Berachain (BERA) is a high-performance, EVM-identical

Layer 1 blockchain built on the

Cosmos SDK and powered by the innovative Proof-of-Liquidity (PoL) consensus mechanism. Unlike traditional networks that reward users for simply locking tokens, Berachain aligns security with liquidity, turning network emissions into real-world business revenue. As of February 2026, Berachain is undergoing a major strategic pivot via its "Bera Builds Businesses" initiative and the upcoming Bectra hard fork.

In this article, you will learn how Berachain’s tri-token model works, the significance of the PoL v2 upgrade, why the Berachain network is shifting toward a revenue-first "BBB" business model in 2026, and how to trade Berachain on BingX.

What Is Berachain (BERA) Layer-1 Blockchain?

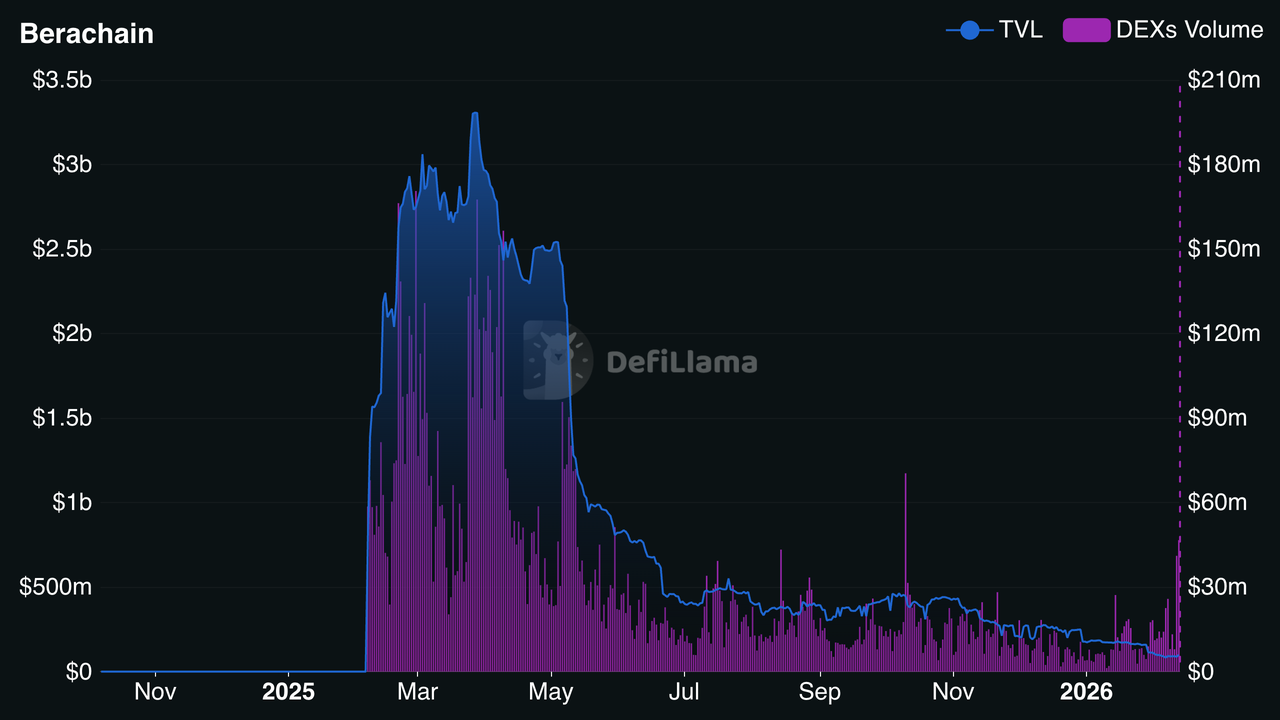

Berachain DeFi TVL | Source: DefiLlama

Berachain is a high-performance, EVM-identical Layer-1 blockchain built on the Cosmos SDK that introduces PoL, a consensus model that directly ties network security to active DeFi participation. Instead of idle staking, validators and users must deploy capital into on-chain liquidity, resulting in an all-time high $250 million+ TVL (total value locked) historically supported by PoL, over 25 milion BERA staked (ATH), and over $30 million in revenue distributed to BERA/BGT holders, placing Berachain among the top 5 chains by tokenholder revenue. As of February 2026, Berachain secures around $100 million in on-chain

stablecoins, maintains a 50% reduction in functional

BERA supply via PoL and DeFi, and shows renewed momentum with $99.5 million DeFi TVL.

