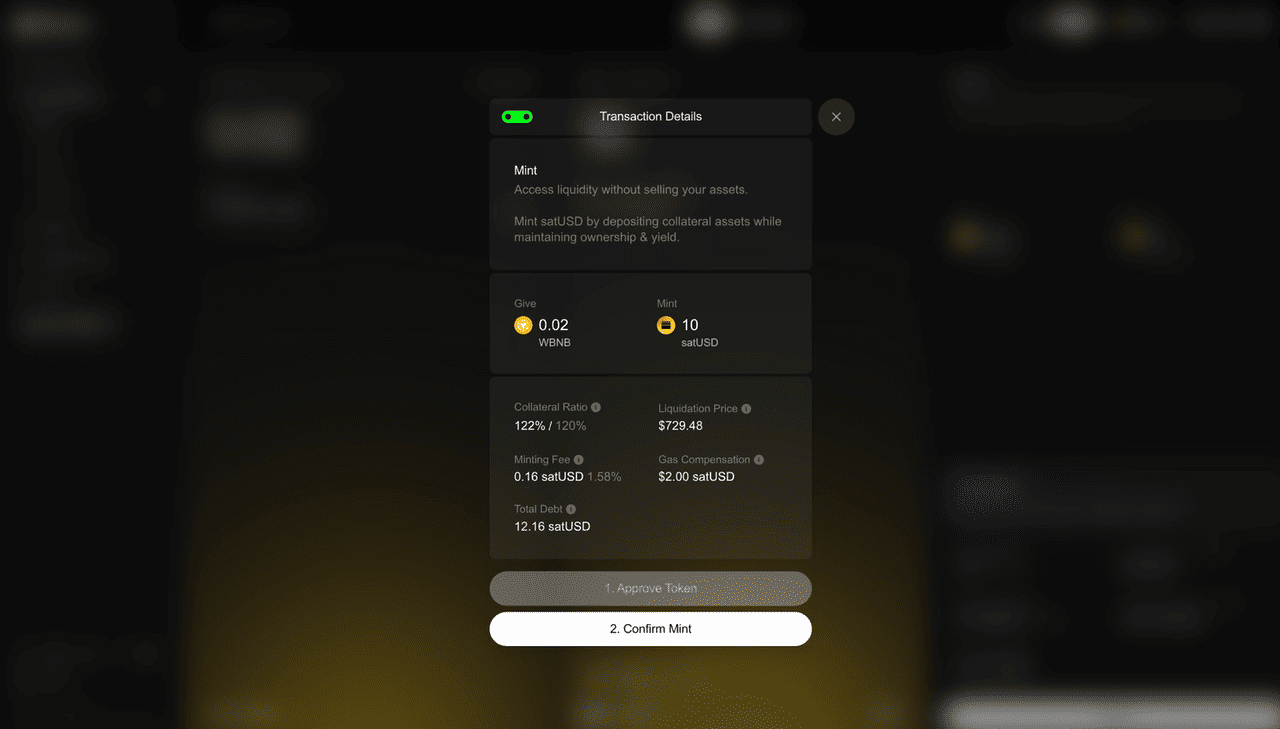

How to Get Started with River Protocol

If you’re new to River, here’s a simple step-by-step look at how to interact with its ecosystem and start using satUSD.

Source: River docs

1. Deposit collateral: Choose a source chain and deposit BTC/ETH/BNB/LSTs into River’s Omni-CDP. Risk parameters (e.g., minimum collateral ratio) vary by asset.

Source: River docs

2. Mint satUSD on any destination chain: River uses LayerZero to message the destination chain to mint satUSD 1:1 against your position, no third-party bridge. The supply stays consistent using burn/lock + mint messaging.

Source: River docs

3. Use or stake your satUSD

• Spend/trade satUSD across supported ecosystems.

• Stake for satUSD+ to earn protocol revenue; it remains liquid and composable.

4. Risk controls & peg: satUSD maintains its $1 target with over-collateralization, liquidations, redemptions, and on-chain arbitrage; River also defines Recovery Mode rules when system-wide collateralization falls.

