Peer-to-peer (P2P) crypto trading is booming in 2025, driven by the

bull market and user demand for flexibility, competitive rates, and direct trading without relying on traditional exchanges. Millions of users are now choosing to trade directly with counterparties through leading platforms that offer fast, user-friendly experiences. Closely tied to this trend, the global P2P lending market is projected to reach $558.91 billion by 2027, growing at an annual rate of 29.7%, according to Allied Market Research.

But as the P2P crypto market expands, so do the risks. The freedom and decentralization that attracts users also opens the door to scams, fraud, and regulatory challenges, making risk awareness and platform security more important than ever.

Staying safe is a shared responsibility between the platform and its users. In this guide, you will learn the top 7 fraud tactics, fake receipts, impersonation, and more, and how BingX’s escrow, verified merchants, and 24/7 support keep your funds safe. We’ll walk you through real-world examples of P2P scams, red flags in P2P trading, and step-by-step strategies to protect your funds.

What Is P2P Trading, and Why Is It a Scam Target?

Peer-to-peer or P2P trading lets you buy and sell crypto directly with your counterparties, without middlemen. You agree on a price and payment method, then complete the trade through a platform like BingX. It offers users flexibility, competitive rates, and the ability to trade directly with others, without relying on traditional exchanges. But with this freedom comes risk.

In 2024 alone, scammers stole an estimated $9.9 billion in crypto, according to

Chainalysis. That number could exceed $12 billion as more fraudulent wallets are identified. A rising share of that fraud is tied to P2P scams, including fake payment receipts, impersonation, and off-platform traps. Fraud rings are becoming more professional, leveraging AI-powered tools, stolen data, and even P2P-style scam marketplaces like Huione Guarantee, which processed over $70 billion in crypto transactions, a significant portion linked to scam activity.

BingX provides several safety features to protect P2P users, including

escrow protection that holds crypto until both parties confirm payment, verified merchants, in-app chat support, and a dispute resolution system. While BingX provides key protections, staying safe is a shared responsibility between the platform and its users.

If you’re using

P2P trading, it’s important to stay alert.

What Is a P2P Scam in Crypto and How Does It Work?

A P2P crypto scam is a type of fraud that targets users trading crypto directly with others on peer-to-peer platforms. Instead of completing the deal honestly, the scammer tricks the other party using fake payment proofs, impersonation, or off-platform communication.

Here’s how it typically works: the scammer poses as a buyer or seller on a P2P platform like BingX. They may send a fake bank transfer screenshot, use someone else’s identity, or ask you to cancel the trade after you’ve sent money. Their goal is to get you to release your crypto or payment without completing their part of the deal. These scams often rely on urgency, pressure, and false trust, so it’s important to stay alert and always verify payment in your bank or wallet before releasing any assets.

Top 7 P2P Scam Types to Watch in 2025

BingX, like other leading exchanges, has seen scammers use increasingly advanced tactics. In 2025, scammers are using even more advanced tactics, including fake payment proofs,

social engineering, and impersonation. Leading crypto exchange platforms have seen a rise in P2P fraud, and with new fraud types like pig butchering growing 40% year-over-year, 2025 is shaping up to be one of the riskiest years yet for unprotected P2P traders.

Each of these scams uses urgency, manipulation, or fake authority to mislead you. Here are the typical P2P scams you need to stay alert to.

