The

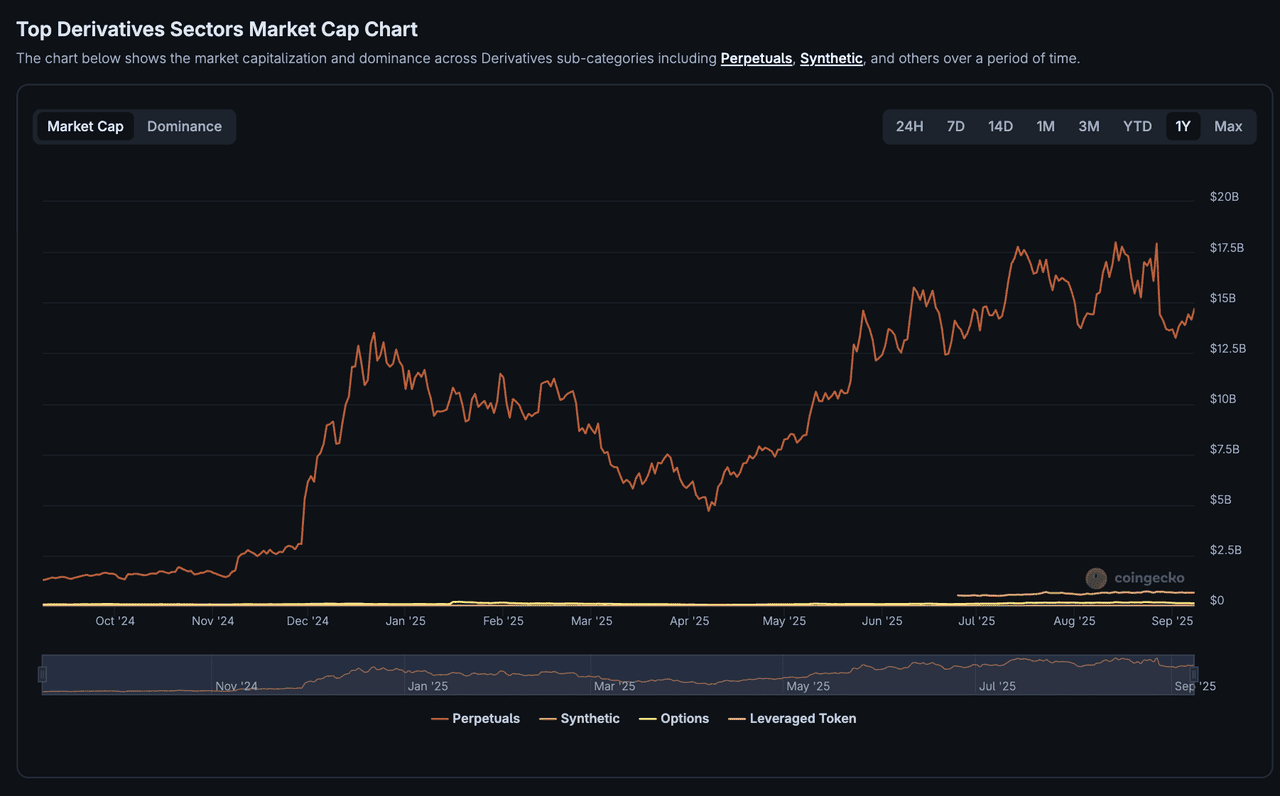

decentralized finance (DeFi) landscape has undergone a dramatic transformation in 2025, with derivative protocols emerging as the backbone of on-chain trading infrastructure. According to

CoinGecko, over the past year, the sector’s market cap soared 654%, rising from about $2.5 billion in October 2024 to nearly $18.9 billion by late August 2025. Of this, perpetual protocols account for more than $17.9 billion, underscoring their central role in decentralized derivatives.

