MYX Finance (MYX) is making headlines in 2025 with its explosive price rally, surging over 1,000% in 30 days and over 680% in the past seven days, reaching a new all-time high above $0.93. Backed by strong trading volume, a unique trading engine, and growing DeFi interest, MYX is positioning itself as a major player in the on-chain

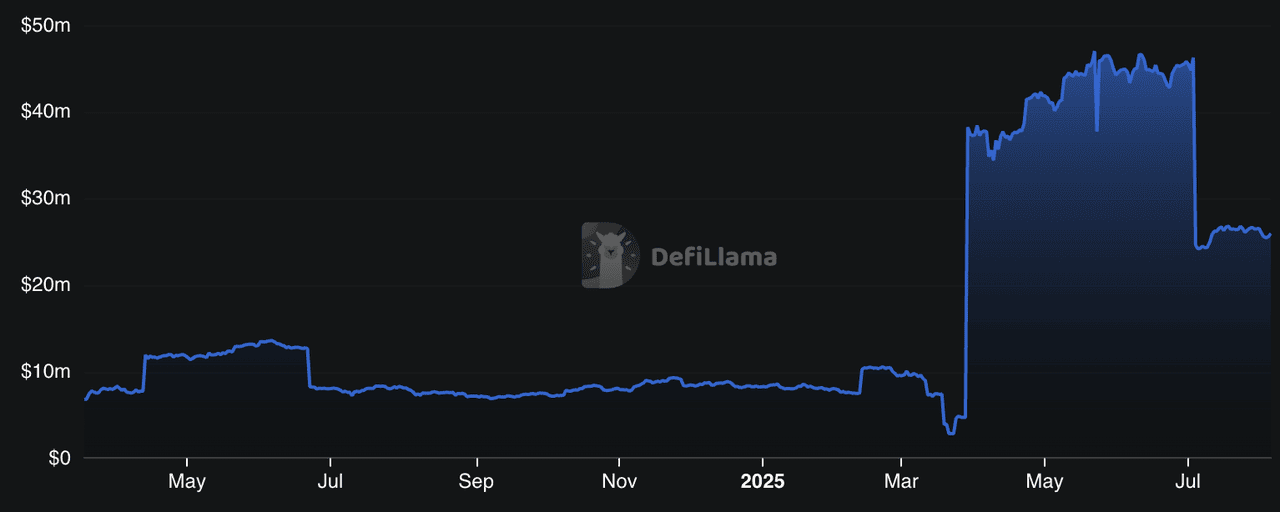

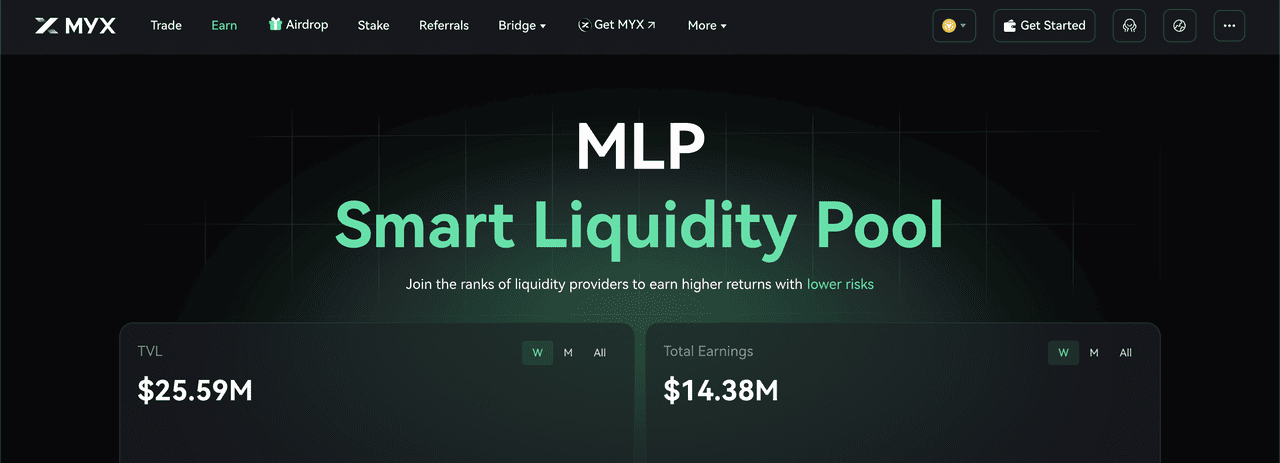

derivatives market. As of August 2025, MYX Finance has a total value locked (TVL) of over $25 million, a near 10x growth since March 2025.