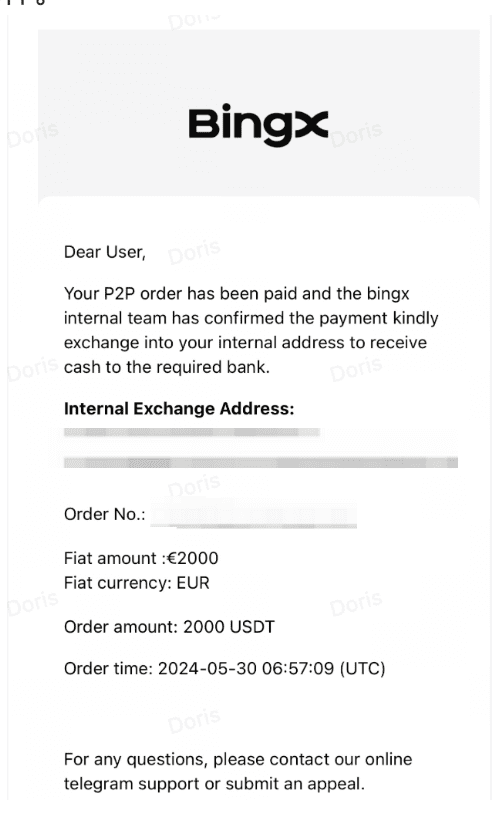

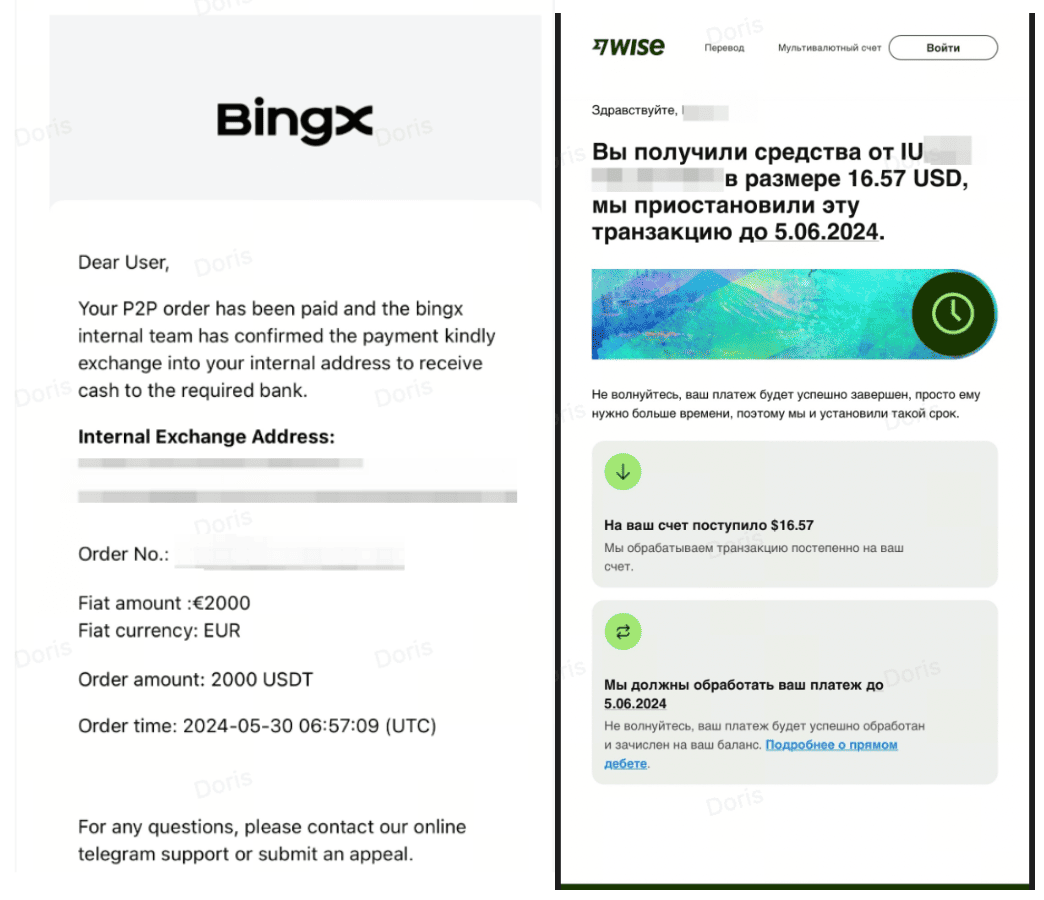

1. Fake Proof‑of‑Payment (Receipt Forgery)

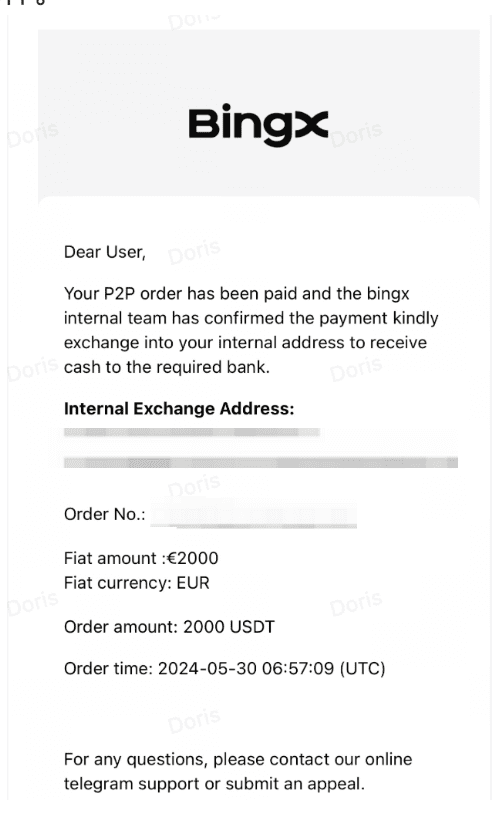

Example of a fake proof-of-payment P2P scam

One of the most common P2P scams involves the buyer sending fake payment confirmations. These are usually edited screenshots of a bank transfer, a forged email, or a fake SMS that looks like it came from a real payment app. The goal is to trick you into thinking you’ve received money, so you release the crypto before checking your account.

These forgeries are highly convincing. Scammers often copy real bank logos, use accurate timestamps, and even mimic official message formats.

In one case, a seller released crypto after seeing what looked like a genuine mobile banking receipt, only to find out later that no payment was made. These scams work by preying on urgency and visual deception. Always verify funds directly in your bank or

wallet, and never rely on screenshots.

To stay safe, always verify the payment directly in your bank or wallet, and never trust screenshots alone. BingX protects you with an escrow system that holds your crypto until payment is confirmed, and you can file an appeal anytime if something feels off.

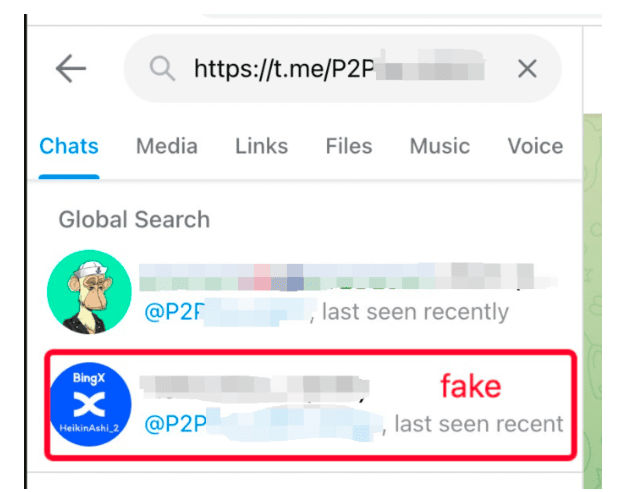

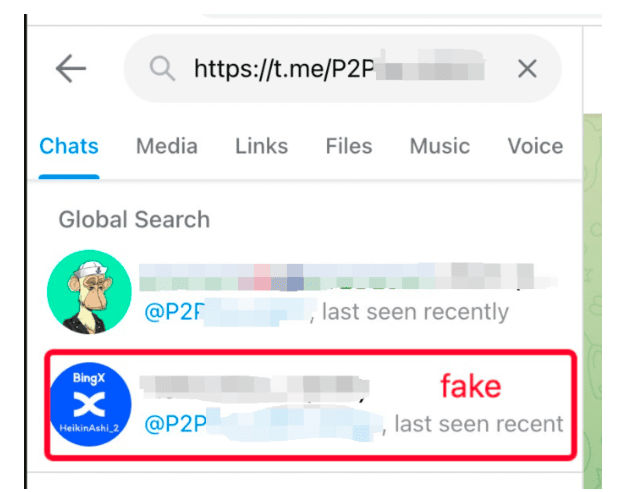

2. Impersonation Scams

Example of a fake impersonation scam in P2P

In this scam, attackers pretend to be official BingX support staff, system assistants, or trusted users. They may reach out to you through the order chat, SMS, or even email, using fake names, logos, or spoofed addresses. Their goal is to build trust, then manipulate you into sharing sensitive information or releasing funds.

For example, a scammer might pose as a “BingX system assistant” and claim that a payment is held in escrow, instructing you to release crypto to receive it. They may use urgent language and official-sounding messages. These scams work because they exploit your trust in authority, and rely on you not double-checking who you’re actually talking to.

Always verify that you're communicating through the official BingX platform and never trust messages from outside sources. BingX helps protect you with in-app chat, verified merchant badges, and a Report button you can use to alert the support team if anything feels suspicious.

3. Triangle / Double‑Payment Scams

Triangle scams are more complex and involve two scammers working together to confuse the seller. One scammer places a fake order and doesn’t pay. Meanwhile, the other sends money from a different account, referencing the first order. The seller, thinking the payment is for the original trade, releases crypto to the wrong scammer.