What makes this surge notable is how it far outpaces growth in other DeFi segments. While

liquid staking and

lending expanded steadily, and the overall DeFi token market cap grew around 40% year-on-year, derivatives increased more than sixfold in the same period. This places derivative protocols among the fastest-growing verticals in DeFi, signaling a structural shift as traders increasingly rely on on-chain perpetuals for leverage, hedging, and liquidity.

What Is a Perpetual DEX (Perp DEX) and How Does It Work?

A Perpetual DEX, or Perpetual Decentralized Exchange, is a decentralized platform that allows users to trade contracts whose value comes from underlying assets such as

Bitcoin,

Ethereum, or

stablecoins without directly owning them. Instead of buying or selling the tokens themselves, traders use perpetual futures to speculate on price movements, hedge risk, or gain leveraged exposure.

The perpetual contract, or perp, is the most common design. Unlike traditional futures, it has no expiry date. To keep perp prices aligned with spot markets, these platforms use a

funding rate mechanism, where traders on one side of the market (long or short) periodically pay the other depending on market conditions. Because they operate on smart contracts, perpetual DEXs execute trades transparently, allow users to retain custody of their assets, and settle transactions in a permissionless way.

In practice, traders connect through

crypto wallets, deposit collateral such as

USDC or ETH, and open leveraged positions. Behind the scenes, perpetual DEXs rely on components like decentralized order books or

automated market makers (AMMs),

oracle feeds to provide reliable price data, and liquidation engines to manage risk. The result is a trading system that mirrors traditional derivatives markets but runs fully on-chain, available globally, 24/7, without intermediaries.

What Drives the Growth of Derivative Perpetual Protocols in 2025?

Explosive growth has made derivative protocols impossible to ignore, but their importance in 2025 goes beyond numbers. From Hyperliquid’s dominance to the rise of challengers like MYX and Aster, whale-driven spectacle, and rapid innovation, several forces have made derivatives the core of DeFi’s trading infrastructure.

1. Hyperliquid’s Growth Sparks Innovation Across Perpetual DEXs

From

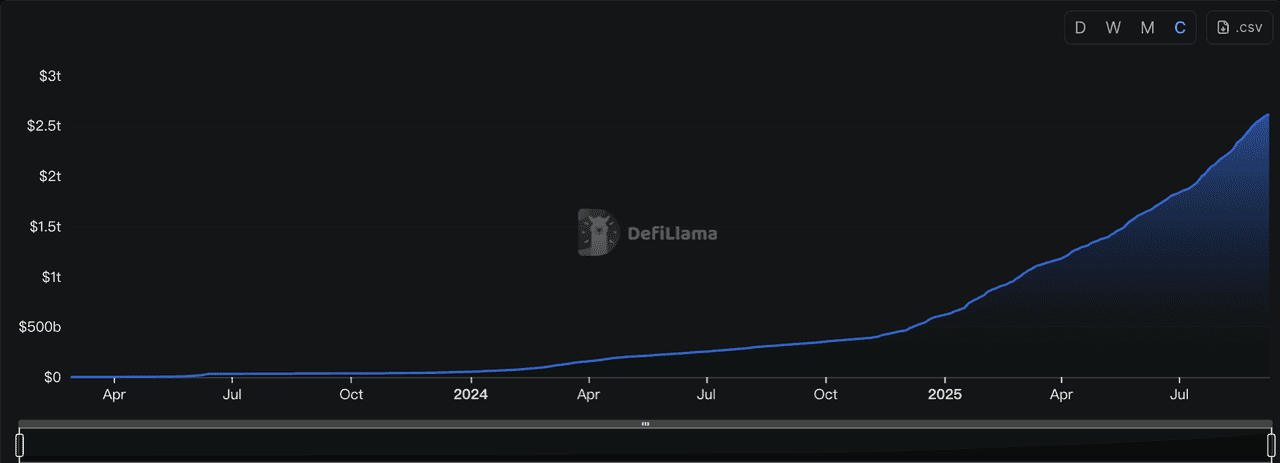

DefiLlama data, by August 2025, Hyperliquid dominated the decentralized perpetual market with 70–80% market share, handling over $350 billion in monthly volume and frequently exceeding $30 billion per day. The platform’s revenue soared past $100 million per month, setting a new standard in capital efficiency.

