Base is Coinbase’s

Layer-2 blockchain built on the

Optimism stack. It’s designed to make crypto faster, cheaper, and more accessible, especially for

DeFi users. Instead of relying on

Ethereum’s expensive

gas fees, Base uses Optimistic Rollups to batch transactions and settle them securely on Ethereum.

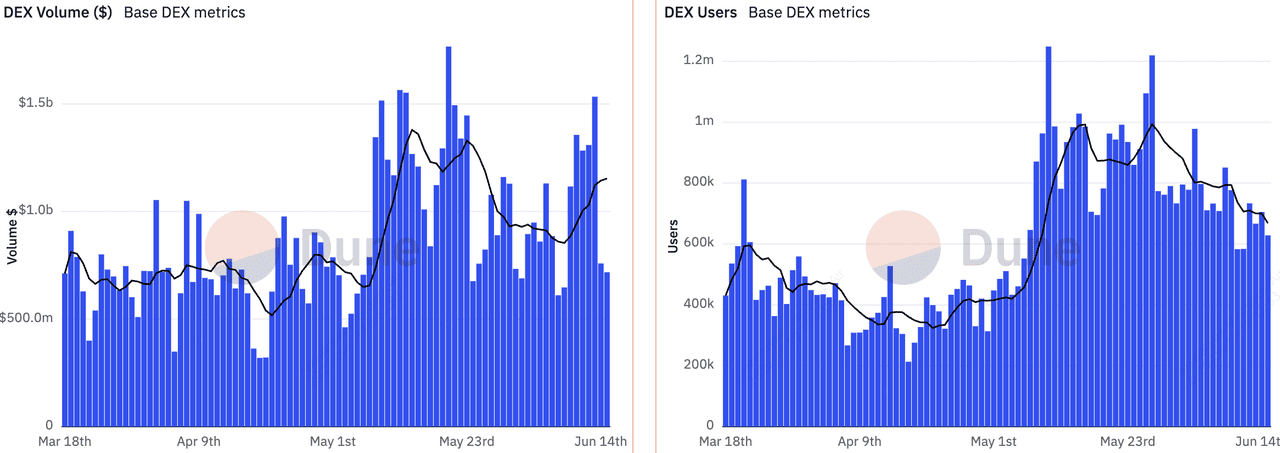

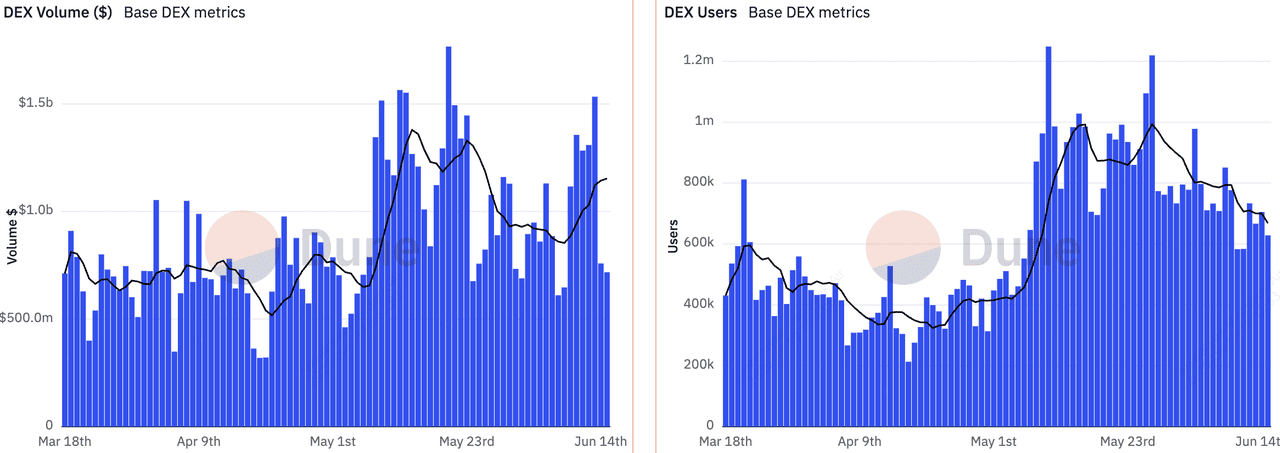

Trading volume and number of users of DEXs on the Base network | Source: Dune Analytics

That means you get the best of both worlds: Ethereum-grade security with lower costs and lightning-fast speeds. For decentralized exchanges (

DEXs), this is the perfect playground.

Whether you're swapping tokens,

farming yields, or exploring new

memecoins, Base makes DeFi easier for everyone. In this guide, we’ll break down the top 5 DEXs on the Base network in 2025, so you can trade smarter, save on fees, and get the most out of your crypto.

What Is Base Blockchain and Why Is It Gaining Popularity in 2025?

