Allora Network is the first decentralized "Model Coordination Network" (MCN) designed to overcome the limitations of siloed machine intelligence. By coordinating thousands of independent machine learning models, Allora provides a superior alternative to centralized AI systems. As of February 2026, the network has processed over 692 million inferences, powering predictive signals for DeFi protocols,

AI agents, and cross-chain applications on networks like

Ethereum,

Solana, and

Arbitrum.

In this article, you will learn what Allora is, how its unique "Inference Synthesis" engine works, the utility of the ALLO token, why it is considered a cornerstone of the emerging

Decentralized AI (DeAI) stack, and how to trade Allora (ALLO) on BingX spot and futures markets.

What Is Allora (ALLO) Decentralized AI Network?

Allora is an open-source, objective-centric AI network that aggregates multiple machine learning models to solve specific tasks, or "Topics." Instead of a user having to choose one specific model, they specify an objective, e.g., "Predict the price of

ETH in 10 minutes", and the network dynamically combines the outputs of multiple models to deliver a single, optimized inference.

Launched on mainnet in November 2025, Allora operates as a sovereign

Layer 1 blockchain built on the

Cosmos SDK. It uses a specialized consensus mechanism that rewards participants not just for providing data, but for the quality and accuracy of their intelligence. As of February 2026, the network has generated over 692 million inferences, supports more than 288,000 active workers, and runs 55+ live Topics, highlighting growing adoption and real-world usage across decentralized finance, forecasting, and AI-driven analytics.

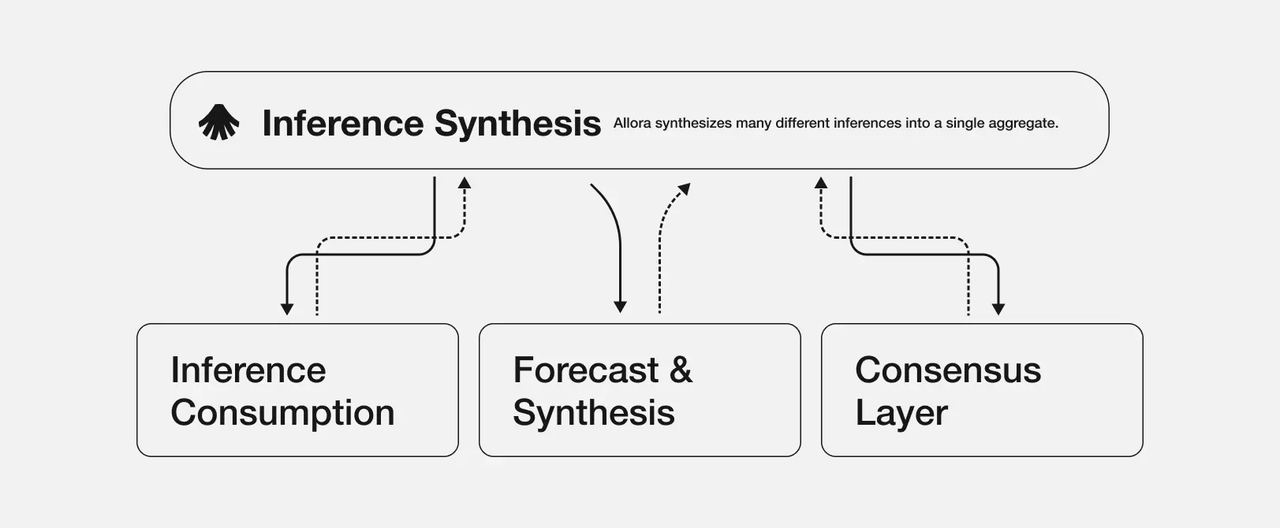

The network is structured across three primary layers:

1. Inference Consumption Layer: Where dApps and developers request and pay for predictions.

2. Forecasting and Synthesis Layer: Where independent models or Workers generate inferences and others predict their performance.

3. Consensus Layer: Manages the economic security of the network via the ALLO token and ensures verifiable truth through

Zero-Knowledge Machine Learning (zkML).

What Are the Key Features of the Allora Ecosystem?

1. Collective Intelligence: By leveraging "Ensemble Learning," Allora produces results that surpass the capabilities of any individual model. This is particularly effective for financial markets where different models specialize in different timeframes or market regimes.

