The landscape of Bitcoin ownership has undergone a seismic shift in early 2026. What was once a decentralized experiment dominated by hobbyists is now a high-stakes arena for trillion-dollar asset managers, sovereign nations, and

Bitcoin Treasury Companies (DATCos). As

Bitcoin trades near the $66,500 mark following a volatile February, the concentration of supply among a few elite entities has never been more scrutinized.

How many people own and use Bitcoin? | Source: Bitbo

By February 2026, the total circulating supply of Bitcoin has reached roughly 19.98 million BTC, leaving less than 1.1 million yet to be mined. However, the "real" available supply is much tighter. With an estimated 3.7 million BTC lost forever and massive institutional accumulation through Spot ETFs, the battle for the remaining coins is defining the 2026 market cycle.

This article breaks down the 2026 Bitcoin Rich List, identifying the top 10 Bitcoin whales, governments, and corporate giants that control the world’s most valuable digital asset.

Who Are the Top 10 Bitcoin Holders: 2026 Entity Breakdown

When grouping individual wallets into entities, the 2026 distribution reveals that a handful of players control over 25% of the total supply.

| Rank |

Entity |

Entity Type |

BTC Holdings |

USD Value (at $66.5k) |

| 1 |

Satoshi Nakamoto |

Individual (Creator) |

1,100,000 |

$73.15B |

| 2 |

Coinbase |

Exchange (Total Custody) |

884,675 |

$58.83B |

| 3 |

BlackRock (IBIT) |

ETF Issuer |

765,294 |

$50.89B |

| 4 |

Strategy (MSTR) |

Public Company |

714,644 |

$47.52B |

| 5 |

Binance |

Exchange |

629,000 |

$41.83B |

| 6 |

Fidelity (FBTC) |

ETF Issuer |

471,000 |

$31.32B |

| 7 |

U.S. Government |

Government |

328,372 |

$21.84B |

| 8 |

China |

Government |

194,000 |

$12.90B |

| 9 |

Tether |

Private Company |

96,369 |

$6.41B |

| 10 |

Block.on |

Exchange/Brokerage |

164,000 |

$10.9B |

Data as of February 13, 2026. Values calculated at $66,500/BTC.

1. Satoshi Nakamoto

As of February 13, 2026,

Satoshi Nakamoto, the pseudonymous creator remains Bitcoin’s ultimate "black hole" for liquidity, controlling exactly 1,096,354 BTC, valued at $72.9 billion as of mid-February 2026 according to Arkham Intelligence’s entity clustering.

Nakamoto's Bitcoin holdings, identified via the "Patoshi" mining pattern, are fragmented across 21,900+ distinct addresses that have seen zero outbound activity since mid-2010. While his personal stash remains dormant, the

Genesis block has become a high-value "burn" destination; on February 7, 2026, an anonymous user sent 2.565 BTC, valued around $181,000 at the time, to the original 1A1zP address. Because the 50 BTC reward in the Genesis block is technically unspendable due to protocol constraints, analysts view these modern inflows as symbolic "digital offerings" rather than signs of Satoshi's return, effectively removing more supply from the 21 million hard cap.

2. Coinbase

As the primary custodian for the majority of U.S.

Spot Bitcoin ETFs,

Coinbase Global (COIN) sits at the center of the institutional ecosystem, controlling 884,675 BTC, approx. $58.83 billion, as of February 13, 2026. This massive pool is not a single prop-desk position; it represents an omnibus of assets belonging to millions of retail users, institutional "Prime" clients, and the underlying collateral for several of the largest ETFs. From a practical perspective, Coinbase's on-chain reserves serve as the world's largest liquidity hub, and the company maintains a high-velocity operational buffer to handle daily inflows and withdrawals without affecting its core corporate treasury, which holds a separate, smaller balance of 14,548 BTC.

