Telegram has officially evolved from a privacy-focused messaging app into a global financial powerhouse. In 2026, the ecosystem is no longer just about "Tap-to-Earn" games or simple chats; it is a full-fledged Web3 hub where over 100 million users manage digital assets directly within their conversation lists.

The Open Network (TON) DeFi TVL and DEX volume | Source: DefiLlama

In 2026, the intersection of social media and decentralized finance has reached a tipping point. Telegram has officially surpassed 1 billion monthly active users, with over 500 million daily active users now spending an average of 41 minutes per day within the app. This massive attention economy is increasingly powered by The Open Network (TON), which has seen its cumulative on-chain wallet activations skyrocket to over 48 million as of early 2026.

With TON DeFi processing over 2 million transactions daily and the ecosystem maturing into a "Utility Phase," the choice of a wallet is no longer just a technical preference but also a strategic decision. Whether you are part of the 15 million Telegram Premium subscribers accessing exclusive Web3 features or a retail investor exploring the $1.2 billion tokenized equity market via xStocks, your wallet is your primary interface for security and sovereignty.

This guide explores the top 7 Telegram wallets in 2026. We break down the official bots, decentralized apps, and multi-chain powerhouses that are defining the future of

Social Finance (SocialFi). Let's find your perfect gatekeeper to the TON ecosystem.

Why Is the Telegram Crypto Ecosystem So Popular in 2026?

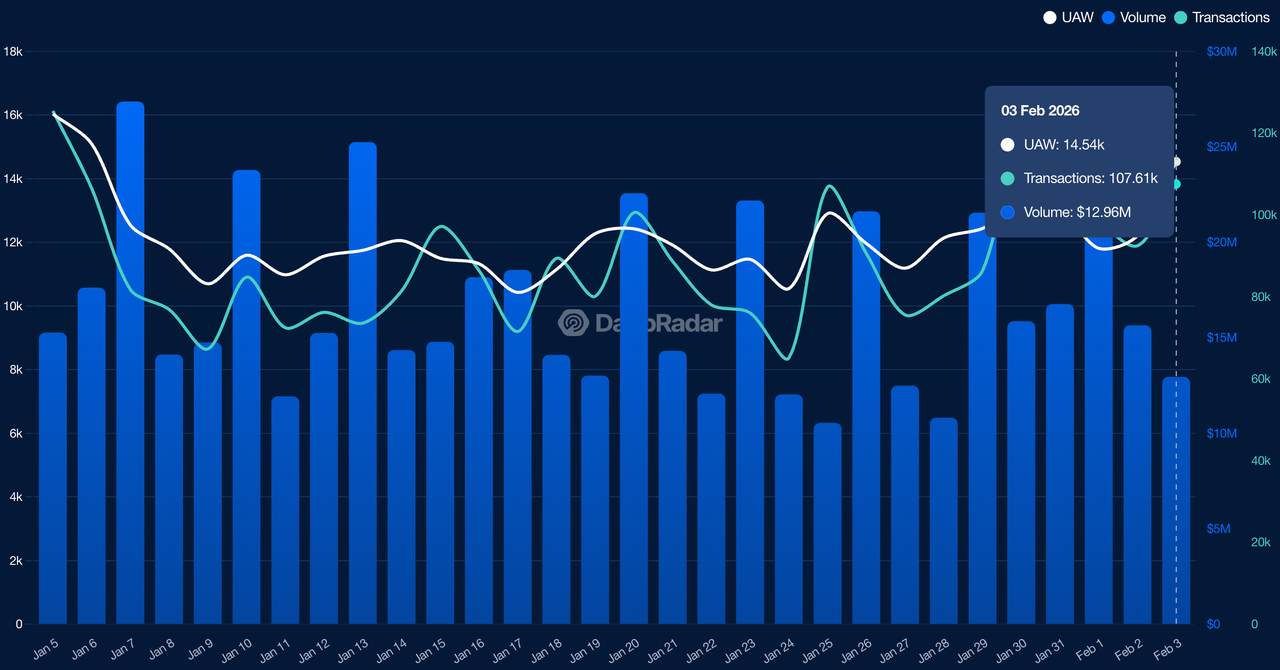

TON ecosystem on-chain activity | Source: DappRadar

The rise of Telegram’s crypto layer is fueled by "frictionless onboarding." In 2026, TON remains one of the most efficient blockchains, boasting sub-second finality and negligible fees, averaging $0.01 per transaction. The integration of the TON Teleport Bridge has further boosted the network by enabling seamless

Bitcoin interoperability, allowing users to move BTC into the TON ecosystem without leaving the app.