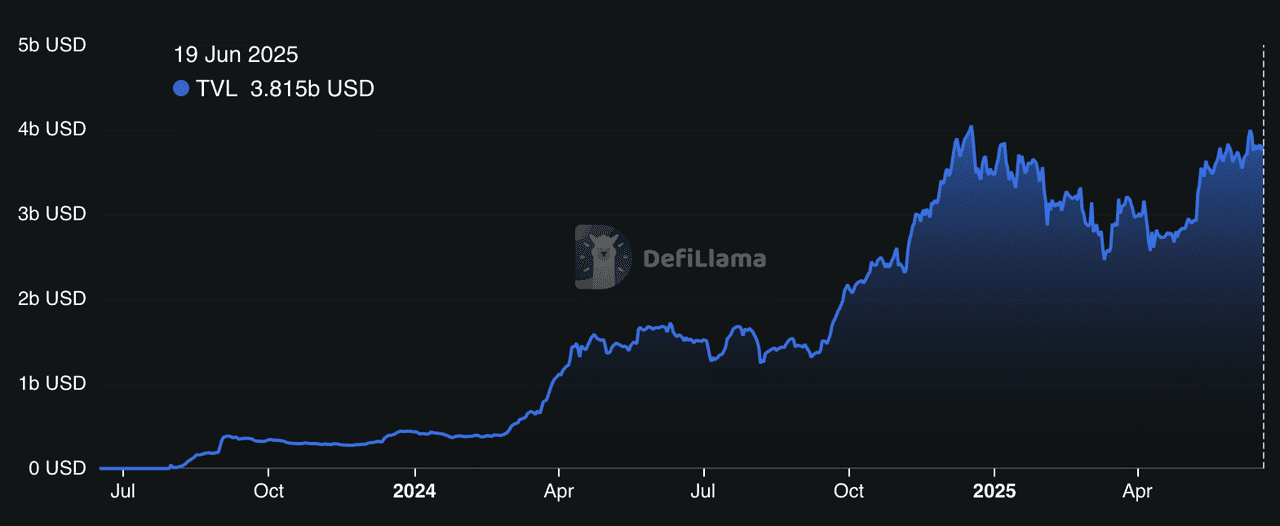

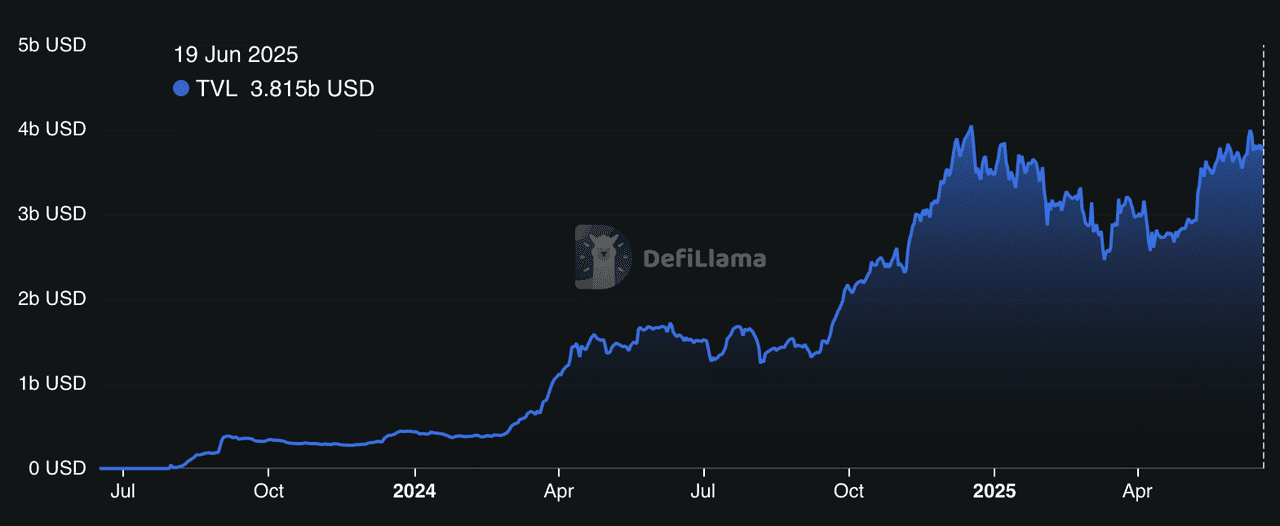

Base has quickly climbed the DeFi ranks in 2025. In the DeFi sector, Base ranks as the largest Ethereum Layer-2 by total value locked (TVL) with a DeFi TVL of over $3.8 billion, and ranks sixth among all blockchains. More than $1 billion in daily DEX volume flows through Base, putting it just behind

BNB Chain,

Ethereum, and

Solana in trading activity.