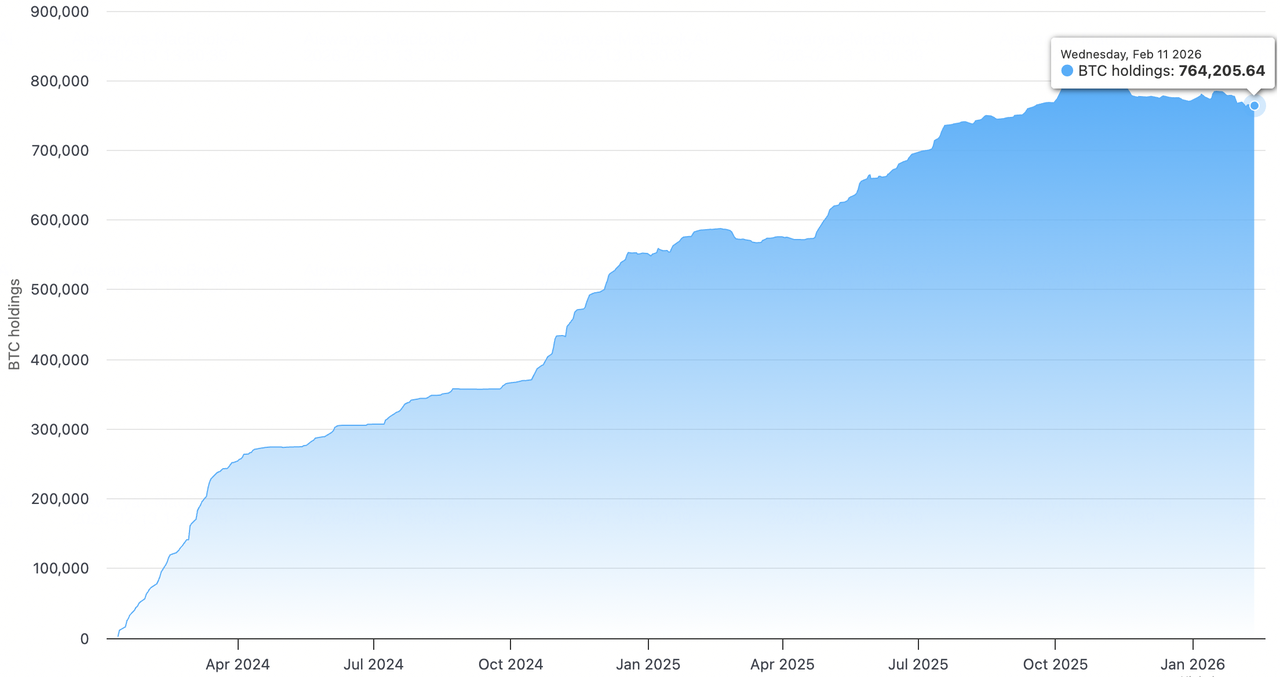

3. BlackRock (IBIT)

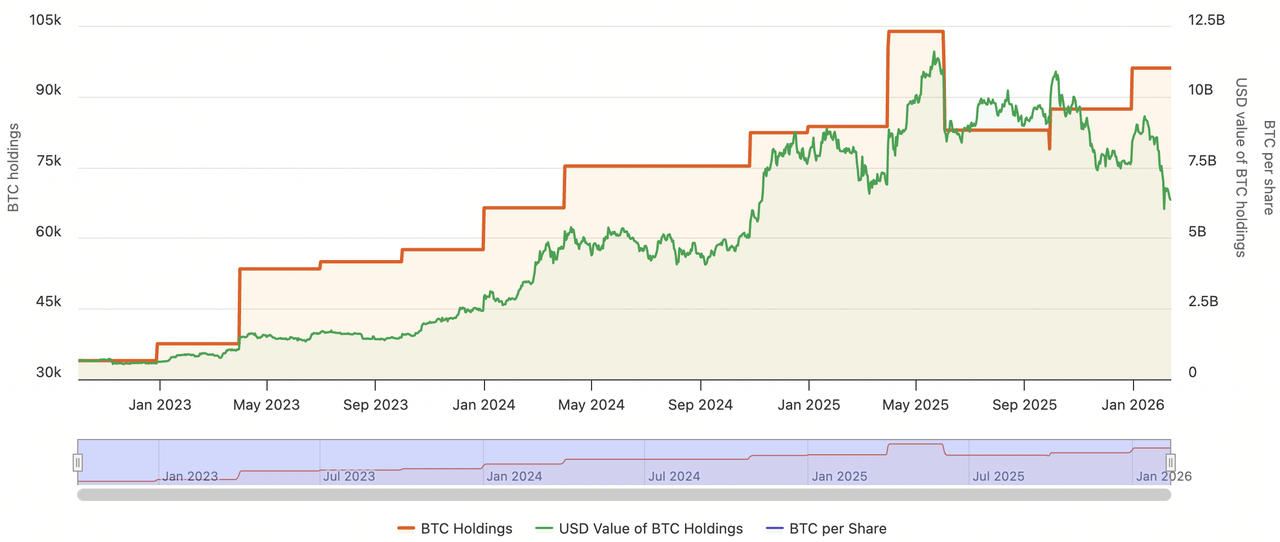

BlackRock (IBIT) ETF's Bitcoin holdings | Source: Bitbo

As of February 13, 2026, BlackRock’s iShares Bitcoin Trust (IBIT) has solidified its position as the world's largest institutional Bitcoin vehicle, holding an unprecedented 765,294 BTC, valued at $50.89 billion. Representing approximately 3.8% of the total circulating supply, IBIT acts as the primary liquidity bridge for Wall Street, having achieved the title of the fastest-growing ETF in history. Despite a volatile start to 2026 that saw its Assets Under Management (AUM) fluctuate from $100 billion peaks, the fund continues to absorb a significant portion of the daily exchange float. With its holdings custodying on-chain via Coinbase Prime, BlackRock’s massive scale is the single largest factor driving the current institutional supply shock, as its consistent inflows effectively remove Bitcoin from the reach of retail exchanges.