In 2026, the intersection of social media and decentralized finance has hit a definitive tipping point. As of February 2026, Telegram has solidified its position as the world’s 5th most-used social platform, reaching 1 billion monthly active users and over 500 million daily active users who spend an average of 41 minutes daily within the app.

The underlying engine for this financial revolution,

The Open Network (TON), now supports a sophisticated economy where over 48 million wallets have been activated since inception. The network handles a staggering 2.16 million daily transactions, while the Total Value Locked (TVL) in TON DeFi remains a critical indicator of its maturing infrastructure.

Key statistics as of early 2026 highlight this dominance:

• Global Reach of 1 Billion Monthly Active Users (MAUs): Telegram’s massive scale is now 12.5x larger than the entire global DeFi user base of 2022, providing an unprecedented foundation for mass crypto adoption.

• Network Velocity of 2.16 Million Daily Transactions: The TON blockchain maintains sustained high throughput, proving its capability to compete with major

Layer-1 networks like

Solana in terms of speed and scalability.

• Stablecoin Liquidity of $837 Million+ Circulating USDT: Massive

stablecoin liquidity within the app enables high-velocity, non-volatile

P2P payments, making crypto practical for daily global commerce.

• Social Adoption of 15 Million Premium Users: This represents a massive, high-intent pool of power users who are primed for advanced Web3 features, tokenized services, and AI-integrated trading bots.

Whether you are trading

memecoins,

staking for passive yield, or exploring NFTs, the Telegram ecosystem provides the most accessible environment in the crypto world today.

What Are the Top 7 Telegram Wallets for 2026?

Choosing the right wallet depends on your balance between ease of use and security. Here are the leading contenders for 2026.

1. @Wallet

Type: Custodial / Hybrid

Best For: Beginners, instant P2P transfers, and fiat-to-crypto onramps.

As the official financial layer of the Telegram ecosystem, @Wallet is natively integrated into the app’s interface for over 1 billion monthly active users, requiring no external downloads. In 2026, it serves as the ultimate "invisible" bank, supporting instant, zero-fee off-chain transfers to any Telegram contact, a feature that has driven its adoption to over 25 million active accounts. While the core wallet is custodial, managing keys on your behalf for ease of use, it uniquely offers TON Space, a

non-custodial "wallet within a wallet" that grants users full sovereignty over their private keys to interact with over 250 TON dApps and NFTs. Beyond simple storage, the bot features a robust P2P Market with a competitive 0.9% maker fee, facilitating seamless swaps between Toncoin (TON), Bitcoin (BTC), and

USDT across multiple global fiat currencies.

2. MyTonWallet

Type: Self-Custodial / Open-Source

Best For: Power users, airdrop hunters, and multi-chain asset management.

Trusted by over 9 million users worldwide, MyTonWallet is a feature-rich, non-custodial solution that bridges the gap between the TON and

TRON ecosystems. Audited by CertiK for top-tier security, it allows users to manage unlimited independent accounts and execute multi-send transactions, a critical tool for efficient airdrop distributions and portfolio management. In 2026, it stands out with a built-in Swap Aggregator for best-in-market rates and native support for Telegram Gifts, TON DNS, and W5 Gasless transfers, which allow you to pay network fees directly in USDT. Whether on mobile, desktop, or as a browser extension, it provides professional-grade tools like interactive price charts and Ledger hardware integration, ensuring that advanced traders maintain total sovereignty without sacrificing the speed of the Telegram environment.

3. Tonkeeper

Type: Non-Custodial / Open-Source

Best For: DeFi power users, NFT collectors, and long-term stakers.

Tonkeeper is the dominant non-custodial force in the ecosystem, commanding a massive user base that facilitates over 9 million monthly transactions. In 2026, it remains the primary gateway for DeFi enthusiasts due to its seamless integration with the W5 wallet standard, which enables "Gasless" transfers, allowing you to pay network fees using the same token you are sending, such as USDT or NOT, rather than needing a native TON balance.