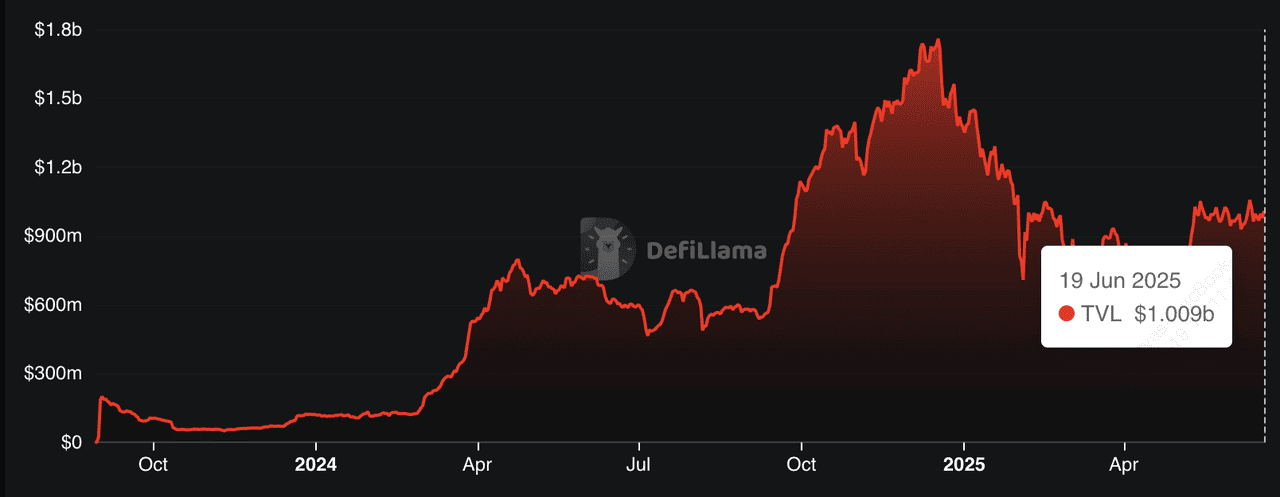

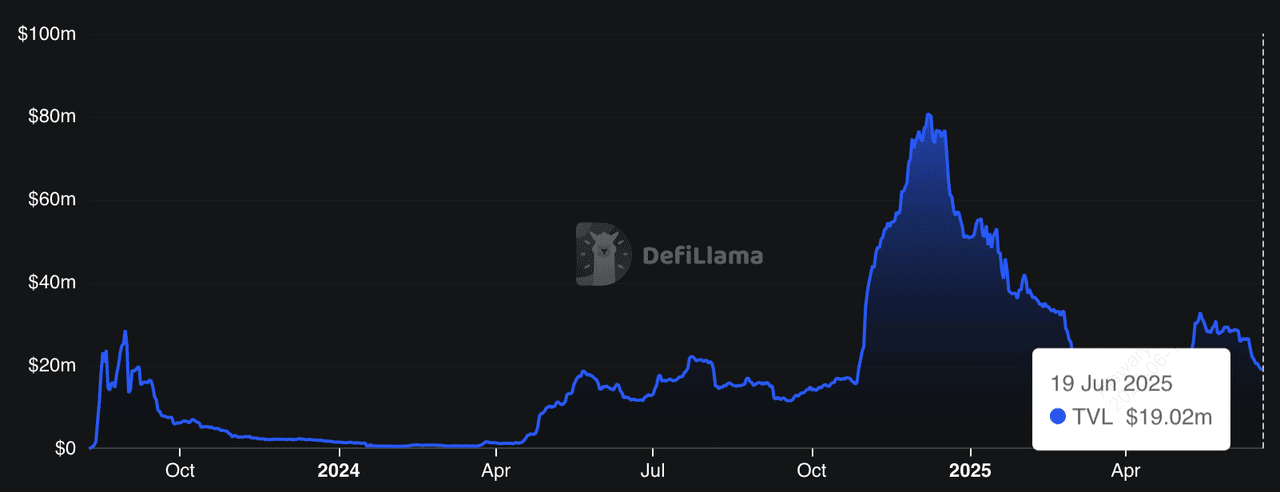

Base layer-2 network's DeFi TVL | Source: DefiLlama

The reason? Base combines low transaction fees and fast confirmation times with the battle-tested security of Ethereum. While a simple swap on Ethereum can cost anywhere from $5 to $50+ during periods of high network congestion, the same transaction on Base typically costs less than $0.10. Base also supports up to 10,000 transactions per second (TPS) through its use of Optimistic Rollups, compared to Ethereum’s roughly 15 TPS, making it far more scalable for real-time DeFi use.