MYX Finance TVL | Source: DefiLlama

But what exactly is MYX Finance, and why are traders flocking to it? In this guide, we’ll explain what MYX Finance is, how it works, the reasons behind the recent MYX price surge, and how you can start using it today.

What Is MYX Finance and How Does It Work?

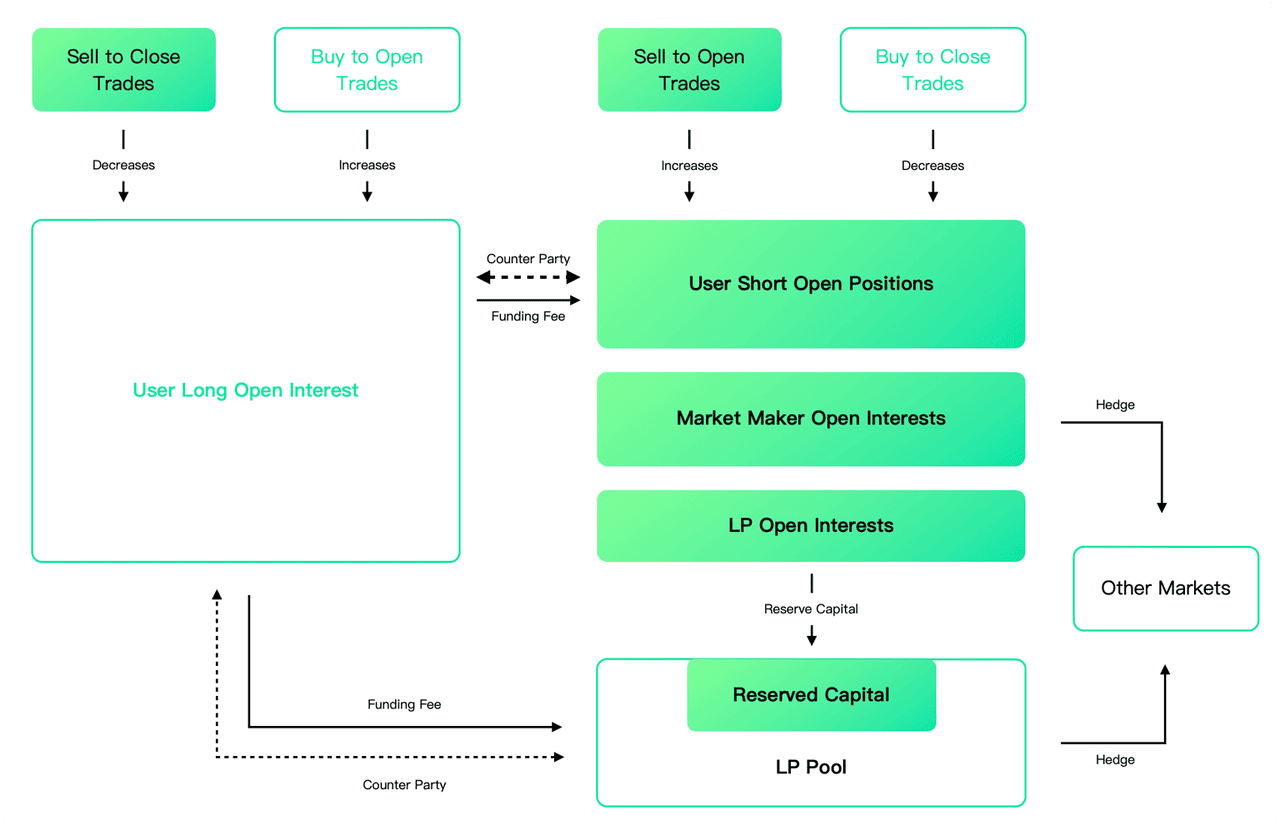

At the heart of MYX Finance is the Matching Pool Mechanism (MPM), a unique trading engine that seamlessly matches long and short positions without relying on traditional order books. This enables capital-efficient trading and instant execution, even during high volatility.

Key Features of MYX Finance DEX

How MYX Finance works | Source: MYX Finance docs

• Perpetual Futures Contracts: USDC-margined and settled with up to 50x leverage

• No Registration Required: Trade directly from your wallet

• Low Fees: Maker/taker model with fees as low as 0.018%

• Gas-Free Seamless Trading: Enabled via MYX’s Seamless Key and Particle Wallet

Whether you’re a new DeFi user or an experienced trader, MYX offers an intuitive yet powerful alternative to centralized futures platforms.

