United Stables ($U) has rapidly emerged as a critical infrastructure layer in the crypto ecosystem, officially launching on the

BNB Chain and

Ethereum in December 2025. Unlike traditional

stablecoins that compete for market share, $U aggregates major assets like

USDT and USDC into a single, highly liquid settlement asset.

As of February 2026, $U has reached a circulating supply of over 709 million tokens and nearly 26,000 holders, supported by a growing network of institutional partners, including Binance and Bitget. By consolidating scattered liquidity pools, $U provides a seamless bridge for trading, DeFi, and autonomous AI agents, while maintaining 1:1 parity with the US dollar through a transparent, audited reserve framework.

In this article, you will learn what United Stables (U) is, the mechanics of its hybrid reserve system, the role of its native yield features, how it powers autonomous financial systems, and how to buy $U tokens on BingX.

What Is the United Stables (U) Liquidity Layer?

United Stables' vision | Source: United Stables

United Stables (U) is a multi-chain stablecoin protocol that issues the $U token, a digital dollar designed for maximum interoperability. While the stablecoin market has long been dominated by single-issuer assets, United Stables addresses the "liquidity wall" problem, where capital is trapped across different blockchains and exchanges, by acting as an aggregator.

Instead of requiring users to choose between competing stablecoins, $U allows institutions to mint tokens using a diversified basket of fiat and established stablecoins like

USDT,

USDC, and

USD1. This cooperative approach transforms $U into a liquidity foundation rather than a competitor.

Key strategic pillars of United Stables include:

1. Unified Liquidity: Aggregating capital from various sources into one token to reduce slippage and trading friction.

2. AI-Native Infrastructure: Supporting programmable payments and microtransactions for autonomous systems.

3. Inclusive Finance: Enabling fast, low-cost borderless payments for both banked and unbanked users globally.

In early 2026, the protocol reached a major milestone with its integration into top

BNB Chain projects such as

Venus,

ListaDAO, and Binance Wallet, solidifying its role as a primary settlement asset for the next wave of

on-chain finance.

How Does United Stables Stablecoin Layer Work?

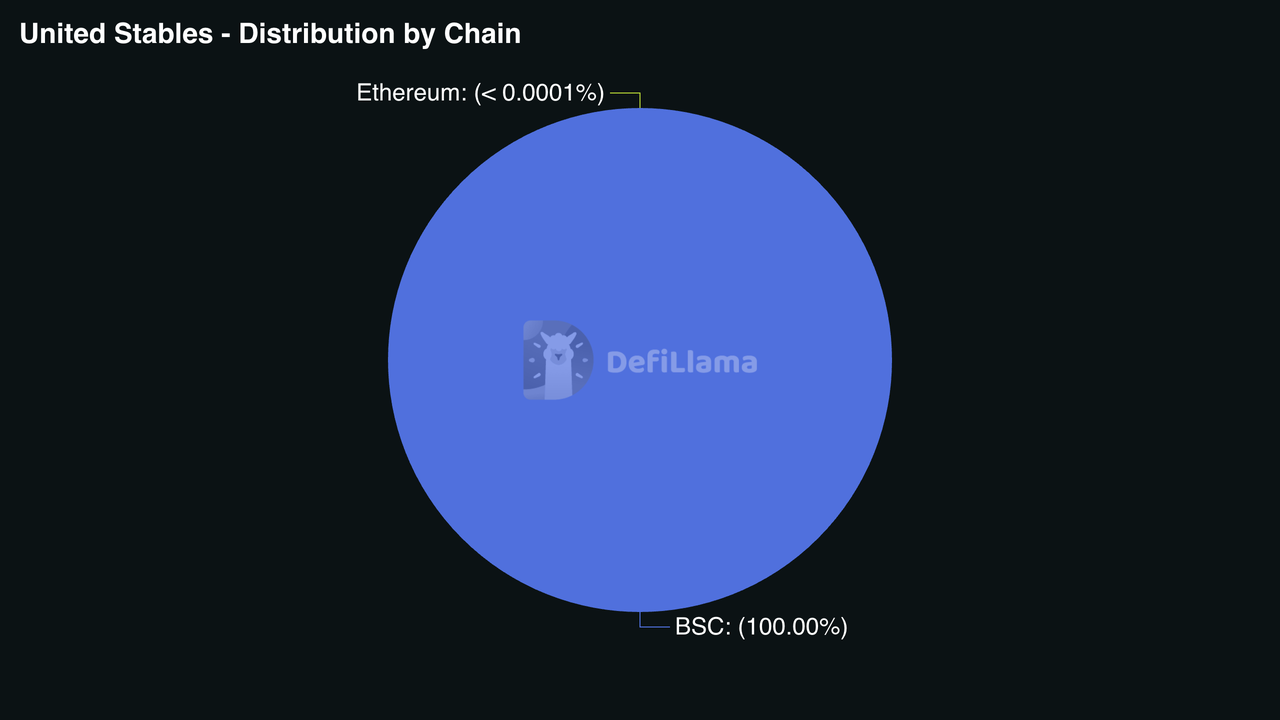

United Stables distribution breakdown by blockchain | Source: DefiLlama

United Stables replaces the fragmented model of digital cash with a programmable, "inclusive" architecture. It operates as an infrastructure layer that bridges the gap between

traditional finance (TradFi) and decentralized finance (DeFi).