2. Zero-Knowledge Machine Learning (zkML): Through integration with partners like

Polyhedra, Allora ensures that AI computations are verifiable on-chain without requiring Workers to reveal their proprietary model weights. This protects intellectual property while guaranteeing that the AI actually "did the work" it claimed to do.

3. EVM-Scale Integration: While built on Cosmos, Allora is designed for broad interoperability. In early 2026, it expanded its predictive feeds to

Monad and

Base, allowing EVM developers to plug intelligence oracles directly into their smart contracts for automated trading and

risk management.

How Does Allora Network Work?

An overview of Allora's architecture | Source: Allora docs

Allora replaces the traditional "one-model-fits-all" approach with a self-improving loop of coordination and evaluation.

1. Topic Creation and Objectives

The network is organized into Topics, which define a specific machine learning objective. Each topic has a set of rules, including a "loss function" to measure accuracy and a defined source of "ground truth" or actual results.

2. Inference and Forecasting By Workers

Participants known as Workers run ML models to generate predictions or inferences. Crucially, Workers also perform Forecasting, predicting how accurate other workers will be under current market conditions. This makes the network "context-aware," allowing it to prioritize certain models during high volatility and others during stable periods.

3. Evaluation and Ground Truth By Reputers

Once the real-world event occurs, e.g., the 10-minute window closes, Reputers source the ground truth data. They calculate the "loss" or error for each Worker's prediction. Reputers must stake ALLO tokens; if they provide malicious or incorrect data, their stake can be slashed.

4. Inference Synthesis

The network uses a process called Regret Minimization to synthesize all inputs. It assigns weights to models based on their historical performance and the real-time forecasts provided by other workers. The final output is a weighted average that is statistically more reliable than any single model in the ensemble.

What Is the ALLO Token Used For?

The ALLO token is the utility and governance backbone of the network, with a maximum supply of 1 billion tokens.

• Purchasing Inferences: Consumers pay in ALLO to access predictions. The network uses a Pay-What-You-Want (PWYW) model to encourage market-driven price discovery.

• Staking and Security: Validators and Reputers stake ALLO to secure the network and vouch for the accuracy of inferences.

• Worker Incentives: Model builders earn ALLO rewards based on the measurable impact and accuracy of their contributions.

• Governance: Holders vote on protocol parameters, such as the creation of new topics or updates to the reward emission schedule.

What Is Allora (ALLO) Tokenomics?

