Passive income from crypto isn’t just about “buy and hold” anymore, it’s about making your assets work for you. In August 2025,

Bitcoin hit a new all-time high above $124,000, pushing the total crypto market cap past $4.1 trillion. With the industry booming and experts predicting

BTC's value to go up as high as $1 million in the coming years, both beginners with a few hundred dollars and seasoned investors with six-figure portfolios are finding smarter ways to earn steady returns as they hold their crypto assets.

This guide breaks down 10 proven methods to grow your crypto holdings without the need for constant trading.

Why Does a Passive Crypto Income Matter in 2025?

In traditional finance, most savings accounts or fixed deposits earn just 2–4% per year, barely enough to keep up with persistent inflation. Even after the Fed’s anticipate rate cuts in the coming months, which pushed traditional yields lower, savers are still struggling to outpace rising living costs.

By contrast, the crypto market in 2025 offers far more opportunities to grow your wealth. With strategies like staking, lending, liquidity mining, and

real-world asset tokenization, investors can earn anywhere from 5–25%+ annually, depending on risk appetite and market conditions.

What makes crypto different is its open, global, and permissionless nature. Unlike banks that adjust rates slowly based on monetary policy, crypto protocols operate 24/7, competing for liquidity and rewarding users directly. This creates multiple avenues for generating passive income, not just from

stablecoins like

USDC or USDT, but also from assets like

ETH,

AVAX, or tokenized U.S. Treasuries that track real-world yields.

Passive income in crypto can:

• Diversify your returns beyond price speculation.

• Offset market downturns by creating steady cash flow.

• Reinvest profits for compounding, accelerating long-term growth.

• Provide liquidity without selling your core Bitcoin or

Ethereum holdings.

For beginners, this means you’re not limited to waiting for prices to rise; you can actively put your crypto to work and build wealth in ways traditional finance, constrained by inflation and Fed rate cuts, simply doesn’t allow.