For users with zero TON, the innovative Tonkeeper Battery system allows for "charging" via in-app purchases or stablecoins to cover swaps and NFT transfers automatically. Beyond its built-in dApp browser and secure Signer offline vault, Tonkeeper provides direct access to Tonstakers, the network's liquidity leader, and Fragment, the official marketplace for tokenized Telegram usernames and anonymous numbers.

4. Atomic Wallet

Type: Non-Custodial / Decentralized

Best For: Diversified portfolio management and anonymous cross-chain swaps.

Atomic Wallet is the premier choice for users seeking to manage a vast array of assets beyond the TON ecosystem, supporting over 1,500 coins and tokens across 50+ blockchains as of 2026. Trusted by over 15 million users, it combines decentralized storage with a built-in Instant Swap service that allows for anonymous exchanges between 60+ crypto pairs with up to 1% cashback rewards paid in AWC. As a non-custodial solution, it ensures that private keys are AES-encrypted and stored exclusively on your local device, requiring no KYC or account registration for its core features. In 2026, its ecosystem has expanded into a full-scale trading hub, featuring

Perpetual Futures with up to 40x leverage and a high-yield staking dashboard offering up to 23% APR on assets like

Monad, Solana, and

Ethereum, all manageable from a single, intuitive interface.

5. Swapster

Type: Feature-Rich Bot / Licensed Hybrid

Best For: Frequent off-ramps, virtual card payments, and integrated business payroll.

Swapster has evolved into a powerhouse of financial infrastructure within Telegram, serving over 130,000 global users with a total value transferred exceeding $50 billion as of February 2026. Beyond its core function as a high-velocity bridge for TON,

BTC, and USDT, Swapster now facilitates a borderless lifestyle through instant virtual card issuance compatible with Apple Pay and Google Pay, allowing users in over 100 countries to spend crypto balances at over 150 million merchants. For entrepreneurs, its Swapster Business suite provides a complete toolkit for automated payroll, real-time revenue dashboards, and fully compliant invoice creation. As a licensed digital asset provider, Swapster ensures bank-grade security with automated global AML screening, maintaining trust for institutional-scale monthly volumes of 2 million+ transactions.

6. Tonhub

Type: Non-Custodial / Mobile-Exclusive

Best For: Security-conscious mobile users, high-yield staking, and real-world crypto spending.

Developed by the Ton Whales team, Tonhub is a high-performance, non-custodial wallet designed for the 2026 mobile economy, currently supporting a thriving community of over 300,000 daily active users. It is the premier choice for "SocialFi" spending, featuring the Visa/Mastercard compatible Tonhub Card, which allows users in the EU and beyond to spend TON and USDT at over 90 million merchants globally with a transparent 1.5% conversion fee and a generous €50,000 monthly limit.

For investors, Tonhub offers one of the most streamlined liquid staking experiences on the market; with a minimum deposit of just 50 TON, users can join decentralized nominator pools to earn a share of validator rewards (typically 60% distribution to nominators) while maintaining instant liquidity. Its 2026 architecture leverages biometric security and advanced anti-fraud monitoring, ensuring that while you enjoy near-instant transaction signing for the latest TON games, your private keys never leave your device’s secure enclave.

7. NOW Wallet

Type: Non-Custodial / Multi-Chain

Best For: Anonymous swaps, TRON power users, and cashback-seeking traders.

Powered by the veteran ChangeNOW exchange engine, NOW Wallet is the 2026 gold standard for cross-chain privacy, supporting over 1,500 tokens across 70+ blockchains, including BTC, ETH, SOL, and XMR, with zero KYC for core features. It is particularly renowned for its GasFree USDT transfers on TRON, a feature that abstracts away the need for TRX by allowing users to pay a fixed 1 USDT fee directly from their stablecoin balance.

For those focused on growth, ChangeNOW Pro integration offers a monthly 0.1% cashback on all exchange turnovers and unlocks automated AML address checks for high-security transactions. By storing all private keys locally on-device and offering WalletConnect for 25+ dApp networks, NOW Wallet provides a professional, unified interface for users who demand both multi-chain flexibility and absolute data sovereignty.

How to Choose the Right Telegram Wallet for You

To choose the right Telegram wallet in 2026, you must evaluate how a provider balances the convenience of the messaging interface with the rigorous security required for Web3 assets.