Why Is the MYX Token Soaring?

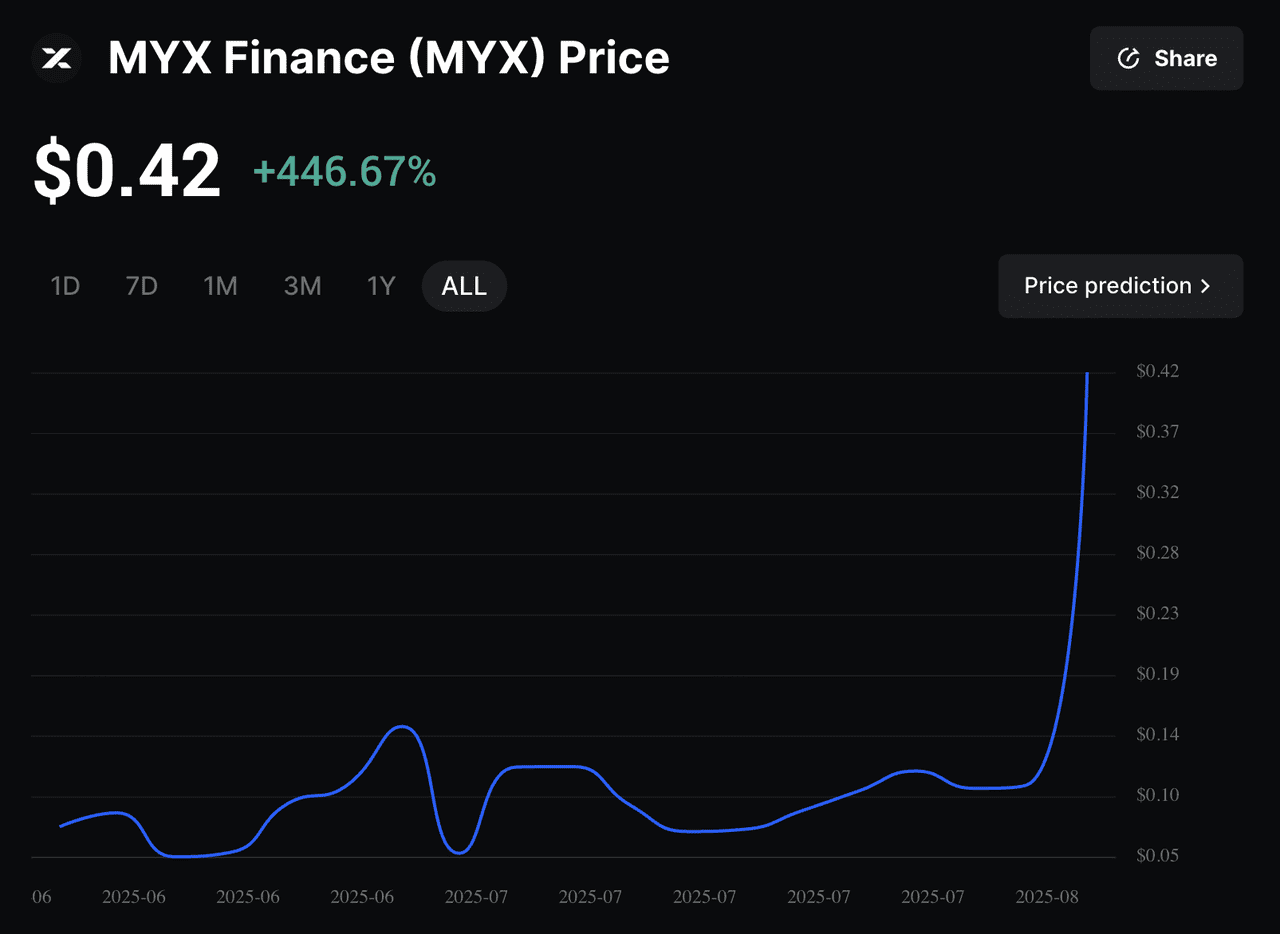

MYX Finance price chart on BingX

As of August 5, 2025, MYX Finance (MYX) has surged by over 1,000% in the past 30 days and more than 680% in the past 7 days, reaching a new all-time high of $0.9317. Just two months ago, the token was priced at $0.04672, reflecting a remarkable +1950% gain since mid-June. This parabolic rise has been driven by a combination of speculative interest and strong on-chain performance. MYX recently recorded $133.27 million in 24-hour trading volume (up 382%) and over $2.45 billion in weekly volume. Its market cap now stands at $107.8 million, with a fully diluted valuation (FDV) of $807.82 million and TVL of $25.92 million, resulting in a Market Cap/TVL ratio of 4.94, an indicator of elevated investor confidence and aggressive growth expectations.