From a technical and economic standpoint, Berachain delivers single-slot finality and 40% faster block times than

Ethereum via BeaconKit, while its evolving stack, including the Bectra hard fork, introduces universal smart accounts and gas payments in $HONEY, improving capital efficiency for institutional DeFi. With a circulating supply of 213 million BERA following the February 2026 unlock, a 1:3 DAT treasury cash-to-market-cap ratio, and over $32 million allocated for BERA buybacks, Berachain is positioning itself as a revenue-aware, chain-owned DeFi hub focused on long-term value accrual rather than short-term incentive chasing.

What Is Berachain's Tri-Token Model?

The Berachain ecosystem operates on a unique tri-token model: $BERA serves as the liquid gas and staking token for transaction fees; $BGT (Bera Governance Token) is a non-transferable governance token earned through liquidity provision; and $HONEY is the native, over-collateralized stablecoin. As of February 2026, the network is undergoing a significant transition toward the Bera Builds Businesses (BBB) model, shifting from incentive-heavy emissions to sustainable, revenue-generating applications.

1. Gas Token $BERA: Used for transaction fees and validator staking. In 2026, the PoL v2 upgrade transformed BERA into a yield-bearing asset by reallocating protocol incentives directly to stakers.

2. Governance Token $BGT: A non-transferable (soulbound) token earned by providing liquidity. Holders delegate BGT to validators to influence which protocols receive future emissions.

3. $HONEY Stablecoin: An over-collateralized stablecoin pegged to the US Dollar, serving as the primary medium of exchange within the Berachain DeFi suite.

Following a massive supply unlock in February 2026, Berachain has transitioned from its 2025 liquidity bootstrapping phase into a mature ecosystem focused on sustainable cash flow rather than pure token inflation.

How Does Berachain Network Work?

Berachain utilizes BeaconKit, a modular framework that allows it to be EVM-Identical. This means Berachain doesn't just "support" Ethereum apps; its execution environment is an exact replica, allowing for instant adoption of Ethereum upgrades like Pectra.

1. The Proof-of-Liquidity (PoL) Flywheel

Users earn $BGT by depositing assets into Reward Vaults. These vaults act as gates; for the first time, Layer 1 emissions are monetized. Validators "auction" these emissions to protocols that provide the highest incentives (bribes), which are then shared with $BGT delegators.

2. Validator "Bribes" and Boosting

Validators compete for BGT delegations by offering "incentives" (bribes) to users. These incentives are paid by protocols that want validators to direct BGT emissions to their specific liquidity pools.

3. PoL v2: Native Yield for BERA

A major update in late 2025/early 2026, PoL v2, introduced a 33% redirection mechanism. Now, 33% of all protocol-provided incentives are automatically converted into $WBERA and distributed to $BERA stakers. This gives the gas token a "real yield" derived from actual on-chain economic activity.

Key Components in Berachain's DeFi Ecosystem

Berachain’s native application suite forms a vertically integrated DeFi Stack, where each protocol is designed to feed liquidity back into the Proof-of-Liquidity flywheel.

• BEX, Berachain Exchange: More than a simple AMM, the BEX is the network’s liquidity engine, recording over $5 billion in cumulative spot volume by early 2026. It utilizes a Balancer-style architecture, allowing users to provide liquidity and earn $BGT rewards while benefiting from "gasless" swaps via account abstraction.