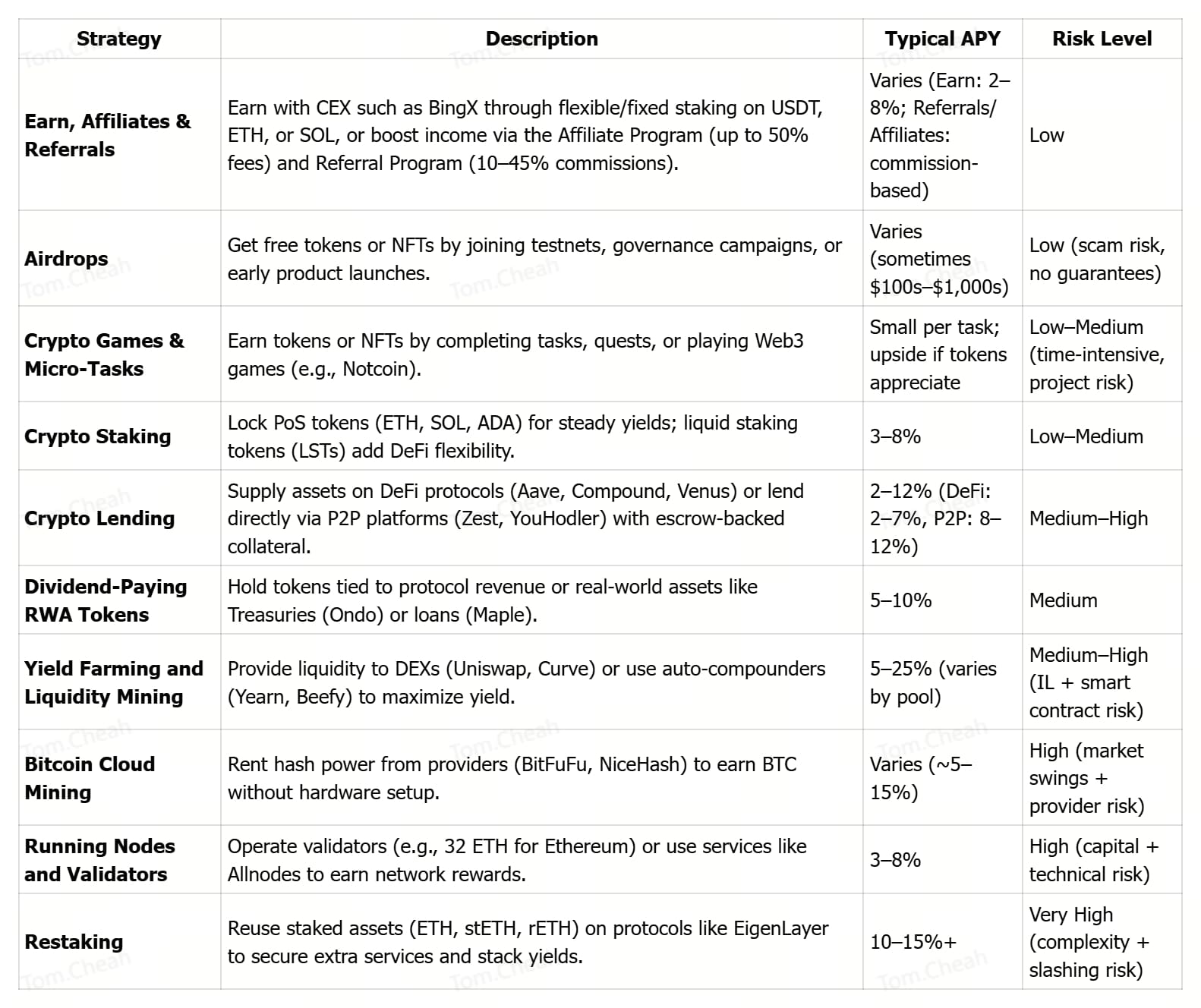

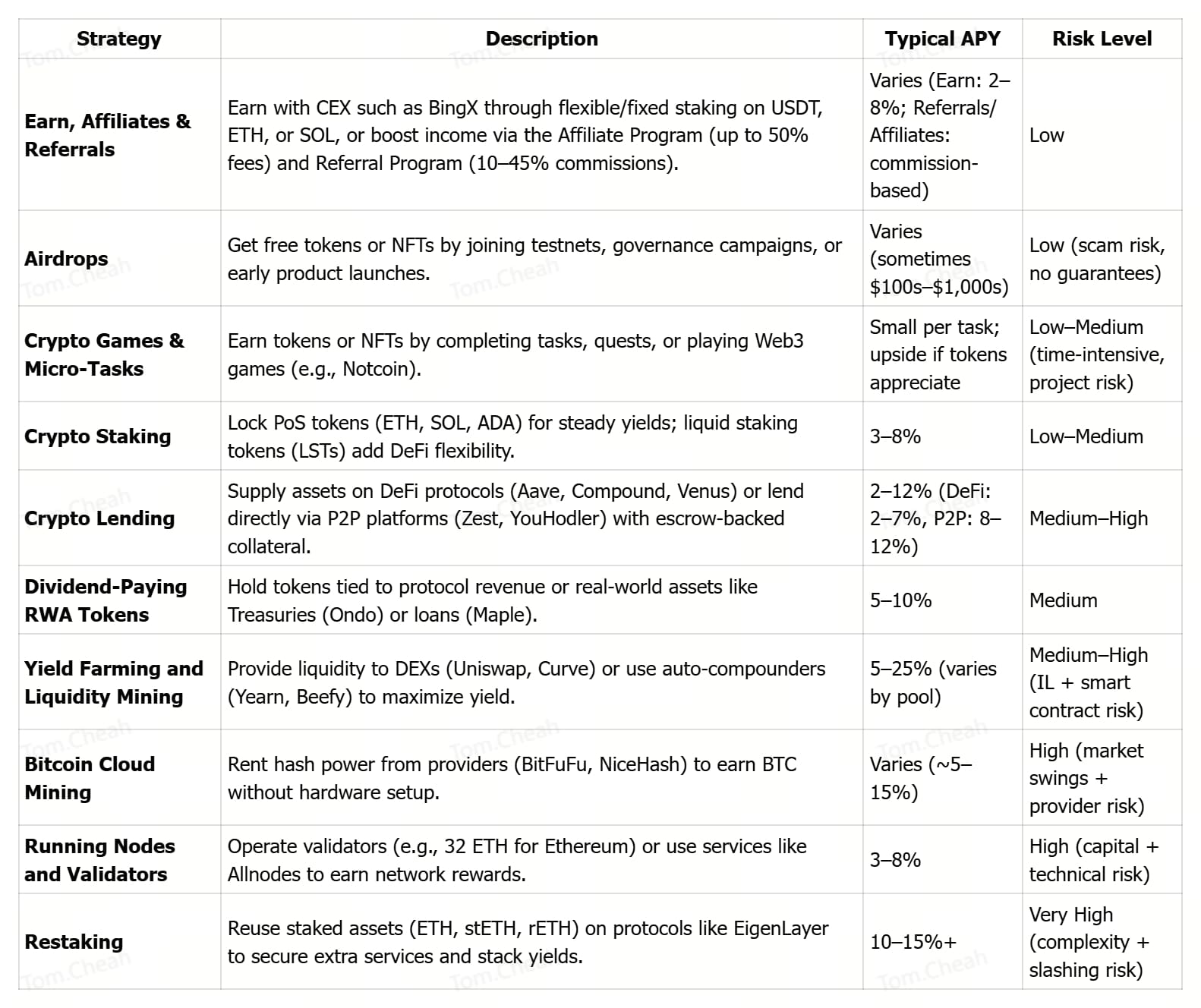

The 10 Best Passive Income Strategies for 2025

In 2025, passive income in crypto goes far beyond simple staking. From cloud mining to real-world asset (RWA) yields, here are the top 10 strategies to earn consistent returns and grow your portfolio in a rapidly growing crypto market.

1. Earn Passive Income on Centralized Exchanges (CEXs)

You don’t need to be an advanced DeFi user to start earning passive income. Centralized exchanges like BingX make it simple by offering beginner-friendly products. With

BingX Earn, you can stake or subscribe to flexible and fixed-term products on assets like USDT, ETH, or SOL and start receiving steady rewards without needing to run validators or manage wallets. Flexible products let you redeem anytime, while fixed-term plans offer higher yields if you commit longer. It’s one of the easiest ways for beginners to put idle crypto to work with just a few clicks.

Beyond staking, BingX also offers affiliate and referral programs that let you earn from growing the community. The

Affiliate Program is designed for content creators and influencers, offering up to 50% commission on trading fees, daily settlements, and exclusive campaign support. Meanwhile, the

Referral Program is open to all users; just share your unique referral code and earn a progressive commission (starting at 10% and up to 45% at higher levels) whenever your friends trade. Together, BingX Earn plus affiliate and referral rewards give beginners and pros alike multiple ways to build passive income while staying within a trusted exchange ecosystem.

2. Airdrops

Airdrops are one of the most popular entry points for beginners to earn free crypto. Projects distribute tokens or NFTs to early users to encourage adoption, reward community members, or promote upcoming launches. You can qualify by joining testnets, trying out new protocols, or participating in community governance. Some airdrops have been extremely lucrative, for example, early

EigenLayer users in 2024 earned over $2,000 just by restaking ETH and testing the protocol. NFT drops can also provide value, with Blur’s early recipients profiting by reselling their free collectibles once the marketplace gained traction.

The benefits of airdrops include zero upfront cost, the chance to explore new ecosystems, and significant upside if the project succeeds. Platforms like