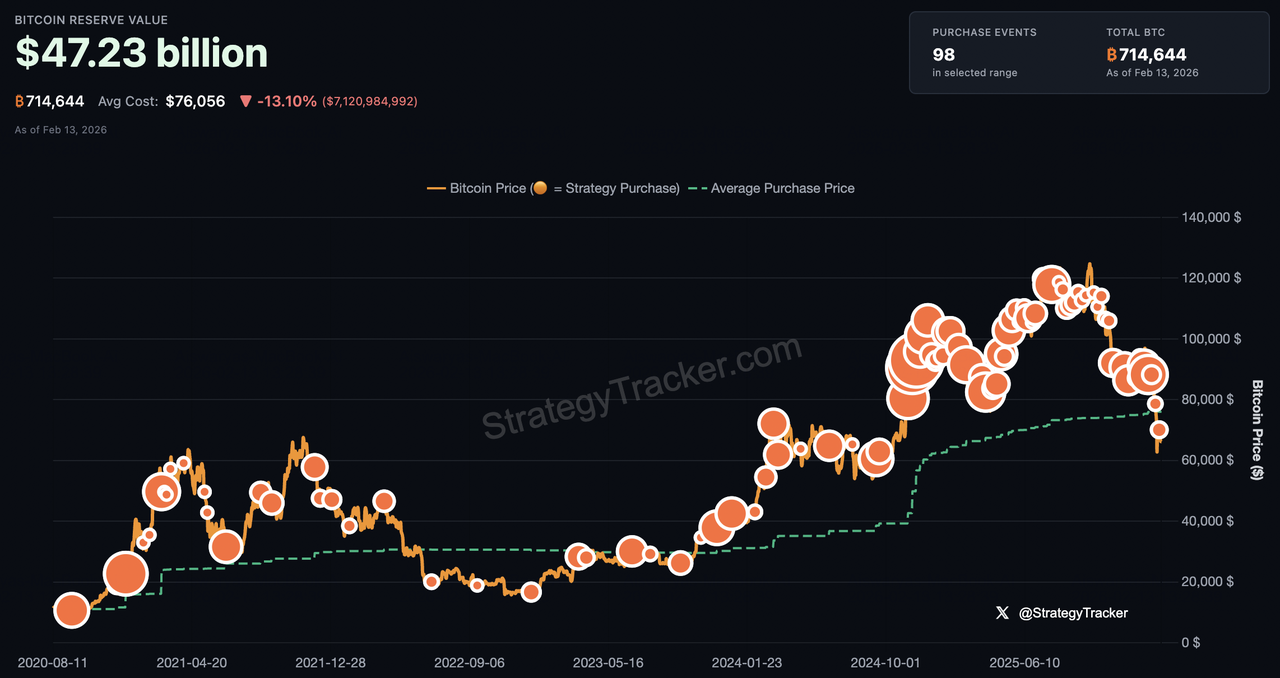

4. Strategy (formerly MicroStrategy)

Strategy (MSTR) Bitcoin holdings | Source: SaylorTracker

Under the leadership of Executive Chairman Michael Saylor,

Strategy Inc. (MSTR) has transitioned from a software provider into the world’s first Bitcoin Treasury Company, now controlling 714,644 BTC, roughly 3.4% of the total supply. As of February 13, 2026, the firm’s holdings are valued at $47.33 billion, carrying an unrealized paper loss of approximately $7.03 billion against an aggregate purchase price of $54.35 billion at an average cost of $76,056 per BTC. Despite the February 6 Deep Discount event where the stock's market value fell below its net asset value to 0.85x mNAV, Strategy doubled down on its high-conviction orange dots strategy, acquiring 1,142 BTC for $90 million on February 9. The firm remains financially resilient, maintaining $2.25 billion in cash, enough to cover dividend and debt obligations for 30 months, while positioning its

STRC preferred stock as a new layer of digital credit to fund perpetual accumulation without forced liquidation.

5. Binance

As the world’s largest cryptocurrency exchange by volume, Binance controls approximately 629,000 BTC, valued at $41.83 billion, primarily stored in its "34xp4" cold wallet and a network of secure storage addresses. Similar to Coinbase, these funds are managed on behalf of a global user base, though Binance’s reserves are notably diverse across international jurisdictions following its 2025 regulatory expansion in the UAE and ADGM. For traders, Binance’s

Proof of Reserves (PoR) system, now updated in real-time, provides a transparent view of these holdings, ensuring that customer assets are backed 1:1, even as the exchange maintains its role as the primary venue for global Bitcoin price discovery.