Let’s say Scammer A creates a 2,000 USDT order but doesn’t send payment. Scammer B sends 2,000 USDT for another trade but falsely links it to Order A. The seller sees the money, gets confused, and releases the crypto to Scammer A. This scam works by overloading you with information and playing on urgency, especially if you're handling multiple orders at once.

To avoid this, always double-check that the sender’s name and payment details match the order exactly. BingX’s built-in order chat and confirmation system help you stay organized, and you can pause the trade and contact support if anything seems unclear.

4. Chargebacks & Check Fraud

Chargeback scams happen when a buyer uses a reversible payment method like PayPal, Venmo, or even checks. Once you release the crypto, the buyer disputes the payment with their bank, claiming it was made by mistake or was unauthorized. Your account gets debited, but the scammer keeps the crypto.

For instance, a seller on a P2P platform accepted a check payment and released the crypto after seeing the deposit. Days later, the check bounced. The seller lost both the crypto and the money. These scams exploit time delays and loopholes in payment systems, so always avoid high-risk payment methods and never accept checks in P2P trades.

To stay safe, only accept secure, irreversible payment methods approved by BingX, and never agree to checks or third-party payments. BingX allows merchants to filter for safe payment options and provides an appeal system to help resolve disputes if a buyer reverses a payment.

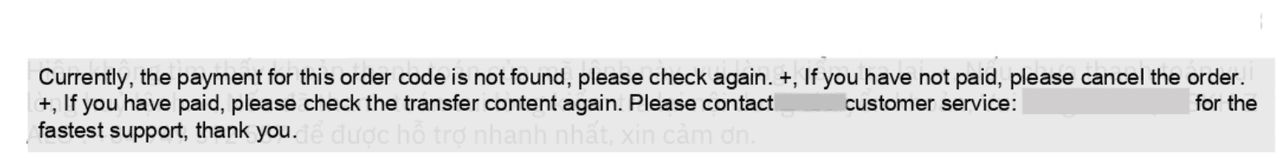

5. Order‑Cancellation After Payment

Order cancellation scam in P2P trading

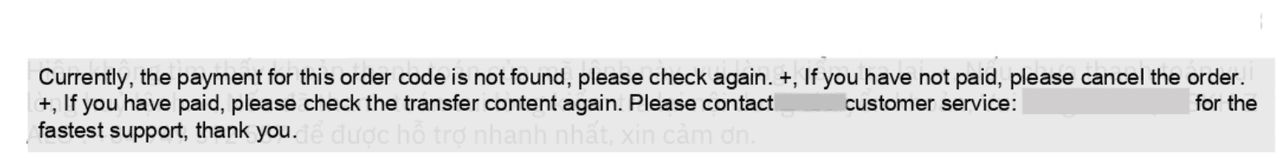

This scam mainly targets buyers. After you’ve sent your payment, the seller asks you to cancel the order, claiming there’s a technical problem or payment issue. If you cancel, the system automatically returns the crypto to the seller, and they disappear with your money.

One BingX user shared how a seller insisted on canceling the trade after payment was made, citing a “platform bug.” The buyer, wanting to be cooperative, canceled the order and lost everything. This scam succeeds by taking advantage of your good intentions and desire to resolve issues quickly. Never cancel after payment unless you’ve been fully refunded first.

To protect yourself, never cancel an order after payment unless you’ve been fully refunded. BingX records all order messages and transaction details, so if this happens, you can file an appeal and let the support team step in to resolve the issue.

6. SMS / Email Clones

Fake SMS or email scams in P2P trading

Scammers sometimes use fake SMS or email alerts that look like they’re from your bank or wallet provider. These messages tell you that a payment has been received, often including real-looking transaction details, account names, and amounts. But in reality, no payment was made.

For example, a seller got a text message saying, “You have received 1,500 USDT.” It looked identical to a real bank notification. But when the seller checked their account, the funds weren’t there. These scams are effective because they create a false sense of confirmation, tricking you into releasing funds without verifying anything.

Always ignore such alerts and check your bank or wallet directly to confirm the funds before taking any action. If something seems off, you can use BingX’s in-app appeal feature to pause the trade while the support team investigates and verifies the payment.

7. Off‑Platform / Cash‑in‑Person Scams

Some scammers try to move the conversation outside of BingX, asking you to use Telegram, WhatsApp, or in-person cash transactions. They may promise better rates or faster payments. But once you leave the platform, you lose the protection of BingX’s escrow system and support team.