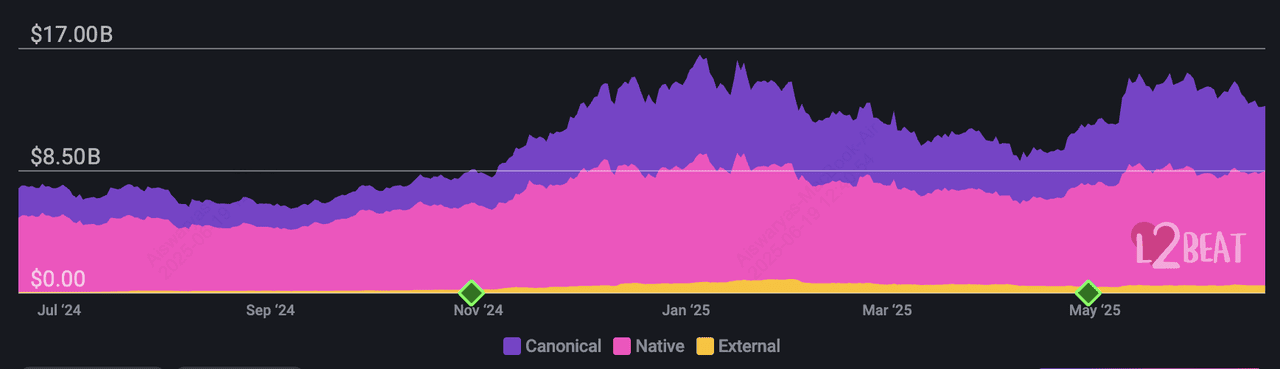

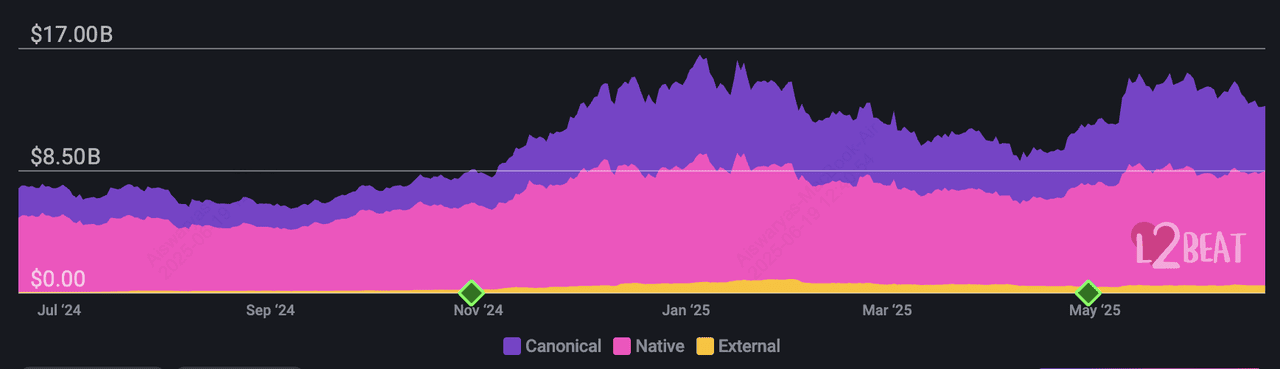

As of June 2025, Base secures over $13 billion in total value locked (TVL), making it the second-largest Ethereum Layer-2 network after

Arbitrum One. With faster performance and dramatically reduced costs, Base offers an ideal environment for building and using

decentralized applications at scale.

Base network's TVL | Source: L2Beat

Backed by Coinbase and compatible with popular

EVM wallets like

MetaMask, Base is now one of the most active networks for DeFi traders,

NFT collectors, and

Web3 builders alike. If you're looking to explore decentralized exchanges in 2025, Base is the place to start.

Top 5 DEXs in the Base Ecosystem for 2025

We ranked the top DEXs on Base by evaluating their liquidity, fees, ease of use, features like staking or governance, and overall security, using trusted sources like CoinGecko, DappRadar, and CoinMarketCap to guide our picks. These factors help you find the right platform for swapping tokens, earning rewards, or launching new assets on Base.

1. Aerodrome Finance

Aerodrome Finance is the largest DEX on the Base network, capturing over 52% of Base’s daily DEX volume as of June 2025. Launched in August 2023, Aerodrome is built on the Velodrome V2 framework and serves as the central liquidity hub for Base-native tokens. It offers deep liquidity, low-fee swaps, and yield opportunities, making it a key player in Base’s DeFi ecosystem.

Aerodrome uses a veNFT-based governance model where users can lock AERO tokens to earn veAERO, vote on emissions, and receive trading fee rewards. Its Slipstream pools reduce slippage on high-volume trades, attracting both traders and liquidity providers. With no VC funding and an open governance design, Aerodrome was launched as a public good to drive long-term, community-led growth.

The platform’s momentum accelerated in June 2025 after Coinbase integrated Aerodrome into its retail app, exposing millions of users to Base-native DeFi. Around the same time, Aerodrome became the main liquidity layer for cbXRP, a tokenized version of

XRP integrated with lending platform Moonwell. This cross-chain move strengthened Aerodrome’s role as the

liquidity backbone of Base, fueling demand and reinforcing its position at the center of Base’s DeFi expansion.