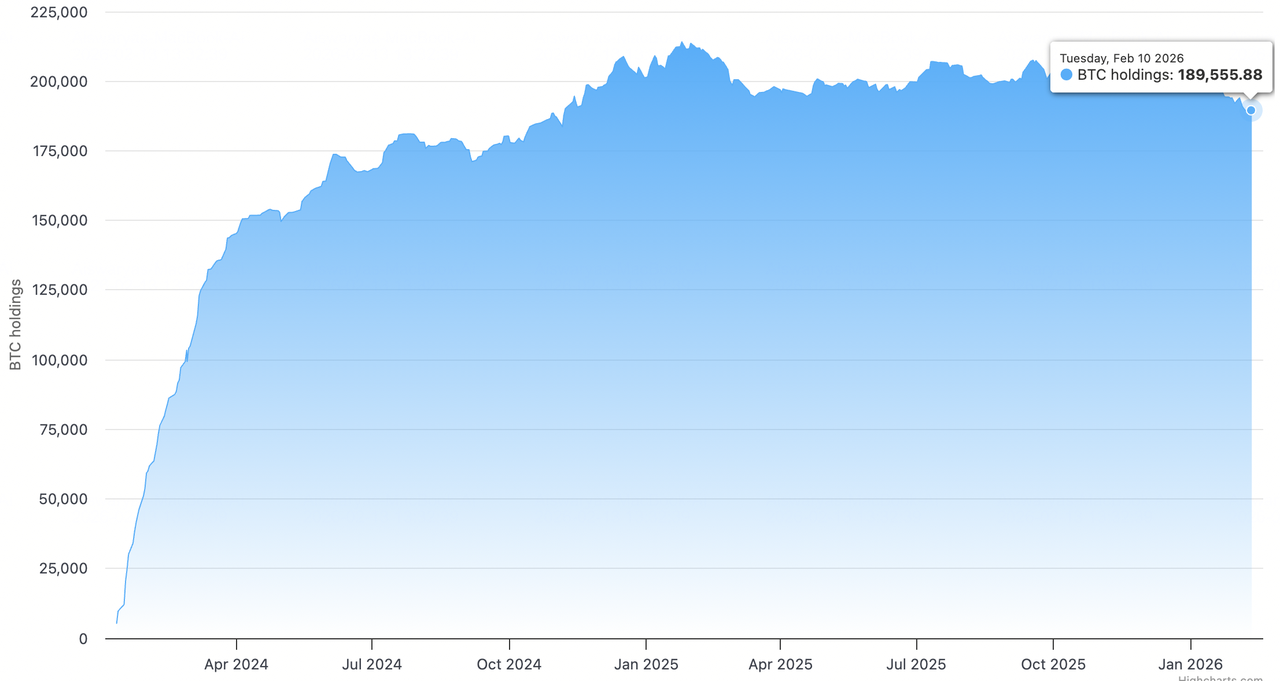

6. Fidelity (FBTC)

Following closely behind BlackRock, Fidelity’s Wise Origin Bitcoin Fund (FBTC) holds 471,000 BTC, approx. $31.32 billion, in its self-custodied vaults. Unlike other ETF issuers that rely on third-party custodians, Fidelity utilizes its own institutional-grade infrastructure, Fidelity Digital Assets, to manage its private keys. This vertical integration is a key practical advantage for long-term institutional holders, as it removes third-party counterparty risk. As of February 2026, FBTC remains a top-tier vehicle for 401(k) and pension fund exposure, with its holdings reflecting a consistent, low-churn accumulation strategy by traditional finance giants.

7. The United States Government

As of February 13, 2026, the United States Government remains the world’s largest national Bitcoin holder, controlling 328,372 BTC, valued at $21.84 billion. These holdings are almost exclusively the result of high-profile law enforcement seizures, including the historic Silk Road marketplace shutdown and the Bitfinex hack recovery. A massive boost to the national treasury occurred in October 2025, when the FBI confiscated 127,271 BTC from the Prince Group fraud syndicate. Practically, the U.S. government’s "diamond hands" are a matter of legal process rather than investment strategy; however, any announced auction or liquidation from these seized wallets, such as those managed by the U.S. Marshals Service, remains a major "black swan" event that can trigger immediate, double-digit volatility across global markets.

8. China’s Passive Bitcoin Reserve

Despite maintaining a blanket ban on cryptocurrency trading and mining since 2021, China remains the world's second-largest governmental holder of Bitcoin, controlling an estimated 194,000 BTC, valued at $12.90 billion. These assets were primarily seized during the massive 2019-2020 crackdown on the PlusToken Ponzi scheme, which defrauded millions of investors. While the Chinese government officially states that these assets are transferred to the national treasury, the stash is shrouded in mystery; unlike the U.S., China provides no public auction schedule or transparent reporting on the status of these coins. On-chain analysts periodically flag movement from PlusToken-linked addresses to exchanges like Huobi, fueling constant market speculation that Beijing may be "passively" holding or quietly liquidating its reserves to fund state initiatives, making it one of the most significant "hidden variables" in global Bitcoin liquidity.