Technical indicators support this rally. MYX broke out of a symmetrical triangle chart pattern, often a precursor to large price moves. The Bull Bear Power (BBP) continues to rise, a Chaikin Money Flow (CMF) reading of +0.44 suggests sustained accumulation, and a bullish

moving average convergence divergence (MACD) crossover confirms upside momentum. Beyond charts, the protocol's rising popularity reflects a broader trend in the crypto market: growing demand for on-chain high-leverage derivatives, a narrative that gained traction with the success of platforms like

Hyperliquid. MYX has positioned itself well within this trend by offering zero-slippage execution, gas-free trading, and seamless onboarding—features that appeal to both retail users and professional traders.

Ecosystem growth is also fueling the rally. MYX Finance is backed by institutional investors like Sequoia China and GSR, with its infrastructure audited by PeckShield. The successful launch of MYX V1 and anticipation for the upcoming MYX V2 upgrade have further attracted liquidity and user engagement. The team allocated 14.7% of total supply to airdrops, creating buzz and widening token distribution across early adopters. Meanwhile, daily transaction counts, active wallet connections, and trading activity continue to rise across supported chains such as BNB Chain, Linea, and Arbitrum. While MYX has quickly evolved from a low-cap altcoin to a mid-cap contender, users should remain mindful of potential short-term corrections as the token enters price discovery territory.

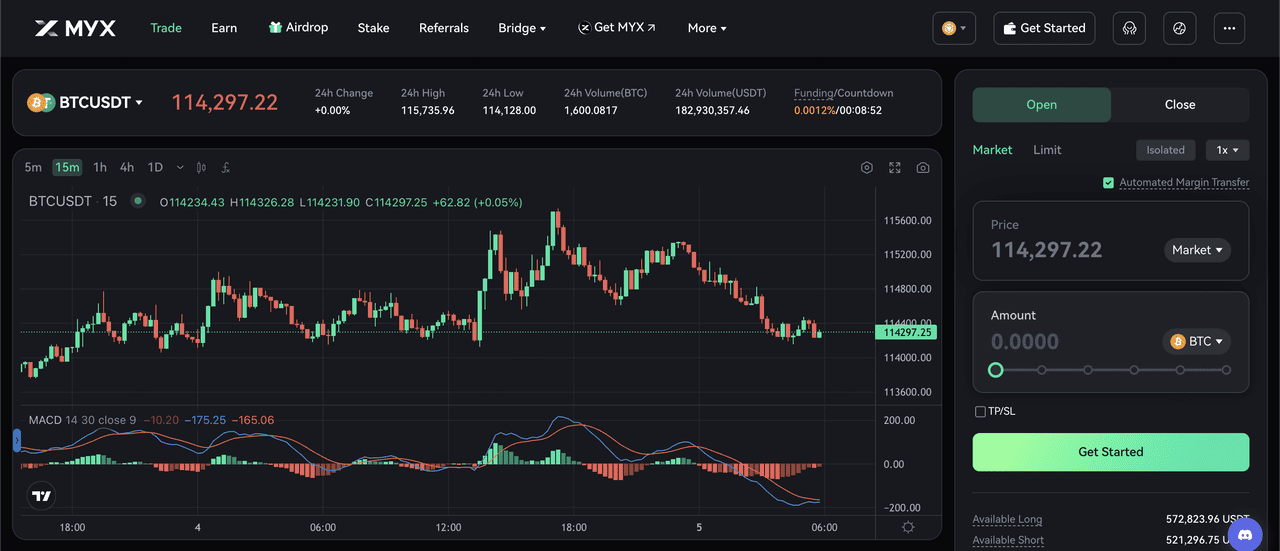

How to Trade on MYX Finance Platform?

MYX Finance is more than just a trading platform. It’s a full-featured DeFi protocol designed for high-speed derivatives trading and passive income opportunities.