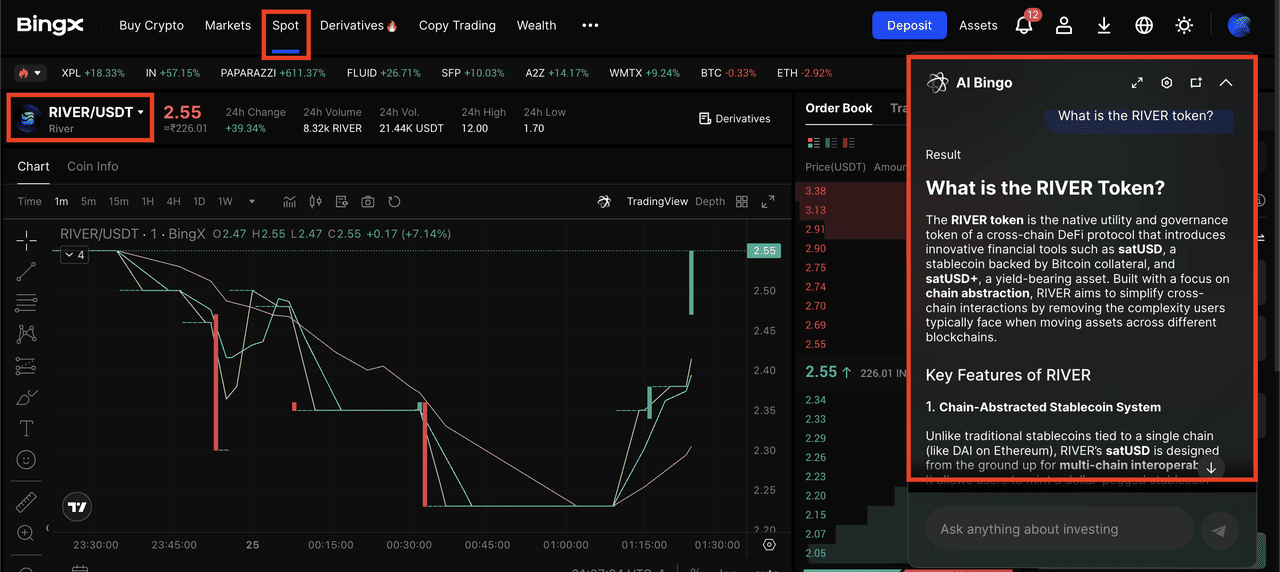

How to Trade River (RIVER) on BingX

BingX has officially listed RIVER/USDT for trading on both the Spot and Futures markets, giving you flexible ways to gain exposure to River’s ecosystem. With

BingX AI tools, you can analyze market trends, monitor volatility, and set smarter strategies before entering trades.

Buy or Sell RIVER/USDT on the Spot Market

RIVER/USDT trading pair on the spot market powered by AI Bingo

Spot trading is well-suited for beginners who want to gradually build a position in RIVER over time, allowing them to buy and hold tokens without leverage while gaining exposure to the project’s long-term growth.

1. Create and verify your BingX account by registering with your email or phone number and completing the

KYC process to unlock full trading access.

2. Deposit

USDT into your Spot wallet using bank transfer, card payment, or by transferring crypto from another wallet or exchange.

3. Search for

RIVER/USDT in the

Spot market to access River’s live trading pair and view the current price chart, order book, and recent trades.

4. Choose your preferred order type. A

Market order buys instantly at the current price, while a Limit order lets you set your own price and executes only when the market reaches it.

5. Track your RIVER holdings under the Assets tab and consider using

Dollar-Cost Averaging (DCA) by making small, recurring purchases to smooth out volatility.