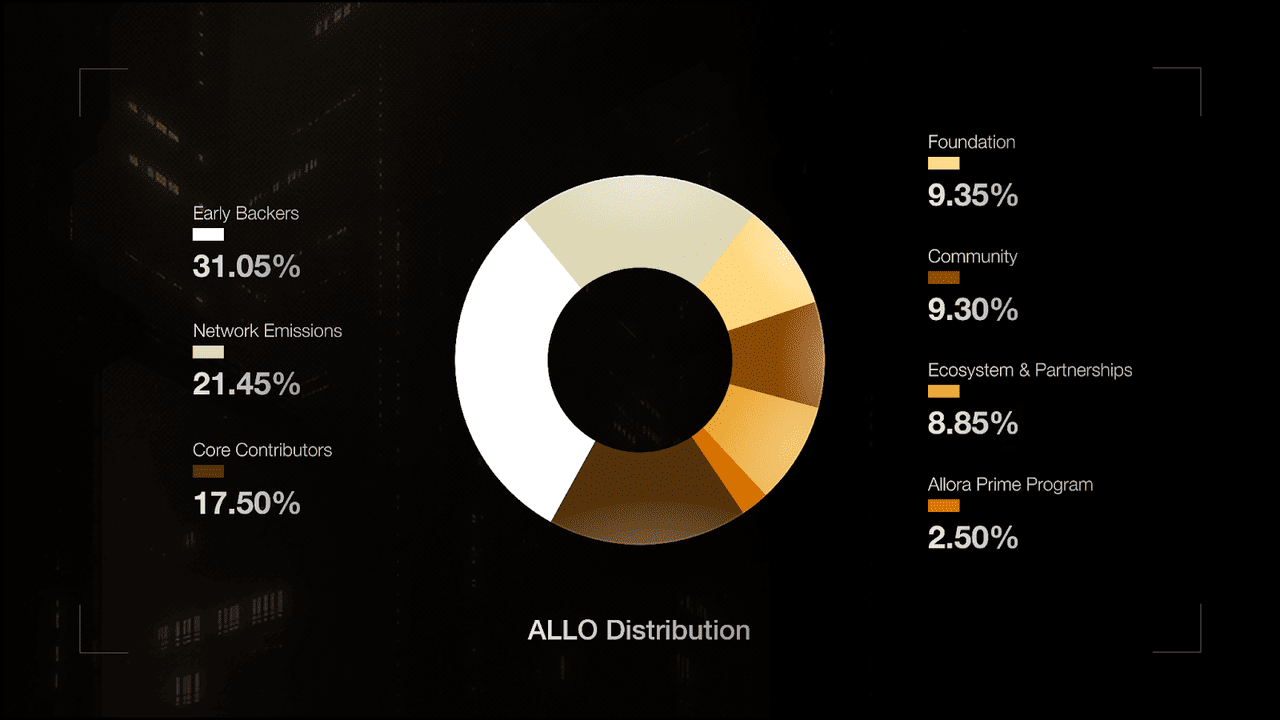

ALLO token distribution | Source: Allora blog

The Allora Network (ALLO) has a fixed maximum supply of 1,000,000,000 (1 billion) tokens, which facilitates all economic activity within its decentralized intelligence marketplace.

• Early Backers (31.05%): Reserved for strategic investors with a three-year lockup and linear vesting.

• Network Emissions (21.45%): Rewards for Workers, Reputers, and Validators, distributed via a Bitcoin-like halving schedule.

• Core Contributors (17.50%): Allocated to the team behind the protocol's development, subject to a three-year lockup.

• Foundation (9.35%): Funds dedicated to ongoing network operations, development, and long-term security.

• Community Pool (9.30%): Distributed for testnet participation, airdrops, and other ecosystem incentives.

• Ecosystem & Partnerships (8.85%): Used for grants to teams building applications on the network.

• Allora Prime Staking (2.50%): Enhanced rewards for early, high-conviction network participants.

How to Trade Allora (ALLO) on BingX

Powered by

BingX AI insights, you can trade ALLO with real-time analytics and trend signals.

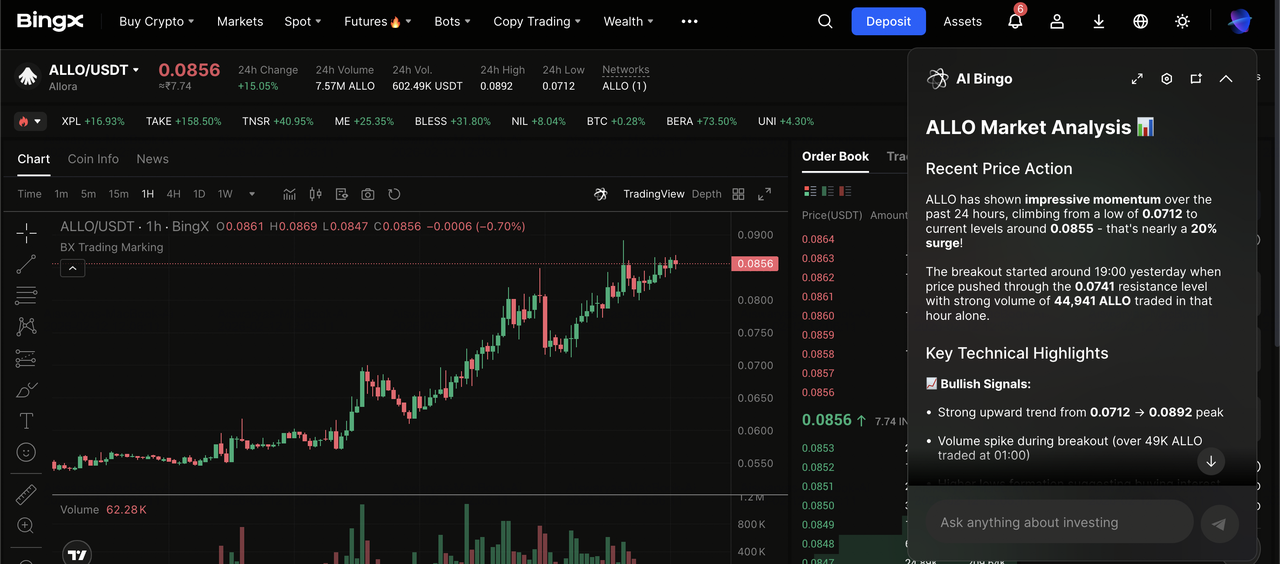

How to Buy or Sell ALLO on the Spot Market

ALLO/USDT trading pair on the spot market featuring BingX AI insights

1. Create and fund your account: Sign up on BingX and

deposit USDT.