1. Trade Perpetual Futures

On MYX Finance, you can trade top crypto assets like

BTC,

ETH,

SOL, and others using USDC-margined perpetual contracts with up to 50× leverage. Trades are executed instantly and without slippage thanks to the Matching Pool Mechanism (MPM), which pairs long and short positions internally. Risk is managed via isolated margin, ensuring that losses are confined to individual positions rather than your entire portfolio.

2. Provide Liquidity

Users can add collateral to Liquidity Pools and receive MLP tokens, which represent their share of the pool. Liquidity providers earn 40% of all trading fees, a portion of funding fees, and profits/losses from closed positions. As TVL grows (currently over $25.9 million), LPs benefit from high capital efficiency and passive income, especially in balanced markets with near 50:50 long/short ratios.

3. Participate in Governance

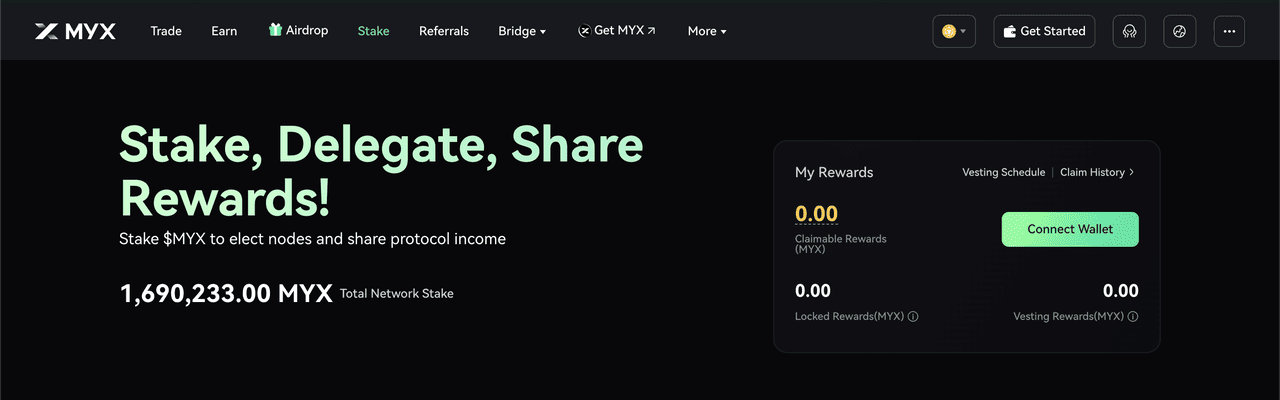

By

staking MYX tokens, you gain voting rights within the protocol’s decentralized governance system. Token holders can propose and vote on changes to trading fees, protocol upgrades, risk parameters, and the structure of the Keeper Network. This gives the community direct influence over the platform’s evolution and helps align incentives between developers, traders, and token holders.

4. Become a Node or Delegator

To run a Keeper Node, users must stake at least 300,000 MYX and maintain uptime to execute trades, upload price data, and record on-chain histories. Alternatively, users can delegate their MYX tokens to active nodes to earn a share of trading fees, MYX buybacks, and execution rebates without running infrastructure. The Keeper Network rotates every week, allowing broader participation and ensuring decentralized trade settlement across supported chains.