In one case, a buyer was asked to send money to an off-platform wallet in exchange for a higher exchange rate. After the payment was made, the seller vanished. These scams work by removing safety barriers and increasing the chances of untraceable fraud. Always stay on the BingX platform and never agree to trade outside of it.

To stay safe, always complete your trades within the BingX platform and avoid sharing personal contact details. BingX’s secure escrow system and 24/7 support team are there to protect you. Report any user who tries to take the trade off-platform.

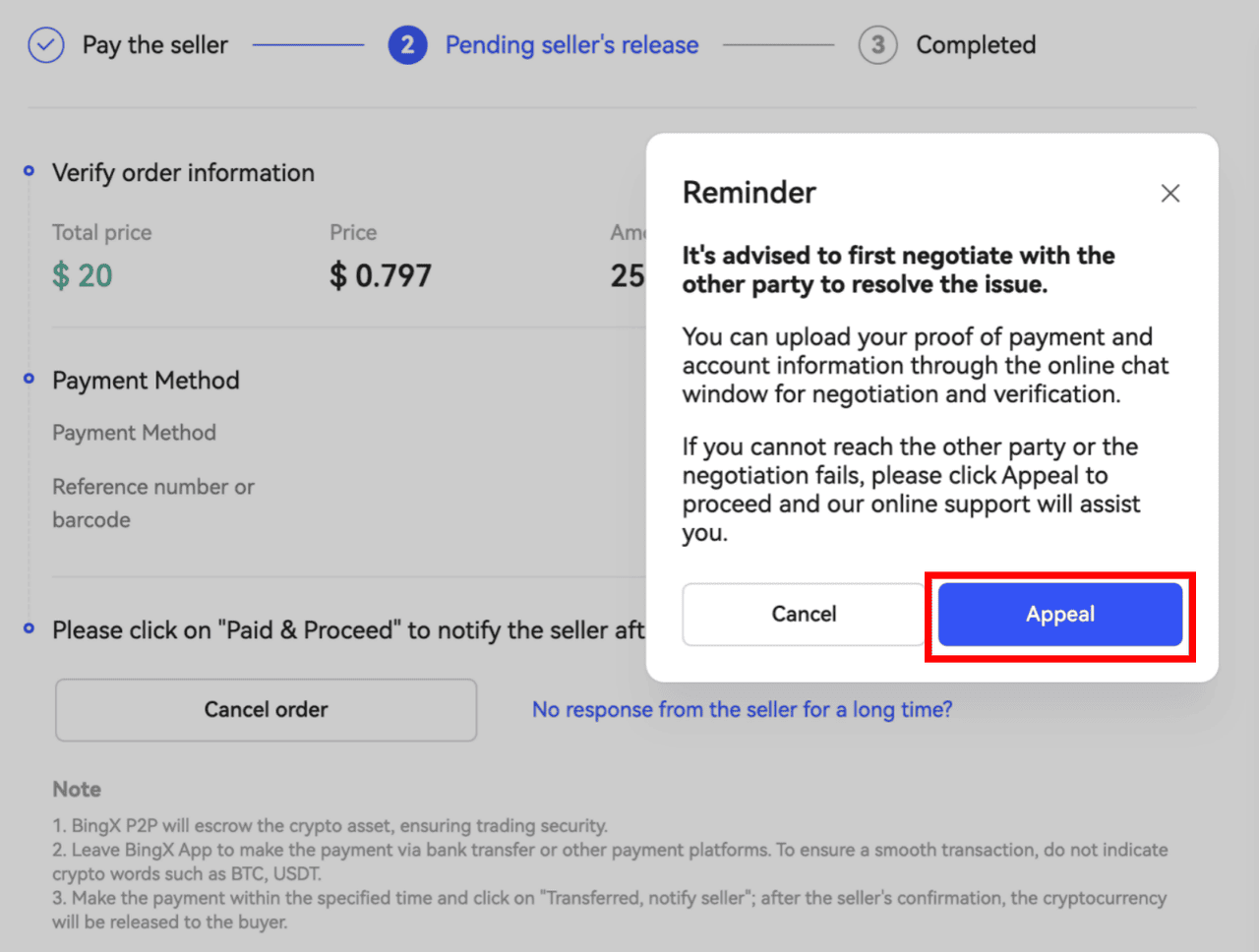

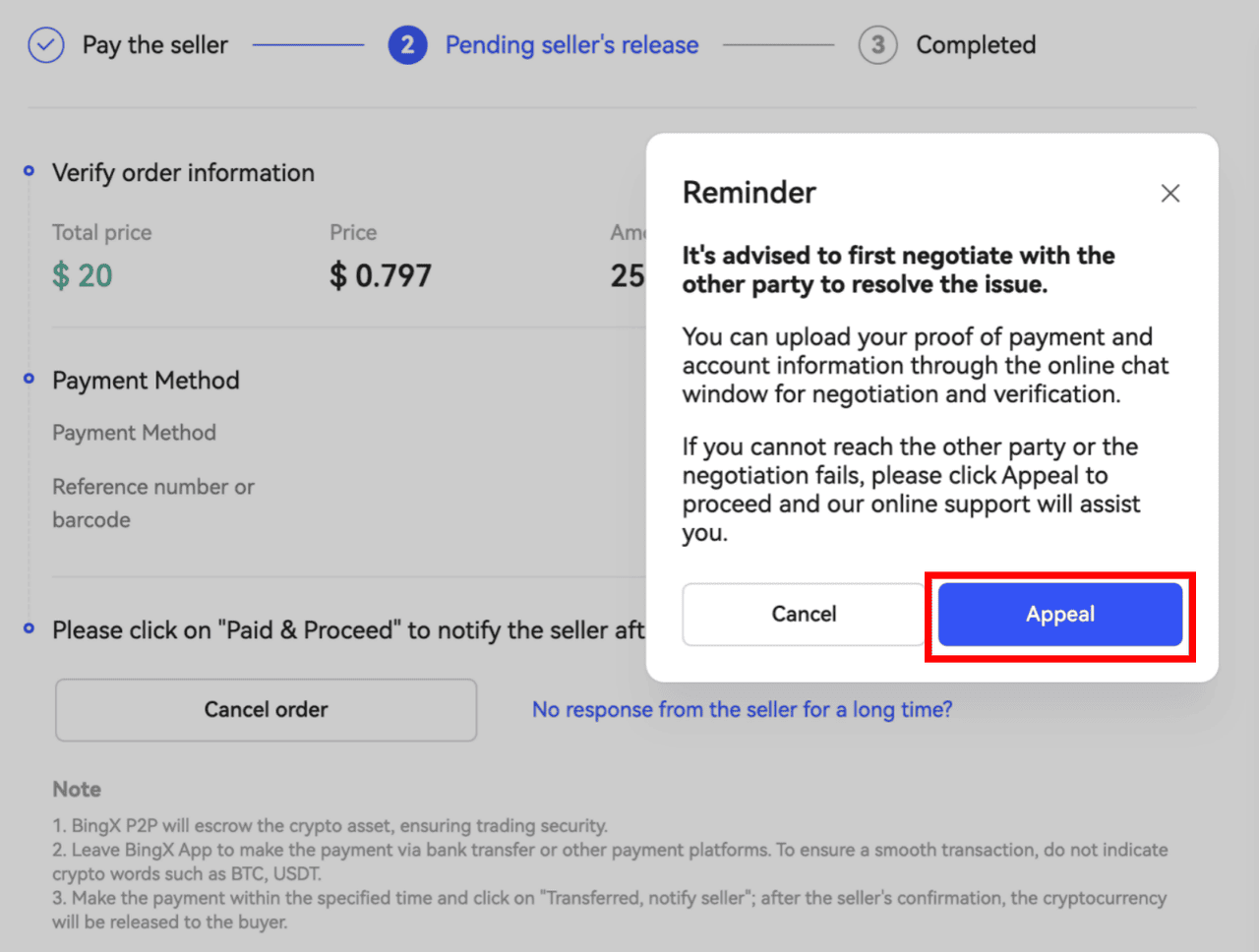

Protect Your P2P Trades with BingX’s Built‑in Safeguards

How to file an appeal on BingX P2P

BingX takes your security seriously. The platform is designed with multiple layers of protection to help you trade confidently in the P2P marketplace.

• Escrow Protection for Every Trade: When you start a trade, your crypto is automatically locked in escrow. This ensures that funds are only released after both parties confirm the payment. If the buyer doesn’t pay, your crypto is returned.

•

24/7 Appeal and Dispute Support: Things don’t always go smoothly, but help is always available. If you spot something suspicious or communication breaks down, you can file an appeal directly in the chat window. The BingX support team is available 24/7 to assist.