9. Tether

Tether's BTC holdings | Source: BitcoinTreasuries

Tether Holdings Ltd., the issuer of the

USDT stablecoin,

USAT stablecoin, and

Tether Gold (XAUT), has evolved into a major Bitcoin "whale" with reserves totaling 96,369 BTC, valued at $6.41 billion, as of February 13, 2026. Since May 2023, Tether has committed to investing up to 15% of its quarterly net realized operating profits into Bitcoin to diversify its backing away from traditional cash equivalents. Practically, this turns Tether into a perpetual "buy-side" force; as long as USDT demand grows with market cap recently hitting $187 billion, Tether will continue to strip BTC supply from the market, treating it as a primary reserve asset alongside its massive $122B U.S. Treasury portfolio.

10. Block.one

As the largest private company holder, Block.one, the firm behind the EOSIO software, reportedly holds 164,000 BTC, valued at $10.9 billion. These holdings were primarily seeded from the proceeds of its historic 2018 ICO and have been managed as a long-term capital reserve. Practically, Block.one’s stash is often viewed with caution by the market, as it is one of the few massive legacy stashes that is not tied to a public ETF or a regulated exchange's user funds. While the company has used its BTC to seed its Bullish exchange subsidiary, the vast majority of this supply remains sidelined, making it a significant potential source of long-term liquidity or over-the-counter (OTC) supply.

How to Trade Bitcoin (BTC) on BingX

Whether you are a retail trader or looking for long-term exposure like the whales, BingX provides professional tools to trade Bitcoin with deep liquidity and

BingX AI-driven insights.

Buy or Sell BTC on the Spot Market

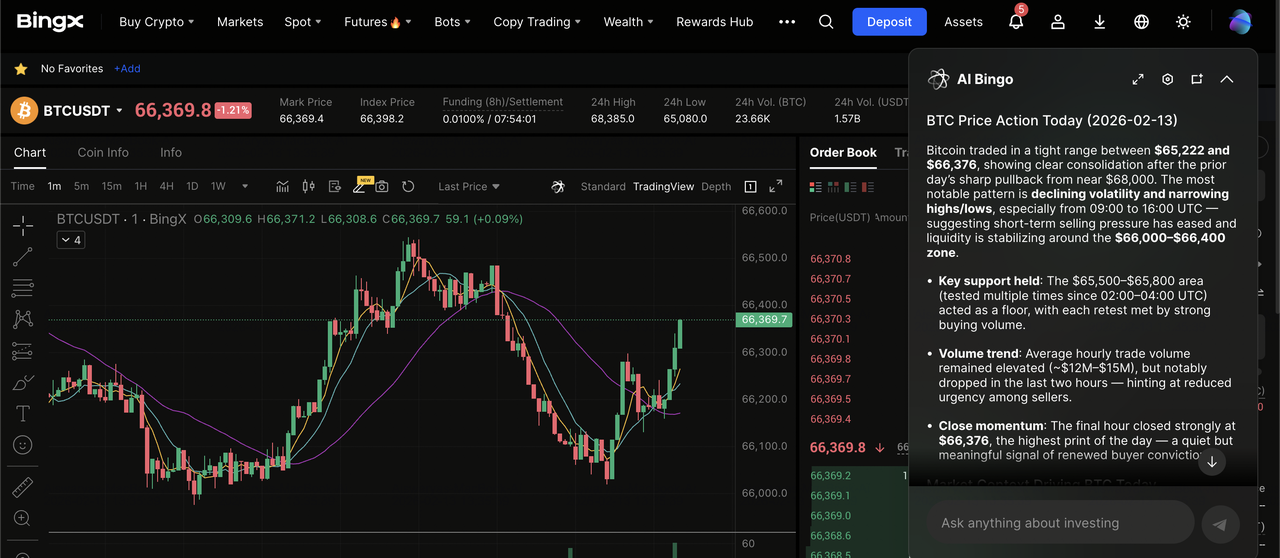

BTC/USDT trading pair on the spot market powered by BingX AI insights

Spot trading is the preferred method for long-term "HODLers" who want to own the underlying asset.