1. Custody Model (Control vs. Convenience): Decide between custodial wallets like the default @Wallet, which manage keys for you but carry platform risk, and non-custodial wallets like Tonkeeper or MyTonWallet, where you have 100% control over your 24-word seed phrase.

2. TON Ecosystem Integration: Ensure the wallet supports native TON features such as W5 Gasless transfers, paying fees in USDT instead of TON, and direct interaction with

Telegram Mini Apps (TMAs).

3. Multi-Chain Support: If you hold assets beyond Toncoin, look for "Multi-Chain" specialists like Atomic Wallet or NOW Wallet that support 50+ blockchains including Bitcoin, Ethereum, and Solana.

4. Security Infrastructure: Prioritize wallets offering biometric authentication via FaceID/Fingerprint,

two-factor authentication (2FA), and compatibility with hardware signers like

Ledger for cold storage.

5. Fiat On/Off-Ramps: For frequent spending, select wallets like Swapster or Tonhub that offer integrated P2P markets, virtual debit cards via Apple Pay and Google Pay, and direct withdrawals to bank cards.

6. Advanced Web3 Features: Power users should check for built-in DEX aggregators for the best swap rates, NFT galleries for managing digital collectibles, and

liquid staking dashboards to earn passive APY.

7. Regulatory Compliance: Ensure the wallet uses automated AML (Anti-Money Laundering) screening and, if you are a high-volume trader, check if they offer tiered

KYC levels to increase your transaction limits.