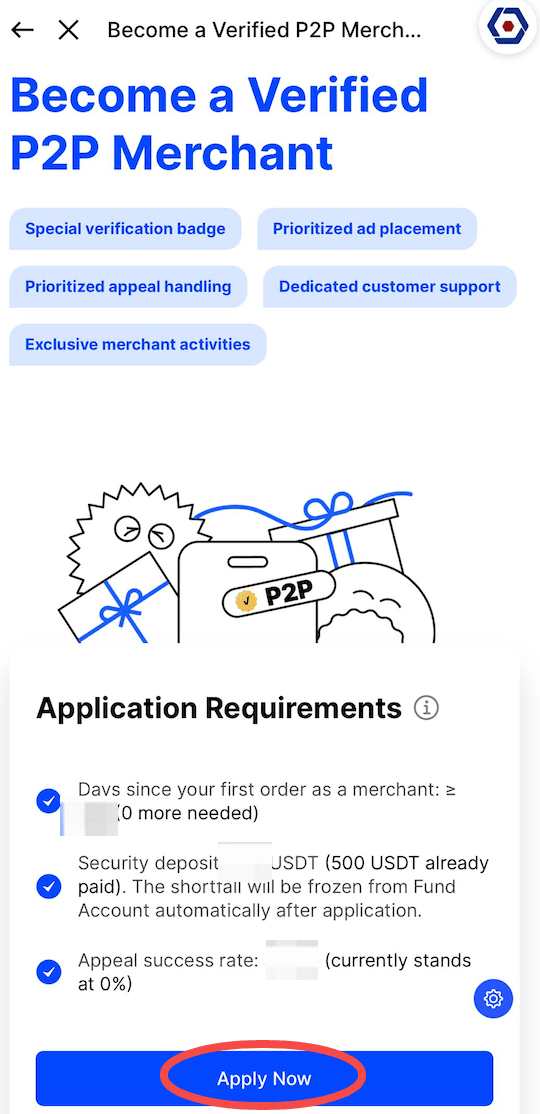

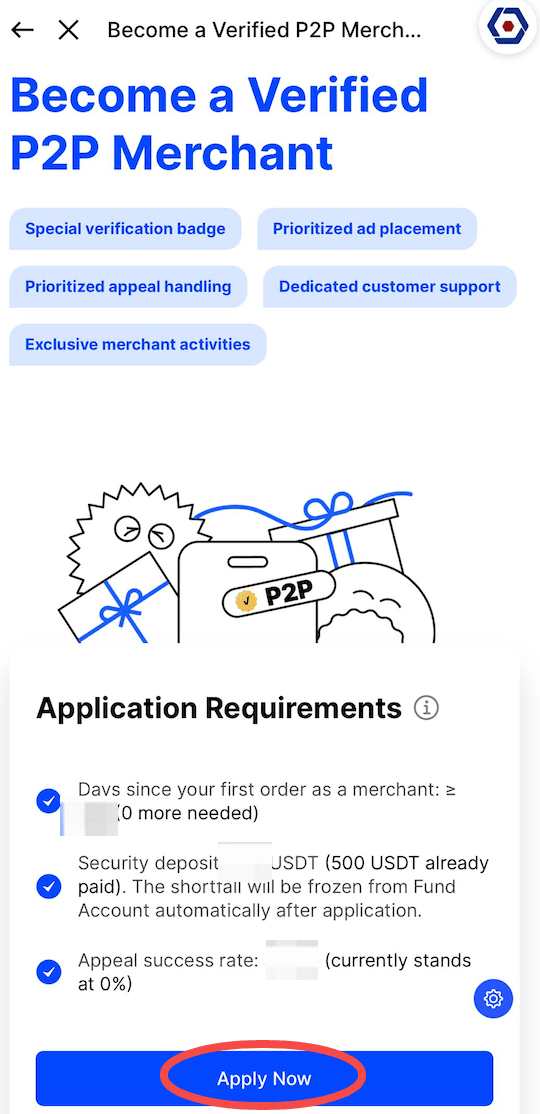

• Verified Merchant Program: BingX features a

verified merchant system, marked by a yellow badge. These users have completed ID checks and met strict performance standards. Trading with verified merchants reduces your risk.

How to become a verified merchant on BingX P2P

• Advanced Anti-Fraud Controls: BingX also runs a real-time risk control system to detect suspicious activity. The platform continuously monitors trades to block known scam patterns and protect users from fraud.