Meanwhile, MYX Finance surged forward with $9+ billion in monthly volume, and Aster broke ground by offering 24/7 stock perpetuals alongside up to 1001× leverage, pushing its cumulative trading volume past $408 billion. These figures illustrate how Hyperliquid’s rise has redefined what perpetual protocols must deliver and how challengers are innovating in response

Cumulative trading volume on Hyperliquid perps has reached a mind-boggling $2.5T | Source: DefiLlama

2. Whale Drama Has Made On-Chain Derivatives a Spectacle

High-profile traders on Hyperliquid have powered a new wave of attention throughout 2025. In May 2025, James Wynn made headlines after losing $1.24 million of a $1.28 million bet, withdrawing only about $33,000 before deactivating his social accounts. In July 2025, the trader known as The White Whale topped the Hyperliquid leaderboard with over $50 million in profits in just 30 days.

Around the same time, Machi Big Brother (Jeffrey Huang) gained attention after depositing $6 million USDC in May and achieving a 92.11% win rate across 76 trades, with his account’s unrealized value peaking at $35 million before falling back below $3 million in August during a market correction. These transparent, on-chain dramas continue to fuel community discussion and attract new traders to perpetual markets.

3. Innovation in Derivatives Now Competes with CEXs

Perpetual DEXs are delivering execution quality that rivals centralized exchanges (CEXs). Hyperliquid supports sub-second finality, up to 100,000 orders per second, and gasless trading with advanced on-chain order types. This level of performance has pushed derivatives ahead of AMM-based spot DEXs and lending protocols, positioning them as the most advanced layer of DeFi execution.