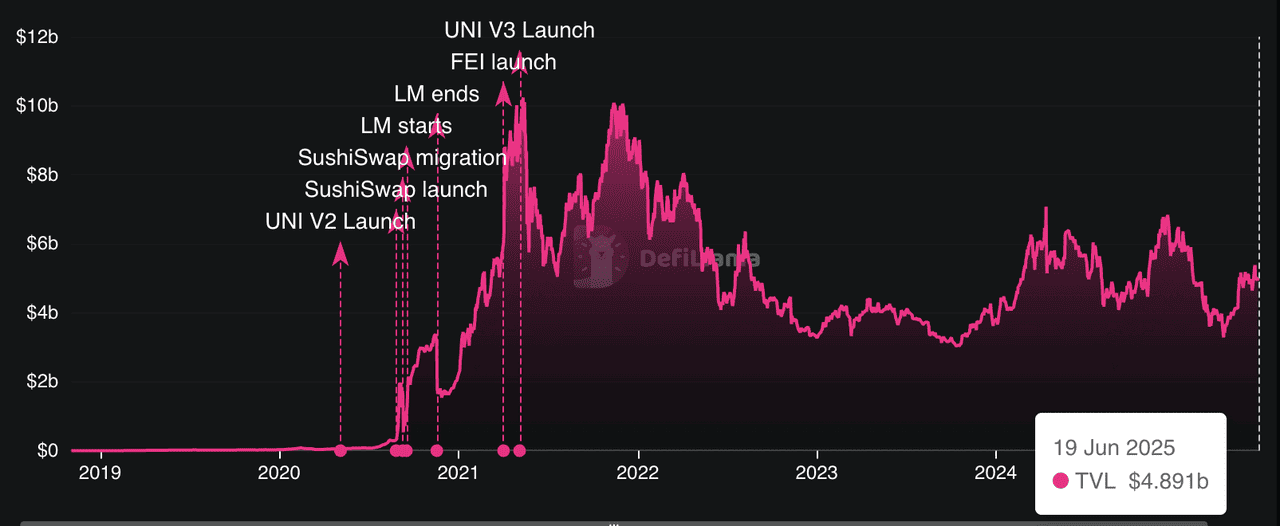

2. Uniswap (V3)

Uniswap V3 is one of the most trusted and widely used decentralized exchanges in the crypto ecosystem. On the Base network, it accounts for about 16% of daily DEX trading volume, with over $427 million in TVL and nearly $350 million in 24-hour volume. Built on Ethereum and later expanded to Base, Uniswap V3 brings the same permissionless, non-custodial infrastructure with significantly lower gas fees. It’s a secure, peer-to-contract protocol that allows you to swap

ERC-20 and Base-native tokens directly from your wallet, with no sign-ups, no intermediaries.

What makes Uniswap V3 stand out on Base is its concentrated liquidity model. As a liquidity provider, you can choose specific price ranges to deploy your assets, maximizing capital efficiency and potential earnings. This design helps traders get better execution with less slippage, especially on larger trades. The protocol supports tiered fee levels depending on volatility, and its user interface remains one of the cleanest and most intuitive in DeFi. However, Uniswap on Base doesn’t offer native governance or yield farming incentives like some other Base DEXs. It also may charge higher swap fees on volatile tokens compared to native platforms such as Aerodrome or PancakeSwap.

Still, for beginners and experienced users alike, Uniswap V3 on Base is a top choice for fast, reliable trading. With a strong track record, deep liquidity, and multi-chain reach, it remains a foundational protocol for exploring decentralized finance on Base.

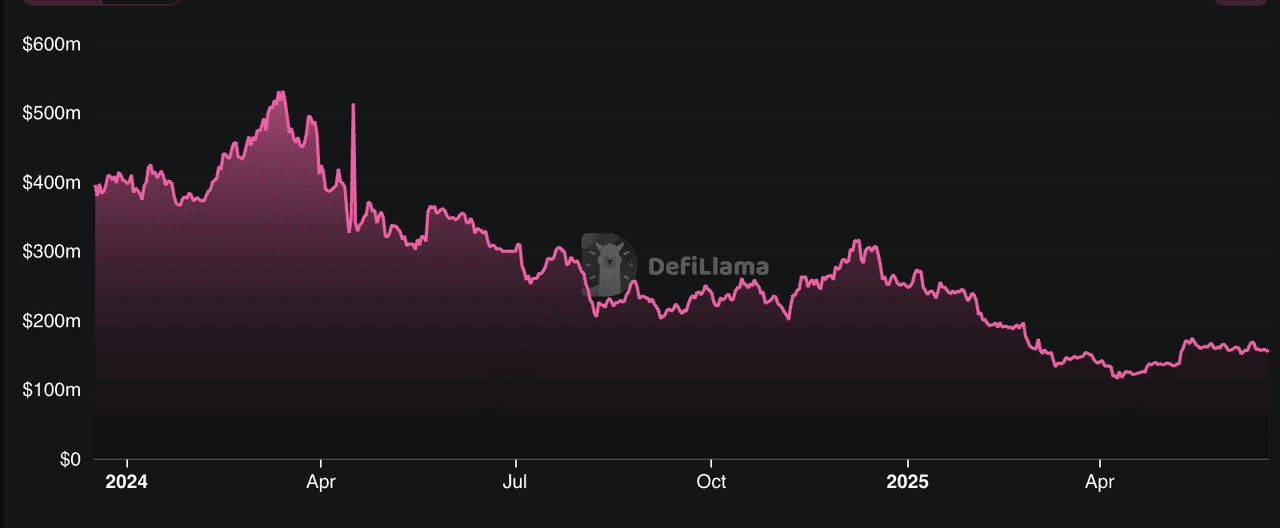

3. PancakeSwap (V3)

PancakeSwap V3 is one of the top-performing decentralized exchanges on the Base network, accounting for roughly 17.8% of Base’s daily DEX trading volume. Originally launched on BNB Smart Chain, PancakeSwap expanded to Base in 2023 as part of its multichain strategy. On Base, it offers a similar experience, low trading fees, fast swaps, and a beginner-friendly interface, making it an attractive option for new DeFi users. With a TVL of over $20 million and daily trading volume exceeding $160 million, PancakeSwap continues to gain traction on this Layer-2.