• BEND for Lending and Credit: Acting as the network's institutional-grade money market, BEND reached over $14 million in deposits in its primary HONEY vault within months of launch. It enables users to supply interest-bearing assets like $WBERA and $HONEY as collateral to access instant credit, deepening the velocity of capital across the chain.

• BERP for Perpetual Futures: The platform for high-leverage trading, BERP has processed over $1 billion in perpetual volume. It offers traders deep liquidity and efficient capital deployment, allowing them to speculate on blue-chip assets with institutional-level execution and minimal slippage.

• BeraHub: Serving as the ecosystem’s "Mission Control," BeraHub is the centralized interface where users manage their $BGT delegation, review active Reward Vaults, and participate in governance. In 2026, it was updated to support Account Overriding, a feature allowing for permissionless transaction management for automated or delegated strategies.

What’s New in the Berachain Ecosystem in 2026: The Bectra Fork and "BBB"

The Berachain of 2026 is defined by two major pillars aimed at long-term sustainability.

The Bectra Hard Fork in Q1 2026

Scheduled for Q1 2026, the Bectra Hard Fork (Q1 2026) is the most significant technical milestone since mainnet launch, bringing

Ethereum's Pectra features to Berachain.

• Universal Smart Accounts: Integrated account abstraction for batch transactions and spending limits.

• Gas Flexibility: Users can now pay gas fees directly in the $HONEY stablecoin.

• Throughput: Optimistic payload building under development, aiming for a 10x increase in transaction speeds.

Bera Builds Businesses (BBB) Initiative

The traditional L1 model of providing free public goods is being replaced. Berachain's 2026 focus is on internal incubation and S-tier partnerships that directly drive value to $BERA.

• Liquid Royalty: Tokenizing e-commerce royalties with a $1 billion pipeline of revenue streams.

• SukukFi: Shariah-compliant tokenized telecom bonds with over $10 million in ready-to-go contracts.

• The BERA DAT: A $32M+ treasury strategy used to acquire revenue-generating businesses that buy back $BERA.

What Is the BERA Token Used For?

As of 2026, $BERA has evolved from a simple gas utility into a core value-capture asset:

• Network Fees: Paying for transaction execution and being burned.

• Validator Staking: Securing the network and earning block rewards.

• Real Yield Staking: Via PoL v2, earning a share of all "bribes" paid by ecosystem protocols.

• Collateral: Used as a primary asset in Berachain's lending and

perps markets.

What Is Berachain (BERA) Tokenomics?

Berachain features a dynamic token economy with a total genesis supply of 500 million BERA and an uncapped maximum supply driven by an annual inflation rate of approximately 10%.

• Community Allocations (48.9%): The largest share, dedicated to an initial airdrop (15.8%), future community initiatives (13.1%), and a dedicated Ecosystem & R&D fund (20%).

• Investors (34.3%): Distributed to early backers across Seed, Series A, and Series B funding rounds.

• Initial Core Contributors (16.8%): Allocated to the founding team at Big Bera Labs and key advisors.

• Vesting Schedule: All locked tokens follow a uniform 1-year cliff, after which 1/6th is released, with the remaining 5/6ths vesting linearly over the following 24 months.