1. Create and verify your account on BingX.

3. Choose

Market Order for instant execution or Limit Order to buy at your target price.

4. Manage your holdings in your BingX wallet with top-tier security.

Find out more about how to

buy Bitcoin on BingX in our starter guide.

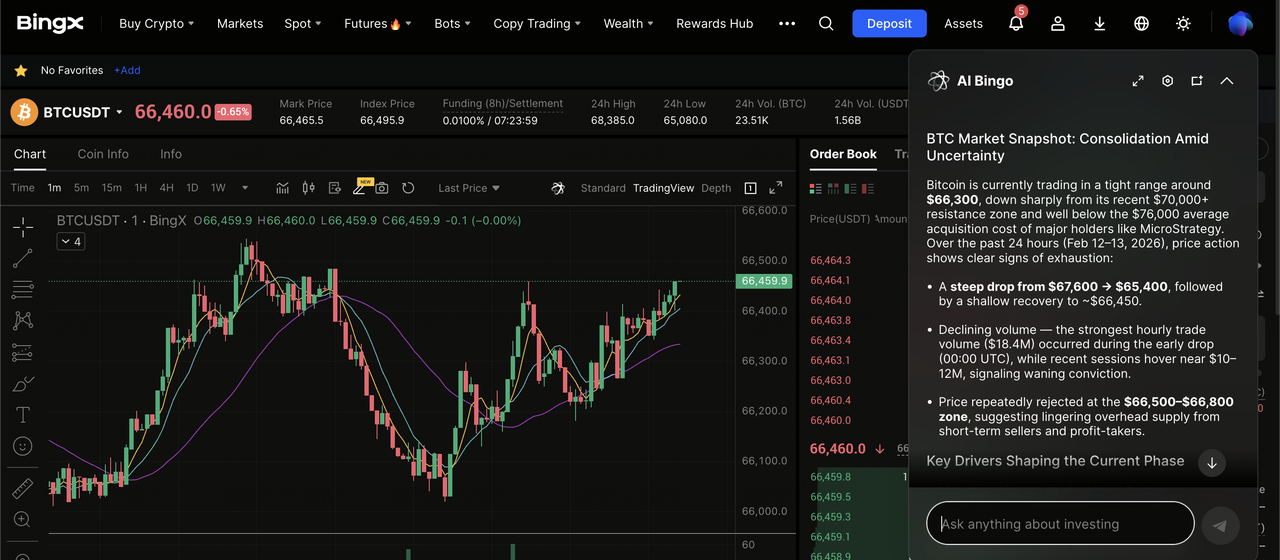

Long or Short BTC with Leverage on Futures

BTC/USDT perpetual contract on the futures market featuring BingX AI

For those looking to capitalize on the volatility of whale movements, BingX Futures offers Perpetual Contracts with up to 150x leverage.