2. Buy ALLO on spot: Search for the

ALLO/USDT pair on the

spot market, choose your order type, and execute.

3. Monitor Liquidity: As of February 2026, ALLO has shown strong spot demand with turnover ratios exceeding 2.0x, indicating high liquidity.

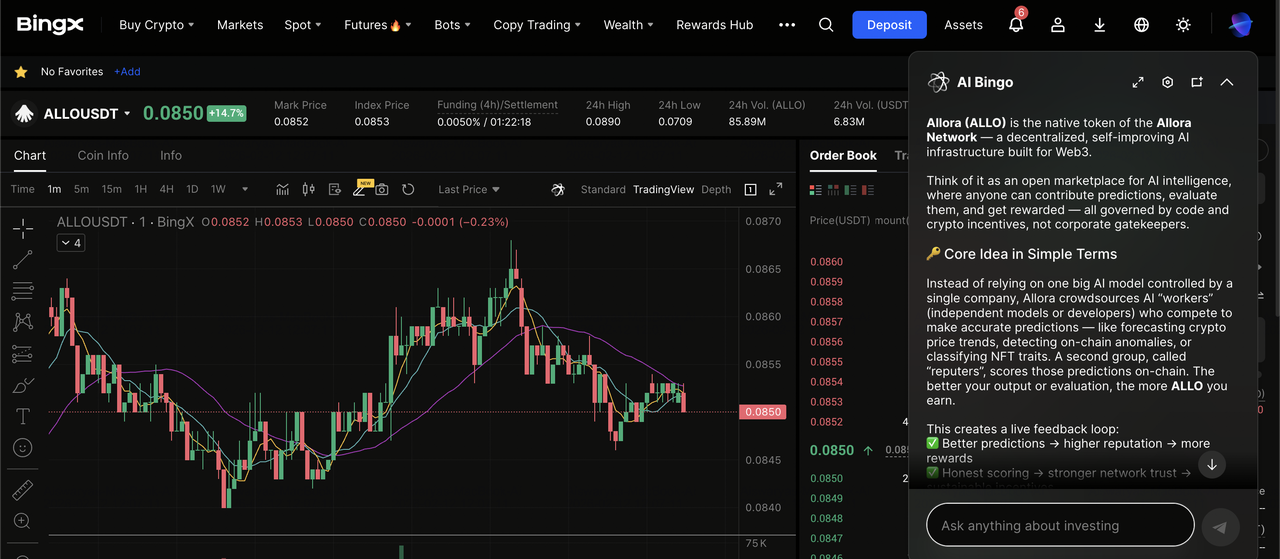

Long or Short ALLO on the Futures Market

ALLO/USDT perpetual contract on the futures market powered by BingX AI insights

1. Fund Your Futures Wallet: Transfer USDT from your Fund Account to the Perpetual Futures Account.

2. Select the ALLO/USDT Contract: Open

Futures, search ALLO, and choose

ALLO/USDT Perpetual. Remember to use BingX AI Insights for real-time sentiment and volatility.

3. Configure the Trade: Choose Isolated for limited risk or Cross margin, set leverage, e.g., 2x–10x, and place a

Limit or price-specific or Market or instant order.

Note: ALLO is volatile, and leverage amplifies losses.

4. Set Risk Controls (Required): Always set

Take Profit, Stop Loss, and optionally a Trailing Stop to lock gains and cap downside.