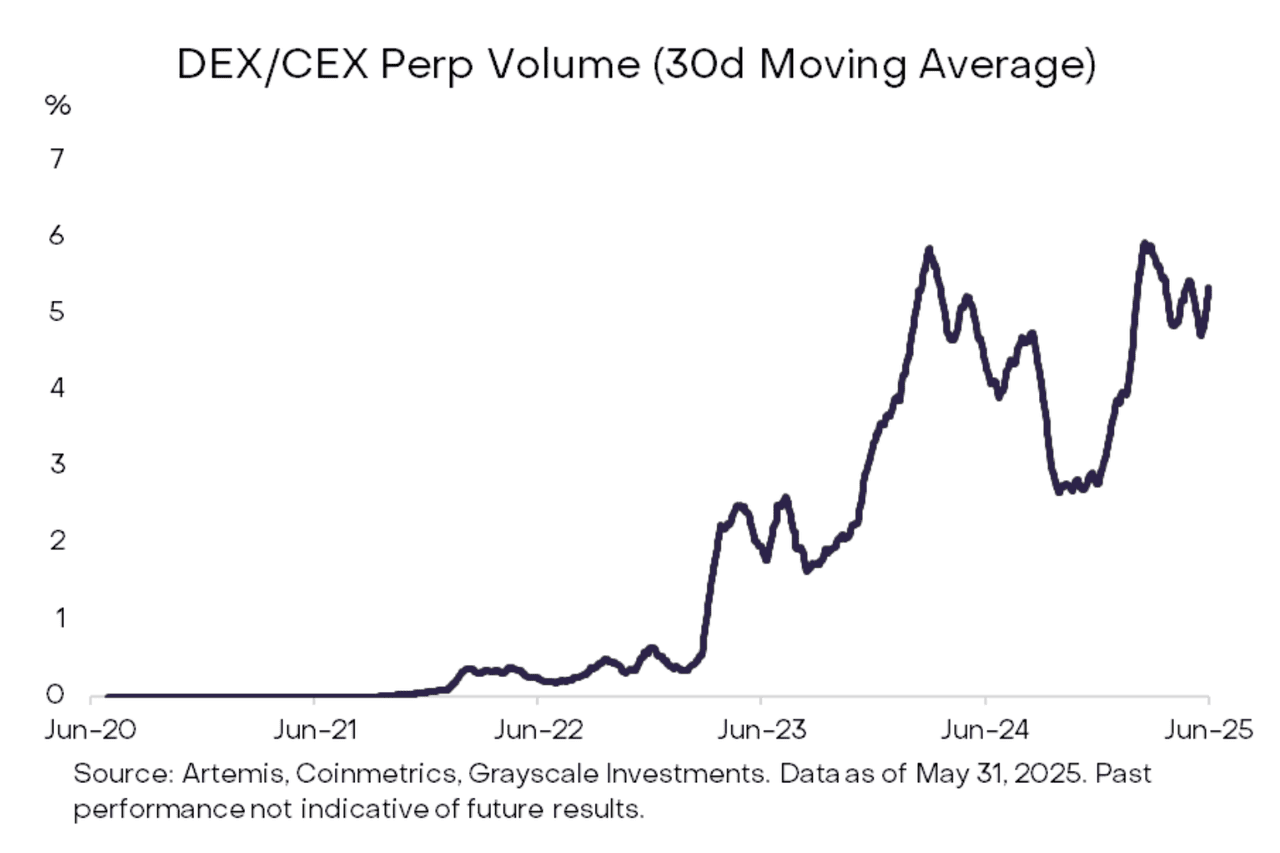

The shift is also visible at the market share level: according to

Grayscale and CoinMetrics, DEXs accounted for only about 1% of global perpetual trading in 2022, but by mid-2025 they consistently capture 4–6%. In other words, nearly one in twenty perpetual contracts worldwide is now executed on a decentralized platform, a remarkable leap that underscores how innovation in derivatives has turned DEXs into real competitors to CEXs.

Source: Grayscale Research Report - DEX Appeal: The Rise of Decentralized Exchanges

Top Perpetual DeFi Platforms to Know in 2025

A handful of platforms define the frontier of on-chain derivatives in 2025. From dominant players setting the pace to fast-rising challengers testing new models, these exchanges highlight where perpetual trading is headed next.

1. Hyperliquid (HYPE) - Perpetual Exchange on Custom Layer-1

Source: Hyperliquid Foundation

By August 2025,

Hyperliquid (HYPE) commands 80% of the decentralized perpetual contracts market share, processing $357 billion in monthly derivatives trading volume with daily volumes now topping $30 billion. The protocol has achieved remarkable infrastructure milestones, supporting up to 200,000 orders per second with sub-second block times while maintaining 99.99% uptime.

Hyperliquid operates through a dual-layer system combining HyperCore (custom Layer-1) with HyperEVM (EVM-compatible layer) for seamless DeFi integration. The platform's community-first approach allocated 70% of tokens to users without venture capital involvement, while its deflationary model burns 97% of trading fees to reduce token supply. This combination of cutting-edge infrastructure, transparent operations, and user-focused tokenomics has created strong community loyalty and sustainable growth in the perpetual trading market.

2. dYdX (DYDX) - Perpetual Exchange on Cosmos

The platform's TVL of over $1 billion and daily trading volume of $2.8 billion reflect its dominance in derivatives, with dYdX Chain remaining stable as the platform prepares for major upgrades including spot trading integration and Telegram-based trading launching September 2025. The protocol's community governance model continues to evolve, with 25% of protocol fees allocated to token buybacks.

dYdX (DYDX) moved from Ethereum to its own blockchain on

Cosmos, enabling full decentralization with faster transactions and higher capacity than traditional Layer 1 or

Layer 2 solutions. The platform offers over 220 markets with up to 50x leverage, supporting deposits from six major blockchains including Ethereum and

Arbitrum. With advanced trading features and institutional-grade infrastructure, dYdX serves sophisticated traders seeking centralized exchange functionality with decentralized security and transparency.