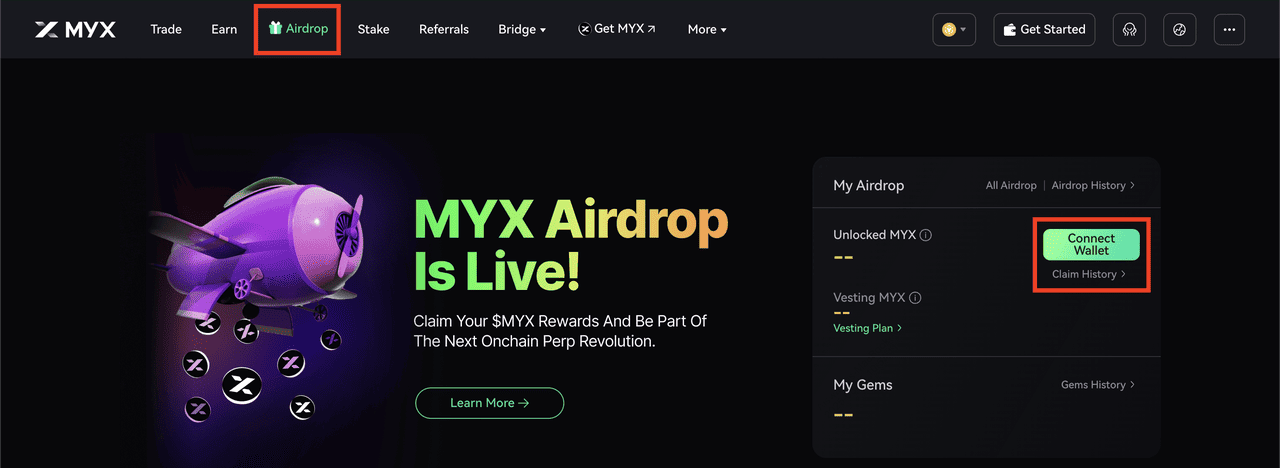

How to Claim the MYX Finance Airdrop

To reward early supporters and ecosystem contributors, MYX Finance is distributing 14.7% of its total 1 billion MYX token supply through a multi-phase airdrop campaign. This includes allocations for users who participated in MYX’s early activities, testnet campaigns, and holders of BMYX, a pre-launch representation token.

The airdrop claim portal went live at the official

MYX Finance airdrop claim page on May 6, 2025, and eligible participants can begin claiming their rewards directly on the BNB Chain. If you're eligible, you could receive a portion of the 67,036,090 MYX designated for the initial drop.

Who Is Eligible for $MYX Airdrop?

1. Early contributors who interacted with MYX testnet or community tasks

2. BMYX token holders who purchased via Binance Wallet IDO

3. Users selected through snapshot-based distribution rounds

Note: BMYX holders will receive their tokens automatically, no claim is required.

MYX Finance Airdrop Snapshot Dates and Release Schedule

• May 6, 2025, 08:00 UTC – Eligibility preview began

• May 6, 2025, 12:00 UTC – Airdrop claim portal opened

• Initial Release – 30% of each eligible user's airdrop available immediately

• Remaining 70% – Unlocked linearly over the next 5 months, with 14% released on the 6th of each month

• Redemption Deadline – Each unlocked portion must be claimed within 90 days of release, or it will be forfeited and sent to the treasury

How to Claim Your MYX Airdrop

1. Visit the MYX Finance airdrop claim page on the app at https://app.myx.finance/integral

3. Switch your wallet network to BNB Chain (BEP-20)

4. The site will auto-detect your eligibility and display the claimable amount

5. Click [Claim], approve the transaction, and pay a small BNB gas fee

6. Once confirmed, the airdropped MYX tokens will appear in your wallet

Things to Note Before Claiming MYX Tokens

Before claiming, make sure you’re using the official MYX airdrop page to

avoid phishing scams or fake links. Keep at least 0.01–0.02 BNB in your wallet to cover gas fees during the transaction. If you're not eligible for this round, stay engaged with upcoming MYX campaigns for future airdrop opportunities. Remember, each unlocked token phase must be claimed within 90 days, or it will be permanently forfeited; set reminders so you don’t miss out.

MYX Token Utility and Tokenomics

The $MYX token is the core utility and governance asset of the MYX Finance ecosystem. Beyond being a speculative asset, MYX plays an essential role in enabling secure trading, incentivizing liquidity providers, powering governance, and rewarding ecosystem participants.

The $MYX token unlocks several important functions within the MYX protocol:

1. Staking & Governance: MYX holders can stake their tokens to participate in governance proposals that influence trading fees, system upgrades, and treasury allocations. This allows the community to steer the future of the protocol in a decentralized and transparent manner.

2. Keeper Network Participation: Running a Keeper node, responsible for executing trades, submitting price data, and maintaining trading history, requires staking at least 300,000 MYX. Users who prefer a passive role can delegate their MYX to active nodes and earn a share of their rewards, including execution rebates and fee distributions.

3. VIP Trading Tiers: Holding MYX unlocks reduced trading fees through a tiered VIP structure. For example, users with over 100,000 MYX can qualify for maker fees as low as 0.01% or even receive negative maker fees (rebates) at the highest tiers.

4. Buyback Yield for Stakers: A portion of MYX Finance’s protocol revenue, generated through trading fees and liquidation penalties, is used to buy back MYX tokens from the open market. These tokens are then redistributed to stakers, creating a real yield mechanism for long-term holders.