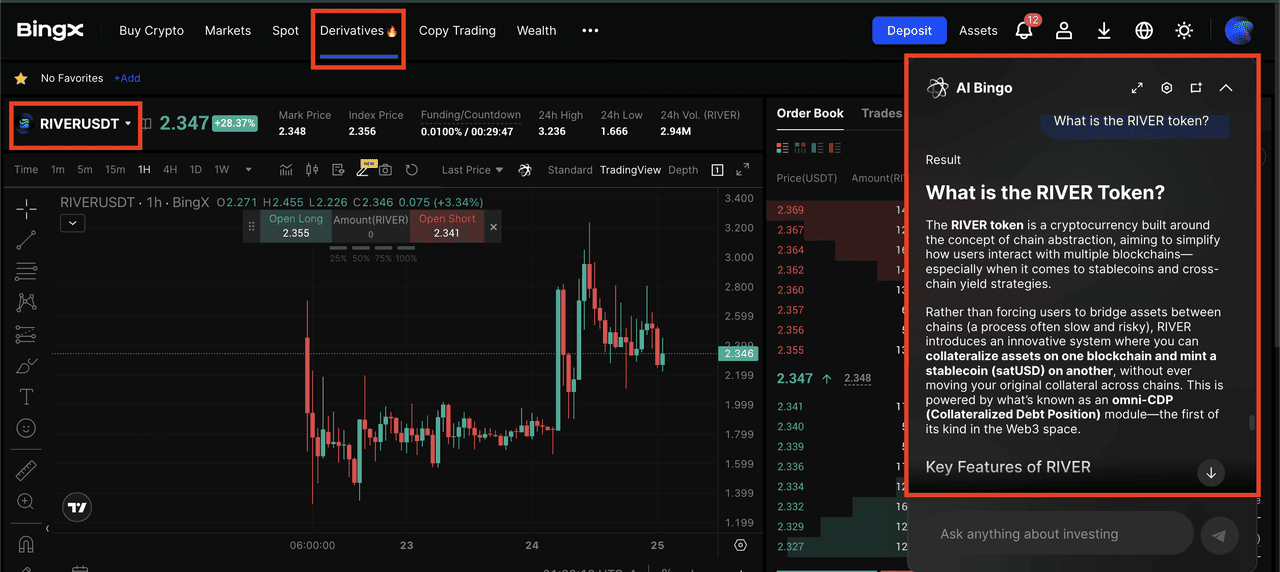

Trade RIVER/USDT Perpetual Futures

RIVER/USDT perpetual contract on the futures market powered by AI Bingo

For traders looking to capture short-term price movements in either direction using leverage, this approach offers the potential for amplified gains but also carries significantly higher risk and the possibility of rapid losses.

2. Begin with low leverage, say 2–3×, to reduce liquidation risk while you familiarize yourself with funding rates, margin requirements, and how positions are managed.

3. Decide your trading direction: go Long if you anticipate RIVER’s price will rise, or go Short if you expect a pullback from post-event hype or upcoming token unlocks.

4. Manage your risk carefully by setting clear stop-loss and take-profit levels, and keep position sizes small enough that normal market swings won’t wipe out your margin.

5. Monitor market signals like

funding rates,

open interest, and the price gap between spot and perpetual contracts to avoid entering trades during overheated or crowded conditions.

Tip: Avoid chasing spikes right after incentive events; look for pullbacks to support with recovering volume or breakouts confirmed by higher highs and rising volume.

Key Considerations Before Investing in River (RIVER)

Before adding RIVER to your portfolio, it’s important to weigh both the opportunities and the risks tied to its design and adoption.

• Unlock and Conversion Overhang: River’s dynamic airdrop delays sell pressure but doesn’t eliminate it. A surge in conversions later in the 180-day window could add significant supply and impact price stability.

• Event-Driven Liquidity: Trading campaigns can temporarily boost activity, but volumes often fade once incentives end. Shallow liquidity may lead to heightened volatility.

• Cross-Chain Complexity: River relies on LayerZero’s OFT for interchain messaging, which adds technical moving parts. Sustained security and synchronization are critical to avoid systemic risks.

• Adoption Risk: satUSD growth, TVL inflows, and vault participation need to keep pace with expanding supply. If adoption slows, token economics could weaken despite initial scarcity.

Bottom Line and Near-Term Watchlist

River (RIVER) is positioning itself as a cross-chain liquidity protocol centered on satUSD and supported by vault products and a dynamic airdrop model. Its tokenomics deliberately constrain supply at launch, creating scarcity that can fuel sharp price movements in either direction. Over the next several months, the pace of River Points conversions, growth in satUSD circulation, and institutional adoption through Prime and Smart Vaults will be the main indicators of whether RIVER’s momentum can translate into sustainable value.

Traders should keep a close eye on circulating supply expansion, TVL trends across chains, and liquidity depth on both CEXs and DEXs. While River’s architecture and design choices have generated strong early interest, risks remain. Unlocks, fading event-driven volumes, or slower-than-expected adoption could pressure price performance. As always, approach with caution, track fundamentals regularly, and only invest what you can afford to lose.

Related Reading