3. MYX Finance (MYX) - Perpetual Exchange on BNB Chain/Linea

MYX Finance (MYX) has achieved a

total value locked (TVL) of over $25 million with near 10x growth since March 2025, establishing itself as the dominant decentralized derivatives protocol on

Binance Smart Chain with $342.78 million in perpetual volume. The protocol has processed over 200,000 unique trading addresses across

Linea and

BNB Chain, demonstrating strong adoption across multiple ecosystems.

MYX Finance uses its Matching Pool Mechanism (MPM) to eliminate slippage by internally matching long and short positions, achieving capital efficiency up to 125x while maintaining zero slippage. The platform offers USDC-margined perpetual futures with up to 50x leverage and features cross-chain trading that lets users trade from any supported blockchain without bridging assets. MYX's focus on user experience includes gasless transactions and simplified onboarding, making it accessible to both traditional finance users and DeFi natives.

4. Drift Protocol (DRIFT) - Perpetual Exchange on Solana

Drift Protocol (DRIFT) is the largest open-sourced perpetual futures exchange built on

Solana, with over $24 billion in cumulative trading volume, $300+ million TVL, and 180,000+ users. The protocol leverages Solana's 100-millisecond finality to deliver seamless trading and yield opportunities with high transaction throughput and ultra-low fees.

Drift offers comprehensive trading with perpetual futures up to 101x leverage, spot trading up to 5x leverage, and token swaps, all powered by Solana's fast blockchain. The platform's cross-margined system lets users use any token as collateral while automatically earning yield on deposits, with orders filled instantly through its JIT liquidity mechanism. Drift also supports pre-launch token trading and integrates

Pyth Network for accurate pricing, making it a complete trading destination for both retail and institutional users on Solana.

5. Aster (ASTER) - Perpetual Exchange on BNB Chain/Arbitrum

Token Trading Information: Sep 17, 2025 $ASTER TGE

Aster DEX (formerly Astherus) emerged from the merger between leading BNB Chain yield protocol Astherus and perpetual DEX APX Finance, creating a unified platform that combines perpetual trading with yield-earning strategies. The protocol is currently preparing for its ASTER Token Generation Event scheduled for September 17, 2025, and is featured as the inaugural project on CoinMarketCap's CMC Launch platform with over $350 million TVL and nearly 20% of the entire perpetual DEX market share.

Aster offers two trading modes: Simple Mode for one-click trades up to 1001x leverage with MEV protection, and Pro Mode with advanced order book interface and extremely low fees of 0.01% for makers and 0.035% for takers. The platform operates across seven EVM chains and Solana without requiring

KYC, supporting non-custodial trading with professional tools. With Stage 1 achieving 527,224 wallets and $37.7 billion trading volume, Aster's Stage 2 program now rewards users with 704 million ASTER tokens or 8.8% of total supply for the community airdrop, emphasizing real user engagement over speculation.