Top 7 Tips to Avoid P2P Scams

Staying safe in P2P trading doesn’t require advanced skills, just smart habits and attention to detail. Here are seven simple tips to protect your crypto on BingX:

1. Only trade with BingX verified merchants (yellow tick): Look for the yellow verification badge next to a trader’s name. Verified merchants have completed

KYC checks and have strong reputations on the platform. Stick with them to reduce risk.

2. Always verify payer details, such as name, account numbers: Before you accept any payment, make sure the payer’s name and bank account match what’s listed on BingX. If anything looks off, don’t proceed. Third-party payments are a red flag.

3. Confirm payment directly in your bank/wallet before releasing crypto: Never rely on screenshots or messages. Log in to your bank account or wallet and check the balance yourself. Only release crypto once you’re sure the payment is real and complete.

4. Ignore urgent or threatening messages, and stay calm: Scammers often create pressure. They may claim their account will freeze or they’ll report you. Don’t let panic guide your decision. Take your time and follow your process.

5. Scrutinize payment proof for inconsistencies: If a buyer sends a screenshot, look closely. Watch for strange fonts, mismatched logos, or missing details. Fake proofs often look almost real, but not quite. When in doubt, report it.

6. Keep communication within BingX chat only: Avoid WhatsApp, Telegram, or email. Only use the official BingX chat window during trades. This keeps a record of all messages in case you need to file an appeal.

7. Use Report / Appeal features and contact support promptly: If something doesn’t feel right, tap "Report" or start an appeal from the order page. Include screenshots and transaction IDs.

BingX support is available 24/7 to help resolve disputes.

Conclusion

P2P trading on BingX offers convenience, flexibility, and direct access to buyers and sellers. But with that freedom comes responsibility. To stay safe, you need to be alert, follow platform rules, and never rely on screenshots or promises as proof of payment. Always confirm funds directly in your account before releasing crypto, and use BingX’s built-in tools, like verified merchant badges, escrow, and the appeal system, to reduce risk.

Remember, crypto transactions are irreversible. If you release funds to a scammer, there’s often no way to get them back. That’s why it’s essential to trade carefully, avoid third-party communication, and act quickly if anything seems suspicious. Use the checklist above as your guide, and take full advantage of BingX’s protective features. With the right habits, you can enjoy secure and stress-free P2P trading.

Related Reading

FAQs on P2P Crypto Scams

1. What are P2P crypto scams?

A P2P crypto scam happens when someone tricks you during a peer-to-peer trade. Instead of completing the transaction honestly, the scammer uses fake payment proofs, false identities, or pressure tactics to steal your funds. These scams are common because P2P trading connects you directly with another person—without a central authority. That means you're responsible for checking every detail before releasing your crypto.

2. Is crypto P2P trading safe in 2025?

Yes, P2P trading can be safe in 2025, but only if you follow the right precautions. With the crypto market booming, more people are using P2P platforms to buy and sell digital assets directly. This also attracts scammers who exploit fast-paced trades and user inexperience. Platforms like BingX have built-in safety features like escrow protection, verified merchants, and 24/7 support. But staying safe depends on your actions. Always double-check payments, avoid off-platform chats, and never rush into a deal.

3. What is escrow in BingX P2P trading?

Escrow is a safety feature that protects both the buyer and the seller. When a P2P trade starts, the crypto is held in escrow by the platform. This means the seller's crypto is locked and won’t be released until the buyer confirms payment. If something goes wrong, you can appeal and the funds stay safe until the issue is resolved. Escrow helps prevent fraud and builds trust between strangers trading online.

4. How to avoid getting scammed on BingX P2P?

To avoid getting scammed on BingX P2P, always trade with verified merchants, confirm the payer’s details, and check payments directly in your bank or wallet. Keep all communication within the BingX app and use the appeal button if anything feels off. Staying alert and using BingX’s built-in tools can help you trade safely.

5. What to do if you get scammed on BingX?

If you’ve been scammed on BingX, use the Appeal button immediately and share all proof, including screenshots and payment details, with support. Change your passwords, enable

two-factor authentication, and report the fraud to your bank. Avoid third-party recovery services. BingX’s 24/7 dispute team is your best chance to resolve the issue.

Example of a fake proof-of-payment P2P scam

Example of a fake proof-of-payment P2P scam Example of a fake impersonation scam in P2P

Example of a fake impersonation scam in P2P Order cancellation scam in P2P trading

Order cancellation scam in P2P trading

How to file an appeal on BingX P2P

How to file an appeal on BingX P2P How to become a verified merchant on BingX P2P

How to become a verified merchant on BingX P2P