Galxe, Layer3, and QuestN regularly host campaigns tied to major Web3 projects, offering tokens or NFTs for completing simple on-chain actions. However, rewards are not guaranteed, and scams are common, so always use a dedicated wallet and stick with trusted platforms.

3. Micro-Tasks and Crypto Games

Micro-tasks offer another easy way to earn crypto rewards. These include completing social media campaigns, joining community quests, testing dApps, or contributing content. Platforms like Zealy, Crew3, and Guild.xyz provide task boards where you can earn tokens, XP, or NFTs for small contributions. While each reward is small, they can add up over time and often provide early exposure to promising projects.

Crypto games also fall under this category. Many

Web3 games reward players with tokens or NFTs that can later be traded. For instance,

Notcoin on Telegram distributed free

NOT tokens through simple gameplay, which later reached a market cap above $1 billion. These games combine entertainment with earning opportunities, making them attractive for users who want both fun and financial upside. Just remember that time commitment can be high, and not every game or task will deliver valuable rewards. Always research before engaging, and focus on platforms with strong backers to minimize risks.

4. Staking and Liquid Staking

Staking is one of the most straightforward ways to earn passive income in crypto, especially for long-term holders of proof-of-stake (PoS) coins like Ethereum,

Solana, or

Cardano. By locking your tokens into a validator network, you help secure the blockchain and validate transactions, receiving staking rewards in return. Typical yields range from about 3–4% APY for Ethereum, 7–8% for Solana, and 3–5% for Cardano, making it a low-maintenance and predictable strategy for steady returns.

Liquid staking builds on this by offering more flexibility. Platforms such as

Lido,

Rocket Pool, or

Marinade issue

liquid staking tokens (LSTs) like stETH or mSOL, which represent your staked assets. These tokens not only keep generating staking rewards but can also be deployed across DeFi protocols for lending, trading, or

yield farming. This dual benefit lets you earn multiple streams of income without unstaking your original holdings, which makes liquid staking especially attractive to investors seeking higher capital efficiency.