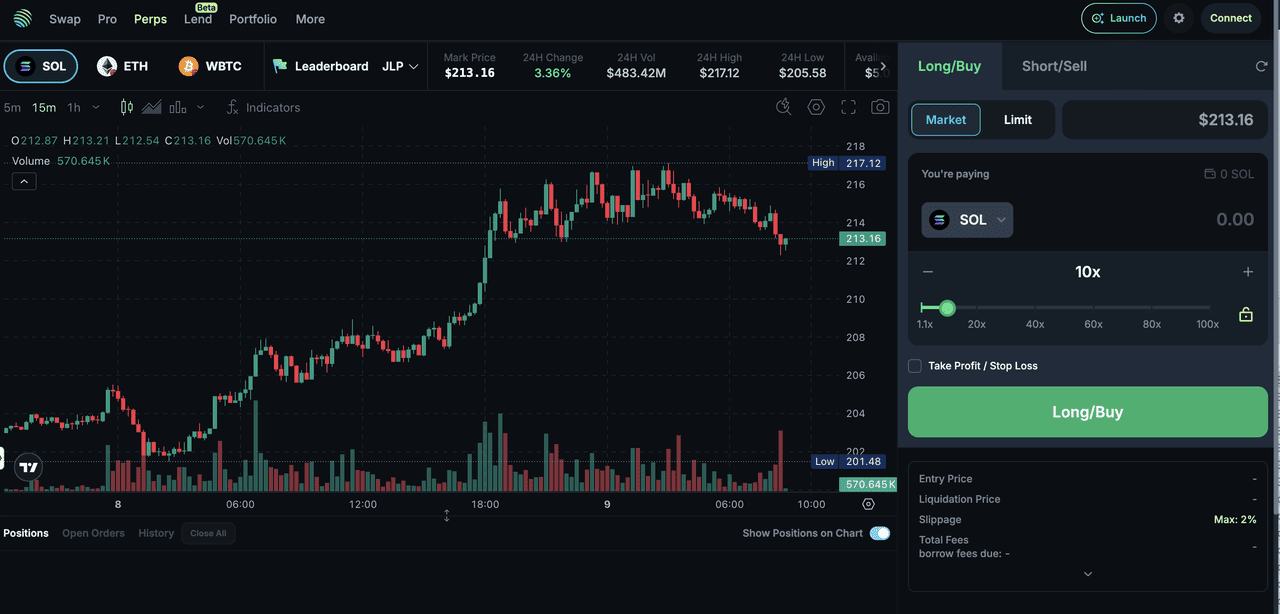

6. Jupiter (JUP) - Perpetual Exchange on Solana

Jupiter Perps has established itself as Solana's dominant perpetual futures exchange, processing over $294 billion in cumulative trading volume and achieving 66% market share of Solana's derivatives activity. Despite offering only three trading pairs, SOL, wBTC, ETH, the protocol generated $32 billion in volume within two months of beta launch, producing $50 million in fees while maintaining monthly growth rates exceeding 46% in volumes and 40% in fees. The platform serves over 7,000 daily active addresses, demonstrating remarkable capital efficiency that rivals established competitors.

Jupiter Perps operates as part of Jupiter's broader DeFi ecosystem, which includes

Solana's leading DEX aggregator, spot trading, and memecoin platform APE, collectively managing $2.5 billion TVL and $93 billion in monthly volume. The platform offers up to 150x leverage through its LP-based liquidity model, where users can trade with zero

slippage using any Solana token as collateral. Jupiter's position as Solana's primary DeFi gateway, combined with plans to expand beyond three trading pairs, positions it to capture significant market share as derivatives trading continues growing across blockchain networks.

7. GMX (GMX) - Perpetual Exchange on Arbitrum/Avalanche/Solana

GMX has facilitated nearly 300 billion in trading volume since 2021, with the protocol generating around $100-200 million in fees over two years and maintaining over $450 million in total value locked across its deployments. The platform received the largest

Arbitrum incentive grant of 12 million

ARB tokens, demonstrating ecosystem support for its growth.

GMX operates as both a perpetual exchange for traders and a crypto index fund for liquidity providers, with all assets pooled together where profits and losses depend on net trader performance. The platform enables up to 100x leverage with minimal slippage and serves as foundation infrastructure for over 80 ecosystem integrations. GMX's expansion to Solana in 2025 and upcoming features, including gasless transactions and cross-chain functionality, position it as a cornerstone of multi-chain DeFi infrastructure.