1. The Stablecoin-Inclusive Reserve Model

Unlike traditional stablecoins backed solely by cash or Treasuries, $U employs a hybrid collateralization strategy. Its reserves consist of:

• Cash and Cash Equivalents: Maintained with accredited banking institutions.

• Top-Tier Stablecoins: $U treats other audited stablecoins as direct collateral, effectively "wrapping" their liquidity.

2. Multi-Chain and Gasless Architecture

Natively deployed on BNB Chain and Ethereum, $U utilizes the EIP-3009 standard. This allows for gasless, signature-based transactions, meaning users or

AI agents can authorize transfers without needing to hold the network's native gas token like

BNB or

ETH. This is a game-changer for micro-payments and mass-market adoption.

3. Native Yield and Auto-Compounding

One of the unique features of $U is its yield-bearing mechanism. The protocol generates revenue from its underlying reserves, e.g., interest from Treasury bills or

staking rewards. Instead of the protocol retaining these profits, they are distributed to $U holders. In many wallet integrations, this yield is reflected through an auto-compounding balance, making $U "productive money" that grows even when held statically.

4. Real-Time Proof of Reserves (PoR)

To maintain trust, United Stables utilizes on-chain oracles to provide near real-time

Proof of Reserves. This ensures that the total supply of $U never exceeds the value of its segregated, audited collateral, maintaining a healthy 1:1 peg.

What Are the Key Use Cases for United Stables Layer, From Trading to AI Agents?

United Stables is designed to be more than just a store of value; it is a tool for the "intelligent economy."

• Unified Trading Pairs: By using $U as a base currency, exchanges can offer deeper liquidity and tighter spreads, as $U consolidates the volume of multiple stablecoins into a single pair.

• Autonomous AI Commerce: $U is built for AI-driven agents. Through partnerships with platforms like Pieverse,

AI bots can manage discovery, checkout, and instant settlement autonomously using $U as their native currency.

• Institutional Settlement: The protocol provides a compliant, transparent rail for OTC desks and corporate treasuries to move large-scale funds with audit-ready reporting.

• Global Remittances: By leveraging the low fees of the BNB Chain, $U reduces the cost of cross-border transfers from the 5–10% industry average to under 1.5%.

What Is the U Token Used for?

While $U functions as a stable settlement asset, it also serves as the gateway to the United Stables ecosystem's incentives and governance:

• Medium of Exchange: $U is the primary unit of account for transactions within the United Stables ecosystem and its partners.

• Staking and Rewards: Users can stake $U to earn protocol emissions and reward multipliers. Staking often grants voting power, allowing users to influence protocol parameters and emission schedules.

• Collateral in DeFi: Due to its stable value and native yield, $U is a highly efficient collateral asset for lending protocols like Venus, allowing users to borrow against their holdings while still earning a return.

How Does United Stables Differ From Other Stablecoins Like USDT and USDC?

| Feature |

United Stables ($U) |

Tether (USDT) |

USD Coin (USDC) |

| Reserve Strategy |

Inclusive: Basket of fiat, RWAs, and other stablecoins. |

Diversified: Cash, Treasuries, BTC, Gold, and Loans. |

Conservative: 100% Cash and short-term U.S. Treasuries. |

| Primary Goal |

Liquidity Unification & AI Commerce. |

Global Liquidity & Trading. |

Transparency & Institutional Compliance. |

| Yield Mechanism |

Native & Auto-compounding: Yield distributed to holders. |

None (Issuer retains all interest). |

None (Issuer retains all interest). |

| AI Readiness |

High: Native support for gasless AI agent payments. |

Low: General-purpose only. |

Medium: Via third-party CCTP & Layer 2s. |

| Transparency |

Real-time On-chain Proof-of-Reserves. |

Quarterly/Monthly attestations. |

Monthly independent audits (Deloitte). |

| Network Focus |

Unifies BNB Chain & Ethereum. |

Dominant on Tron and Ethereum. |

Strong on Ethereum, Solana, & Base. |

While USDT and USDC have long dominated the market, United Stables ($U) introduces a fundamentally different philosophy centered on liquidity unification rather than competition. Traditional stablecoins like USDT and USDC operate as closed-loop systems where their reserves are strictly limited to cash, Treasuries, or proprietary debt. In contrast, $U utilizes a stablecoin-inclusive reserve model, meaning it can hold other audited stablecoins, including USDC and USDT themselves, as backing. This allows $U to act as a "meta-layer" that unifies fragmented liquidity across ecosystems, whereas traditional issuers often contribute to fragmentation by competing for isolated market share.