3 Key Considerations Before Investing in Allora (ALLO)

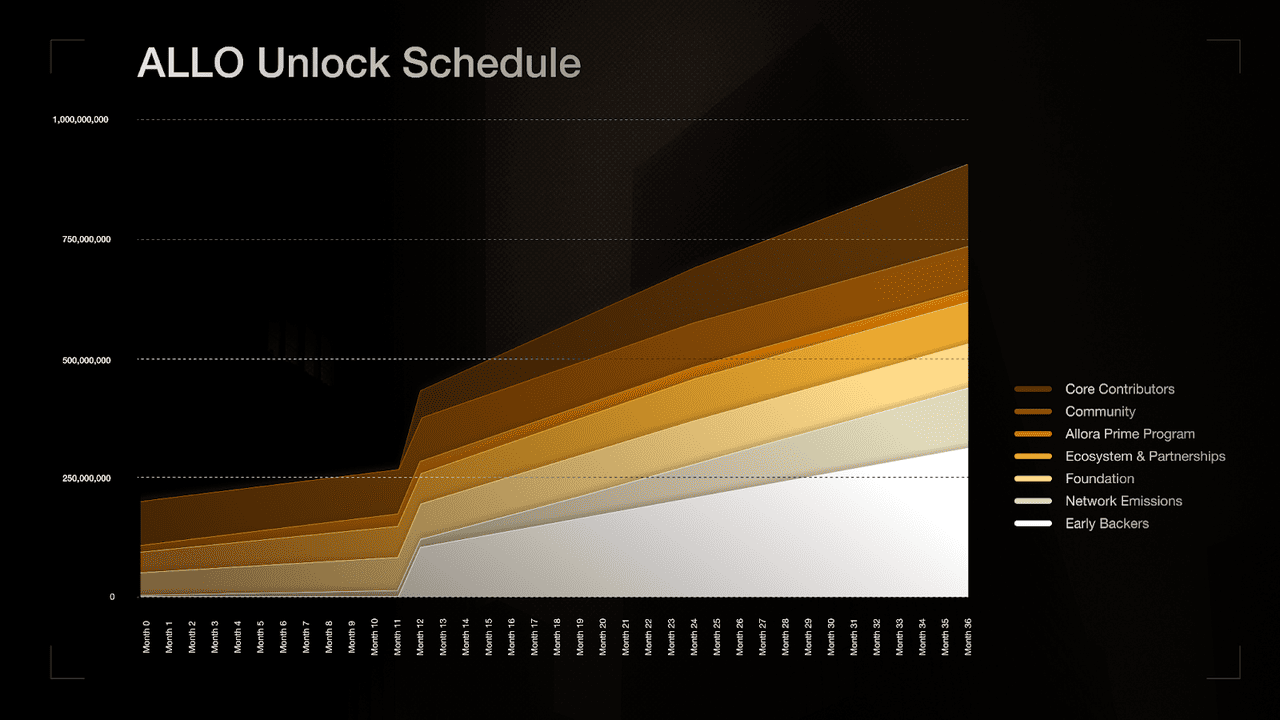

Allora vesting schedule | Source: Allora blog

While the decentralized AI sector offers immense growth potential, navigating its specific economic and technical landscapes requires a balanced understanding of the network's long-term structure.

1. Token Release Schedule: Approximately 31% of the supply is held by early backers and 17.5% by core contributors. While these are locked for 12 months post-TGE since November 2025, significant unlocks in late 2026 could impact the ALLO token price.

2. Adoption vs. Tech: The value of ALLO is tied to the demand for its inferences. While the tech is robust, it relies on developers choosing decentralized AI over centralized APIs like OpenAI.

3. Market Volatility: As a newly launched DeAI token, ALLO can experience sharp price swings driven by social sentiment and exchange volume spikes.

Final Thoughts: Is Allora a Good Buy in 2026?

As of early 2026, the Allora Network has successfully transitioned from an experimental testnet to a functional Intelligence Layer with live integrations across major ecosystems like Solana, Monad, and Base. Its core value proposition, providing verifiable, collective intelligence, is increasingly relevant as autonomous AI agents begin to act as independent economic participants.

The network’s objective-centric approach offers a tangible utility that distinguishes it from more speculative AI projects. If the broader market trend continues to shift toward decentralized, auditable machine learning, Allora’s infrastructure is well-positioned to capture a share of the high-frequency trading and DeFi risk management markets.

Risk reminder: ALLO is a high-risk DeAI asset with significant volatility, adoption uncertainty, and potential price pressure from 2026 token unlocks; only invest what you can afford to lose and always do your own research.

Related Reading