3. Use BingX AI signals to identify trend reversals or liquidity clusters or whale zones.

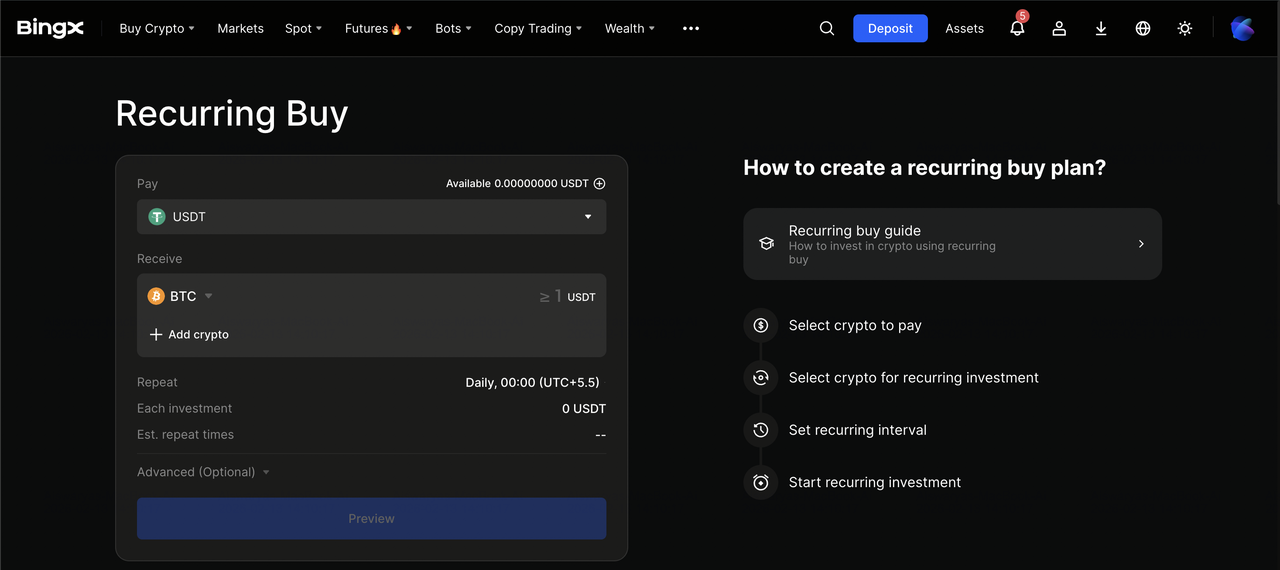

DCA Bitcoin with BingX Recurring Buy

DCA Bitcoin on Recurring Buy

BingX Recurring Buy is the most effective tool for long-term investors to mimic whale-like accumulation by removing emotional bias and market timing stress.

1. Log in to the BingX App or website, go to Spot, and select Recurring Buy.

2. Select USDT or

USDC as your payment currency and Bitcoin (BTC) as your target asset.

3. Set your Investment Amount, starting from as low as 1 USDT, and choose your Frequency from Hourly, Daily, Weekly, or Monthly.

4. Review your plan and click Confirm to activate. BingX will now automatically buy BTC at the exact market price during each scheduled cycle.

5. Track or adjust your plan anytime under the Recurring Buy Dashboard; you can pause, edit, or cancel with zero penalties.

What Are the 4 Key Risks for Bitcoin Holders in 2026?

While the "Rich List" indicates strong conviction from major players, the 2026 market carries unique risks:

1. Concentration Risk: If a single entity like Strategy or a major ETF were forced to liquidate, the market impact would be catastrophic.

2. Regulatory Uncertainty: Ongoing litigation regarding government seizures, like the Prince Group case, keeps large swaths of supply in a legal gray area.

3. Miner Capitulation: With production costs estimated at $87,000, price drops below this level, as seen on February 6, can force

BTC miners to sell their reserves to cover electricity costs.

4. Lost Supply: While Satoshi's coins are considered lost, any movement from a dormant whale address can trigger immediate market panic.

Conclusion: Should You Follow the BTC Whales?

The 2026 Bitcoin Rich List shows that Smart Money is no longer just individuals, but it is the bedrock of global finance and national treasuries. Entities like Strategy and BlackRock are betting on the "infinite horizon" of Bitcoin.

However, for individual investors, the key is to manage risk. While whales can weather $5 billion paper losses, retail traders must use tools like those on BingX to protect their capital. As the supply continues to tighten, owning even a fraction of a Bitcoin puts you ahead of the global curve.

DYOR and stay tuned to the on-chain data to track where the big money moves next.

Related Reading