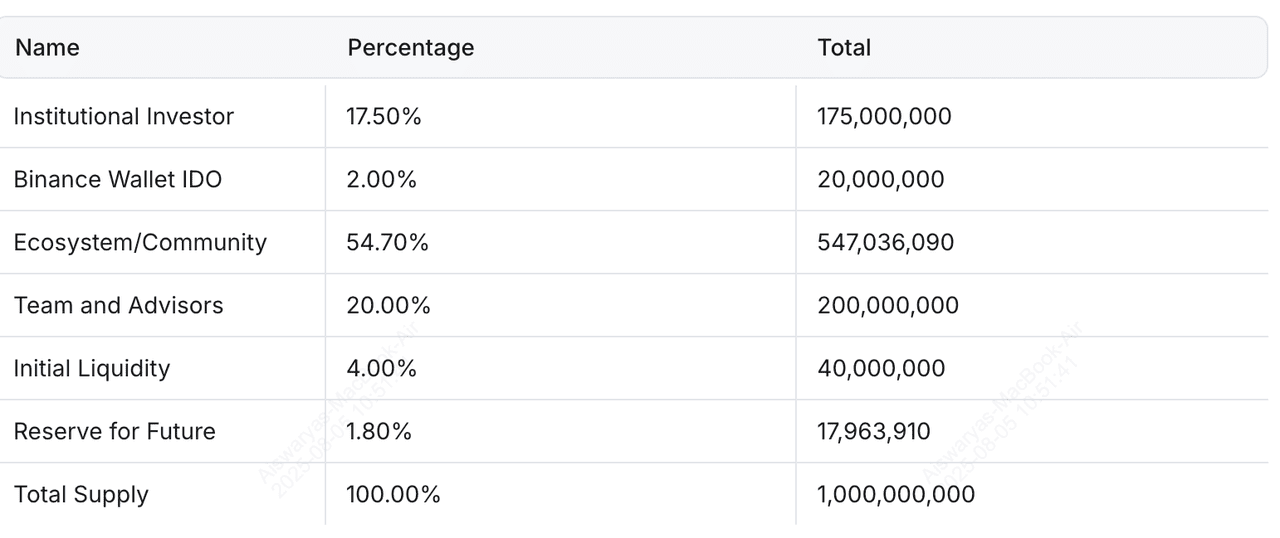

MYX Token Allocation

MYX token distribution | Source: MYX Finance docs

The total supply of MYX is capped at 1 billion tokens, with a structured allocation designed to support long-term growth, community incentives, and protocol stability.

• Community & Ecosystem (54.7% – 547,036,090 MYX): Allocated to community incentives, airdrops, ecosystem grants, and liquidity mining programs to drive user growth and protocol adoption.

• Team & Advisors (20.0% – 200,000,000 MYX): Reserved for core contributors, developers, and advisors, subject to long-term vesting schedules to ensure alignment with the project's success.

• Institutional Investors (17.5% – 175,000,000 MYX): Allocated to strategic backers and early investors who supported the protocol's early development phases.

• Initial Liquidity (4.0% – 40,000,000 MYX): Used to provide initial liquidity on decentralized exchanges and ensure smooth trading post-launch.

• Binance Wallet IDO (2.0% – 20,000,000 MYX): Dedicated to public sale participants through the Binance Wallet IDO event, offering fair community access to the token.

• Reserve (1.8% – 17,963,910 MYX): Held for future use cases, emergency needs, or governance-approved initiatives as the protocol evolves.