What sets PancakeSwap apart is its full-featured DeFi suite powered by the

CAKE token, which supports yield farming, staking, and ecosystem governance. Users can earn CAKE through liquidity mining, participate in Syrup Pools for passive token rewards, or enjoy gamified products like lotteries, predictions, and NFT drops. While some advanced tools available on BNB Chain haven’t fully migrated to Base, the core features, trading, earning, and staking, are already live and effective. PancakeSwap also supports cross-chain liquidity, helping users move assets easily across ecosystems.

Despite slightly lower liquidity on Base compared to its original chain, PancakeSwap remains a go-to platform for DeFi enthusiasts looking to earn yield and trade affordably. Its strong brand, deflationary tokenomics, and consistent community growth position it well within the Base ecosystem as a reliable and scalable DEX. Whether you're new to crypto or a seasoned yield farmer, PancakeSwap offers one of the most accessible and rewarding ways to participate in DeFi on Base.

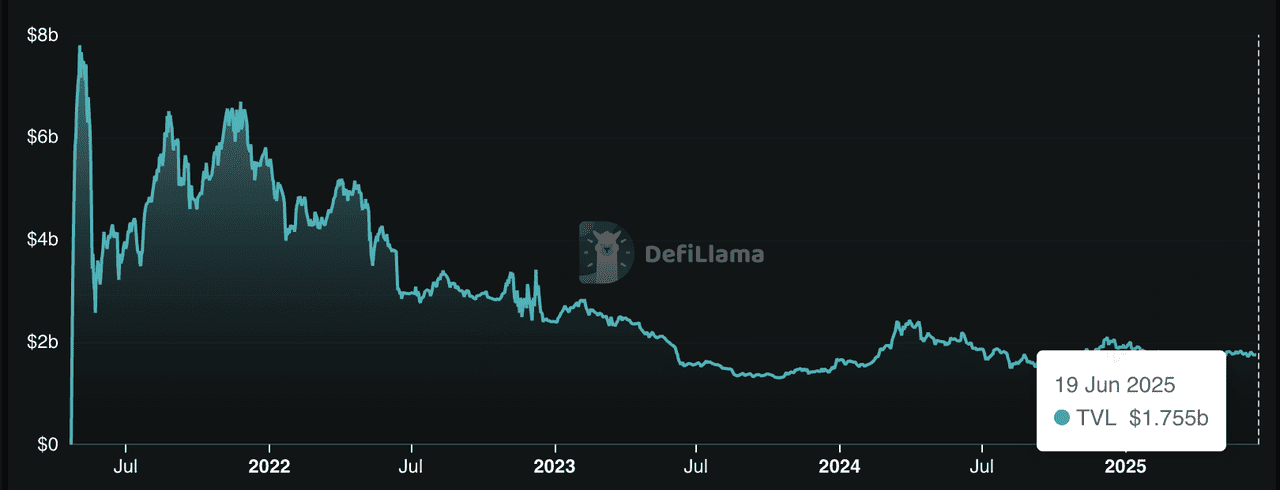

4. SushiSwap (V3)

SushiSwap V3 is a trusted and community-driven decentralized exchange that currently handles about 1.1% of Base’s daily DEX volume. With a TVL of over $10.5 million and 24-hour trading volume exceeding $10.3 million on Base, SushiSwap provides a familiar environment for DeFi users looking for more than just basic token swaps. Originally launched in 2020 as a fork of Uniswap, SushiSwap expanded its ecosystem with a full suite of DeFi tools, including yield farming, lending, and cross-chain swaps. On Base, it continues to offer these features through its BentoBox vault system, supporting both bridged assets and Base-native tokens.

What sets SushiSwap apart is its strong emphasis on community governance and long-term sustainability. The platform’s

SUSHI token allows holders to participate in voting and earn staking rewards, while xSUSHI, the staked version of the token, distributes protocol fees to loyal users. SushiSwap also features a DEX aggregator, routing trades across multiple liquidity sources to get the best execution prices. While it may have slightly higher fees than some Base-native DEXs and lower liquidity than giants like Aerodrome or Uniswap, SushiSwap compensates with its rich DeFi ecosystem, reliable brand, and multi-chain reach.

For users already familiar with DeFi, SushiSwap on Base is a solid choice. It blends the flexibility of a mature protocol with the cost advantages of Base’s Layer-2 infrastructure. Whether you're looking to stake, farm, lend, or trade with optimized routes, SushiSwap delivers a well-rounded DeFi experience backed by years of development and a loyal user base.