However, staking and liquid staking are not risk-free. Validators can face slashing penalties for downtime or malicious activity, and liquid staking adds smart contract risk on top of network risks. Token prices may also fluctuate, reducing the value of your rewards. For beginners, services like

BingX Earn simplify the process, offering fixed and flexible staking options for coins like ETH,

SOL, and

ADA directly through your account. For advanced users, exploring liquid staking tokens in DeFi can unlock higher yields, but only after carefully weighing the risks involved.

5. Crypto Lending

Crypto lending lets you earn passive income by allowing others to borrow your assets in exchange for interest. This can be done through DeFi protocols like Aave, Compound, or Venus, where loans are overcollateralized and interest rates are set algorithmically. These platforms typically offer 4–7% APY on stablecoins like USDC or USDT, and 2–4% on assets like ETH, providing predictable returns backed by smart contracts.

For those seeking more control and higher yields, peer-to-peer (P2P) lending platforms such as Zest Protocol or YouHodler allow you to negotiate terms directly with borrowers. You can set the loan size, interest rate, and duration, often earning 8–12% APY for stablecoin loans, with collateral held in escrow. While P2P can offer better rewards, it also carries higher risks of borrower default, liquidity lockups, and collateral value fluctuations. To manage risks, start small, lend only to verified borrowers, ensure strong overcollateralization (120–150%), and diversify across multiple loans or protocols. This way, crypto lending can provide steady income while balancing risk and reward.

6. Yield Farming and Liquidity Mining

Yield farming and liquidity mining reward you for depositing assets into DeFi protocols like Uniswap, Curve, or Balancer. By providing token pairs to liquidity pools, you earn a share of trading fees and may receive bonus governance tokens. Returns vary by pool, stablecoin pairs like USDC/USDT offer safer yields of 5–8% APY, while volatile pairs such as ETH/USDC or POL/USDT can generate double-digit returns, though with higher risk. Platforms like

PancakeSwap on

BNB Chain also attract users with high-yield opportunities and low fees.

For a more hands-off approach, yield aggregators such as

Yearn Finance, Beefy Finance, or Autofarm automate this process. They shift funds across protocols to capture the best yields and reinvest rewards for compounding, saving you from constant monitoring and gas costs. While these tools maximize efficiency, risks like impermanent loss, smart contract vulnerabilities, and yield dilution still apply. Beginners may start with stablecoin pools, while experienced users can diversify across both farming platforms and aggregators to balance risk and reward.

7. Dividend-Paying Real-World Asset (RWA) Tokens

Dividend-paying

real-world asset (RWA) tokens offer investors a way to earn passive income backed by tangible assets or protocol revenues. Instead of relying solely on crypto-native mechanisms, these tokens distribute returns from sources like U.S. Treasuries, real estate, or business loans. For example,

Ondo Finance brings government bonds on-chain with yields around 5% APY, while

Maple Finance provides 7–10% APY through institutional lending. Projects like Centrifuge and Goldfinch go further by tokenizing trade finance and extending credit to real-world businesses, giving investors steady and diversified income streams that connect traditional markets with blockchain.

The appeal lies in stability and diversification, but RWA tokens also carry important risks. Regulatory uncertainty could affect how these assets are classified, while counterparty risk remains if asset managers or borrowers fail to meet obligations. Liquidity can also be limited, making it harder to exit positions quickly. To mitigate these challenges, investors should verify that payouts are transparently recorded on-chain, research how the underlying assets are managed, and stick to platforms with strong compliance and reputable backers. This ensures exposure to the benefits of real-world yields while keeping risks in check.

8. Bitcoin Cloud Mining

Cloud mining offers a way to gain exposure to Bitcoin mining without buying and maintaining expensive hardware. Instead of setting up your own ASIC rigs, you rent hashing power from providers who manage the equipment and operations for you. In return, you receive a share of the mining rewards, minus fees, directly to your wallet. Earnings depend on factors like Bitcoin’s price, network difficulty, and provider costs, with a $1,000 contract potentially yielding $80–$150 per month under current conditions as of August 2025. Services such as BitFuFu, NiceHash, and ECOS Mining make it easy to scale by purchasing additional contracts.

While convenient, cloud mining comes with notable risks. Profitability can swing with Bitcoin’s market price and mining difficulty, and hosting or maintenance fees may cut into returns. There’s also the danger of unreliable or fraudulent providers, making due diligence essential before committing funds. To reduce risk, start small, compare provider fees, and stick to reputable platforms with transparent payout structures. Cloud mining can be profitable during

bull markets, but it’s important to manage expectations and monitor market conditions closely.