Beyond its reserve structure, $U is uniquely engineered for the autonomous economy, a feature notably absent from the first generation of stablecoins. While USDT and USDC focus on human-to-human or human-to-protocol interactions, $U incorporates EIP-3009 for gasless transactions and

x402-enabled delegated execution. These technical standards enable AI agents to perform micro-transactions and automated financial tasks without human intervention or the need to hold native gas tokens. While USDT relies on sheer liquidity and USDC on regulatory compliance, $U positions itself as the programmable settlement rail for machine-to-machine commerce.

How to Buy United Stables (U) on BingX

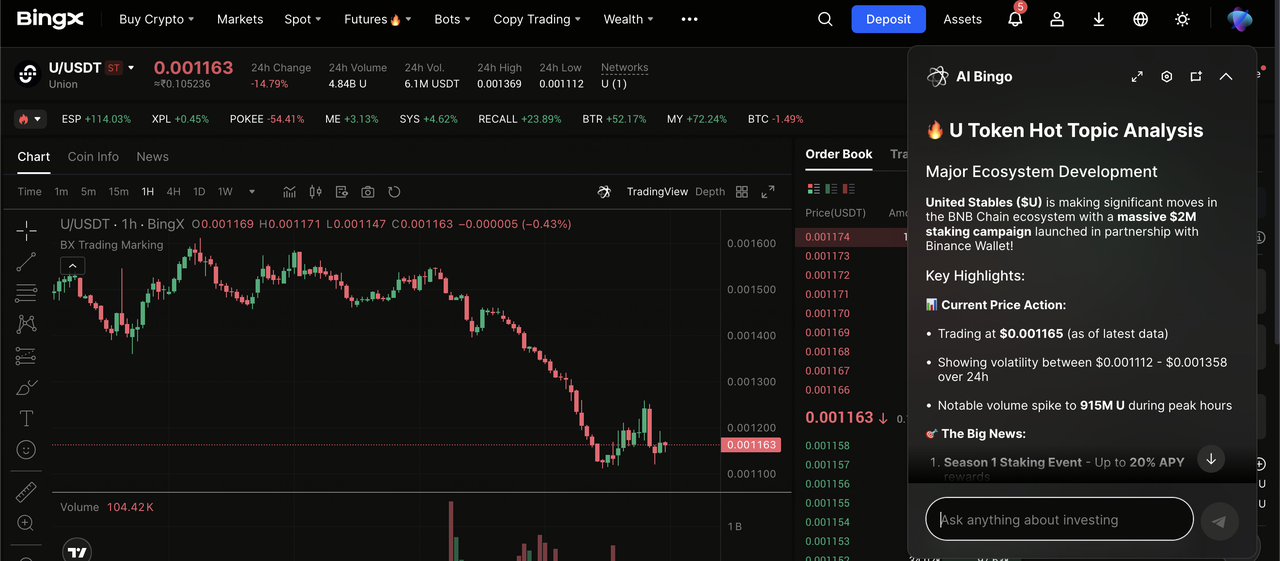

You can leverage BingX AI to analyze market sentiment before buying United Stables (U) on the spot market.

1. Fund Your Account: Log in to your BingX account and ensure you have USDT in your Spot Wallet; if not, you can buy crypto via P2P or credit card.

2. Navigate to Spot Trading: Hover over the Spot menu on the top navigation bar and select

Spot.

3. Search for $U: Use the search bar on the top left of the trading interface to type "U" and select the

U/USDT trading pair.

4. Set Your Order: Choose between a

Market Order to buy immediately at the current price or a Limit Order to set a specific price you are willing to pay.

5. Execute the Trade: Enter the amount of $U tokens you wish to purchase and click the Buy U button to complete your transaction.

3 Key Considerations Before Using United Stables (U)

As with any financial technology, users should evaluate the risks associated with the United Stables protocol.

1. Reserve Composition Risk: While $U is diversified, it is still exposed to the stability of the stablecoins and banks that make up its reserves.

2. Technological Dependency: The "gasless" and AI features rely on specific smart contract standards like EIP-3009. Users should ensure they use compatible wallets to access these features.

3. Regulatory Evolution: As a US dollar-pegged asset issued by United Stables Limited (BVI), the protocol operates within a complex global regulatory landscape that may evolve over time.

Final Thoughts: Is United Stables ($U) the Future of Stablecoins in 2026?

United Stables ($U) represents a shift toward a more collaborative and efficient digital economy. By addressing liquidity fragmentation and prioritizing AI-native features, it is positioning itself as a potential foundational layer for the next wave of programmable finance. For users seeking a stablecoin that integrates across the BNB Chain and Ethereum ecosystems while offering native yield, $U is an infrastructure project worth watching as it scales.

While $U is designed for stability, users should be aware of several inherent risks. As a stablecoin-inclusive asset, $U is subject to contagion risk; a significant

de-pegging event of an underlying reserve asset like USDT or USDC could impact the $U peg. Furthermore, the 2026 regulatory landscape remains dynamic; new frameworks like the

U.S. GENIUS Act or the UK's Cryptoassets Regulations may impose strict compliance mandates on interest-bearing stablecoins, potentially affecting yield distribution or regional availability. Always review the latest Proof-of-Reserve reports and smart contract audits before participating in the ecosystem.

Related Reading