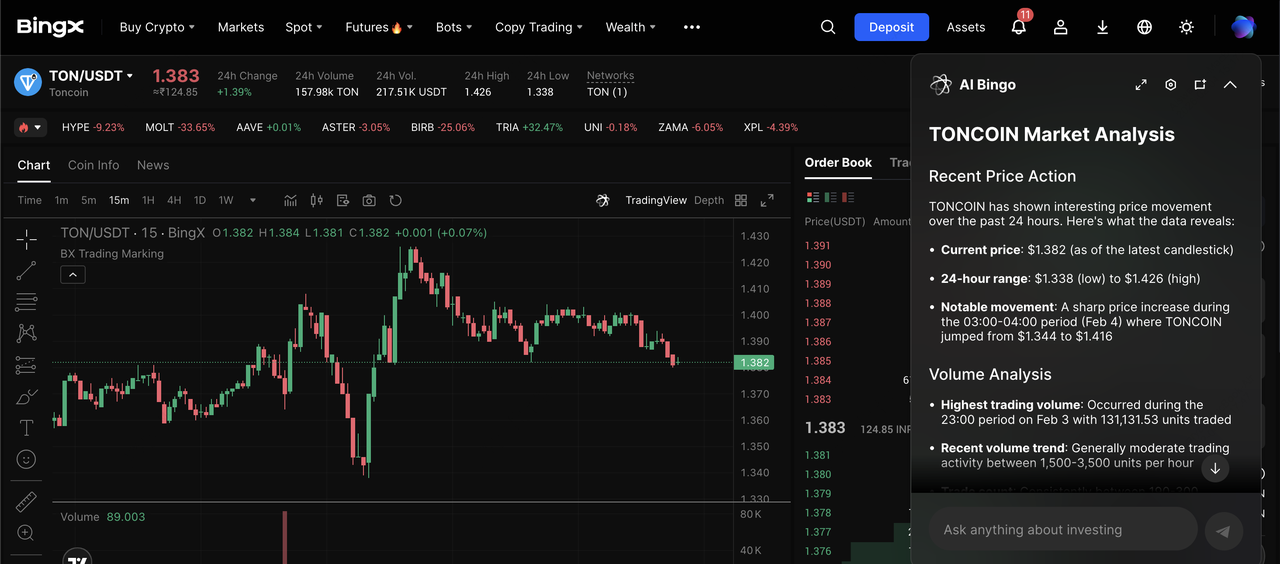

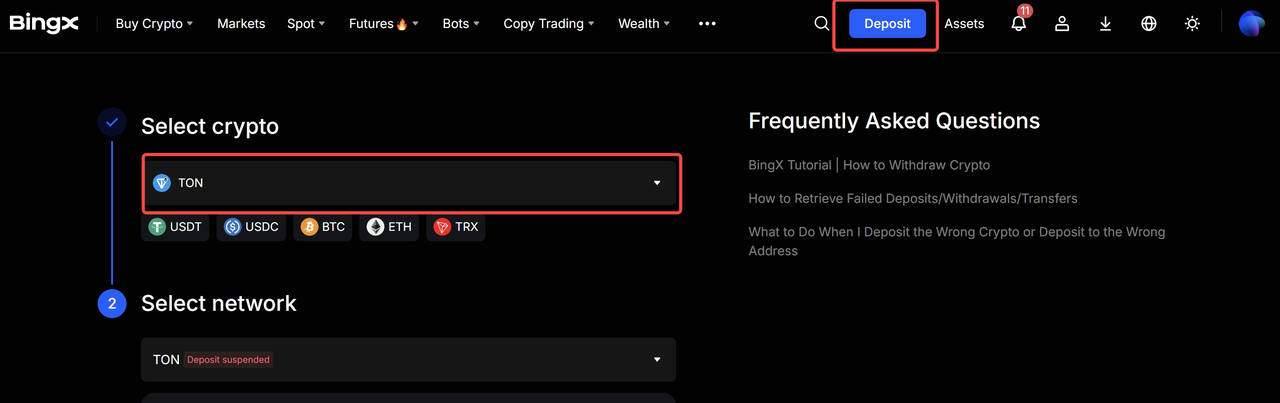

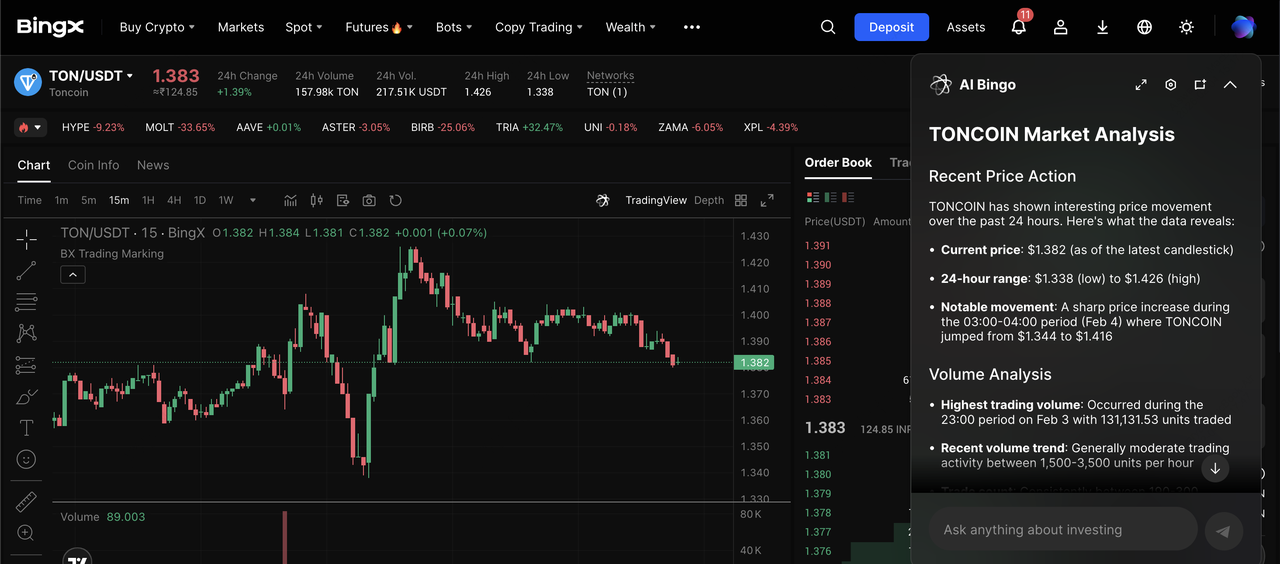

How to Fund Your Telegram Wallet via BingX

Before you can explore the 2026 TON ecosystem, you must fund your wallet with Toncoin (TON). BingX offers one of the most liquid spot markets for TON with competitive 0.1% trading fees.

Step 1: Buy Toncoin (TON) on BingX

1. Log in and Verify: Access your BingX account and ensure you have completed Identity Verification (KYC).