9. Running Nodes or Validators

Running nodes or validators is a more advanced way to earn passive income while directly contributing to blockchain security. In Proof-of-Stake systems, validators confirm transactions, propose new blocks, and earn rewards in return. To participate, you typically need to stake a significant amount of the network’s native token, such as 32 ETH for Ethereum, which yields about 3.5% APY plus transaction fees. Other networks like

Cosmos and

Avalanche also offer attractive returns, with

ATOM validators earning around 5–8% annually depending on delegation and commission rates.

While the rewards are steady and align with long-term network growth, operating validators comes with higher risks and requirements. Validators can be penalized (slashed) if they go offline or act maliciously, and staked assets are locked for set periods, limiting flexibility. Technical know-how, reliable hardware, and stable internet are essential for solo setups. For those less tech-savvy, platforms like Allnodes, Kiln, or Figment offer non-custodial or enterprise-grade validator services, lowering the barrier to entry while still providing exposure to validator rewards.

10. Restaking

Restaking takes traditional staking a step further by letting you reuse your staked assets to secure additional blockchain services. Instead of simply earning base staking rewards, protocols like EigenLayer allow you to pledge ETH or liquid staking tokens (like stETH or rETH) to support infrastructure such as oracles, sidechains, or data availability layers. This “stacking” of rewards can significantly boost yields; for example, raising Ethereum staking returns from 3–4% APY to as much as 10–15% APY. For experienced DeFi users, restaking offers a way to maximize capital efficiency without un-staking from the original network.

However, this strategy comes with higher complexity and risks. Validators or services you restake with can face slashing penalties, which may reduce your staked assets, and many restaking protocols are still relatively new, making smart contract vulnerabilities a real concern. Liquidity is another trade-off, as it can take time to exit restaked positions. For those looking to try, it’s best to start small, allocating only a portion of staked assets, and use established platforms with transparent audits. This way, investors can explore the extra yield opportunities of restaking while keeping risks under control.

How to Pick the Best Passive Income Strategy for You

Not every passive income method is right for every investor. Your choice depends on risk tolerance, time commitment, technical skills, and available capital. Use this guide to match strategies to your profile.

1. Low Risk, Easy Entry

If you’re new to crypto or prefer steady, predictable returns, these methods require minimal technical knowledge and have lower volatility. They work well for building passive income without constantly watching the market.

• Centralized Exchange Products (e.g., BingX Earn) – Subscribe to flexible or fixed-term savings products and earn passive yields directly on exchanges without managing wallets or DeFi platforms.

• Staking (including liquid staking or ETFs) – Lock tokens like ETH or SOL to earn 3–8% APY, with liquid staking letting you keep assets usable in DeFi.

• Stablecoin Yield Farming – Deposit USDC or USDT into trusted lending protocols for 4–8% APY while avoiding major price swings.

2. Minimal Investment, Time-Based Income

If you have more time than capital, these strategies let you earn crypto with little upfront cost, often by participating in community-driven activities.

• Airdrops – Receive free tokens by testing products, completing tasks, or joining network campaigns.

• NFT Drops – Claim exclusive digital collectibles and resell them for potential profit.

• Micro-Tasks (e.g., Freecash) – Perform small online activities like surveys, app testing, or content engagement for crypto payouts.

• Crypto Games (e.g., Notcoin, Hamster Kombat, Catizen) – Play Web3 or

Telegram-based games that reward you with tradable tokens or NFTs, combining entertainment with earning potential.

3. High Reward, High Risk

If you’re comfortable with volatility and understand smart contract risks, these methods can generate high yields but require close attention and risk management.

• Restaking (e.g., EigenLayer) – Stack yields on your staked ETH for 10–15% APY, though slashing and platform risks apply.

• Yield Farming on Newer Platforms – Earn double-digit APYs on emerging DeFi projects, but diversify to reduce exposure to untested protocols.

4. DIY for Enthusiasts

For tech-savvy investors who enjoy hands-on management, running infrastructure or mining can produce steady rewards and deepen blockchain expertise.

• Run Your Own Node – Operate validator nodes on Ethereum, Cosmos, or Avalanche for network rewards and governance power.

• Cloud Mining – Rent computing power from remote providers to earn BTC or other PoW coins without physical mining rigs.

Final Thoughts

Earning passive income in crypto in 2025 is about balancing reward and risk. Staking and stablecoin lending offer steady yields. Restaking and yield farming can supercharge returns, but come with complexity.

Start with small allocations, diversify across strategies, and use trusted platforms like BingX for staking, lending, and asset management. The right mix will grow your portfolio while letting your crypto work for you around the clock.

Related Reading