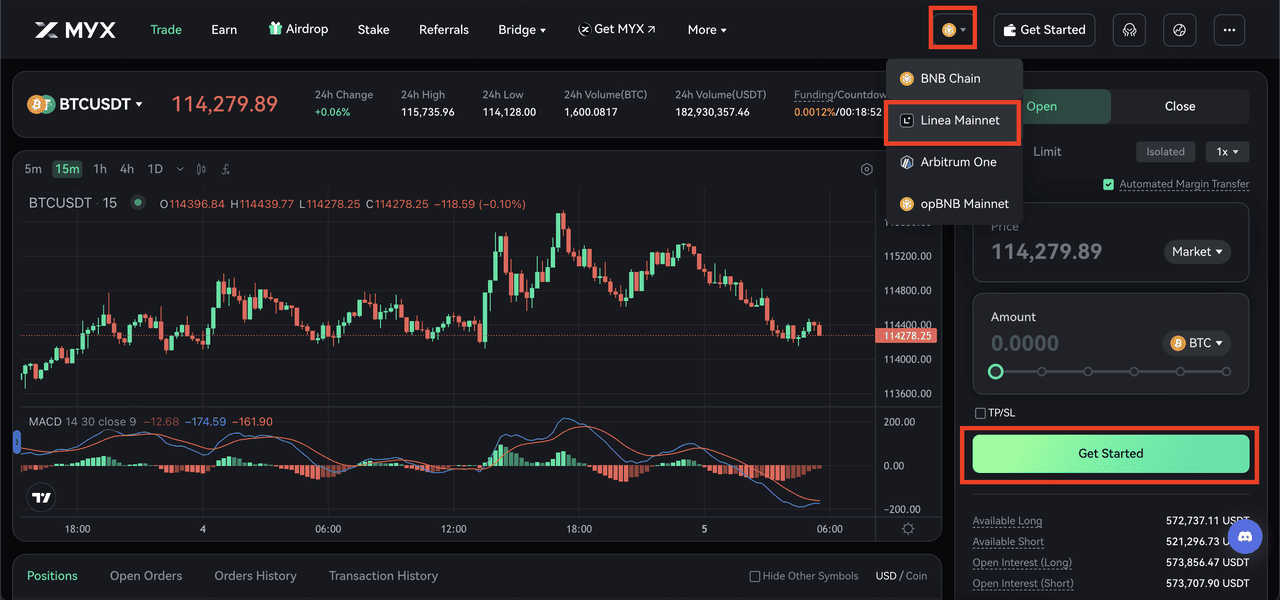

How to Get Started with MYX Finance on Linea

Linea is a fast, low-cost zkEVM Layer-2 network that supports Ethereum-compatible smart contracts, making it ideal for trading on MYX Finance with minimal fees and near-instant confirmations. If you're new to using Layer-2 networks, the

Linea ecosystem offers a smooth DeFi experience, especially when paired with MYX’s Seamless Trading system.

Whether you're an experienced derivatives trader or just exploring DeFi, MYX on Linea offers a fast, secure, and intuitive way to access perpetual trading with zero slippage and high capital efficiency. Here's how to use MYX Finance on Linea network:

1. Set Up a Linea-Compatible Wallet: Install a supported wallet like MetaMask or Rabby. Then, manually add the Linea network using the RPC settings from Chainlist.org, or connect automatically via trusted dApps.

2. Fund Your Wallet: You’ll need USDC on Linea to start trading on MYX. The easiest way is to

buy USDC on BingX, then withdraw it to your Linea-compatible wallet using a supported network like

Ethereum. From there, you can bridge your USDC to Linea using tools like Orbiter Finance,

Across Protocol, or the official Linea bridge. Also, keep a small amount of

ETH on Linea for gas fees, though most MYX trades are gas-free when using the Seamless Key.

3. Visit the MYX App: Go to

https://myx.finance, connect your wallet, and switch to the Linea network. The app will automatically detect your setup and enable trading features.

4. Set Up a Seamless Key (Optional but Recommended): MYX offers a unique Seamless Key system that removes the need for repetitive wallet signatures and manual gas payments. You can create one using your email, phone number, or social login via Particle Network. Once activated, you can trade with the speed and simplicity of a centralized exchange, without giving up custody.

5. Start Trading on MYX: You’re ready to go. Open long or short positions on assets like BTC, ETH, or SOL with up to 50x leverage. You can manage margin settings, monitor funding rates, and view real-time price feeds sourced from

Pyth Oracle, all within the same dashboard.

Key Considerations Before Using MYX

Before using MYX Finance, it’s important to understand its advantages. The platform offers zero-slippage execution, making it ideal for professional traders. Its Seamless Key enables fast, gas-free onboarding through social logins, while MYX tokens provide real yield, reduced fees, and DAO governance rights via the Keeper Network. The protocol also features fair tokenomics and strong incentives for both liquidity providers and stakers.

However, MYX also comes with risks. As a newer project, its token remains highly volatile, and leverage trading can result in rapid liquidations if not managed carefully. MYX is currently listed on a limited number of exchanges, and while its smart contracts are audited, all DeFi platforms carry inherent technical and market risks. It’s best to start small, do your own research, and only invest what you can afford to lose.

Conclusion

MYX Finance is introducing a new approach to decentralized derivatives trading with its Matching Pool Mechanism, zero-slippage execution, and seamless onboarding experience. Backed by strong token utility, real yield incentives, and growing multi-chain support, it has emerged as a noteworthy protocol in the 2025 DeFi landscape.

However, like all high-growth crypto projects, MYX comes with risks, including leverage-related liquidations, token volatility, and smart contract vulnerabilities. Whether you're a trader, liquidity provider, or passive participant, it’s essential to understand how the platform works and manage your exposure responsibly before getting involved.

Related Reading