How to Trade Berachain (BERA) on BingX

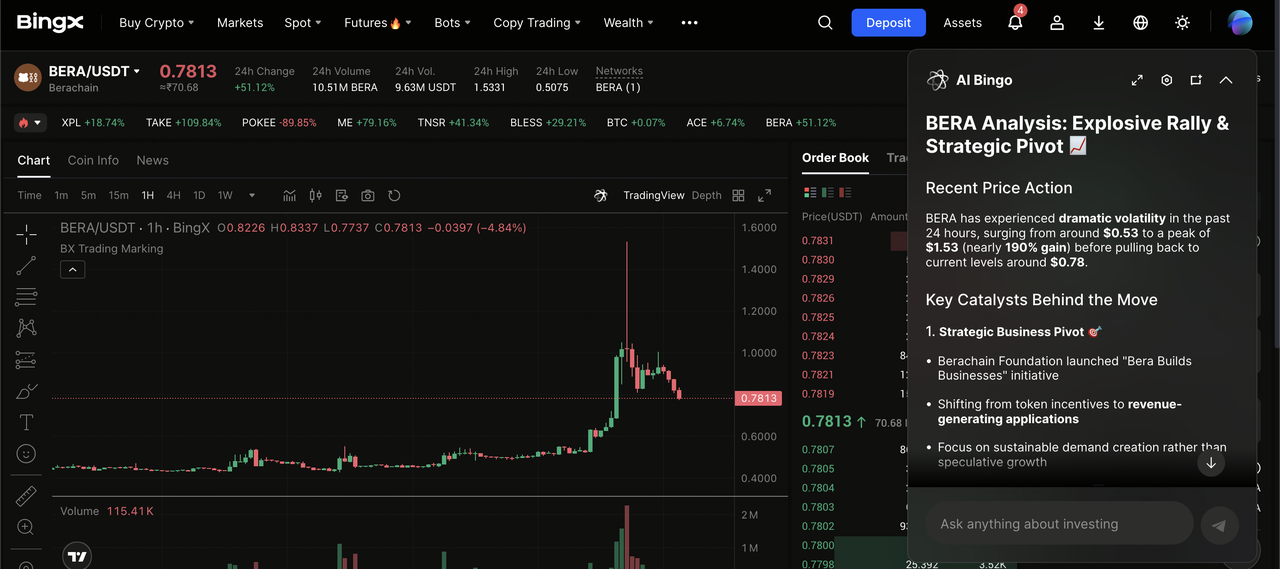

Powered by

BingX AI insights, BingX combines real-time market analytics and deep liquidity to help you trade BERA on the spot and futures markets effectively.

How to Buy BERA on the Spot Market

BERA/USDT trading pair on the spot market powered by BingX AI insights

1. Create and verify your account: Sign up on BingX and complete identity verification.

2. Fund your account: Deposit USDT or buy it instantly using a credit/debit card, Apple Pay, or Google Pay via the Quick Buy tab.

3. Trade BERA/USDT: Go to the Spot market, search for

BERA/USDT, and execute your trade to hold the token in your spot account.

Trade BERA with Leverage on the Futures Market

2. Adjust Leverage and Margin: Set your leverage, e.g., 5x, 10x, and choose between Isolated Margin, which limits risk to a single trade, or Cross Margin, which uses your entire account balance to prevent liquidation.

3. Open a Position:

• Go Long (Buy): Select this if you expect the ecosystem's "BBB" pivot and revenue-generating apps to drive $BERA value upward.

• Go Short (Sell): Select this if you wish to hedge against the ongoing 2026 supply unlocks or anticipate a market correction.

3 Key Considerations Before Investing in Berachain (BERA)

While Berachain’s novel economic model offers significant upside, investors should carefully weigh the following technical and market factors before allocating capital to the ecosystem.

1. Supply Absorption: A major 41.7% token unlock occurred in February 2026. While the market absorbed this via a relief rally, consistent monthly unlocks of around 2.5% remain.

2. Revenue Dependency: Success hinges on the team’s ability to scale the 3–5 high-conviction BBB applications into profitable businesses.

3. Regulatory Safety: Berachain’s focus on

RWA via SukukFi, Liquid Royalty, etc. requires strict jurisdictional compliance, which can limit user access in certain regions.

Final Thoughts: Is Berachain the Future of DeFi?

Berachain has successfully survived its "honeymoon" phase and is now building a sophisticated, revenue-driven economy. With $BERA now offering native yield and the Bectra fork bringing cutting-edge account abstraction, the network is well-positioned for the 2026 RWA and institutional cycle. However, investors should monitor the TVL growth of the new BBB projects as a primary indicator of long-term value.

Related Reading