5. Alien Base

Alien Base is one of the newest and most creative decentralized exchanges on the Base network, capturing around 0.5% of Base’s daily trading volume. Since launching in late 2023, Alien Base has attracted a growing community of early adopters, developers, and memecoin enthusiasts by focusing on fast swaps, ultra-low fees, and token creation tools. With a TVL of over $19 million and a 24-hour trading volume exceeding $2.3 million, it has quickly gained momentum in the Base ecosystem. Unlike more traditional DEXs, Alien Base offers an engaging experience built around innovation, simplicity, and community governance.

What sets Alien Base apart is its on-chain token generator, which allows users to launch their own tokens in seconds, ideal for experimental projects and meme tokens. The platform uses Epsilon aggregation technology to find the best trading routes across Base’s liquidity pools, keeping swap fees as low as 0.16%. Users can also stake to earn ETH or ALB rewards and participate in airdrop campaigns, adding strong incentive layers for participation. Future upgrades under development include limit orders, TWAPs, margin trading (Project Quasar), and an all-in-one AMM-derivatives engine (Project Nebula), making Alien Base a forward-looking DEX built for more than just simple swaps.

While it doesn’t yet have the liquidity depth of giants like Uniswap or Aerodrome, Alien Base makes up for it with developer-friendly tools,

DAO governance, and a growing roadmap of advanced trading features. It’s perfect for degen traders, token creators, and anyone who wants to explore emerging opportunities on Base. As the platform matures and continues integrating features like lending, derivatives, and protocol-owned liquidity, Alien Base is positioning itself as a full-stack DeFi platform that’s human-friendly, flexible, and radically open.

How to Choose the Right DEX to Explore the Base Ecosystem

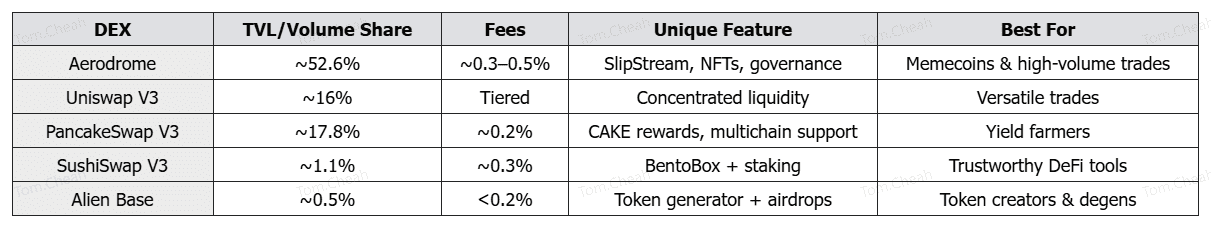

Choosing the right decentralized exchange (DEX) on Base depends on your goals. Review the table below to compare features and find the best fit for your strategy.

If you're chasing memecoin trends or high-volume swaps, Aerodrome offers deep liquidity and strong incentives. Prefer familiar tools and flexible trading options? Uniswap V3 gives you powerful features like concentrated liquidity and wide token support.

Looking for yield farming or low-fee trades? PancakeSwap V3 might be your best bet. For those who value reputation and a full DeFi suite, SushiSwap V3 brings BentoBox and staking to the Base network. And if you're a degen or creator, Alien Base lets you launch tokens and earn rewards with ultra-low fees.