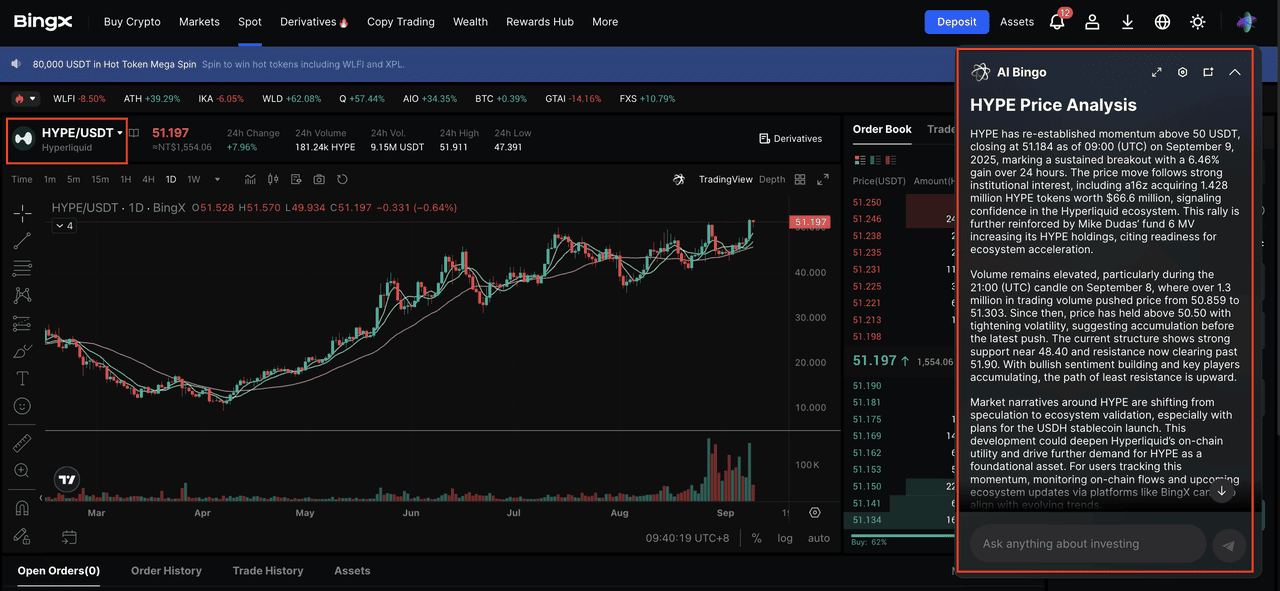

How to Trade Perpetual Protocol Tokens on BingX

Perpetual protocol tokens are at the center of DeFi in 2025, as traders look to capture exposure to platforms driving on-chain derivatives growth. BingX makes it simple to access these tokens through its spot and futures markets, while

BingX AI provides real-time insights to guide smarter trading decisions.

Source: BingX HYPE/USDT Spot Market

Step 1: Find Your Trading Pair

Step 2: Analyze with BingX AI

Click the AI icon on the trading page to access

BingX AI. The tool highlights price trends, support and resistance levels, and market signals, helping you evaluate your entry and exit points more effectively.

Step 3: Execute and Monitor Your Trade

Place a market order for instant execution or a limit order to set your desired entry price. Keep monitoring BingX AI for updates as market conditions evolve, so you can adjust your position accordingly.

With BingX and BingX AI, trading perpetual protocol tokens becomes more accessible and data-driven, whether you are building a long-term position in DeFi’s fastest-growing sector or taking advantage of short-term volatility.

Final Thoughts: The Road Ahead for Perpetual Protocols

The rise of derivative perpetual DEXs in 2025 marks more than a passing trend. It signals a structural shift in how traders access leverage, manage risk, and speculate on-chain. With cumulative volumes already in the trillions and market share steadily eating into CEX dominance, perpetual protocols are becoming a foundational layer of DeFi.

Looking ahead, competition will likely intensify. Dominant players like Hyperliquid will continue setting the pace, while challengers such as MYX and Aster push boundaries with new products, higher leverage, and innovative market designs. At the same time, regulators are beginning to pay closer attention to decentralized derivatives, which could shape how these platforms evolve.

According to Grayscale and CoinMetrics, perpetual DEXs grew from about 1% of global perpetual trading in 2022 to 4–6% by mid-2025. This steady rise shows that decentralized derivatives are gaining lasting traction and are positioned to capture an even greater share of global markets going forward.

Related Reading