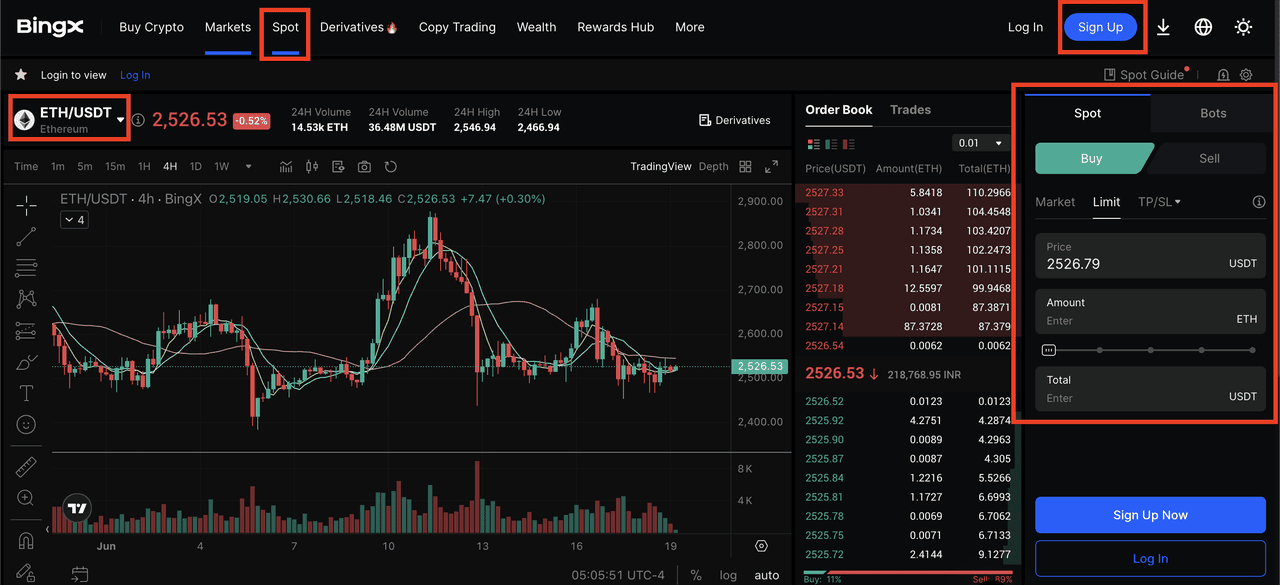

How to Start Trading on a Base-Powered DEX

Ready to try DeFi on Base? Follow these simple steps to start swapping, staking, and exploring DEXs:

1. Set up MetaMask (or any EVM-compatible wallet) and add the Base network. You can do this automatically via

Chainlist or manually by entering Base’s RPC details.

2. Buy tokens like USDT or

ETH on BingX and transfer them to your wallet. This gives you the funds to interact with DEXs on Base.

3. Choose your DEX. Connect your wallet, find the trading pair or liquidity pool, and start swapping or staking.

4. Manage risk wisely. Start with small amounts, check contract audits, and monitor slippage, especially on low-liquidity tokens.

Once you're set up, you can explore new tokens, earn rewards, or provide liquidity, right from your wallet on Base.

Key Considerations Before Using a DEX on Base

Decentralized exchanges on Base offer fast, low-cost trading, but they come with limitations. Most DEXs don’t have built-in charting tools, so you’ll need to rely on external platforms for price analysis. You also won’t find limit or stop orders, which means trades execute at market price with no control over timing. Liquidity varies across platforms. While Aerodrome handles large trades with ease, smaller DEXs like Alien Base may experience slippage due to thinner liquidity pools.

To stay safe while using Base DEXs, take a few simple precautions. Always verify contract addresses using official sources to avoid phishing scams. Stick with audited platforms like Uniswap and SushiSwap for better security. If you're trying a new DEX, start with small amounts and test how the system works. Also, learn about automated market makers (

AMMs), especially how impermanent loss and slippage can affect your trades. These basic steps go a long way in protecting your crypto.

Conclusion

Each DEX on Base offers unique advantages depending on your trading goals. Aerodrome excels in high-volume swaps and meme coin activity, while Uniswap V3 is ideal for those seeking flexible, efficient liquidity strategies. PancakeSwap V3 stands out for yield farming with minimal fees, and SushiSwap V3 provides a reliable, feature-rich experience for DeFi users. AlienBase, on the other hand, caters to early adopters and token creators with innovative tools and ultra-low fees.

Base continues to grow as a leading Layer-2 network for decentralized finance. Its fast transaction speeds, low costs, and expanding ecosystem make it an attractive option for both new and experienced users. However, DeFi still carries risk, such as smart contract bugs, price volatility, and slippage which can affect your trades. Always do your own research (

DYOR), start small, and use secure wallets when exploring new DEXs on Base.

Related Reading

FAQs on Base DEXs

1. Are Base DEXs safe to use?

Many DEXs on Base, like Uniswap and SushiSwap, are audited and widely used. Still, always double-check contract addresses, start small, and avoid unknown platforms unless you do your own research.

2. Which Base DEX has the most liquidity?

Aerodrome leads in daily volume and liquidity on Base. It's the most popular DEX for high-volume trades and meme tokens.

3. What’s the cheapest DEX on Base?

AlienBase and PancakeSwap usually offer the lowest swap fees, often under 0.2%. Base itself helps keep gas costs low, just a few cents per trade.

4. Can I earn rewards on Base DEXs?

Yes. You can earn by providing liquidity, staking tokens, or joining yield farming pools. Platforms like Aerodrome, PancakeSwap, and SushiSwap offer reward programs.

5. Is there a native token for each DEX?

Yes. For example, Aerodrome has AERO, PancakeSwap uses CAKE, and AlienBase uses ALB. Some tokens give you governance rights or extra rewards.

6. How do I bridge funds to Base to use a DEX?

You can buy ETH or USDT on BingX and transfer it to your wallet. Then, use Base’s official bridge to move assets from Ethereum or supported chains.

7. Can I use Base DEXs on mobile?

Yes. Mobile wallets like MetaMask support Base. You can trade on most Base DEXs using your mobile browser or wallet dApp browser.

8. What are potential risks when trading on Base DEXs?

Smart contract bugs, slippage, and low liquidity on newer DEXs can impact your experience. Always test with small amounts and use trusted platforms.

Trading volume and number of users of DEXs on the Base network | Source: Dune Analytics

Trading volume and number of users of DEXs on the Base network | Source: Dune Analytics Base layer-2 network's DeFi TVL | Source: DefiLlama

Base layer-2 network's DeFi TVL | Source: DefiLlama Base network's TVL | Source: L2Beat

Base network's TVL | Source: L2Beat